Global Anionic Resins Market - Key Trends and Drivers Summarized

Why Are Anionic Resins Essential in Modern Water and Chemical Treatment Processes?

Anionic resins have become indispensable components in a wide array of water purification, chemical processing, and industrial applications, offering unique capabilities that surpass traditional treatment methods. But what exactly are anionic resins, and why are they so vital in these sectors? Anionic resins are a type of ion exchange resin specifically designed to attract and remove negatively charged ions (anions) such as nitrates, sulfates, bicarbonates, and even heavy metal contaminants from solutions. They are composed of polymer matrices with functional groups that bind anions, making them highly effective in water softening, deionization, and contaminant removal. The versatility of anionic resins extends beyond water treatment, as they are also used in chemical synthesis, pharmaceuticals, food processing, and catalysis. In wastewater treatment, they play a critical role in removing harmful contaminants and achieving zero liquid discharge (ZLD) goals, which is a growing regulatory requirement in many industries. Their ability to selectively target specific ions makes them a preferred choice for industries looking to achieve high purity levels in water and chemicals. With the increasing scarcity of clean water resources and the tightening of environmental regulations, anionic resins are becoming more crucial than ever in ensuring that industrial processes are both efficient and environmentally compliant.What Emerging Trends Are Transforming the Anionic Resins Market?

The anionic resins market is undergoing significant evolution, driven by innovations in resin technology, rising environmental awareness, and shifting industrial demands. One of the most impactful trends is the development of high-capacity resins with enhanced selectivity. These next-generation resins are designed to offer higher ion exchange capacities and improved chemical stability, making them suitable for more challenging applications, such as the removal of complex pollutants and highly toxic contaminants from industrial effluents. Another key trend is the increasing adoption of hybrid resins, which combine the properties of multiple resin types, such as anion and cation resins, in a single matrix. These hybrid materials are providing more comprehensive solutions by simultaneously targeting both positive and negative ions, thus optimizing treatment efficiency and reducing the number of treatment stages. Additionally, the integration of nanotechnology is revolutionizing the market by creating resins with ultra-high surface areas and nanoscale functional groups, which offer superior kinetics and enhanced binding capacity. The push towards sustainability is also influencing the market, as industries seek environmentally friendly and low-energy solutions. Regenerable and reusable anionic resins that minimize chemical waste are gaining traction, aligning with the increasing focus on sustainable practices. Furthermore, there is a growing trend of using anionic resins in niche applications like rare earth element recovery and pharmaceutical purification, expanding their market potential beyond traditional water treatment. These trends are redefining the capabilities of anionic resins, making them more versatile and effective across a broader range of industrial applications.How Are Regulatory and Environmental Pressures Shaping the Anionic Resins Market?

Stringent regulatory standards and rising environmental concerns are having a profound impact on the anionic resins market, creating both opportunities and challenges for manufacturers and end-users. As industries face growing scrutiny over their water usage and waste disposal practices, there is a strong push towards the adoption of advanced ion exchange resins that can help achieve compliance with environmental regulations. For example, in the water treatment sector, anionic resins are increasingly used to meet strict limits on nitrate and heavy metal levels in effluent water, as set by regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Environment Agency (EEA). Additionally, the implementation of tighter regulations around zero liquid discharge (ZLD) in several regions is driving demand for highly efficient anionic resins that can handle complex wastewater streams and facilitate the recovery and reuse of valuable resources. In the chemical processing industry, anionic resins are being employed to minimize the release of hazardous chemicals, aligning with the global shift towards sustainable chemical management as mandated by the REACH regulation in Europe and other global standards. These regulatory requirements are pushing companies to invest in high-performance anionic resins that not only remove contaminants effectively but also reduce chemical consumption and operational costs. On the environmental front, there is increasing pressure on industries to adopt green technologies that minimize their environmental footprint. As a result, manufacturers are focusing on developing eco-friendly and bio-based anionic resins that offer similar performance to traditional resins but with lower environmental impact. These trends are driving innovation and encouraging the adoption of advanced anionic resin technologies that support regulatory compliance and sustainability goals.What Are the Key Growth Drivers of the Anionic Resins Market?

The growth in the anionic resins market is driven by several factors, primarily influenced by advancements in technology, expanding application areas, and evolving industrial needs. One of the key drivers is the increasing demand for high-purity water across various industries, including power generation, pharmaceuticals, and electronics manufacturing, where even trace levels of impurities can significantly impact product quality and process efficiency. As a result, anionic resins are being widely adopted for deionization and ultrapure water production. Another major growth factor is the expanding use of anionic resins in industrial wastewater treatment, where they are used to remove specific pollutants such as nitrates, sulfates, and arsenic to meet stringent discharge regulations. The rising focus on resource recovery is also driving demand for specialized resins that can selectively capture valuable metals from mining effluents or recover rare elements from industrial waste streams, creating new market opportunities. Additionally, the increasing use of anionic resins in the food and beverage industry for decolorization, deashing, and acid removal in products like fruit juices and sweeteners is broadening the scope of applications. The push towards sustainability is another critical driver, with industries seeking to adopt more environmentally friendly processes that minimize chemical waste and optimize water usage. This is leading to a growing preference for reusable and long-lasting anionic resins that reduce the frequency of regeneration and minimize environmental impact. Furthermore, advancements in resin manufacturing technologies, such as the development of high-performance macroporous resins and hybrid materials, are enhancing the efficiency and versatility of anionic resins, making them suitable for complex applications. These factors, combined with increased investment in research and development, are propelling the growth of the anionic resins market, positioning it as a vital component in modern water treatment and chemical processing solutions.Report Scope

The report analyzes the Anionic Resins market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Power, Water & Wastewater Treatment, Food & Beverage, Chemical & Petrochemical, Pharmaceutical, Electrical & Electronics, Metal & Mining, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Power End-Use segment, which is expected to reach US$249.3 Million by 2030 with a CAGR of a 7.2%. The Water & Wastewater Treatment End-Use segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $157.5 Million in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $193.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Anionic Resins Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Anionic Resins Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Anionic Resins Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

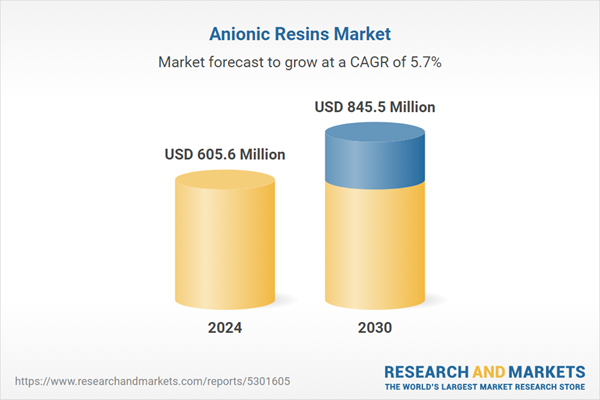

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Dow, Inc., DuPont de Nemours, Inc., Ion Exchange, Jiangsu Suqing Water Treatment Engineering, Lanxess and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Anionic Resins market report include:

- Dow, Inc.

- DuPont de Nemours, Inc.

- Ion Exchange

- Jiangsu Suqing Water Treatment Engineering

- Lanxess

- Mitsubishi Chemical

- Novasep

- Purolite

- Resintech

- Samyang

- Thermax

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dow, Inc.

- DuPont de Nemours, Inc.

- Ion Exchange

- Jiangsu Suqing Water Treatment Engineering

- Lanxess

- Mitsubishi Chemical

- Novasep

- Purolite

- Resintech

- Samyang

- Thermax

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 605.6 Million |

| Forecasted Market Value ( USD | $ 845.5 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |