Increasing Opportunities for AI Imaging in Emerging Economies

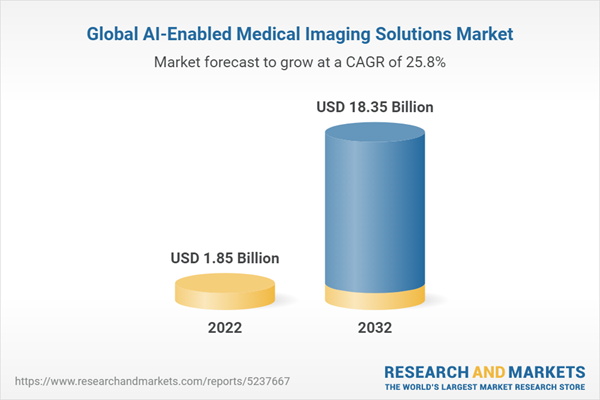

The global AI-enabled medical imaging solutions market was valued at $1,854.5 million in 2022 and is anticipated to reach $18,356.5 million by 2032, witnessing a CAGR of 25.76% during the forecast period 2022-2032. The growth in the global AI-enabled medical imaging solutions market is expected to be driven by the increasing awareness regarding the early detection of chronic disorders, the facilitation of better clinical decisions and increased accuracy with artificial intelligence, the shortage of healthcare workforce, technological advancements in artificial intelligence (AI)-enabled products and the increasing regulatory approvals for them, and the increasing therapeutic applications of AI-enabled devices.

Market Lifecycle Stage

The AI-enabled medical imaging solutions market is in the developing phase. AI-enabled medical imaging solutions in emerging countries, technological advancements in imaging devices, and the adoption of artificial intelligence and deep learning in imaging systems are some of the major opportunities in the global AI-enabled medical imaging solutions market. Furthermore, some of the key trends going on in the market are a significant number of collaborations among market players, the adoption of machine learning and deep learning in medical imaging, various new product offerings, and the expansion of companies into the global AI-enabled medical imaging solutions market.

Impact of COVID-19

Immediately after the outbreak of COVID-19, the focus of the healthcare systems switched to managing the pandemic and related crises. This led to hospital budgets shrinking and thus resulted in the slow growth of AI. However, AI is being deployed in radiology departments across the globe to help fight COVID-19, and AI-based tools are playing an important role in fighting the COVID-19 pandemic. The adoption of AI in clinical settings increased during the pandemic owing to its numerous advantages in tackling COVID-19. According to a study published in September 2021 by the Frontiers, titled “Artificial Intelligence for COVID-19: A Systematic Review,” AI assisted in achieving high execution in diagnosis, prognosis evaluation, pandemic prediction, and drug discovery for COVID-19. Thus, there was an appositive impact of COVID-19 on the adoption of AI in clinical settings and clinical decision-making.

Market Segmentation

Segmentation 1: by Modality

- Computed Tomography (CT)

- Magnetic Resonance (MR)

- X-Ray

- Ultrasound

- Mammography

- Multimodality Imaging Systems

- Other Modalities

Based on modality, the global AI-enabled medical imaging solutions market is expected to be dominated by the computed tomography (CT) segment.

Segmentation 2: by Product

- Hardware

- Software

Based on product, the global AI-enabled medical imaging solutions market is dominated by the software segment.

Segmentation 3: by Deployment Model

- Cloud- and Web-Based Solutions

- On-Premises Solutions

Based on deployment model, the global AI-enabled medical imaging solutions market is dominated by the cloud- and web-based solutions segment.

Segmentation 4: by Workflow

- Image Acquisition

- Image Analysis

- Detection

- Diagnosis and Treatment Decision Support

- Predictive Analysis and Risk Assessment

- Triage

- Reporting and Communication

Based on workflow, the global AI-enabled medical imaging solutions market is dominated by the image analysis segment.

Segmentation 5: by Therapeutic Application

- Specialty Imaging

- General Imaging

Based on therapeutic application, the global AI-enabled medical imaging solutions market is dominated by the specialty imaging segment.

Segmentation 6: by Region

- North America - U.S., Canada

- Europe - Germany, France, U.K., Italy, Spain, Switzerland, Sweden, Netherlands, and Rest-of-Europe

- Asia-Pacific - Japan, China, India, Australia and New Zealand, South Korea, Singapore, and Rest-of-Asia-Pacific

- Rest-of-the-World - Israel, Brazil, Mexico, and Rest-of-Rest-of-the-World

Based on region, the global AI-enabled medical imaging solutions market is dominated by North America.

Recent Developments in the Global AI-Enabled Medical Imaging Solutions Market

- In November 2022, Aidoc received U.S. FDA approval for its CT-based AI solution for the diagnosis of aortic dissection (AD) and all vessel occlusions (VOs).

- In September 2022, Aidoc partnered with Sana Klinikum Lichtenberg, which is the largest German private hospital network of 55 facilities. Through this partnership, Aidoc’s AI solution for pulmonary embolism (PE) will be integrated into all the facilities of Sana Klinikum Lichtenberg.

- In June 2022, Blackford Analysis Limited partnered with Us2.ai to bring advanced echocardiography analysis tools to the Blackford Platform.

- In May 2022, Butterfly Network, Inc. partnered with the Medical University of South Carolina to work on transforming patient care, health education, and medical research.

- In August 2021, Blackford Analysis Limited partnered with Qlarity Imaging to bring QuantX Diagnostic AI to Radiologists via the Blackford Platform.

- In September 2021, Aidoc and Subtle Medical partnered to establish end-to-end AI solutions for medical imaging.

- In December 2020, Agfa HealthCare, a subsidiary of Agfa-Gavaert Group, launched a new product called RUBEE for AI, which facilitates hospitals to entrench the best artificial intelligence (AI) in their imaging network.

