These nutritional supplements are beneficial in sustaining eye function, decrease the cases of age-related eye diseases, and also protect eyes from harmful radiations. The growth of the eye health supplements market is mainly accredited to the increasing occurrence of eye diseases and the growing geriatric population. Furthermore, rising industrial developments are further anticipated to drive market growth in the coming years. Though, the cost of eye health supplements is high and product availability is also lacking, these factors are hampering the market growth.

The increasing cases of vision impairment and rising myopic population, mainly during the COVID-19 pandemic, due to the increasing use of screens and attending virtual meetings while working from home, is one of the major factors boosting the market. Rising cases of myopia are due to increased risk of several progressive eye disorders including glaucoma, cataract, and age-related macular degeneration. Increasing inclination for eye health supplements among the geriatric population and millennials, highly vulnerable to digital eye fatigue and it is further driving the market globally. The rise in prevalence of numerous eye conditions including dry eye syndrome, cataract, Age-related Macular Degeneration (AMD), and inflammation coupled with the increasing recommendation for eye health supplements by ophthalmologists for treatment and prevention of these disorders is further boosting the market.

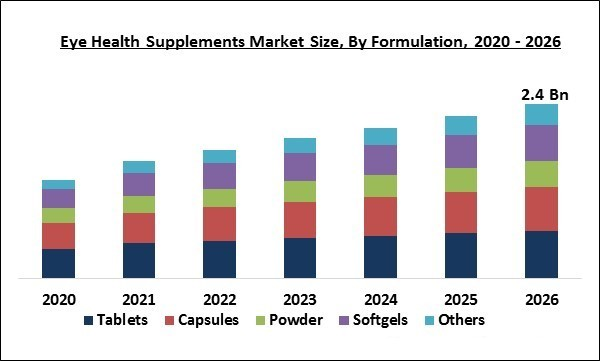

By Formulation

Based on Formulation, the market is segmented into Tablets, Capsules, Powder, Softgels, and Liquid. The soft gels segment is likely to show a considerable growth rate over the forecasted period. It is an effective form of delivering liquid or oil-based supplements. Researchers believe that those supplements which are delivered in their native form are much more effective than modified forms. Moreover, nutrients like krill oil and fish oil are mostly encapsulated in soft gels in order to suppress negative effects that can change the taste and aroma of the oils.

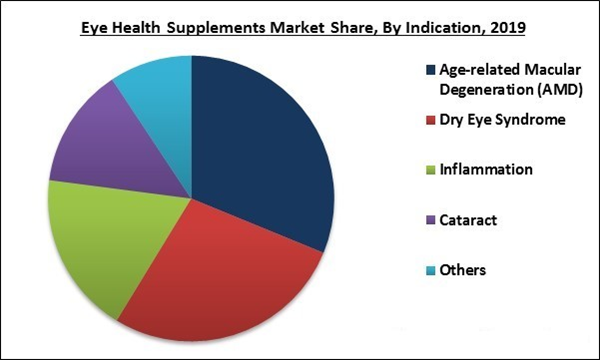

By Indication

Based on Indication, the market is segmented into Age-related Macular Degeneration (AMD), Dry Eye Syndrome, Inflammation, Cataract and Others. In 2019, the AMD segment accounted for the largest share of the market. An increasing prevalence of AMD across the world is further contributing to segment growth. The dry eye syndrome segment is anticipated to show a significant growth rate over the forecast period.

By Ingredient Type

Based on Ingredient Type, the market is segmented into Lutein and Zeaxanthin, Antioxidants, Flavonoids, Alpha-Lipoic Acid, Omega-3 Fatty acids, Coenzyme Q10, Astaxanthin and Others. Lutein and Zeaxanthin ingredients for eye health supplements garnered the largest revenue share in 2019. This is attributed to growing awareness about the benefits provided by Zeaxanthin and Lutein supplements used for the prevention and treatment of various eye disorders such as diabetic retinopathy, AMD, uveitis, and cataract. Furthermore, the increasing occurrence of eye disorders, mainly AMD, and increasing recommendations for these eye-health supplements by clinicians, ophthalmologists, and vision scientists are also contributing to the growth of the segment.

By Region

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The market for eye health supplements in the Asia Pacific is expected to show a considerable growth rate in the coming years. The existence of a large number of local market players are offering affordable and innovative eye health supplements, and contract manufacturing hubs for eye health supplements are continuously increasing in China, India, and the Philippines, thereby driving the market growth in the region.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Nature’s Bounty Co. (The Carlyle Group L.P.), Pfizer, Inc., Alticor Inc. (Amway Corporation), Novartis AG, Kemin Industries, Inc., ZeaVision LLC (EyePromise), EyeScience Labs, LLC, Vitabiotics Ltd., Nutrivein and NutraChamps, Inc.

Strategies deployed in Eye Health Supplements Market

Oct-2019: Novartis received FDA approval for Beovu (brolucizumab) injection, also known as RTH258. This injection is used for the treatment of wet age-related macular degeneration (AMD).

May-2019: Amway expanded its kid’s nutrition portfolio with the introduction of Nutrilite DHA Yummies. The Nutrilite DHA Yummies Soft Gel maintains the healthy nutritional intake of the children as it provides the DHA.

May-2019: EyePromise introduced Screen Shield Teen to its premium EyePromise eye vitamin line. Screen Shield Teen contain naturally-flavored fruit punch chewable eye vitamin. It is developed with all-natural zeaxanthin and other nutrients to prevent children’s eyes from the ill effects of increasing screen exposure.

May-2019: Novartis signed an agreement with Takeda Pharmaceutical Company Limited to acquire the assets associated with Xiidra (lifitegrast ophthalmic solution) 5% worldwide. Xiidra is the first and only prescription treatment that treats both signs and symptoms of dry eye by inhibiting inflammation caused by the disease.

Dec-2018: Pfizer signed an agreement with GlaxoSmithKline, a British multinational pharmaceutical company. In this agreement, they created a premier global consumer healthcare company, GSK Consumer Healthcare. The combined brand portfolio formed the world's largest OTC business with leadership positions in respiratory and vitamins, pain relief, minerals and supplements, and therapeutic oral health.

Jun-2018: EyePromise launched a new and improved formula to its EyePromise Restore line, with the addition of vitamins B6 and B12, folic acid, and Coenzyme Q10. Eyepromise Restore is an ocular nutrition supplement designed to protect and support vision for individuals concerned with, at-risk for, or in the early stages of age-related macular degeneration.

Jul-2017: Kemin Industries got the approval for Kemin ZeaONE Zeaxanthin by the National Health and Family Planning Commission (NHFPC) of China. Kemin ZeaONE Zeaxanthin is a naturally-sourced zeaxanthin produces FloraGLO Lutein, the most studied lutein brand in the world and the number one lutein recommended by doctors in the U.S.

May-2017: Alcon, a division of Novartis, introduced a chewable vitamin for supporting eye health in people with age-related macular degeneration. The Systane ICaps vitamins contain the following per serving: 500 mg of vitamin C, 400 IU of vitamin E, 25 mg of zinc, 2 mg of copper, 10 mg of lutein and 2 mg of zeaxanthin.

Jul-2016: Kemin Industries received patent by the United States Patent and Trademark Office for the role of its products, FloraGLO Lutein and ZeaONE Zeaxanthin. Kemin’s patent permits vitamin and dietary supplement manufacturers uses FloraGLO and/or ZeaONE to position their products for blue light protection. The patent specifically included products involving ocular antioxidants like lutein and zeaxanthin employed to protect the eye from light-induced damage.

Scope of the Study

Market Segments covered in the Report:

By Formulation

- Tablets

- Capsules

- Powder

- Softgels,

- Liquid

By Indication

- Age-related Macular Degeneration (AMD)

- Dry Eye Syndrome

- Inflammation

- Cataract

- Others

By Ingredient Type

- Lutein and Zeaxanthin

- Antioxidants

- Flavonoids

- Alpha-Lipoic Acid

- Omega-3 Fatty acids

- Coenzyme Q10

- Astaxanthin

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- The Nature’s Bounty Co. (The Carlyle Group L.P.)

- Pfizer, Inc.

- Alticor Inc. (Amway Corporation)

- Novartis AG

- Kemin Industries, Inc.

- ZeaVision LLC (EyePromise)

- EyeScience Labs, LLC

- Vitabiotics Ltd.

- Nutrivein

- NutraChamps, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- The Nature’s Bounty Co. (The Carlyle Group L.P.)

- Pfizer, Inc.

- Alticor Inc. (Amway Corporation)

- Novartis AG

- Kemin Industries, Inc.

- ZeaVision LLC (EyePromise)

- EyeScience Labs, LLC

- Vitabiotics Ltd.

- Nutrivein

- NutraChamps, Inc.