Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The technological advancements are reshaping the market, enabling more sophisticated testing methods and real-time monitoring of environmental parameters. Big data analytics further enhance decision-making by processing large datasets efficiently. The trend towards sustainable practices drives the need for environmental testing to verify efforts in minimizing environmental impact. As environmental protection gains prominence, the demand for accurate and comprehensive testing services continues to grow.

Key Market Drivers

Growing Concern for Environmental Health

The remarkable expansion of the United States Environmental Testing Market is propelled by the increasing public consciousness regarding environmental health. With the visible impacts of climate change and pollution, individuals are more aware of the profound influence of human activities on the environment. This awareness fuels a substantial demand for regular testing across various sample types to uphold environmental standards. The stringent regulations from regulatory bodies drive the environmental testing market further. These regulations mandate regular testing and sample inspections to safeguard both the environment and public health.Consequently, continuous monitoring and compliance become imperative, boosting the need for environmental testing services. The significant technological strides contribute to market growth. Advanced testing methods yield more precise and comprehensive data essential for addressing environmental health concerns effectively. Innovations like advanced sensor technologies enable real-time environmental monitoring, facilitating immediate responses to deviations.

The integration of big data analytics revolutionizes the processing and interpretation of vast environmental datasets, enhancing efficiency. The heightened concern for environmental health is a pivotal driver for the United States Environmental Testing Market. As society confronts complex environmental challenges, the role of environmental testing in evaluating, monitoring, and mitigating these issues grows increasingly crucial. By embracing cutting-edge technologies and emphasizing environmental awareness and compliance, the environmental testing industry remains pivotal in ensuring a sustainable and healthy future for the planet.

Surge in Technological Advancements

The environmental testing market has experienced a significant evolution due to the integration of advanced technologies. These sophisticated testing methods not only yield more precise and thorough data but also play a critical role in evaluating and safeguarding environmental health. Real-time monitoring of environmental conditions, facilitated by advanced sensor technologies, has revolutionized the industry by enabling swift detection and timely mitigation of potential issues.For instance, In January 2024, the Next Generation Emissions Measurement (NGEM) research team announced a collaboration with industry leaders, state and local regulators, communities, and technology firms to develop innovative solutions for detecting and controlling fugitive industrial volatile organic compound (VOC) emissions. Addressing these emissions promptly can result in safer working conditions, cost savings from reduced product loss, lower air pollution, and better public health protection. The EPA is advancing affordable, portable air measurement technologies to enhance the monitoring of fugitive emissions. These technologies enable real-time mobile and stationary measurements to assess common pollutants and air toxins in specific areas, such as near industrial plants, oil and gas operations, rail yards, or ports. Air sensor equipment can be deployed individually or as part of a network for fence line monitoring.

The emergence of big data and analytics has had a profound impact on the market. These state-of-the-art technologies have transformed the processing and interpretation of extensive environmental datasets. Companies can now efficiently identify patterns, trends, and correlations in environmental data, enabling informed decision-making in policy formulation and regulatory compliance.

The incorporation of automation and artificial intelligence (AI) is reshaping environmental testing practices. Automated sample collection and testing procedures enhance efficiency and reduce the risk of human error. AI algorithms can analyze complex environmental datasets, providing deep insights that would be challenging to derive manually. This convergence of automation and AI has the potential to revolutionize the execution and interpretation of environmental testing. Remote sensing technology represents another significant advancement in the environmental testing market. By enabling the monitoring of large and inaccessible areas, this technology furnishes valuable data on air quality, water pollution, and deforestation. It has become increasingly vital for tracking environmental changes and ensuring regulatory compliance, offering a comprehensive perspective on environmental conditions in expansive regions previously challenging to observe.

Key Market Challenges

Surge in Regulatory Compliance

Regulations play a crucial role in upholding environmental standards and safeguarding public health. However, they impose significant challenges on businesses operating in the environmental testing market. One major obstacle is the substantial cost associated with regulatory compliance. Studies have highlighted the economic strains faced by industries like the U.S. tilapia market due to these regulatory expenses. The regulatory compliance brings the risk of greenwashing, where companies may engage in deceptive practices by making misleading claims about environmental benefits.To uphold credibility, environmental testing firms must ensure transparency and accuracy in their testing methods and results, especially as regulatory bodies intensify their crackdown on such misleading practices. The environmental testing market grapples with the complexity of navigating intricate regulatory landscapes, particularly when overlapping with sectors such as life sciences. The life sciences industry has already voiced challenges in effectively responding to the evolving regulatory framework, indicating the need for comprehensive strategies to address regulatory compliance requirements while ensuring the integrity of environmental testing practices. Finding a balance between regulatory compliance and operational efficiency remains a key priority for businesses in the environmental testing market to sustain credibility and foster trust among stakeholders.

Cost Constraints

Cost constraints are a significant challenge for the United States Environmental Testing Market, impacting both businesses and regulatory agencies involved in environmental monitoring and compliance. Conducting comprehensive environmental testing requires significant financial resources due to various factors. Firstly, acquiring and maintaining state-of-the-art testing equipment, instrumentation, and laboratory facilities entails substantial upfront costs and ongoing maintenance expenses. The procurement of specialized reagents, chemicals, and consumables necessary for sample analysis contributes to the overall operational expenses.Employing skilled personnel, including scientists, technicians, and quality assurance professionals, adds to the labor costs associated with environmental testing. These personnel require continuous training to stay updated on evolving testing methodologies and regulatory requirements, further increasing operational expenditures. Ccompliance with stringent regulatory standards necessitates rigorous quality control measures, which entail additional costs for conducting internal audits, proficiency testing, and ensuring accreditation or certification. The outsourcing certain testing services to accredited laboratories may be necessary for smaller firms lacking in-house capabilities, incurring additional costs. Navigating cost constraints while maintaining high testing standards and regulatory compliance poses a significant challenge for businesses operating in the United States Environmental Testing Market.

Key Market Trends

Rise in Air Quality Testing

The surge in demand for air quality testing stems from both regulatory mandates and heightened public awareness regarding the adverse effects of air pollution on human health and the environment. Entities like the U.S. Environmental Protection Agency (EPA) enforce strict standards under the Clean Air Act, necessitating regular and precise testing for common pollutants like particulate matter and hazardous gases. Advancements in technology have revolutionized air quality testing, enabled real-time monitoring and furnished continuous data for informed decision-making. These innovations offer enhanced accuracy and depth in identifying pollutant sources and their impacts.With escalating concerns over air pollution, the United States anticipates a substantial uptick in demand for air quality testing services. For instance, in July 2024, VirExit Technologies Inc., a leader in health, safety, and security solutions, announced a significant agreement with a major U.S. school district to conduct a test pilot of its MaxClean 756 Air and Surface Purification System.

The test will be third-party lab verified to assess the effectiveness of MaxClean 756 in improving indoor air quality and reducing harmful bacteria, viruses, toxic molds, fungi, and volatile organic compounds (VOCs) in a designated area of the facility facing challenges with poor indoor air quality, surface conditions, and pathogen control. Factors driving this growth include urbanization, industrial activities, and the imperative for reliable data to guide policymaking. As regulatory standards evolve and become more rigorous, the need for air quality testing is expected to intensify. Ultimately, air quality testing stands as a pivotal trend in the United States Environmental Testing Market, serving as a critical tool in combating air pollution and safeguarding public health and environmental well-being.

Segmental Insights

Technology Insights

Based on technology, the rapid method segment emerged as the dominating segment in the United States market for environmental testing in 2023. The imperative for stable and efficient analysis tools within the commercial sector is a key catalyst for advancing rapid environmental testing methods. Urbanization and industrialization have escalated contaminant levels across water, air, and soil, prompting governmental intervention and regulatory measures to mitigate environmental degradation. There's a marked upsurge in demand for swift testing solutions. Both governmental bodies and private enterprises are heavily investing in treatment and detection methodologies to bolster testing equipment commercialization. These investments aim to amplify the efficiency and efficacy of environmental testing, creating promising avenues for market expansion.The confluence of reliable, time-saving analysis tools, alongside heightened awareness and regulatory enforcement, propels the rapid environmental testing method market's evolution. With its growth, there's a mounting requirement for innovative approaches to cater to diverse industry needs and ensure environmental sustainability and welfare.

Contaminant Insights

Based on contaminants, the organic compounds emerged as the fastest growing segment in the United States market for environmental testing during the forecast period. Organic contaminants encompass carbon-based substances like organic solvents, pesticides, petroleum-derived waste, wood products, and volatile compounds in gas or liquid form. These compounds are extensively utilized in diverse industries for manufacturing purposes. Unfortunately, some sectors resort to improper disposal methods such as land dumping or releasing untreated industrial waste into natural water bodies, storm drains, or sewer systems.Fluorescence spectroscopy has emerged as a rapid and convenient technique for detecting and quantifying aquatic organic pollutants. As the global population expands and individuals' purchasing power grows, various industries experience significant growth. However, this industrial expansion also contributes to an uptick in organic compound contamination, thereby boosting demand for environmental testing in the United States market. Safeguarding a safe and healthy environment becomes increasingly imperative amidst these challenges.

Regional Insights

Based on Region, Mid-West emerged as the dominating region in the United States Environmental Testing Market in 2023, holding the largest market share in terms of value. The Midwest's prominence in the environmental testing market stems largely from its expansive agricultural landscape. With vast farmland featuring fertile soils and extensive fields, the region not only drives economic growth but also necessitates regular soil and water testing to support sustainable farming practices.The resurgence of manufacturing in the Midwest has heightened the demand for environmental testing services, driven by the need to ensure compliance with stringent regulations. This testing is vital for monitoring the environmental impact of industrial activities on air, water, and soil quality, thereby promoting a healthy environment for both inhabitants and wildlife. Facing unique environmental challenges due to changing climatic conditions, the Midwest emphasizes continuous testing and monitoring to develop informed mitigation strategies and prioritize climate resilience and natural resource preservation.

Key Market Players

- Eurofins Scientific Inc.

- SGS S.A.

- Bureau Veritas SA

- Intertek Group Plc.

- ALS Limited

- Microbac Laboratories, Inc.

- TÜV SÜD America, Inc.

- Mérieux NutriSciences

- R J Hill Laboratories Ltd.

- Synbio Laboratories

Report Scope:

In this report, the United States Environmental Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Environmental Testing Market, By Technology:

- Conventional

- Rapid Method

United States Environmental Testing Market, By Contaminant:

- Microbial Contamination

- Organic Compounds

- Heavy Metals

- Residues

- Solids

United States Environmental Testing Market, By Region:

- North-East

- Mid-West

- South

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Environmental Testing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Eurofins Scientific Inc.

- SGS S.A.

- Bureau Veritas SA

- Intertek Group Plc.

- ALS Limited

- Microbac Laboratories, Inc.

- TÜV SÜD America, Inc.

- Mérieux NutriSciences

- R J Hill Laboratories Ltd.

- Synbio Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | November 2024 |

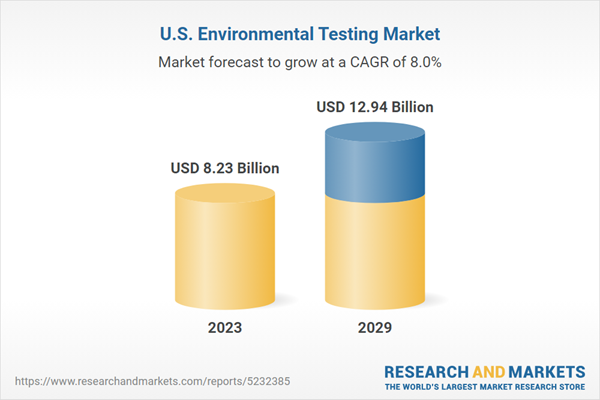

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 8.23 Billion |

| Forecasted Market Value ( USD | $ 12.94 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |