Key Highlights

- Africa's pulp and paper sector has continued to operate as a critical business continuity service during the pandemic, supporting the manufacturing, processing, and distribution of essential goods such as tissue, toilet paper, paper packaging, face masks, and personal hygiene products. In the Middle East, however, with Iran, Saudi Arabia, Qatar, and UAE affected by significant coronavirus cases, there has been increased local production in terms of the food industry.

- The domestic market in the region is still weak due to the strong presence of international players and high energy prices, taxes, customs, and the dumping of imported papers. To cater to this problem, the governments are supporting manufacturers by lowering natural gas prices and imposing protective tarrifs on imported paper to protect the domestic industry.

- Also, the United Arab Emirates and Saudi Arabian governments have announced plans to boost their economy by investing AED 100 billion (~USD 27.23 billion) and SAR 120 billion (~USD 31.93 billion), respectively. This is expected to foster lending and liquidity in SMEs in respective countries.

- Furthermore, a noticeable trend of increasing shelf visibility is gaining traction, facilitating the broad adoption of white print sack kraft paper. For instance, in July 2021, the Mondi Group partnered with Dune Packaging Limited, a Kenya-based packaging company, to increase its product portfolio with open-mouth paper bags for food products, leveraging Mondi's Advantage Kraft White Print Paper.

- The food and beverage sector has seen consistent revenue growth. Supermarkets, department stores, and convenience stores all have high levels of market penetration. Kenya is a maturing deployer in the market under study, along with Eastern Africa. One of the region's most important drivers of the investigated industry is acknowledged to be the rising demand for high-quality foods including wheat, maize, and grain.

- The market barrier is that paper bags are more expensive than plastic bags and require more storage space. Specialty papers are expected to have a significant disadvantage with regard to carbon emissions throughout the manufacturing process, which will restrain market expansion. Another significant barrier to the growth of the speciality paper market in the next years is anticipated to be the advent of the digital era.

- Additionally, paper inactivates the COVID-19 virus, or SARS-CoV-2, far more quickly than plastic does. Three hours after being laid on paper, no virus is present. With such a factor, the MEA region's demand for paper bags soared during the COVID peak. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

MEA Pulp & Paper Market Trends

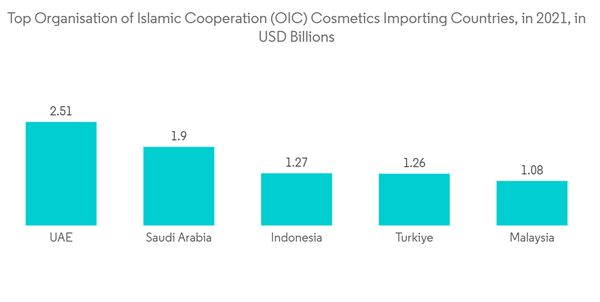

The Cosmetics Industry is Expected to Drive the Growth of the Market

- The UAE and Saudi Arabia are estimated to motivate the demand for cosmetic products during the forecast period owing to the growing demand for Halal cosmetic products within the state.

- Consumers in the UAE have a wide variety of choices in terms of cosmetics and fragrances. Hence, to capture the maximum market share and enhance their market presence, cosmetics and fragrances companies are enhancing their packaging with various materials, some of which are designed for sustainability.

- The country is also witnessing significant investments from across the world in the cosmetics industry to stimulate innovative and sustainable packaging solutions. The first totally Halal-certified cosmetics range in the GCC was introduced by Mikyajy in the UAE, featuring lipsticks as the initial item.

- A full selection of color cosmetics that are 100% Halal-certified will be available with the debut from Mikyajy. The highest assurance of purity is provided by this accreditation. Accredited organization ESMA, which is recognized by the governments throughout the GCC, has certified the entire production process, including the ingredients, manufacturing facilities, and warehousing facilities, 100 percent.

- Amouage, an Oman-based manufacturer of ultra-exclusive luxury fragrances, announced its expansion into the US in collaboration with the nation's top five department shops, including Nordstrom, Neiman Marcus, Bloomingdale's, Bergdorf Goodman, and Saks Fifth Avenue in July 2021. Sales of the company's high-end, ultra-niche fragrances rose by 10% in the first half of 2021 compared to the year before and by 10% from the same period in 2019.

- UAE's exports in cosmetics products increased from USD 1.12 billion in 2016 to USD 3.64 billion in 2021. Exports in cosmetics to OIC countries amounted to USD 2.80 billion in 2021 (77% of UAE’s global exports). Domestic players have a strong regional presence, such as Mikyajy and Cosmo Cosmetics, with Shade M going global.

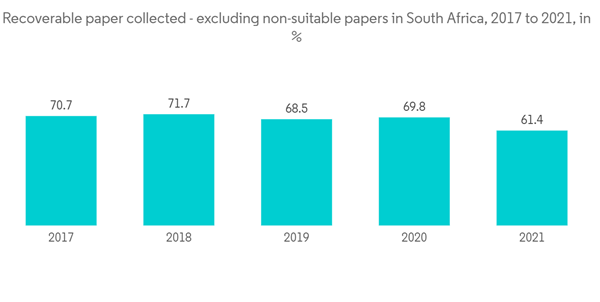

Africa is Expected to Witness Significant Growth

- South Africa has witnessed high levels of urbanization over the last few years. According to a recent study, around 64% of South Africans live in urban areas, which is expected to rise to 71% by 2030. By 2050, eight in ten people are expected to live in urban areas.

- As urbanization is picking up, metros such as the growing cities of Johannesburg, Durban, and Cape Town are attracting a younger generation of consumers who are changing their consumption habits and are increasingly buying processed and packaged foods. This also creates more demand for ready or on-the-go meals, directly driving the demand for pulp and paper-based packaging and products such as tissue paper.

- Moreover, South Africa is in the enviable position of being able to recycle up to 90% of its recovered waste paper locally into paper packaging, serving the agricultural, manufacturing, and retail sectors, which is far better than a country like Sweden, which has high collection rates but only recycles 11%; the majority feeds waste-to-energy plants.

- Moreover, the growing public-private partnerships in the region are expected to proliferate market growth. Ghana is expected to produce its paper by establishing a pulp mill to boost the paper industry in the country and also for export to the West African sub-region.

- The USD 2.8 billion project, which is under a Public-Private Partnership (PPP) agreement, is a joint venture between the government of Ghana, and Greenland Resources AB of Sweden and is expected to produce 1.5million tons of pulp and paper annually to feed the paper industry in the country.

MEA Pulp & Paper Market Competitor Analysis

The market for pulp and paper in the Middle East and African region is partially consolidated, with the top five players having a significant position in the market and is expected to rise at a moderate rate due to the well-performing industries starting from printing, consumer packaging, pharmaceutical, and construction, etc.In September 2022, an investment project for a 200,000 Metric Tons Per Annum (MTPA) kraft liner in the UAE was launched by Keryas Paper Industry, based in Oman. A USD 40 million investment was needed to build the manufacturing facility. According to the announcement, the plant would produce 150 GSM basis-weight kraft packaging paper and low GSM kraft packaging paper with a basis weight of 60 to 80 as an anchor GSM.

In April 2022, Shuaiba Industrial Co. of Kuwait purchased shares from Saudi Yanbu Cement in its subsidiary Yanbu Saudi Kuwaiti Paper Products Co. for SAR 32.3 million (USD 8.6 million). According to a bourse filing, the deal allowed Yanbu Cement to become the sole owner of the paper maker by transferring a 40% holding to it. Cement paper bags of every kind are produced by Yanbu Saudi Kuwaiti Paper Products Co., which also engages in the wholesale cement bag business.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.