South Africa's agricultural sector is one of the world's most diverse, consisting of corporate and private intensive and extensive crop farming systems, including vegetable, fruit, nuts, and grain production. The well-developed commercial farming in South Africa is the backbone of the country's agricultural economy.

However, the country's potential for crop production remains unexploited with the lack of technological advancements and immense mechanization. According to United Nations, mechanization levels on farms across Africa are currently deficient, with the number of tractors at 43 per sq km in South Africa, compared with 128 per sq km in India and 116 per sq km in Brazil.

In addition, the increasing focus on sustainable agricultural mechanization, rapid urbanization, the adoption of innovative technology, the growth of medium-scaled farms, and increased export and eventual high production of commercial crops in the country would drive growth in the market studied during the forecast period. Advanced technologies like artificial intelligence, robotics, google earth, and a growing number of government initiatives have driven the demand for agricultural machinery in South Africa.

South Africa Agricultural Machinery Market Trends

Growing Grain Industry

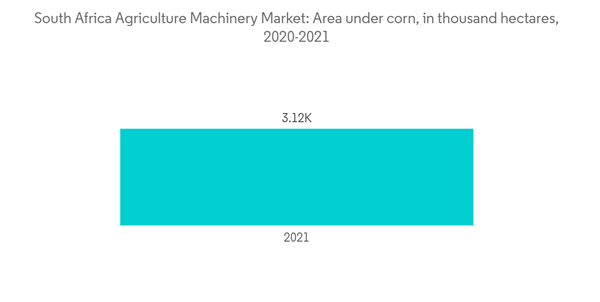

The grain industry, which includes barley, maize, oats, sorghum, and wheat, is one of the largest agricultural industries in South Africa, contributing more than 30% to the total gross value of agricultural production. The industry comprises several key stakeholders, including input suppliers, farmers, silo owners, traders, millers, bakers, research organizations, financiers, etc. The animal feed industry is an important client and player in the grain supply chain. Around 6.0 million tons of grain and 1.6 million tons of oil cake are used by the animal feed manufacturing industry in South Africa annually. In addition, corn is the largest locally produced field crop. South Africa is the leading corn producer in the Southern African Development Community, with an average production of around 15 million tons per annum over the past five years. The growth in the grain industry eventually raised the production and area of grains and the need for increased efficiency in farming, which increased the demand for mechanization in the country to maximize output production and ensure cost-efficient and rapid production, driving the market.Rise in Tractor Sales

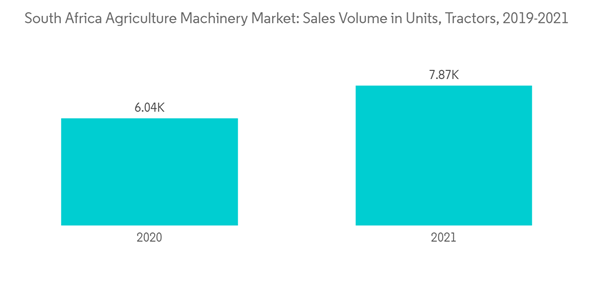

Tractors is one of the most important segments of the South African agricultural machinery market. As basic agriculture machinery, tractors occupy a significant part of agriculture machinery in terms of units sold.Further, a continuous increase in tractor sales has been noticed over the last few years. For instance, according to sales statistics from the South African Agricultural Machinery Association (SAAMA), tractor sales in October 2022 were 1,268 units. This was almost a 48% increase from the 856 units sold in October 2021, while the sales of combined harvesters accounted for only 34 units in June 2021. Moreover, the year-to-date sales of tractors in October 2022 accounted for 7,747, an increase of 19.8% from 2021. Additionally, tractor sales were fuelled by increasing government subsidies for farm mechanization, accommodative financing, growth in the agricultural industry, and increased awareness of farm machine mechanization. The Agricultural Policy 2021 in South Africa is anticipated to raise the adoption of automation and, eventually, the segment's growth.

South Africa Agricultural Machinery Industry Overview

The market is consolidated owing to a few prominent players, accounting for more than half the market's share. The key players in the market include Deere and Company, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra South Africa Pty Ltd, and Kubota Corporation. The primary strategy adopted by the key players is to invest in R&D to encourage innovation and maintain a solid market base.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- John Deere (Pty) Ltd

- CNH Industrial NV

- AGCO Corporation

- Mahindra & Mahindra South Africa Pty Ltd

- Kubota Corporation

- JC Bamford Excavators Limited

- Lindsay Corporation