Speak directly to the analyst to clarify any post sales queries you may have.

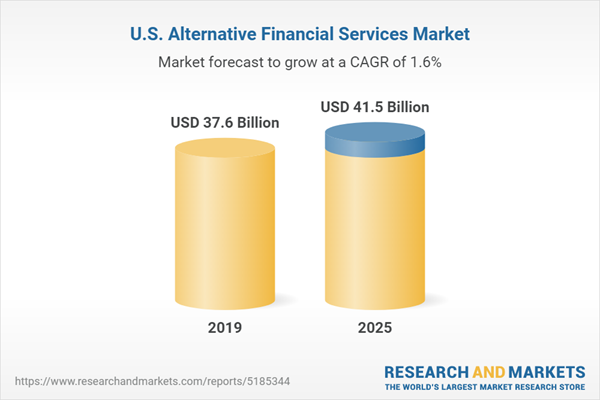

This updated analysis from Marketdata LLC examines the controversial “alternative financial services” sector - a $36 billion business comprised of fragmented and loosely regulated check cashing and money transfer services, payday loan services, pawn shops and rent-to-own stores. These retail and online outlets serve the “unbanked” segment of the U.S. population. Many companies are happy to accept the business of consumers with spotty credit records who need cash fast, and who have been rejected by banks--the 12+million households that choose not to use traditional banks.

There are about 12,000 check cashing stores, 14,000 payday loan outlets, 800,000 money transfer agents, 11,000 pawn shops and 10,000 rent-to-own stores competing for this business today. Many outlets/services overlap-providing multiple services at the same site.The study explores the effects of the current pandemic and recession on operations and revenues, increased competition and disruption by new start-ups, industry consolidation, state and federal regulation, consumer attitudes, and the shift to online virtual distribution channels.

This new study examines the nature of the business, reasons for the growth of non-bank services, immigration trends, industry receipts/growth from 1999-2019, 2020 outlook and 2025 long-term forecasts, average store revenues, customer demographics, key industry trends, federal/state industry regulation/fee caps, self-service check cashing machines, profit margins, franchising, gold buying/selling, global remittance trends, consumer debt levels, and the pivot to online services. Findings of research studies by: FISCA, Financial Health Network, Federal Reserve Board, brokerage analysts, APRO, Consumer Financial Protection Bureau, state banking departments, The World Bank, INS, U.S. Census Bureau, FDIC, and more.

Contains 19 in-depth company profiles (with financials) for:

Purpose Financial (Advance America), Populus (ACE Cash Express), Check Into Cash, Check ‘N Go,

EZCorp., First Cash, Curo Group Holdings, QC Holdings, Western Union, MoneyGram, Euronet, Earnin, Elevate, Enova, Aaron’s, Rent-A-Center and AMSCOT.

FREE with purchase: A "done-for-you" PowerPoint presentation covering the market's characteristics, structure, $ size, growth drivers, forecasts, and key operating metrics.

Table of Contents

1. Introduction: Study Scope, Sources, Methodology

2. Executive Overview of Major Findings

- Definition of the components of the U.S. market serving consumers outside of the traditional financial services market (the “unbanked”). Alternative financial services: Check Cashing Stores, Money Transfer Services, Pawn Shops, Payday Loan Services, Rent-to-Own Stores & Services.

- Demographics of the “unbanked” population, key metrics & characteristics

- Definition of each segment, nature of the business/how it works, number of outlets, major growth drivers, dollar mkt. size 2000-2019, 2020 & 2025 forecasts, major competitors.

- Status report & Structure of the Check Cashing Industry

- Status Report & Structure of the Money transfer Industry

- Status Report & Structure of the Pawn Shops Industry

- Status Report & Structure of the Payday Loans Industry

- Status Report& Structure of the Rent-To-Own Industry

- 2020 outlooks for each industry, effects of Covid-19 pandemic on sales & operations

- 2025 forecast for each industry

- Highlights of each report chapter.

Tables:

- Total Size of the U.S. Alternative Financial Services Industry, by 5 Sub-industries (2000-2025 Historical Revenues & Forecast)

3. Customer Demographics: The Unbanked Population

- Discussion of the unbanked population, Findings of 2016 survey: FDIC National Survey of Unbanked and Underbanked Households”

- percent and no. of unbanked and underbanked U.S. households

- Reasons unbanked households don’t have a bank account

- Perceptions of banks’ interest

- Percent using alternative financial services

- Banking status for select demographic groups

- Use of pre-paid debit cards, alternative financial services used most often

- Bank and nonbank credit

- Banking status by geography

- Usage of international remittances

- Study conclusions

Tables:

- Percentage of Households That Are Unbanked, By State: 2015

- Households Usage of Specific Alternative Financial Services: 2015, 2011

4. The U.S. Check Cashing Industry

Summary & Nature of the Business: How Check Cashing Companies Operate

- Industry definition and size. Number of outlets. Check cashers offer convenience for a price. Typical fees charged.

- Other services offered: money orders, wire transfers, electronic bill payments, notary signatures, utility bill payments, tax preparation, gold buying, payday loans.

Industry History and Evolution

- Beginnings in the Great Depression.

- Impact of deregulation of the U.S. banking industry.

Customer Demographics (by gender, income, race, etc.)

- Scarborough Research study.

- Ace Cash Express customer profile.

- FISCA trade group customer profile

Emerging Industry Trends

- Check cashing fees on the rise, Consumer Federation of America survey

- Industry consolidation

- Increased competition

- The 2019 Federal Reserve Payments Study: key findings

- The entry of Walmart into the check cashing market - discussion

- More competition from: Pay By Touch, 7-Eleven, Walmart

Tables:

- Number and Dollar Value of Payments by Check in the U.S. - 2003-2019

- Number/value/avg. value of commercial checks processed: 1989-2019

- Number/value/avg. value of government checks processed: 1989-2019

- Number/value/avg. value of postal money orders processed: 1989-2019

Industry Regulation

- Federal Regulations, state regulations

- Definition of: The Bank Secrecy Act, Money Laundering Suppression Act, USA Patriot Act, Gramm-Leach-Bliley Act

- Table: Check Cashing Fees, by type check

- Table: State Banking Departments for States With Check Cashing Fee Maximums, address & phone.

Industry Size, Growth, Forecasts

- Discussion of avg. annual receipts per store: for Illinois stores, ACE Cash Express, AMSCOT, DFC Global

- Number of outlets declining – discussion, number operating in 2007 vs. today

- Composition of check cashing revenues by type (check cashing, money orders, $ transfers, debit cards, bill payments, gold buying, tax preparation, pawn services, etc. % of total revenues)

- Factors affecting growth

- 2018-2019 industry performance

- 2020 Forecast, effects of the pandemic

- 2025 long-term outlook and forecast

- Federal Reserve findings of non-cash payment trends: checks vs. debit cards

- Table: Industry revenues, annual % change: 2000 through 2019, 2020 & 20125 F.

Check Cashing Industry Structure & Profit Margins

- Review of the composite financial statements for check cashing outlets in New York State and Illinois.

Competitor Profiles (headquarters location, services, 3-5 year financials when available, 2020 1st half results, mergers, history and company profile)

- Ace Cash Express, Inc. (Purpose Financial)

- Check Into Cash

- Dollar Financial Corporation (Money Mart Financial Services)

- AMSCOT Financial

5. The U.S. Money Transfer Services Industry

Nature of the Business

- The transition from the money order to electronic wire transfers, how electronic transfers work.

- Market drivers: analysis of global migration trends, U.S. population vs. foreign born, illegal immigrants

- Discussion of remittance inflows/outflows, factors affecting, work visas

- Industry trends: increased regulation

- The competition: global & regional providers, banks, informal networks, alternative channels

Regulation of the Industry

- Review of state & federal regulations.

- Definition of: The Bank Secrecy Act, Money Laundering Suppression Act, USA Patriot Act, Gramm-Leach-Bliley Act

Industry Trends

- International money transfer market is very fragmented.

- Major players have a small market share. Number of Western Union & Moneygram agents worldwide, role of Wal-Mart, mobile finance

- New technologies present new competition, discussion of 3 transfer models used, mobile finance

- U.S. banks are developing services for the U.S. - Latin America transmission corridor.

Tables:

- Global migrant stock, by regions: 2005, 2012, 2019

- Origins of the U.S. immigrant population, % born in ea. Nation: 1960-2016

- Top 10 sending countries in the recent years

- Total U.S. Population, Foreign Born Population & Illegal Immigrants: 2001-2017

- U.S. immigration, by country of origin: 2001-2018

- International Migrants: 1970-2019

- Illegal Alien Population, by Country of Birth: 2015 and 2010

- Top Countries Receiving/Sending Remittances: 2010, 2015, 2018

- Global remittance inflows, developed/developing nations: 2001-2020F

- U.S. and Global Remittance Outflows: 2001-2020F

- Destination of outflows from the U.S. - World Bank, other data

- Estimated Remittances from the United States, by Country: 2010-2018

- Number of Western Union and Moneygram Agents Worldwide (2002-2019)

- U.S. Bank money transfer products

Industry Size, Growth, Forecasts

- Industry revenues for 1999 through 2019 - discussion & analysis

- 2019 industry performance: discussion, estimates

- 2020 Forecast: effects of the pandemic, Western Union, Moneygram, Euronet outlooks, forecast

- 2025 Forecast: discussion & analysis, forecast.

Tables:

- Size of U.S. money transfer industry, revenues 1999-2019, 2020 & 2025 forecasts

- Size of U.S. money transfer industry, by company (Western Union, Moneygram, Euronet, U.S. Post Office) 1999-2019

Competitor Profiles (headquarters location, services, company history, recent developments, 3-5 year financials when available, 2020 1st half results).

- Western Union

- Moneygram International

- Euronet Worldwide (Ria Financial Services)

6. The U.S. Pawn Shops Industry

Nature of the Business

- Description of pawn shop services, number of shops, U.S. and Latin American operations, business model

- Industry status report 2019-2020, industry revenues estimates

- Findings of 2018 National Pawnbrokers Assn. survey: pawn loans vs. merchandise sales, online sales, outlook for 2019

- Industry structure, no. of stores, regional concentration, largest competitors/chains

- Description of pawn loans and their fees, layaway, title loans, tax refund loans, prepaid debit cards, gold buying, check cashing

Industry Trends

- Declining number of pawn shops

- Discussion of anti-payday loan legislation, relation to the pawn shops business

- The gold factor: how pawn shops have benefitted from rising price of gold

Tables:

- No. of U.S. pawn shops: 1990-2020 Forecast

- Historical prices of gold: 1999-2020

Industry Size, Growth, Forecasts

- Availability of data on industry size/revenues, sources

- Avg. annual revenues per pawn shop, by EZ Corp, First Cash - for U.S. vs. Latin American pawn shops

- Historical Industry revenues for 2005-2025 F

- Analysis of current & historical revenues of EZ Corp & First Cash

- Analysis of industry performance during the Great Recession of 2008: findings of NPA trade association and state associations

- 2019 industry performance and growth estimate

- 2020 Forecast, effects of the pandemic on operations and revenues, growth estimate, 1st half 2020 sales of top competitors.

- 2025 forecast, discussion of growth drivers, major factors

Tables:

- Estimated Industry Revenues, no. of shops, avg. per shop: 20025-2025 F

Competitor Profiles (headquarters location, services, company history, recent developments, 3-5 year financials when available, 2019 results, 2020 1st half results).

- First Cash (Incl. Cash America, prior to acquisition)

- EZCorp.

Table:

- The Major Pawn shop Chains: no. of stores (U.S., Latin America), revenues: 2019

7. The U.S. Payday Loans Industry

Nature of the Business

- Description of payday loans, how they work, government actions against the industry

- How big banks have supported the industry since 2009, lobbying efforts

- Basic facts and metrics about the industry (avg. loan size, APR, users, etc.)

Industry Trends

- Growth on online installment loans as an alternative to payday loans (emergence of Enova, Elevate, Earnin, other apps and firms)

Industry Size, Growth, Forecasts

- Number of outlets, peak levels, relation to check cashers

- Historical view since 1990s, estimate of no. of outlets by Stephens brokerage firm

- Industry revenues for 1995 through 2025 F - discussion & analysis

- 2016-2018 industry performance findings of Center for Financial Services Innovation study, $ estimates for 2016, 2018

- 2019 industry performance: estimate

- 2020 Forecast, effects of the pandemic on operations and revenues, payday loan application grows, digital lending apps soar in usage, Trump administration reverses rule, estimate of industry size/growth

- 2025 Forecast: discussion & rationale, estimate of industry size/growth

Tables:

- Size of U.S. payday loans industry, revenues 1995-2019, 2020 & 2025 forecasts

Operations

- Profitability of payday lenders, CFPB actions

Legislation, Industry Regulation

- No. of states with anti-payday loan legislation

New Lending Apps

- Discussion of Earnin and Enova products

- User demographics

Competitor Profiles (headquarters location, services, company history, recent developments, 3-5 year financials when available, 2020 1st half results).

Tables:

- Major Payday Loan Companies in 2019 (no. of stores, revenues)

- Major Payday Loan Companies in 2009

- Purpose Financial (Advance America, ACE Cash Express)

- Check ‘N Go

- Check Into Cash

- Dollar Financial

- QC Holdings

- Earnin (online, app)

- Curo Group Holdings (online, app)

- Enova Intl. (online, app)

8. The U.S. Rent-To-Own Industry

Nature of the Business

- Description and evolution of the business, how transactions work, estimate of industry size by APRO trade group

- Avg. store revenues, seasonal sales patterns

Regulation of the Industry

- Review of state & federal regulations, state lease purchase laws

- No. of states with rental purchase statutes

- Typical prices for merchandise vs. outright purchase

Customer Demographics

- Share of population in the “sub-prime” category, findings of Fair Isaac Corp. and APRO studies

Industry Trends

- Increased competition

- Emergence of virtual and kiosk-based operations

Industry Size, Growth, Forecasts

- Opinions of APRO management regarding leaders’ market share

- Relation between the industry and recessions, and interest rates - discussion & analysis

- 2019 industry performance: estimate, why some estimates of $ size of the industry are not accurate

- 2020 Forecast, effects of the pandemic on operations and revenues, RAC and Aaron’s projections of 2020 sales & outlook based on 1st half of year, estimate of industry size/growth

- 2025 Forecast: discussion & rationale, trends over next 5 yrs., forecast of industry size/growth rate.

Tables:

- Size of U.S. rent-to-own stores industry: 1999-2019, 2020 & 2025 forecasts

- Number of Global Rent-To-Own Stores: 2001-2015

- Comparison of Industry Growth & Federal Funds Interest Rates: 1999-2020

Competitor Profiles (headquarters location, services, company history, recent developments, 3-5 year financials when available, 2020 1st half results).

- Rent A Center

- Aaron’s Inc.

9. Reference Directory of Trade Associations & Sources

- Address, phone, contacts for major trade groups, consultants, list of industry studies and articles, Wall Street analysts/research reports.

Companies Mentioned

- AMSCOT

- Aaron’s

- Check Into Cash

- Check ‘N Go

- Curo Group Holdings

- EZCorp.

- Earnin

- Elevate

- Enova

- Euronet

- First Cash

- MoneyGram

- Populus (ACE Cash Express)

- Purpose Financial (Advance America)

- QC Holdings

- Rent-A-Center

- Western Union

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 211 |

| Published | November 2020 |

| Forecast Period | 2019 - 2025 |

| Estimated Market Value ( USD | $ 37.6 Billion |

| Forecasted Market Value ( USD | $ 41.5 Billion |

| Compound Annual Growth Rate | 1.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 17 |