- In May 2020, Agfa HealthCare, a subsidiary of Agfa-Gavaert Group, partnered with Northwest Clinics to expand the imaging platform of clinics with the RUBEE for AI.

- In November 2021, Butterfly Network, Inc. formed a distribution partnership with Abdul Latif Jameel Health for the distribution of its Butterfly iQ+ ultrasound device to people across the Middle East, North Africa, Turkey, and India.

- In August 2021, Caption Health formed an exclusive partnership with Butterfly Network Inc. to facilitate earlier disease detection and management with AI-based guidance and diagnostics.

Demand - Drivers and Limitations

Following are the drivers for the global AI-enabled medical imaging solutions market:

- Increasing Awareness Regarding Early Detection of Chronic Disorders

- Facilitation of Better Clinical Decision-Making and Increased Accuracy with Artificial Intelligence

- Increasing Therapeutic Applications of AI-Enabled Devices

- Technologically Advancements in AI-Enabled Products and the Increasing Regulatory Approvals for them

The market is expected to face some limitations as well due to the following restraints:

- Legal Implications of AI Systems

- Increasing Security Breaches Leading to Privacy and Security Concerns for Healthcare Data

How can this report add value to an organization?

- Product/Innovation Strategy: The product segment helps the reader understand the different types of AI-enabled medical imaging solutions available for use in hospitals and diagnostic centers. Moreover, the study provides the reader with a detailed understanding of the different AI-enabled medical imaging solutions based on modality (computed tomography (CT), magnetic resonance (MR), X-ray, ultrasound, mammography, multimodality imaging systems, and other modalities), product (software and hardware), deployment model (cloud- and web-based solutions and on-premises solutions), workflow (image acquisition, image analysis, detection, diagnosis and treatment decision support, predictive analysis and risk assessment, triage, and reporting and communication), and therapeutic application (specialty imaging and general imaging).

- Growth/Marketing Strategy: The global AI-enabled medical imaging solutions market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, product launches, and funding activities. Partnerships, alliances, and business expansions accounted for the maximum number of key developments, i.e., nearly half of the total developments in the global AI-enabled medical imaging solutions market, followed by regulatory and legal activities and new offerings.

- Competitive Strategy: Key players in the global AI-enabled medical imaging solutions market analyzed and profiled in the study involve players that offer AI-enabled medical imaging solutions. Moreover, a detailed product benchmarking based on workflow, modality, and therapeutic application of the players operating in the global AI-enabled medical imaging solutions market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, collaborations, product launches and approvals, and funding scenarios will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing the company’s coverage, product portfolio, and market penetration.

Key Companies Profiled

- Agfa-Gevaert Group

- Aidoc

- Blackford Analysis Limited

- Butterfly Network, Inc.

- Canon Inc.

- Caption Health

- Carestream Health Inc.

- FUJIFILM Holdings Corporation

- General Electric Company

- Hologic, Inc.

- iCAD, Inc.

- Koninklijke Philips N.V.

- NVIDIA Corporation

- Siemens Healthineers AG

- VUNO, Inc.

Table of Contents

1. Markets

1.1 Global Market Outlook

1.1.1 Product Definition

1.1.2 Inclusion and Exclusion Criteria

1.1.3 Key Findings

1.1.4 Assumptions and Limitations

1.1.5 Market Scenario

1.1.5.1 Realistic Growth Scenario

1.1.5.2 Optimistic Growth Scenario

1.1.5.3 Pessimistic/Conservative Growth Scenario

1.2 Industry Outlook

1.2.1 Industry Ecosystem

1.2.2 Key Trends

1.2.2.1 Significant Number of Collaborations among Market Players

1.2.2.2 Adoption of Machine Learning and Deep Learning in Medical Imaging

1.2.2.3 Shift of AI Technology from On-Premises Solutions to Cloud- and Web-based Platform Approach

1.2.2.4 Rising Number of Start-Ups in the Market

1.2.3 Opportunity Assessment

1.2.4 Regulatory Framework

1.2.4.1 Consortiums, Associations, and Regulatory Bodies

1.2.4.2 Regulatory Framework for Artificial Intelligence-Based FDA-Approved Medical Devices and Algorithms

1.2.4.3 Regulatory Framework in the U.S.

1.2.4.4 Regulatory Framework in Europe

1.2.4.5 Regulatory Framework in Japan

1.2.4.6 Regulatory Framework in China

1.2.4.7 Regulatory Framework in the Other Countries

1.2.5 Patent Analysis

1.2.5.1 Awaited Technological Developments

1.2.5.2 Patent Filing Trend (by Country)

1.2.5.3 Patent Filing Trend (by Year)

1.2.6 Funding Scenario

1.2.7 Case Studies

1.2.7.1 Case Study 1: Aidoc

1.2.7.2 Case Study 2: iCAD, Inc.

1.2.7.3 Case Study 3: Qure.ai

1.2.8 Challenges for Implementation of AI-enabled Solutions in Medical Imaging

1.3 Impact of COVID-19 on the Global AI-Enabled Medical Imaging Solutions

1.3.1 Pre-COVID-19 Phase

1.3.2 During COVID

1.3.2.1 Impact of COVID-19 on Clinical Settings and Clinical Decision-Making

1.3.2.2 Impact on AI-Based Medical Imaging Solution Manufacturers

1.3.3 Post-COVID-19 Phase

1.4 Real World Evidence

1.4.1 Overview

1.4.2 iCAD, Inc.

1.4.2.1 Role of iCAD, Inc. in the Global AI-Enabled Medical Imaging Solutions Market

1.4.2.2 Recent Clinical Study Results

1.4.2.3 Clinical and Business Challenges Solved by ProFound AI

1.4.3 Nanox Imaging LTD.

1.4.3.1 Role of Nanox Imaging LTD. in the Global AI-Enabled Medical Imaging Solutions Market

1.4.4 MIRADA MEDICAL LIMITED

1.4.4.1 Role of MIRADA MEDICAL LIMITED in the Global AI-Enabled Medical Imaging Solutions Market

1.4.5 Subtle Medical, Inc.

1.4.5.1 Role of Subtle Medical, Inc. in the Global AI-Enabled Medical Imaging Solutions Market

1.4.6 Riverain Technologies, LLC

1.4.6.1 Role of Riverain Technologies, LLC in the Global AI-Enabled Medical Imaging Solutions Market

1.4.6.2 Clinical Study Evidence

1.5 Business Dynamics

1.5.1 Impact Analysis

1.5.2 Business Drivers

1.5.2.1 Increasing Awareness Regarding Early Detection of Chronic Disorders

1.5.2.2 Facilitation of Better Clinical Decision-Making and Increased Accuracy with Artificial Intelligence

1.5.2.3 Increasing Therapeutic Applications of AI-Enabled Devices

1.5.2.4 Technologically Advancements in AI-Enabled Products and the Increasing Regulatory Approvals for them

1.5.3 Business Restraints

1.5.3.1 Legal Implications of AI Systems

1.5.3.2 Increasing Security Breaches Leading to Privacy and Security Concerns for Healthcare Data

1.5.4 Business Opportunities

1.5.4.1 Increasing Opportunities for AI Imaging in Emerging Economies

1.5.4.2 Shortage of the Healthcare Workforce Leading to Increased Demand for AI-Enabled Solutions

1.5.4.3 Increasing Synergy Between Manufacturers and Hospitals

2. Global AI-Enabled Medical Imaging Solutions Market (by Modality)

2.1 Key Findings and Opportunity Assessment

2.2 Growth-Share Matrix

2.3 Product Benchmarking

2.4 Computed Tomography (CT)

2.5 Magnetic Resonance (MR)

2.6 Ultrasound

2.7 X-Ray

2.8 Mammography

2.9 Multimodality Imaging Systems

2.10 Other Modalities

3. Global AI-Enabled Medical Imaging Solutions Market (by Product)

3.1 Key Findings and Opportunity Assessment

3.2 Growth-Share Matrix

3.3 Software

3.4 Hardware

4. Global AI-Enabled Medical Imaging Solutions Market (by Deployment Model)

4.1 Key Findings and Opportunity Assessment

4.2 Growth-Share Matrix

4.3 Cloud- and Web-Based Solutions

4.4 On-Premises Solutions

5. Global AI-Enabled Medical Imaging Solutions Market (by Workflow)

5.1 Key Findings and Opportunity Assessment

5.2 Growth-Share Matrix

5.3 Product Benchmarking

5.4 Image Acquisition

5.5 Image Analysis

5.6 Detection

5.7 Diagnosis and Treatment Decision Support

5.8 Predictive Analysis and Risk Assessment

5.9 Triage

5.10 Reporting and Communication

6. Global AI-Enabled Medical Imaging Solutions Market (by Therapeutic Application)

6.1 Key Findings and Opportunity Assessment

6.2 Growth-Share Matrix

6.3 Product Benchmarking

6.4 Specialty Imaging

6.4.1 Cardiology

6.4.1.1 Major Ongoing Clinical Trials for AI in Cardiology

6.4.1.2 Market Sizing and Forecast

6.4.2 Oncology

6.4.2.1 Major Ongoing Clinical Trials for AI in Oncology

6.4.2.2 Market Sizing and Forecast

6.4.2.2.1 By Type

6.4.2.2.1.1 Lung Cancer

6.4.2.2.1.2 Breast Cancer

6.4.2.2.1.3 Other Cancer Types

6.4.3 Neurology

6.4.3.1 Major Ongoing Clinical Trials for AI in Neurology

6.4.3.2 Market Sizing and Forecast

6.4.4 Respiratory

6.4.4.1 Major Ongoing Clinical Trials for AI in Respiratory Diseases

6.4.4.2 Market Sizing and Forecast

6.4.5 Orthopedics

6.4.5.1 Major Ongoing Clinical Trials for AI in Orthopedics

6.4.5.2 Market Sizing and Forecast

6.4.6 Others

6.5 General Imaging

7. Region

7.1 North America AI-Enabled Medical Imaging Solutions Market

7.1.1 Key Findings and Opportunity Assessment

7.1.2 Market Dynamics

7.1.2.1 Impact Analysis

7.1.3 Market Sizing and Forecast

7.1.3.1 North America AI-Enabled Medical Imaging Solutions Market (by Country)

7.1.3.1.1 U.S.

7.1.3.1.2 Canada

7.2 Europe AI-Enabled Medical Imaging Solutions Market

7.2.1 Key Findings and Opportunity Assessment

7.2.2 Market Dynamics

7.2.2.1 Impact Analysis

7.2.3 Market Sizing and Forecast

7.2.3.1 Europe AI-Enabled Medical Imaging Solutions Market (by Country)

7.2.3.1.1 Germany

7.2.3.1.2 U.K.

7.2.3.1.3 France

7.2.3.1.4 Italy

7.2.3.1.5 Spain

7.2.3.1.6 Switzerland

7.2.3.1.7 Sweden

7.2.3.1.8 Netherlands

7.2.3.1.9 Rest-of-Europe

7.3 Asia-Pacific AI-Enabled Medical Imaging Solutions Market

7.3.1 Key Findings and Opportunity Assessment

7.3.2 Market Dynamics

7.3.2.1 Impact Analysis

7.3.3 Market Sizing and Forecast

7.3.3.1 Asia-Pacific AI-Enabled Medical Imaging Solutions Market (by Country)

7.3.3.1.1 China

7.3.3.1.2 Japan

7.3.3.1.3 Australia and New Zealand

7.3.3.1.4 India

7.3.3.1.5 South Korea

7.3.3.1.6 Singapore

7.3.3.1.7 Rest-of-Asia-Pacific

7.4 Rest-of-the-World AI-Enabled Medical Imaging Solutions Market

7.4.1 Key Findings and Opportunity Assessment

7.4.2 Market Dynamics

7.4.2.1 Impact Analysis

7.4.3 Market Sizing and Forecast

7.4.3.1 Rest-of-the-World AI-Enabled Medical Imaging Solutions Market (by Country)

7.4.3.1.1 Israel

7.4.3.1.2 Brazil

7.4.3.1.3 Mexico

7.4.3.1.4 Rest-of-Rest-of-the-World

8. Markets - Competitive Benchmarking & Company Profiles

8.1 Competitive Landscape

8.1.1 Key Strategies and Developments

8.1.1.1 Partnerships, Alliances, and Business Expansions

8.1.1.2 Regulatory and Legal Activities

8.1.1.3 New Offerings

8.1.1.4 Funding Activities

8.1.1.5 Mergers and Acquisitions

8.1.2 Key Development Analysis (Heat Map)

8.2 Company Profiles

8.2.1 Agfa-Gevaert Group

8.2.1.1 Company Overview

8.2.1.2 Role of Agfa-Gevaert Group in the Global AI-Enabled Medical Imaging Solutions Market

8.2.1.3 Product Portfolio

8.2.1.4 Financials

8.2.1.5 Analyst Perception

8.2.2 Aidoc

8.2.2.1 Company Overview

8.2.2.2 Role of Aidoc in the Global AI-Enabled Medical Imaging Solutions Market

8.2.2.3 Product Portfolio

8.2.2.4 Recent Developments

8.2.2.5 Analyst Perspective

8.2.3 Blackford Analysis Limited

8.2.3.1 Company Overview

8.2.3.2 Role of Blackford Analysis Limited in the Global AI-Enabled Medical Imaging Solutions Market

8.2.3.3 Product Portfolio

8.2.3.4 Recent Developments

8.2.3.5 Analyst Perspective

8.2.4 Butterfly Network, Inc.

8.2.4.1 Company Overview

8.2.4.2 Role of Butterfly Network, Inc. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.4.3 Product Portfolio

8.2.4.4 Financials

8.2.4.5 Recent Developments

8.2.4.6 Analyst Perspective

8.2.5 Canon Inc.

8.2.5.1 Company Overview

8.2.5.2 Role of Canon Inc. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.5.3 Product Portfolio

8.2.5.4 Financials

8.2.5.5 Recent Developments

8.2.5.6 Analyst Perception

8.2.6 Caption Health

8.2.6.1 Company Overview

8.2.6.2 Role of Caption Health in the Global AI-Enabled Medical Imaging Solutions Market

8.2.6.3 Product Portfolio

8.2.6.4 Recent Developments

8.2.6.5 Analyst Perspective

8.2.7 Carestream Health Inc.

8.2.7.1 Company Overview

8.2.7.2 Role of Carestream Health Inc. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.7.3 Product Portfolio

8.2.7.4 Analyst Perspective

8.2.8 FUJIFILM Holdings Corporation

8.2.8.1 Company Overview

8.2.8.2 Role of FUJIFILM Holdings Corporation in the Global AI-Enabled Medical Imaging Solutions Market

8.2.8.3 Product Portfolio

8.2.8.4 Financials

8.2.8.5 Recent Developments

8.2.8.6 Analyst Perspective

8.2.9 General Electric Company

8.2.9.1 Company Overview

8.2.9.2 Role of General Electric Company in the Global AI-Enabled Medical Imaging Solutions Market

8.2.9.3 Product Portfolio

8.2.9.4 Financials

8.2.9.5 Recent Developments

8.2.9.6 Analyst Perspective

8.2.10 Hologic, Inc.

8.2.10.1 Company Overview

8.2.10.2 Role of Hologic, Inc. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.10.3 Product Portfolio

8.2.10.4 Financials

8.2.10.5 Recent Developments

8.2.10.6 Analyst Perspective

8.2.11 iCAD, Inc.

8.2.11.1 Company Overview

8.2.11.2 Role of iCAD, Inc. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.11.3 Product Portfolio

8.2.11.4 Financials

8.2.11.5 Recent Developments

8.2.11.6 Analyst Perspective

8.2.12 Koninklijke Philips N.V.

8.2.12.1 Company Overview

8.2.12.2 Role of Koninklijke Philips N.V. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.12.3 Product Portfolio

8.2.12.4 Financials

8.2.12.5 Recent Developments

8.2.12.6 Analyst Perception

8.2.13 NVIDIA Corporation

8.2.13.1 Company Overview

8.2.13.2 Role of NVIDIA Corporation in the Global AI-Enabled Medical Imaging Solutions Market

8.2.13.3 Product Portfolio

8.2.13.4 Financials

8.2.13.5 Recent Developments

8.2.13.6 Analyst Perspective

8.2.14 Siemens Healthineers AG

8.2.14.1 Company Overview

8.2.14.2 Role of Siemens Healthineers AG in the Global AI-Enabled Medical Imaging Solutions Market

8.2.14.3 Product Portfolio

8.2.14.4 Financials

8.2.14.5 Recent Developments

8.2.14.6 Analyst Perspective

8.2.15 VUNO, Inc.

8.2.15.1 Company Overview

8.2.15.2 Role of VUNO, Inc. in the Global AI-Enabled Medical Imaging Solutions Market

8.2.15.3 Product Portfolio

8.2.15.4 Recent Developments

8.2.15.5 Analyst Perspective

List of Figures

Figure 1: Applications of AI in Healthcare

Figure 2: Global AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 3: Global AI-Enabled Medical Imaging Solutions Market, Impact Analysis

Figure 4: Global AI-Enabled Medical Imaging Solutions Market Share (by Modality), 2021 and 2032

Figure 5: Global AI-Enabled Medical Imaging Solutions Market Share (by Product), 2021 and 2032

Figure 6: Global AI-Enabled Medical Imaging Solutions Market Share (by Workflow), 2021 and 2032

Figure 7: Global AI-Enabled Medical Imaging Solutions Market Share (by Therapeutic Application), 2021 and 2032

Figure 8: Global AI-Enabled Medical Imaging Solutions Market Share (by Deployment Model), 2021 and 2032

Figure 9: Global AI-Based Medical Imaging Solutions Market (by Region), $Million, 2021 and 2032

Figure 10: Share of Key Developments and Strategies, January 2019-November 2022

Figure 11: Global AI-Enabled Medical Imaging Solutions Market Segmentation

Figure 12: Global AI-Enabled Medical Imaging Solutions Market: Research Methodology

Figure 13: Primary Research

Figure 14: Secondary Research

Figure 15: Data Triangulation

Figure 16: Global AI-Enabled Medical Imaging Solutions Market, Research Process

Figure 17: Assumptions and Limitations

Figure 18: Global AI-Enabled Medical Imaging Solutions Market Size and Growth Potential (Realistic Growth Scenario), $Million, 2020-2032

Figure 19: Global AI-Enabled Medical Imaging Solutions Market Size and Growth Potential (Optimistic Growth Scenario), $Million, 2020-2032

Figure 20: Global AI-Enabled Medical Imaging Solutions Market Size and Growth Potential (Pessimistic Growth Scenario), $Million, 2020-2032

Figure 21: Industry Ecosystem

Figure 22: Machine Learning and Deep Learning

Figure 23: Advantages of Cloud- and Web-Based AI Platforms

Figure 24: Global AI-Enabled Medical Imaging Solutions Market, Key Trends, Opportunity Assessment

Figure 25: Regulatory Process for Medical Devices in the U.S.

Figure 26: Global AI-Enabled Medical Imaging Solutions Market, Patent Analysis (by Country), January 2018-December 2022

Figure 27: Global AI-Enabled Medical Imaging Solutions Market, Patent Analysis (by Year), January 2018-December 2022

Figure 28: Trend for Fundings in AI-Enabled Medical Imaging Solutions Market, 2019-2022

Figure 29: Evaluation Criteria for AI-Enabled Solutions Adoption in Medical Imaging

Figure 30: Global AI-Enabled Medical Imaging Solutions Market, Pre-COVID-19, $Million, 2020-2032

Figure 31: iCAD, Inc. Product Offerings, Application and Efficiency

Figure 32: Comparison between the Individual Reader Performance with ProFound AI and without ProFound AI

Figure 33: Nanox Imaging LTD. Product Offerings, Application and Efficiency

Figure 34: Nanox EcoSystem

Figure 35: Nanox Business Model

Figure 36: MIRADA MEDICAL LIMITED Product Offerings, Application and Efficiency

Figure 37: Comparison of Time for DLCExpert Contours vs. Manual Contours

Figure 38: Subtle Medical, Inc. Product Offerings, Application and Efficiency

Figure 39: Comparison of Acquisition Time for Accelerated Scan Enhanced by SubtleMR vs. Original Scan

Figure 40: Comparison of Acquisition Time for Accelerated Scan Enhanced by SubtlePET vs. Original Scan

Figure 41: Riverain Technologies, LLC: Product Portfolio, Application and Efficiency

Figure 42: Better Outcomes from ClearRead Solutions

Figure 43: Study Results for Sensitivity and Specificity of SSNs, GGNs, and PSNs

Figure 44: Global AI-Enabled Medical Imaging Solutions Market, Impact Analysis

Figure 45: Various Study Articles Published on Increasing Use of Artificial Intelligence in Early Detection of Chronic Disease, 2003-2022

Figure 46: AI in Healthcare

Figure 47: Increasing FDA Approvals for AI-Enabled Products for Different Therapeutic Applications, 2016-2021

Figure 48: Technological Advancements in AI Medical Imaging

Figure 49: Regulatory Approvals for AI-Enabled Medical Imaging Solutions, 2019-2022

Figure 50: Global AI-Enabled Medical Imaging Solutions Market (by Modality)

Figure 51: Global AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Modality), $Million, 2021-2032

Figure 52: Global AI-enabled Medical Imaging Solutions Market, Growth-Share Matrix (by Modality), 2022-2032

Figure 53: Global AI-Enabled Medical Imaging Solutions Market, Product Benchmarking (by Modality)

Figure 54: Global AI-Enabled Medical Imaging Solutions Market (Computed Tomography (CT)), $Million, 2020-2032

Figure 55: Global AI-Enabled Medical Imaging Solutions Market (Magnetic Resonance (MR)), $Million, 2020-2032

Figure 56: Global AI-Enabled Medical Imaging Solutions Market (Ultrasound), $Million, 2020-2032

Figure 57: Global AI-Enabled Medical Imaging Solutions Market (X-Ray), $Million, 2020-2032

Figure 58: Global AI-Enabled Medical Imaging Solutions Market (Mammography), $Million, 2020-2032

Figure 59: Global AI-Enabled Medical Imaging Solutions Market (Multimodality Imaging Systems), $Million, 2020-2032

Figure 60: Global AI-Enabled Medical Imaging Solutions Market (Other Modalities), $Million, 2020-2032

Figure 61: Global AI-Enabled Medical Imaging Solutions Market (by Product)

Figure 62: Global AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Product), $Million, 2021-2032

Figure 63: Global AI-enabled Medical Imaging Solutions Market, Growth-Share Matrix (by Product), 2022-2032

Figure 64: Global AI-Enabled Medical Imaging Solutions Market (by Software), $Million, 2021-2032

Figure 65: Global AI-Enabled Medical Imaging Solutions Market, Software, (by Type) $Million, 2021-2032

Figure 66: Global AI-Enabled Medical Imaging Solutions Market (Hardware), $Million, 2020-2032

Figure 67: Global AI-Enabled Medical Imaging Solutions Market (by Deployment Model)

Figure 68: Global AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Deployment Model), $Million, 2021-2032

Figure 69: Global AI-Enabled Medical Imaging Solutions Market, Growth-Share Matrix (by Deployment Model), 2022-2032

Figure 70: Global AI-Enabled Medical Imaging Solutions Market (Cloud- and Web-Based Solutions), $Million, 2020-2032

Figure 71: Global AI-Enabled Medical Imaging Solutions Market (On-Premises Solutions), $Million, 2020-2032

Figure 72: Global AI-Enabled Medical Imaging Solutions Market (by Workflow)

Figure 73: Use Cases of Machine Learning in Different Workflow Segments

Figure 74: Global AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Workflow), $Million, 2021-2032

Figure 75: Global AI-enabled Medical Imaging Solutions Market, Growth-Share Matrix (by Workflow), 2022-2032

Figure 76: Global AI-Enabled Medical Imaging Solutions Market, Product Benchmarking (by Workflow)

Figure 77: Global AI-Enabled Medical Imaging Solutions Market (Image Acquisition), $Million, 2020-2032

Figure 78: Global AI-Enabled Medical Imaging Solutions Market (Image Analysis), $Million, 2020-2032

Figure 79: Global AI-Enabled Medical Imaging Solutions Market (Detection), $Million, 2020-2032

Figure 80: Global AI-Enabled Medical Imaging Solutions Market (Diagnosis and Treatment Decision Support), $Million, 2020-2032

Figure 81: Global AI-Enabled Medical Imaging Solutions Market (Predictive Analysis and Risk Assessment), $Million, 2020-2032

Figure 82: Global AI-Enabled Medical Imaging Solutions Market (Triage), $Million, 2020-2032

Figure 83: Global AI-Enabled Medical Imaging Solutions Market (Reporting and Communication), $Million, 2020-2032

Figure 84: Global AI-Enabled Medical Imaging Solutions Market (by Therapeutic Application)

Figure 85: Global AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Therapeutic Application), $Million, 2021-2032

Figure 86: Global AI-enabled Medical Imaging Solutions Market, Growth-Share Matrix (by Therapeutic Application), 2022-2032

Figure 87: Global AI-Enabled Medical Imaging Solutions Market, Product Benchmarking (by Specialty Imaging)

Figure 88: Global AI-Enabled Medical Imaging Solutions Market (by Specialty Imaging), $Million, 2020-2032

Figure 89: Global AI-Enabled Medical Imaging Solutions Market (Cardiology), $Million, 2020-2032

Figure 90: AI in Oncology

Figure 91: Global AI-Enabled Medical Imaging Solutions Market (by Oncology), $Million, 2020-2032

Figure 92: Global AI-Enabled Medical Imaging Solutions Market (Lung Cancer), $Million, 2020-2032

Figure 93: Global AI-Enabled Medical Imaging Solutions Market (Breast Cancer), $Million, 2020-2032

Figure 94: Global AI-Enabled Medical Imaging Solutions Market (Other Cancer Types), $Million, 2020-2032

Figure 95: Global AI-Enabled Medical Imaging Solutions Market (Neurology), $Million, 2020-2032

Figure 96: Global AI-Enabled Medical Imaging Solutions Market (Respiratory), $Million, 2020-2032

Figure 97: Global AI-Enabled Medical Imaging Solutions Market (Orthopedics), $Million, 2020-2032

Figure 98: Global AI-Enabled Medical Imaging Solutions Market (Others), $Million, 2020-2032

Figure 99: Global AI-Enabled Medical Imaging Solutions Market (General Imaging), $Million, 2020-2032

Figure 100: Global AI-Enabled Medical Imaging Solutions Market Share and CAGR (by Region), 2021 and 2022-2032

Figure 101: North America AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Country), $Million, 2021-2032

Figure 102: North America AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 103: North America AI-Enabled Medical Imaging Solutions Market (by Country), Share (%), 2021 and 2032

Figure 104: U.S. AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 105: Canada AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 106: Europe AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Country), $Million, 2021-2032

Figure 107: Europe AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 108: Europe AI-Enabled Medical Imaging Solutions Market (by Country), Share (%), 2021 and 2032

Figure 109: Germany AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 110: U.K. AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 111: France AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 112: Italy AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 113: Spain AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 114: Switzerland AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 115: Sweden AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 116: Netherlands AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 117: Rest-of-Europe AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 118: Asia-Pacific AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Country), $Million, 2021-2032

Figure 119: Asia-Pacific AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 120: Asia-Pacific AI-Enabled Medical Imaging Solutions Market (by Country), Share (%), 2021 and 2032

Figure 121: China AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 122: Japan AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 123: Australia and New Zealand AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 124: India AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 125: South Korea AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 126: Singapore AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 127: Rest-of-Asia-Pacific AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 128: Rest-of-the-World AI-Enabled Medical Imaging Solutions Market Incremental Opportunity (by Country), $Million, 2021-2032

Figure 129: Rest-of-the-World AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 130: Rest-of-the-World AI-Enabled Medical Imaging Solutions Market (by Country), Share (%), 2021 and 2032

Figure 131: Israel AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 132: Brazil AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 133: Mexico AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 134: Rest-of-Rest-of-the-World AI-Enabled Medical Imaging Solutions Market, $Million, 2020-2032

Figure 135: Share of Key Developments and Strategies, January 2019-November 2022

Figure 136: Partnerships, Alliances, and Business Expansions (by Company), January 2019-November 2022

Figure 137: Regulatory and Legal Activities (by Company), January 2019-November 2022

Figure 138: New Offerings (by Company), January 2019-November 2022

Figure 139: Funding Activities (by Company), January 2019-November 2022

Figure 140: Mergers and Acquisitions (by Company), January 2019-November 2022

Figure 141: Key Development Analysis (Heat Map), January 2019-November 2022

Figure 142: Agfa-Gevaert Group: Product Portfolio

Figure 143: Agfa-Gevaert Group: Overall Financials, $Million, 2019-2021

Figure 144: Agfa-Gevaert Group: Net Revenue (by Segment), $Million, 2019-2021

Figure 145: Agfa-Gevaert Group: Net Revenue (by Region), $Million, 2019-2021

Figure 146: Agfa-Gevaert Group: R&D Expenditure, $Million, 2019-2021

Figure 147: Aidoc: Product Portfolio

Figure 148: Blackford Analysis Limited: Product Portfolio

Figure 149: Butterfly Network, Inc.: Product Portfolio

Figure 150: Butterfly Network, Inc.: Overall Financials, $Million, 2019-2021

Figure 151: Butterfly Network, Inc.: Net Revenue (by Segment), $Million, 2019-2021

Figure 152: Butterfly Network, Inc.: Net Revenue (by Region), $Million, 2019-2021

Figure 153: Butterfly Network, Inc.: R&D Expenditure, $Million, 2019-2021

Figure 154: Canon Inc.: Product Portfolio

Figure 155: Canon, Inc.: Overall Financials, $Million, 2019-2021

Figure 156: Canon, Inc.: Net Revenue (by Segment), $Million, 2019-2021

Figure 157: Canon, Inc.: Revenue (by Region), 2019-2021

Figure 158: Canon, Inc.: R&D Expenditure, $Million, 2019-2021

Figure 159: Caption Health: Product Portfolio

Figure 160: Carestream Health Inc.: Product Portfolio

Figure 161: FUJIFILM Holdings Corporation: Product Portfolio

Figure 162: FUJIFILM Holdings Corporation: Overall Financials, $Million, 2019-2021

Figure 163: FUJIFILM Holdings Corporation: Net Revenue (by Segment), $Million, 2020-2021

Figure 164: FUJIFILM Holdings Corporation: Net Revenue (by Healthcare Segment), $Million, 2020-2021

Figure 165: FUJIFILM Holdings Corporation: Net Revenue (by Region), $Million, 2020-2021

Figure 166: FUJIFILM Holdings Corporation: R&D Expenditure, $Million, 2019-2021

Figure 167: General Electric Company: Product Portfolio

Figure 168: General Electric Company: Overall Financials, $Million, 2019-2021

Figure 169: General Electric Company: Net Revenue (by Segment), $Million, 2019-2021

Figure 170: General Electric Company: Net Revenue (by Region), $Million, 2019-2021

Figure 171: General Electric Company: R&D Expenditure, $Million, 2019-2021

Figure 172: Hologic, Inc.: Product Portfolio

Figure 173: Hologic, Inc.: Overall Financials, $Million, 2019-2021

Figure 174: Hologic, Inc.: Net Revenue (by Segment), $Million, 2019-2021

Figure 175: Hologic, Inc.: Net Revenue (by Region), $Million, 2019-2021

Figure 176: Hologic, Inc.: R&D Expenditure, $Million, 2019-2021

Figure 177: iCAD, Inc.: Product Portfolio

Figure 178: iCAD, Inc.: Overall Financials, $Million, 2019-2021

Figure 179: iCAD, Inc.: Net Revenue (by Segment), $Million, 2019-2021

Figure 180: Koninklijke Philips N.V.: Product Portfolio

Figure 181: Koninklijke Philips N.V.: Overall Financials, $Million, 2019-2021

Figure 182: Koninklijke Philips N.V.: Revenue (by Segment), $Million, 2019-2021

Figure 183: Koninklijke Philips N.V.: Revenue (by Region), $Million, 2019-2021

Figure 184: Koninklijke Philips N.V.: R&D Expenditure, $Million, 2019-2021

Figure 185: NVIDIA Corporation: Product Portfolio

Figure 186: NVIDIA Corporation: Overall Financials, $Million, 2019-2021

Figure 187: NVIDIA Corporation: Net Revenue (by Segment), $Million, 2019-2021

Figure 188: NVIDIA Corporation: Net Revenue (by Region), $Million, 2019-2021

Figure 189: NVIDIA Corporation: R&D Expenditure, $Million, 2019-2021

Figure 190: Siemens Healthineers AG: Product Portfolio

Figure 191: Siemens Healthineers AG: Overall Financials, $Million, 2019-2021

Figure 192: Siemens Healthineers AG: Net Revenue (by Segment), $Million, 2019-2021

Figure 193: Siemens Healthineers AG: Net Revenue (by Region), $Million, 2019-2021

Figure 194: Siemens Healthineers AG: R&D Expenditure, $Million, 2019-2021

Figure 195: VUNO, Inc.: Product Portfolio

List of Tables

Table 1: Key Questions Answered in the Report

Table 2: Parameters for Realistic, Optimistic, and Pessimistic Growth Scenarios

Table 3: FDA Approved AI/ML-Based Medical Devices and Algorithms, 2020, 2021, and 2022

Table 4: Global AI-Enabled Medical Imaging Solutions Market, Key Collaborations

Table 5: AI-Enabled Medical Imaging Solutions Market, Start-Ups

Table 6: List of Consortiums, Associations, and Regulatory Bodies

Table 7: Global AI-Enabled Medical Imaging Solutions Market, Awaited Technologies

Table 8: Investments and Funding in AI Medical Imaging, 2019-2022

Table 9: Comparison Between 2D Reading and AI-Enabled 3D DBT Reading

Table 10: Accuracy of Disease Detection Using Artificial Intelligence

Table 11: Global AI-Enabled Medical Imaging Solutions Market, Ongoing Clinical Trials for AI in Cardiology

Table 12: Global AI-Enabled Medical Imaging Solutions Market, Ongoing Clinical Trials for AI in Oncology

Table 13: Global AI-Enabled Medical Imaging Solutions Market, Ongoing Clinical Trials for AI in Neurology

