Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Trends in the market indicate a shift toward synthetic and semi-synthetic lubricants, which offer improved performance characteristics over traditional mineral oils. Consumers are becoming more educated about the benefits of these advanced lubricants, such as better fuel efficiency, extended oil change intervals, and enhanced protection against wear and tear. As automakers continue to innovate and develop more efficient engines, the demand for specialized lubricants tailored to meet these advancements is also rising. Environmental concerns are driving a growing preference for eco-friendly and bio-based lubricants, providing new opportunities for manufacturers to innovate and cater to a more environmentally conscious consumer base.

Despite the positive growth trajectory, the market faces several challenges. Intense competition among numerous players can lead to price wars, impacting profit margins for manufacturers. Moreover, the fluctuating prices of base oils and raw materials pose a risk to stability and can affect production costs. Regulatory compliance is another area that requires attention, as manufacturers must adhere to stringent emissions and product formulation standards. To navigate these challenges, companies need to invest in research and development to create high-performance products that meet evolving consumer needs while remaining cost-effective. Addressing these challenges effectively can lead to substantial opportunities for growth in the dynamic Indian automotive lubricant market.

Market Drivers

Rising Vehicle Ownership

The increasing disposable income of the Indian population has led to a significant rise in vehicle ownership. As economic conditions improve and urbanization expands, more individuals and families are purchasing vehicles, whether for personal or commercial use. This surge is not only seen in metropolitan areas but also in smaller towns and rural regions, where improved infrastructure and access to financing have made vehicle ownership more attainable. With more vehicles on the road, there is a corresponding increase in the demand for automotive lubricants, which are essential for maintaining engine performance and ensuring vehicle longevity.For instance, In August 2024, data from the Ministry of Statistics and Programme Implementation shows that vehicle ownership among the lowest-income households in India has surged from 6% to 40% over the past ten years. This reflects a significant increase in the proportion of the country's poorest households that now own a vehicle.

Growing Awareness of Vehicle Maintenance

In recent years, there has been a noticeable increase in consumer awareness regarding the significance of vehicle maintenance. Owners are now more informed about the need for regular servicing, oil changes, and the use of quality lubricants to ensure optimal vehicle performance. This trend is driven by access to information through digital platforms, automotive service campaigns, and an overall cultural shift towards responsible vehicle ownership. As a result, consumers are increasingly prioritizing the use of high-quality lubricants that can enhance engine efficiency and prolong vehicle life.This heightened awareness is further reinforced by automotive manufacturers, who emphasize maintenance in their marketing strategies. Many vehicle brands provide detailed maintenance schedules and recommendations for lubricant types, educating consumers about the impact of quality lubricants on vehicle health. As customers begin to understand the correlation between lubricant quality and vehicle performance, they are more likely to invest in premium products. This shift in consumer behavior contributes to a growing market for advanced lubricants, creating opportunities for manufacturers to introduce innovative products that align with consumer expectations.

Technological Advancements in Lubricant Formulations

Manufacturers are continuously investing in research and development to create formulations that cater to the specific needs of modern engines. This includes the development of low-viscosity oils that enhance fuel efficiency and the incorporation of additives that provide superior protection against oxidation and sludge formation. As automakers design engines with tighter tolerances and higher performance standards, the need for specialized lubricants becomes increasingly critical. This presents an opportunity for lubricant manufacturers to differentiate their products in a competitive market.For instance, in April 2024, Shell Lubricant India has launched an enhanced range of Shell Advance Motorcycle Oil. The newly formulated Advanced AX7 synthetic technology oil offers riders an exceptionally smooth experience, leveraging innovative flexi molecule technology to ensure optimal power transfer from the engine to the wheels. Additionally, the Shell Advanced AX5 premium mineral oil has been upgraded with Active Cleansing Technology and improved specification.

Key Market Challenges

Intense Competition and Pricing Pressures

The automotive lubricant market is characterized by intense competition among a multitude of players, ranging from large multinational corporations to smaller local manufacturers. This competitive landscape often leads to aggressive pricing strategies, with companies seeking to capture market share by undercutting prices. While this can benefit consumers in the short term through lower prices, it poses significant challenges for manufacturers aiming to maintain healthy profit margins and quality. Sustaining profitability in such an environment requires careful cost management, innovation, and differentiation in product offerings.Fluctuating Raw Material Prices

Another significant challenge in the automotive lubricant industry is the volatility of raw material prices. The costs of base oils and additives, which are critical components of lubricants, can fluctuate due to various factors, including geopolitical tensions, supply chain disruptions, and changes in demand. Such volatility can significantly impact production costs, making it challenging for manufacturers to set competitive prices while ensuring profitability.Key Market Trends

Shift Toward Synthetic and Semi-Synthetic Lubricants

The automotive lubricant market is experiencing a notable shift toward synthetic and semi-synthetic products, driven by their superior performance characteristics compared to traditional mineral oils. Consumers are increasingly aware of the benefits these advanced lubricants offer, including enhanced engine protection, improved fuel efficiency, and longer oil change intervals. As a result, sales of synthetic lubricants are on the rise, capturing a larger share of the market.This trend is further supported by advancements in lubricant technology, which have made synthetic oils more accessible and affordable for the average consumer. As automotive manufacturers continue to develop high-performance engines that require specialized lubricants, the demand for synthetic and semi-synthetic options is expected to grow.

Growth in the Electric Vehicle (EV) Market

The rise of electric vehicles (EVs) presents a unique opportunity for the automotive lubricant market. As more consumers shift toward EVs due to environmental concerns and government incentives, the demand for specialized lubricants and fluids for these vehicles is increasing. While EVs require different lubrication solutions than traditional internal combustion engine vehicles, the need for high-performance fluids remains critical for ensuring optimal operation.Furthermore, as governments worldwide push for a transition to greener transportation, the EV market is set for sustained growth. Manufacturers are developing lubricants specifically designed for EV applications, such as electric motor oils and thermal management fluids. These products enhance performance, efficiency, and durability in electric drivetrains. As the EV market continues to expand, manufacturers are investing in R&D to create tailored solutions that will position themselves as leaders in this emerging segment.

Segmental Insights

Base Oil Insights

The Indian automotive lubricant market is segmented by base oil into three primary categories: synthetic, semi-synthetic, and mineral oils. Synthetic lubricants are engineered using advanced chemical processes to provide superior performance characteristics. They offer enhanced lubrication, improved thermal stability, and better protection against engine wear and tear. Their formulation allows for lower viscosity options, which can improve fuel efficiency and extend oil change intervals, making them a popular choice among performance-focused consumers.Semi-synthetic oils combine mineral oil with synthetic additives, striking a balance between performance and cost. This hybrid formulation provides some benefits of synthetic oils, such as improved engine cleanliness and enhanced protection, while still being more affordable than fully synthetic options. Semi-synthetic lubricants cater to a wide range of consumers who seek quality without the premium price tag associated with fully synthetic products. Their versatility makes them suitable for various driving conditions and engine types, appealing to both casual drivers and those who use their vehicles more intensively.

Mineral oils, derived from refining crude oil, have been traditionally used in the automotive sector and continue to serve a substantial segment of the market. These lubricants are often more affordable and widely available, making them a go-to choice for budget-conscious consumers. While mineral oils may not offer the same level of performance as synthetic or semi-synthetic options, advancements in formulation and additives have improved their effectiveness, ensuring adequate protection and lubrication for many standard vehicles.

Regional Insights

In 2023, the South region of India emerged as the dominant market for automotive lubricants. This growth can be attributed to several factors that have positioned South India at the forefront of the automotive sector. The region boasts a high concentration of automotive manufacturing plants, which serve as a crucial hub for both domestic and international vehicle production. This robust manufacturing base not only increases the demand for lubricants but also encourages the development of specialized products tailored to the needs of various vehicle types produced in the area.A significant factor contributing to the South’s dominance is the rising number of vehicles on the road. Urbanization, coupled with an expanding middle class, has led to increased vehicle ownership in cities like Bengaluru, Chennai, and Hyderabad. As more consumers invest in personal and commercial vehicles, the demand for quality lubricants has surged. South India’s consumers are also becoming increasingly aware of the importance of regular vehicle maintenance, driving up the demand for high-performance lubricants that can enhance engine efficiency and longevity.

The South region is also characterized by a well-established distribution network for automotive lubricants. Strong relationships between manufacturers and local distributors ensure that a wide range of products is readily available to consumers. This accessibility, combined with growing consumer awareness regarding vehicle maintenance, creates a favorable environment for lubricant sales. Furthermore, local workshops and service centers in South India emphasize the importance of using quality lubricants, reinforcing consumer preferences for advanced products.

Combining a strong automotive manufacturing base, increasing vehicle ownership, a robust distribution network, and a shift toward environmentally conscious products positions South India as a key player in the automotive lubricant market. This dynamic landscape is likely to continue evolving, with ongoing developments in technology and consumer preferences shaping the future of lubricants in the region.

Key Market Players

- Indian Oil Corporation Limited

- Castrol India Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Gulf Oil International Ltd

- Valvoline Cummins Private Limited

- Shell India Markets Private Limited

- TotalEnergies S.A.

- SAVITA OIL TECHNOLOGIES LIMITED

- Veedol Corporation Limited

Report Scope:

In this report, the India Automotive Lubricant market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Automotive Lubricant Market, By Vehicle Type:

- Passenger Car

- Commercial Vehicle

- Two-Wheelers

India Automotive Lubricant Market, By Lubricant Type:

- Engine Oil

- Gear and Brake Oil

- Transmission Fluid

- Grease

India Automotive Lubricant Market, By Base Oil:

- Synthetic

- Semi-Synthetic

- Mineral

India Automotive Lubricant Market, By Sales Channel:

- Online

- Offline

India Automotive Lubricant Market, By Region:

- North India

- West India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Indian Automotive Lubricant market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Indian Oil Corporation Limited

- Castrol India Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Gulf Oil Lubricants India Limited

- Valvoline Cummins Private Limited

- Shell India Markets Private Limited

- Total Oil India Private Limited

- SAVITA OIL TECHNOLOGIES LIMITEDAT&T

- Veedol Corporation Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 99 |

| Published | November 2024 |

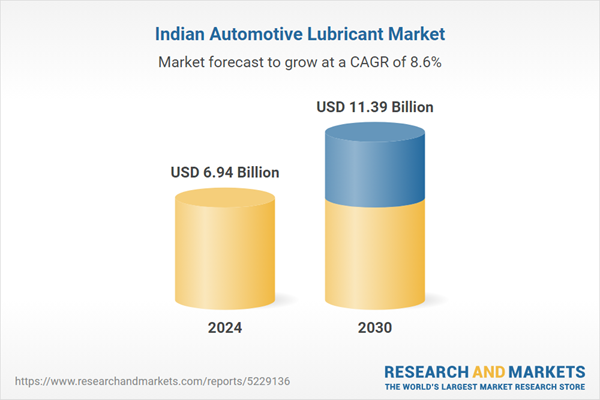

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.94 Billion |

| Forecasted Market Value ( USD | $ 11.39 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |