The COVID-19 pandemic further accelerated cloud migration, compelling financial institutions to support remote operations and digital-first strategies. Cloud-native platforms also benefit from modern architectural frameworks such as containerization and microservices, which improve system reliability and security. Vendors like Temenos, nCino, Finxact (a Fiserv company), and Mambu have become leading players in the cloud CBS space, often in collaboration with major cloud providers such as Amazon Web Services and Microsoft Azure.

The banking industry is undergoing a significant digital transformation, driven by evolving customer expectations and technological advancements. Modern customers demand seamless, personalized, and accessible banking experiences across multiple channels. To meet these expectations, banks are investing in CBS that offers real-time processing, omnichannel support, and integrated customer relationship management. Thus, digital transformation and the focus on customer-centric banking are compelling banks to adopt advanced CBS solutions.

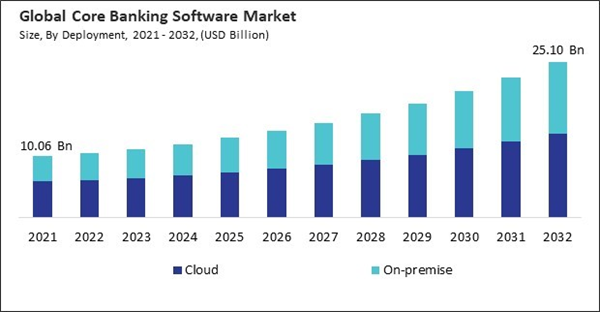

Additionally, the adoption of cloud computing in the banking sector is revolutionizing the way financial institutions operate. Cloud-based CBS offers scalability, flexibility, and cost-effectiveness, enabling banks to respond swiftly to market changes and customer needs. By migrating to the cloud, banks can reduce their reliance on legacy infrastructure, lower operational costs, and enhance system reliability. Therefore, the shift towards cloud-based CBS is driven by the need for agility, efficiency, and innovation in the banking sector.

However, implementing a modern Core Banking Software (CBS) system requires significant investment, making high implementation costs and extended timelines one of the primary restraints in the market. The transition from legacy systems to modern CBS involves expenses that go beyond software acquisition. Banks must invest in new hardware, system integration, data migration, employee training, and ongoing technical support. In conclusion, many mid-sized and smaller banks delay CBS modernization, fearing financial strain and operational risk.

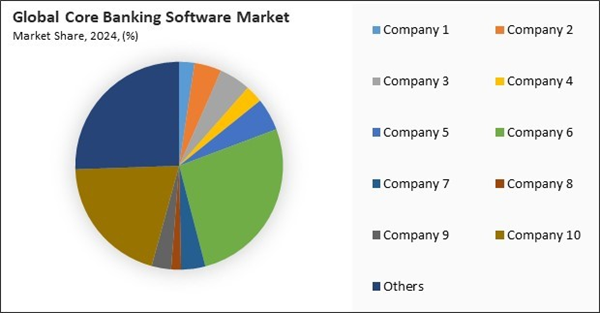

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Digital Transformation and Customer-Centric Banking

- Cloud-Based Core Banking Platforms

- Regulatory Compliance and Risk Management

- Integration with FinTech and Open Banking Initiatives

Restraints

- High Implementation Costs and Extended Timelines

- Legacy System Integration Challenges

- Cybersecurity and Data Privacy Concerns

Opportunities

- Expansion in Emerging Markets and Financial Inclusion

- Integration with FinTech and Open Banking Ecosystems

- Adoption of Advanced Technologies: AI, ML, and Blockchain

Challenges

- Complexity of Legacy System Modernization

- Cybersecurity and Data Privacy Concerns

- Regulatory Compliance and Operational Risks

Deployment Outlook

Based on Deployment, the market is segmented into Cloud and On-premise. on-premise CBS deployment remains prevalent among institutions with legacy infrastructure, complex custom workflows, or regulatory mandates requiring data residency and full system control. These solutions are typically managed internally, offering banks direct oversight of hardware, software, and data. On-premise systems continue to dominate in regions where cloud regulation is evolving slowly, or where large volumes of sensitive data demand tight internal control.Component Outlook

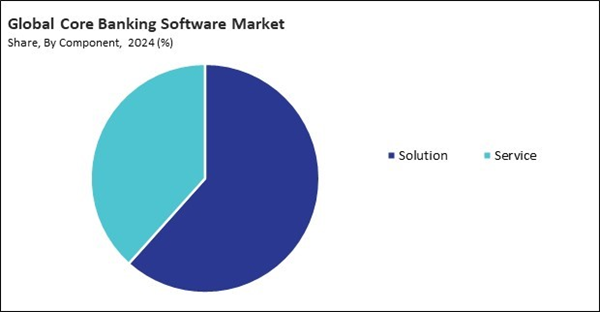

Based on Component, the market is segmented into Solution (Deposits, Loans, Enterprise Customer Solutions, and Other Solution Type) and Service (Professional Service and Managed Service). The Service segment supports the deployment and lifecycle management of core banking solutions. It includes consulting, integration, customization, migration, testing, training, and support services. As CBS platforms become more complex and adaptable to varied banking environments, the role of services in ensuring successful implementation and long-term performance has become increasingly important.End Use Outlook

Based on End Use, the market is segmented into Banks, Financial Institutions, and Other End Use. Banks represent the largest segment in the CBS market and are the primary drivers of demand for robust, scalable, and secure platforms. Commercial, retail, and cooperative banks depend on CBS to manage customer accounts, process transactions, support lending operations, and integrate digital banking services.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Core Banking Software Market in North America is witnessing a significant shift toward platform modernization, driven by the growing pressure on financial institutions to deliver seamless, real-time digital services while maintaining operational resilience. With the increasing use of embedded finance, banks in the region are rethinking their core systems to integrate directly into third-party ecosystems such as retail platforms, fintech apps, and enterprise software environments.Recent Strategies Deployed in the Market

- Mar-2025: Fiserv, Inc. partnered with Republic Bank & Trust Company to implement its DNA core banking platform, enhancing digital transformation, operational efficiency, and real-time transaction processing. The partnership aims to streamline banking processes, reduce manual workloads, and support future growth.

- Feb-2025: Fiserv, Inc. partnered with Third Federal Savings and Loan to implement its DNA core banking system, enhancing real-time transaction processing, operational efficiency, and digital transformation. The platform supports product development and customization, positioning the bank for future growth and improved customer experience.

- Jun-2024: HCLTech expands its partnership with apoBank to provide scalable, secure, and compliant digital foundation services. Leveraging its expertise in Avaloq’s core banking system, HCLTech will enhance apoBank’s IT infrastructure and cloud services, supporting its digital banking transformation and operational efficiency.

- Jan-2024: Finastra Group Holdings Limited partnered with Newgen Software to enhance loan origination by integrating Newgen’s lending solutions with Finastra’s LaserPro platform. This API-driven integration streamlines loan documentation, improves compliance, reduces manual effort, and accelerates financial processes for a seamless digital-first banking experience.

- Jun-2023: Temenos AG and Huawei expand their partnership to modernize core banking systems with cloud technology. Leveraging Huawei Cloud, they enhance scalability, cost efficiency, and security for banks, driving digital transformation and financial inclusion, especially in the Asia-Pacific region.

List of Key Companies Profiled

- Capgemini SE

- Finastra Group Holdings Limited (Vista Equity Partners)

- Temenos AG

- HCL Technologies Ltd.

- Oracle Corporation

- Fiserv, Inc.

- Infosys Limited

- SAP SE

- Tata Consultancy Services Ltd.

- Jack Henry & Associates, Inc.

Market Report Segmentation

By Deployment

- Cloud

- On-premise

By End Use

- Banks

- Financial Institutions

- Other End Use

By Component

- Solution

- Deposits

- Loans

- Enterprise Customer Solutions

- Other Solution Type

- Service

- Professional Service

- Managed Service

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Capgemini SE

- Finastra Group Holdings Limited (Vista Equity Partners)

- Temenos AG

- HCL Technologies Ltd.

- Oracle Corporation

- Fiserv, Inc.

- Infosys Limited

- SAP SE

- Tata Consultancy Services Ltd.

- Jack Henry & Associates, Inc.