Table 14: Global AI-Enabled Medical Imaging Solutions Market, Ongoing Clinical Trials for AI in Respiratory Diseases

Table 15: Global AI-Enabled Medical Imaging Solutions Market, Ongoing Clinical Trials for AI in Orthopedics

Table 16: North America AI-Enabled Medical Imaging Solutions Market, Impact Analysis

Table 17: Europe AI-Enabled Medical Imaging Solutions Market, Impact Analysis

Table 18: Asia-Pacific AI-Enabled Medical Imaging Solutions Market, Impact Analysis

Table 19: Rest-of-the-World AI-Enabled Medical Imaging Solutions Market, Impact Analysis

Table 20: Agfa-Gevaert Group: Key Products and Features

Table 21: Blackford Analysis Limited: Key Products and Features

Table 22: Butterfly Network, Inc.: Key Products and Features

Table 23: Canon Inc.: Key Products and Features

Table 24: Caption Health: Key Products and Features

Table 25: Carestream Health Inc.: Key Products and Features

Table 26: FUJIFILM Holdings Corporation: Key Products and Features

Table 27: General Electric Company: Key Products and Features

Table 28: Hologic, Inc.: Key Products and Features

Table 29: iCAD, Inc.: Key Products and Features

Table 30: Koninklijke Philips N.V.: Key Products and Features

Table 31: NVIDIA Corporation: Key Products and Features

Table 32: Siemens Healthineers AG: Key Products and Features

Table 33: VUNO, Inc.: Key Products and Features

Executive Summary

The global AI-enabled medical imaging solutions market is estimated to reach $18,356.5 million in 2032, reveals this market study. The study also highlights that the market is set to witness a CAGR of 25.76% during the forecast period 2022-2032.

AI-based medical imaging solutions are a disruptive technology with great potential, and the market is anticipated to grow during the forecast period owing to increasing awareness regarding the early detection of chronic disorders, facilitation of better clinical decision-making, and increased accuracy with artificial intelligence.

USPs of the Report

- Extensive product benchmarking on the basis of modality, workflow, and therapeutic applications of top players (including established and emerging players) to offer a holistic view of the global AI-enabled medical imaging solutions market.

- In depth key development analysis

- Regulatory framework and legal requirements for AI-enabled medical imaging solutions

- Clinical trials data for different therapeutic areas of AI-enabled imaging solutions

- Cross segmentation and market numbers on country level

- Key trends and opportunity assessment in the market

- Real world evidence based on different case studies

- Industry ecosystem along with list of FDA approved AI-enabled medical imaging solutions

- Market share analysis

- Funding Scenario

Analyst Perspective

According to the lead research analyst of the report, "Artificial intelligence is fundamentally transforming the medical imaging industry, both in terms of diagnostic accuracy and productivity. Novel cognitive algorithms promise to offer several concrete prospects, such as quantitative imaging, prognostic risk assessment, unceasing treatment monitoring, and above all, utmost diagnostic accuracy. The market is anticipated to grow during the forecast period owing to increasing awareness regarding the early detection of chronic disorders, facilitation of better clinical decision-making, and increased accuracy with artificial intelligence."

Key Companies Operating in the Market

Key players in the global AI-enabled medical imaging solutions market analyzed and profiled in the study involve players that offer AI-enabled medical imaging solutions. Moreover, a detailed product benchmarking based on workflow, modality, and therapeutic application of the players operating in the global AI-enabled medical imaging solutions market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, collaborations, product launches and approvals, and funding scenarios will aid the reader in understanding the untapped revenue pockets in the market.

The key players profiled in the report include Agfa-Gevaert Group, Aidoc, Blackford Analysis Limited, Butterfly Network, Inc., Canon Inc., Caption Health, Carestream Health Inc., FUJIFILM Holdings Corporation, General Electric Company, Hologic, Inc., iCAD, Inc., Koninklijke Philips N.V., NVIDIA Corporation, Siemens Healthineers AG, and VUNO, Inc.

Key Questions Answered in the Report

- What are the major market drivers, challenges, and opportunities in the global AI enabled medical imaging solutions market?

- What are the emerging trends within the global AI-enabled medical imaging solutions market?

- How is each product type of the global AI-enabled medical imaging solutions market expected to grow during the forecast period, and what is the anticipated revenue generated by each of the products by the end of 2032?

- What is the growth potential of the global AI-enabled medical imaging solutions market in North America, Europe, Asia-Pacific, and the Rest-of-the-World (RoW)?

- What is the patent filing trend in the global AI-enabled medical imaging solutions market?

- What are some of the case studies in the global AI-enabled medical imaging solutions market?

- What is the market segmentation based on modality? How are the modalities ranked in terms of the level of AI-enabled medical imaging solutions?

- What is the market segmentation based on therapeutic application? How are the therapeutic applications ranked in terms of the level of AI-enabled medical imaging solutions?

- How has the COVID-19 pandemic impacted the global AI-enabled medical imaging solutions market?

Companies Mentioned

- Agfa HealthCare

- Agfa-Gevaert Group

- Aidoc

- Blackford Analysis Limited

- Butterfly Network, Inc.

- Canon Inc.

- Caption Health

- Carestream Health Inc.

- FUJIFILM Holdings Corporation

- General Electric Company

- Hologic, Inc.

- iCAD, Inc.

- Koninklijke Philips N.V.

- Medical University of South Carolina

- Mirada Medical Limited

- Nanox Imaging Ltd.

- Northwest Clinics

- NVIDIA Corporation

- Qlarity Imaging

- Qure.ai

- Riverain Technologies, LLC

- Sana Klinikum Lichtenberg

- Siemens Healthineers AG

- Subtle Medical, Inc.

- Us2.ai

- VUNO, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | March 2023 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 1.85 Billion |

| Forecasted Market Value ( USD | $ 18.35 Billion |

| Compound Annual Growth Rate | 25.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |