Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

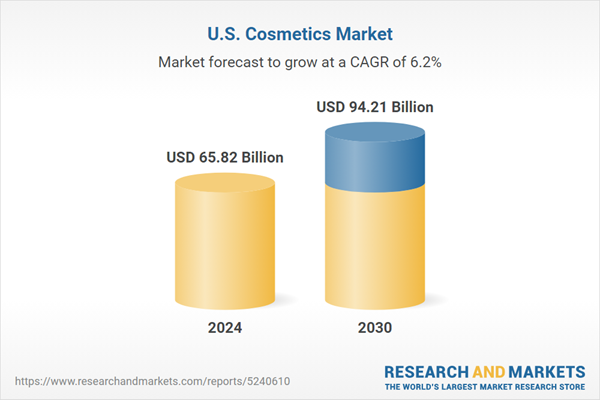

Social media platforms, particularly TikTok and Instagram, significantly impact purchasing decisions, especially among younger demographics. Online sales have grown substantially, accounting for 41% of beauty and personal care purchases, with platforms like Amazon increasing their market share due to competitive pricing, fast delivery, and extensive product variety. As consumers seek convenience and personalization, the U.S. cosmetics market is positioned for sustained expansion.

Key Market Drivers

Demand for Clean, Natural, and Sustainable Beauty Products

One of the leading drivers of the United States Cosmetics Market is the growing preference for clean, natural, and sustainable beauty products. Modern consumers, particularly Millennials and Gen Z, are highly conscious of product ingredients and demand greater transparency from brands. The market has witnessed a surge in products free from harmful substances such as parabens, sulfates, phthalates, and synthetic fragrances. A 2023 study revealed that over 60% of U.S. consumers prioritize clean-label beauty products, reflecting heightened concerns for personal health and environmental sustainability. This trend highlights the industry's ongoing shift toward ethical and eco-friendly practices, driven by the influential purchasing power of younger consumers.Key Market Challenges

Intense Market Saturation and Competition

The U.S. cosmetics market is characterized by intense competition, with a multitude of established brands, indie labels, and global corporations vying for consumer attention. The rise of social media and direct-to-consumer business models has lowered entry barriers, enabling new brands to disrupt traditional players. While this competitive landscape encourages innovation and expands consumer choices, it also presents significant challenges for brand differentiation and loyalty. Frequent product launches, influencer collaborations, and viral marketing campaigns are necessary to maintain visibility, but this "fast beauty" approach can compromise product quality, sustainability, and long-term brand reputation, creating additional pressure on brands.Key Market Trends

Influencer Marketing and Social Media-Driven Trends

Social media continues to be a dominant force shaping consumer behavior and trends within the U.S. cosmetics market. Platforms such as TikTok, Instagram, and YouTube serve as vital discovery and marketing channels, where viral content, tutorials, and product endorsements can significantly boost brand awareness and sales. Influencers play a crucial role in driving purchasing decisions, with user-generated content and real-time reviews fostering authenticity and community engagement. The rise of "social-first" cosmetic brands underscores this trend, with product development often influenced by popular aesthetics such as “no-makeup makeup,” “glass skin,” and bold eye looks. As social media’s influence grows, brands must continually adapt their strategies to remain relevant.Key Market Players

- L'Oreal USA, Inc.

- Shiseido Americas Corporation

- The Estée Lauder Companies Inc.

- E.l.f. Cosmetics, Inc.

- Revlon Consumer Products LLC

- HB USA Holdings, Inc. (Huda Beauty)

- Unilever PLC

- Coty Inc.

- Chanel Inc.

- Ulta Beauty, Inc.

Report Scope:

In this report, the United States Cosmetics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.United States Cosmetics Market, By Type:

- Skin care

- Hair Care

- Bath & Shower products

- Makeup & Color Cosmetics

- Fragrances & Deodorants

United States Cosmetics Market, By End-User:

- Men

- Women

United States Cosmetics Market, By Sales Channel:

- Specialty Stores

- Supermarkets/Hypermarkets

- Multi Branded Store

- Online

- Others

United States Cosmetics Market, By Region:

- South

- West

- Midwest

- Northeast

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Cosmetics Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- L'Oreal USA, Inc.

- Shiseido Americas Corporation

- The Estée Lauder Companies Inc.

- E.l.f. Cosmetics, Inc.

- Revlon Consumer Products LLC

- HB USA Holdings, Inc. (Huda Beauty)

- Unilever PLC

- Coty Inc.

- Chanel Inc.

- Ulta Beauty, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 65.82 Billion |

| Forecasted Market Value ( USD | $ 94.21 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |