The onset of COVID-19 had a significant impact on the market studied. The number of transplants dropped in Europe during the initial phase of the pandemic. The decrease was certainly due to the risk of infection through the allograft, a significant increase in SARS-CoV-2-related morbidity and mortality in immunocompromised hosts. Kidney transplant and live donor programs were particularly affected, with significant negative spillover consequences for patients on the waiting list. According to a research study published in the Pathogens Journal in September 2022, higher mortality was seen during the pandemic among the transplant waiting list (TWL) patients compared to pre-COVID-19 TWL patients in Europe. It shows that there was a delay in transplantation procedures which further impacted the demand for artificial organs and bionics in the region. Hence, the market was affected adversely. However, the high burden of kidney diseases and cardiovascular diseases across Europe during the later phases of the pandemic created a demand for organ transplantations. This created opportunities for artificial organs and bionics and accelerated the market's growth in Europe. Hence, it is expected that the market will witness considerable growth over the analysis period.

Factors such as the rising incidence of organ failures, high Increased incidence of disabilities, scarcity of donor organs, and technological advancements leading to enhanced applications are anticipated to drive market growth over the forecast period.

Kidneys, the liver, lungs, the heart, the central nervous system, and the hematologic system are the major organs that tend to fail among the target population. In Europe, the number of organ failures has been increasing consistently over the few decades, but the number of organ donors is a few. This is creating demand for artificial organs in the region. As per a study published in the Nature Reviews Nephrology Journal in May 2021, changes in demographics and the burden of non-communicable diseases (NCDs) that are responsible for 77% of the disease burden in Europe were major components that increased the chance for organ transplantation in the region.

In addition, as per the European Committee on Organ Transplantation survey results published in September 2022, last year, kidney transplant was the most performed transplant in the European Union and accounted for 15,700 procedures, followed by 6,500 liver transplants and 2,000 heart transplants. This high number of transplants is anticipated to create opportunities for artificial organs and the bionics market in the region. Thus, this is anticipated to contribute to the global artificial organs and bionics implants market growth over the forecast period.

However, expensive procedures and fear of device malfunction and its consequences are expected to hinder the market's growth.

Europe Artificial Organs & Bionic Implants Market Trends

Artificial Kidney Segment is Expected to Have Significant Growth During the Forecast Period

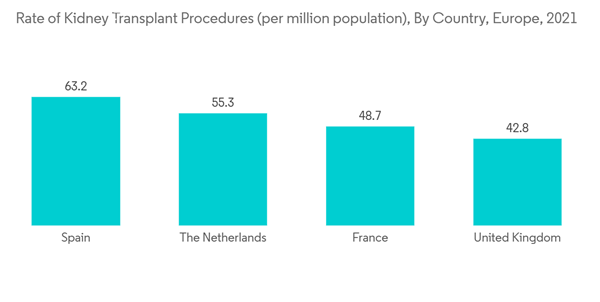

An artificial kidney is a wearable dialysis machine. An individual with end-stage renal disease may use a wearable artificial kidney on a daily or even a continuous basis. The increasing incidence and prevalence of renal failures in Europe are expected to drive segment growth.Kidney disease has become a burden that is leading to kidney failure and causing a major healthcare concern in the European region in recent years. According to the European Parliament press release published in February 2022, nearly 100 million people suffered from chronic kidney disease (CKD), and it was among the most expensive diseases, with an annual cost estimated at USD 140,000 million (EUR 140 billion) in Europe. The incidence of kidney failure (or chronic kidney disease) is expected to increase by 2040 in the region. Thus, the burden of CKD is expected to create demand for the adoption of artificial kidneys for patient survival, thereby fueling the growth of the segment during the forecast period.

Furthermore, organ donation and transplantation remain the foremost and cost-effective clinical solutions for end-stage organ failure. However, the lack of donors leading to the organ shortage and difficulty in obtaining consent has recently been seen in the European region. As per an article published in Transplantation Reviews Journal in April 2021, clinical trials on wearable artificial kidneys were ongoing, and funding activities were also rising to develop implantable artificial kidneys globally, including in Europe. Hence, driving the artificial kidney segment growth.

United Kingdom is Anticipated to Contribute Significantly to the Market Growth

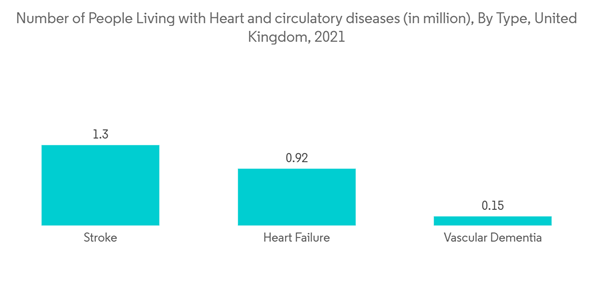

Among the other countries, the United Kingdom is anticipated to witness growth during the analysis period. Factors such as increasing disability and accidental injuries requiring amputations such as limbs, fingers full hands, among others, are major contributors to the artificial organs and bionic implants market growth in the United Kingdom.Aging, diabetes, and vascular disease are all predicted to cause an increase in the number of amputations. Major amputation is among the most destructive complications associated with diabetes, and the number of major lower limb amputations in diabetes continues to rise in the country. As per the datasheet published in June 2022, a total of 7,957 major diabetic lower limb amputations were reported in a period of four years, and the cost of health care for ulceration and amputation in diabetes is approximately USD 1,230 million (GBP 1 billion) per year in the United Kingdom. Thus, the burden of lower limb amputations is expected to accelerate the artificial organs and bionic implants market in the country.

Furthermore, the demand for artificial organs is increasing in the United Kingdom due to a rising waiting list for organ transplantation coupled with a smaller number of live organ donors. According to NHS, a total of 6,759 people were waiting for a transplant in the United Kingdom, but only 2,951 people have received transplantation since April 2022. In addition, as per the Organ Donation and Transplantation Annual Report 2021 published by NHS, organ donation activity fell severely during the period from 1st April 2020 to 31st March 2022, as compared to the same period the previous year. As per the source, from 1st April 2019 to 31st March 2020, a total of 994 living kidney donors were there, which fell to 363 donors in 2020-21 in the country. Thus, due to the shortage of organs for transplantation, the demand for artificial organs is increasing in the country, further fueling the overall market in the country.

Europe Artificial Organs & Bionic Implants Industry Overview

The European artificial organs and bionic implants market is moderately competitive with several major players. Some strategies implemented by market players include agreements, collaborative models, business expansion, and product development. Most of the market players focus on bringing technologically advanced products to acquire the maximum market share. Sonova, Medtronic, Ossur, and Ottobock are a few market players.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Sonova (Advanced Bionics AG)

- Ottobock

- Medtronic plc

- Zimmer Biomet

- Ekso Bionics

- Edwards Lifesciences Corporation

- Terumo Medical Corporation

- OSSUR

- Axiles Bionics

- Cochlear Ltd.