In recent years, the global increment in the number of smokers has been witnessed. New product launches which include numerous flavored tobacco products like menthol cigars & clove cigarettes is one of the major factors boosting the trend of tobacco consumption. This aspect is anticipated to fuel the market growth over the forecasted period. In addition, the increasing preference of smoking alternatives leads to the launch of innovative tobacco products with unique tastes options has been witnesses across the globe. Due to this factor, manufacturers are planning to launch premium tobacco products added with flue-cured tobacco and fine whole leaf.

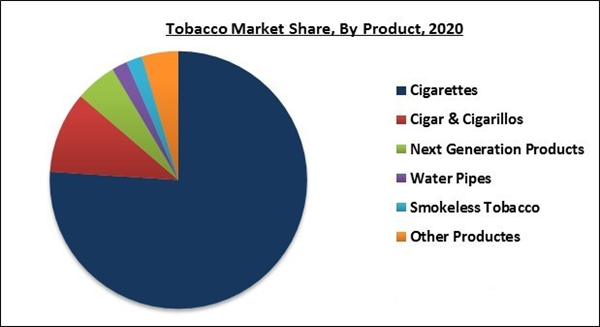

By Product

Based on Product, the market is segmented into Cigarettes, Cigar & Cigarillos, Next Generation Products, Water Pipes, Smokeless Tobacco and Other Products. The cigarettes segment acquired the prominent market share in 2019. The cigarette refers to a cylinder-shaped product that contain psychoactive material like tobacco rolled into thin paper. The consumption of cigarettes is increasing in developing countries and decreasing in the higher income countries. China is considered as one of the largest cigarette markets in the globe. In addition, the introduction of different types of flavors in the cigarette will further boost the adoption of cigarettes across the globe.

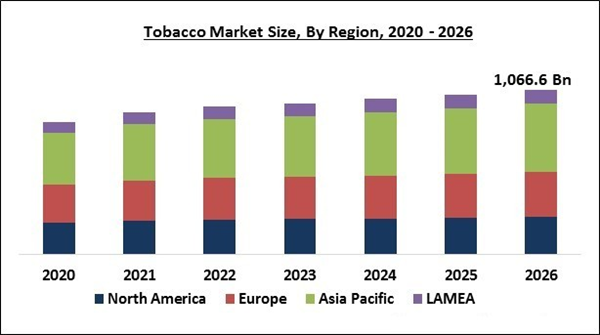

By Region

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia-Pacific is among the largest producers & consumers of tobacco across the globe. The leading companies of the region are China and India. Four largest tobacco companies in the world are China National Tobacco Corporation, PT GudangGaramTbk, Japan Tobacco Inc., and ITC Limited are from Asia-Pacific. China is the biggest market in this region & the country is known for the significant portion of the population who are the consumers of tobacco products. of the easy availability of the tobacco products in contemporary retail outlets in this region acts as the major factor boosting the growth of the tobacco market in this region.

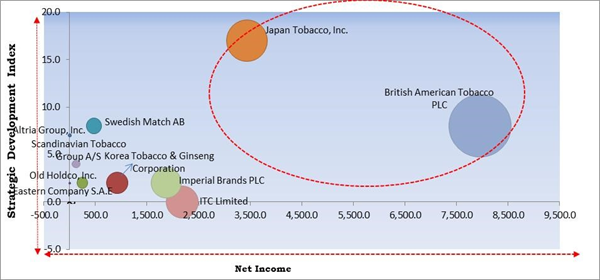

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Japan Tobacco, Inc., and British American Tobacco PLC are the forerunners in the Tobacco Market. Companies such as Swedish Match AB, Altria Group, Inc., Scandinavian Tobacco Group A/S, Korea Tobacco & Ginseng Corporation are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Old Holdco, Inc. (Pyxus International, Inc.), Swedish Match AB, Altria Group, Inc. (Philips Morris International, Inc.), Korea Tobacco & Ginseng Corporation (KT&G Corporation), British American Tobacco PLC, Japan Tobacco, Inc. (Government of Japan), Scandinavian Tobacco Group A/S, ITC Limited, Eastern Company S.A.E, and Imperial Brands PLC.

Strategies deployed in Tobacco Market

Partnerships, Collaborations, and Agreements:

Sep-2020: Japan Tobacco extended its partnership with Sauber Engineering AG (SEN), a leading player in technology and prototype development. In this extended partnership, the companies continued their collaboration for the development of precision engineering projects focused on increasing the performance of the next generation of JT Group products.

Aug-2020: Korea Tobacco & Ginseng Corporation signed an agreement with Philip Morris International, a Swiss-American multinational cigarette and tobacco manufacturing company. In this agreement, Philip Morris commercializes KT&G’s smoke-free alternatives outside of South Korea. Philip Morris launched KT&G’s lil SOLID device and its complementing Fiit consumables in Russia. Lil SOLID is a device that uses a pin-based tobacco heating system developed to offer four consecutive experiences without recharging.

Feb-2020: Pyxus International Inc. came into partnership with Turning Point Brands Inc., Louisville-based tobacco products company. Under the partnership, the companies agreed to share certain research and testing data to make the foundation of certain respective premarket tobacco product applications before the submission to the U.S. Food and Drug Administration. Moreover, Turning Point Brands signed a supply agreement for its house brands of e-cigarette liquids.

Jul-2019: Imperial Brands partnered with Auxly Cannabis Group, a vertically integrated cannabis company. Under this partnership, the companies work together in research and development and provide the Vancouver firm with the global licenses to the British tobacco giant's vaping technology. The partnership also enhanced Imperial Brands' ability to implement their business strategies which further boosts their growth plans.

Feb-2019: Eastern Company renewed its agreement with British American Tobacco (BAT) and Mansour International Distribution Co. In this agreement, Eastern produces foreign Target cigarettes in its partnership with Mansour. Similarly, the company also produces Pall Mall and Viceroy cigarettes in its partnership with BAT.

Acquisition and Mergers:

Nov-2020: British American Tobacco took over the nicotine pouch product assets of Dryft Sciences LLC. This acquisition expanded British American Tobacco's modern oral portfolio in the US from 4 to 28 variants. The improved portfolio includes a broad range of nicotine products and flavors that offers a greater degree of choice, covering all potential consumer preferences.

Apr-2020: Scandinavian Tobacco Group completed the acquisition of Agio Cigars, owned by Agio Beheer BV. Through this acquisition, Scandinavian Tobacco aimed to gain substantial growth in sales and marketing, production, and back-office functions.

Jun-2019: Altria came into an agreement to acquire Burger Söhne, a provider of tobacco products. Under this acquisition, Altria acquired 80 percent of certain companies of Burger Söhne. It commercialized ON! products globally, which is an oral tobacco-derived nicotine (TDN) pouch product. Following the acquisition, the company will get access to the leading products and brands in the moist smokeless tobacco, heated tobacco, and e-vapor categories. The acquisition is expected to add another non-combustible product to Altria's portfolio, which has a high-potential, significantly developing oral TDN products group.

Nov-2018: Japan Tobacco took over the Akij Group's tobacco business. This acquisition accelerated the expansion of the company in the emerging market.

Jul-2018: Swedish Match agreed to acquire Gotlands Snus AB, a privately held Swedish company. The acquisition is expected to expand Swedish Match's business and improve their presence with the production in Gotland. Gotlands Snus complemented Swedish Match's portfolio and offered an increased depth to their offerings.

Sep-2017: Swedish Match took over V2 Tobacco, a privately held smokeless tobacco company. V2 Tobacco´s modern and adaptable production enabled Swedish Match to enhance flexibility and expanded the opportunities to adapt to changing consumer desires. Swedish Match further worked toward its vision of a world without cigarettes.

Sep-2017: Japan Tobacco completed its acquisition of Mighty Corporation, a tobacco company. Following the acquisition, Japan Tobacco expanded its geographical footprints. It also provided the distribution network in the Philippines to Japan tobacco and strengthened the brand's portfolio with the addition of brands like Mighty and Marvels.

Aug-2017: Japan Tobacco came into an agreement to acquire PT. Karyadibya Mahardhika, a kretek cigarette company and its distributor, PT. Surya Mustika Nusantara. The acquisition aims to expand the global presence of Japan Tobacco in the market.

Jul-2017: British American Tobacco completed its acquisition of Reynolds American, an American tobacco company. The acquisition helped the company is positioning itself as a strong, global tobacco and Next Generation Products company, which delivers sustained long-term profit growth and returns.

Product Launches and Product Expansions:

Oct-2019: Marlboro, a division of Altria is developing a new tobacco device, Iqos. This device heats the tobacco instead of burning it, which gives customers the same rush of nicotine as smoking with some toxins.

Jan-2019: Japan Tobacco launched Ploom TECH+, a low-temperature tobacco vapor product, and Ploom S, a high-temperature tobacco vapor product. Both of the new products were added to the online store and retail stores of the company across Japan. These products are highly adopted by the consumers because of their no tobacco smoke smell and better usability.

Scope of the Study

Market Segments covered in the Report:

By Product

- Cigarettes

- Cigar & Cigarillos

- Next Generation Products

- Water Pipes

- Smokeless Tobacco

- Other Products

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Old Holdco, Inc. (Pyxus International, Inc.)

- Swedish Match AB

- Altria Group, Inc. (Philips Morris International, Inc.)

- Korea Tobacco & Ginseng Corporation (KT&G Corporation)

- British American Tobacco PLC

- Japan Tobacco, Inc. (Government of Japan)

- Scandinavian Tobacco Group A/S

- ITC Limited

- Eastern Company S.A.E

- Imperial Brands PLC

Unique Offerings from the Publisher

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Old Holdco, Inc. (Pyxus International, Inc.)

- Swedish Match AB

- Altria Group, Inc. (Philips Morris International, Inc.)

- Korea Tobacco & Ginseng Corporation (KT&G Corporation)

- British American Tobacco PLC

- Japan Tobacco, Inc. (Government of Japan)

- Scandinavian Tobacco Group A/S

- ITC Limited

- Eastern Company S.A.E

- Imperial Brands PLC