Global Ancestry and Relationship Testing Market - Key Trends and Drivers Summarized

Why Are Ancestry and Relationship Tests So Popular Today?

Ancestry and relationship testing have surged in popularity over the past decade, becoming a global phenomenon that is fundamentally changing how people perceive and connect with their heritage and biological relationships. Advances in genetic science and the development of user-friendly DNA test kits have democratized the process, allowing consumers to unlock their genetic history from the comfort of their own homes. Today, a simple saliva or cheek swab can reveal detailed ancestral backgrounds, link individuals to distant relatives, and even provide insights into specific geographical regions their ancestors originated from. Leading companies in this space, such as 23andMe and AncestryDNA, have made ancestry testing mainstream, attracting millions of users around the world who are eager to explore their genetic roots. What was once a complex and costly endeavor reserved for professional genealogists has now become an engaging activity for families, researchers, and history enthusiasts. Beyond personal curiosity, these tests have become powerful tools for reconnecting families, confirming paternity, and even solving cold cases in forensic investigations. The rise of genealogy-focused social media communities has further fueled interest, as users share stories of unexpected findings, long-lost relatives, and newfound cultural identities, making ancestry testing not just a scientific pursuit but a compelling human experience.What Are the Key Trends Reshaping the Ancestry and Relationship Testing Market?

The ancestry and relationship testing market is witnessing several transformative trends that are redefining the scope and applications of genetic testing. One of the most prominent trends is the integration of health-related insights alongside ancestry results. Companies are increasingly combining ancestry testing with genetic health risk reports, offering consumers a more holistic view of their genetic profiles. This trend is particularly strong among tech-savvy millennials and health-conscious consumers who are keen on leveraging genetic information to make informed lifestyle choices. Another noteworthy trend is the growing adoption of direct-to-consumer (DTC) testing models. This shift is reducing the barriers to entry for consumers by eliminating the need for a medical referral, making these tests more accessible and widely adopted. Furthermore, the rising use of artificial intelligence (AI) and machine learning in data analysis is enhancing the accuracy and depth of genetic testing, enabling researchers to draw more precise conclusions about genetic relationships and heritage. The integration of these technologies is expanding the scope of genetic genealogy, providing more detailed family trees, advanced ancestry mapping, and refined ethnic composition analyses. Additionally, the expansion of testing services to include complex relationship verifications, such as sibling, grandparentage, and twin testing, is catering to niche consumer needs. These trends are not only diversifying the types of tests available but are also broadening the appeal of genetic testing to a wider audience, making it an essential component of modern consumer genomics.How Are Regulatory and Ethical Considerations Impacting the Market?

The growing popularity of ancestry and relationship testing has also raised important regulatory and ethical considerations, creating both opportunities and challenges for market players. With the increasing collection of genetic data, concerns about data privacy, security, and potential misuse are at the forefront of industry discussions. In response, regulatory bodies across various regions are tightening guidelines to protect consumer rights and ensure the responsible use of genetic information. For instance, in the United States, the Genetic Information Nondiscrimination Act (GINA) prevents discrimination based on genetic data in health insurance and employment, while in the European Union, the General Data Protection Regulation (GDPR) enforces stringent data privacy standards. These regulations are compelling companies to adopt more robust data protection measures, including transparent consent processes, data encryption, and options for consumers to delete their genetic information upon request. Additionally, the ethical debate surrounding the use of genetic data in law enforcement is intensifying, as authorities increasingly turn to genetic databases to solve cold cases and track down suspects. While this has proven to be a powerful tool for criminal investigations, it has also sparked concerns over privacy infringement and the potential for misuse of sensitive information. As public awareness of these issues grows, companies are under pressure to balance innovation with ethical responsibility, ensuring that they operate within legal frameworks while maintaining consumer trust.What Factors Are Driving the Growth of the Ancestry and Relationship Testing Market?

The growth in the ancestry and relationship testing market is driven by several factors, primarily shaped by technological advancements, changing consumer preferences, and the diversification of testing services. One of the key drivers is the increasing sophistication of genetic testing technologies, including the use of next-generation sequencing (NGS) and advanced bioinformatics tools that allow for more precise and comprehensive genetic analysis. These innovations are enhancing the accuracy of ancestry mapping and relationship verification, making testing results more reliable and appealing to consumers. Another critical driver is the growing popularity of at-home testing kits, which provide a convenient and non-invasive way for individuals to explore their heritage and confirm family relationships. This trend is further supported by the expansion of e-commerce and digital marketing, making it easier for companies to reach a global audience. Additionally, the rising demand for personalized genetic insights is pushing companies to offer bundled services that include not just ancestry and relationship verification, but also health, wellness, and even trait analysis, thus adding value to their offerings. The growing interest in genealogy and the desire to connect with distant relatives are also fueling market growth, as more people look to build family trees and discover unknown family connections. Furthermore, increased media coverage and social media sharing of unexpected ancestry discoveries and emotional reunions are generating buzz and driving consumer interest. These factors, combined with rising awareness of genetic health and heritage, are positioning the ancestry and relationship testing market for continued expansion, attracting both new consumers and established players looking to tap into the lucrative and evolving landscape of consumer genomics.Report Scope

The report analyzes the Ancestry and Relationship Testing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (Online, Over the Counter).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Online Distribution Channel segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of a 11.2%. The Over the Counter Distribution Channel segment is also set to grow at 10.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $235.4 Million in 2024, and China, forecasted to grow at an impressive 14.3% CAGR to reach $391.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ancestry and Relationship Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ancestry and Relationship Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ancestry and Relationship Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 23andMe, Ambry Genetics, Ancestry.com, FamilytreeDNA, Helix genomics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 73 companies featured in this Ancestry and Relationship Testing market report include:

- 23andMe

- Ambry Genetics

- Ancestry.com

- FamilytreeDNA

- Helix genomics

- MyHeritage

- Pathway Genomics

- Quest Diagnostics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 23andMe

- Ambry Genetics

- Ancestry.com

- FamilytreeDNA

- Helix genomics

- MyHeritage

- Pathway Genomics

- Quest Diagnostics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 211 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

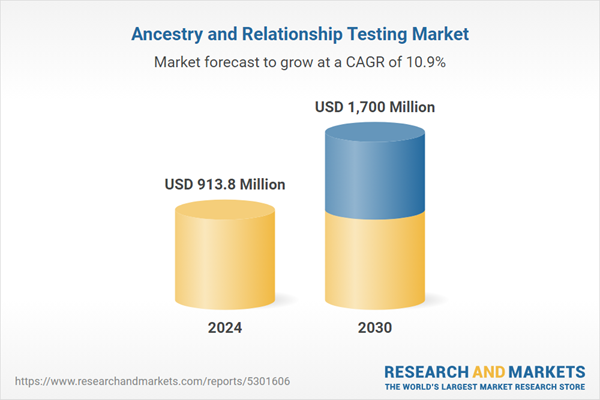

| Estimated Market Value ( USD | $ 913.8 Million |

| Forecasted Market Value ( USD | $ 1700 Million |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |