Global Alginate Dressings Market - Key Trends and Drivers Summarized

Why Are Alginate Dressings Revolutionizing Wound Care?

Alginate dressings have emerged as a groundbreaking innovation in wound care, offering unique advantages in managing moderate to heavily exuding wounds. Made from natural fibers derived from seaweed, particularly the alginic acid found in brown algae, these dressings have a remarkable ability to absorb large amounts of wound exudate, transforming into a gel-like substance when in contact with moisture. This gel formation helps maintain a moist wound environment, which is crucial for accelerating the healing process. Alginate dressings are particularly effective for wounds such as ulcers, burns, surgical incisions, and traumatic injuries that produce significant fluid. Their absorptive capacity, combined with the gentle nature of the gel they form, makes them suitable for wounds that require minimal disruption during dressing changes, thus reducing pain and trauma to the wound bed. Furthermore, alginate dressings possess natural hemostatic properties, implying that they help control minor bleeding, making them invaluable in the early stages of wound care. As a result, these dressings are becoming an essential tool for healthcare providers seeking more efficient and comfortable treatment options for patients with complex wound healing needs.How Do Alginate Dressings Compare to Traditional Wound Dressings?

Alginate dressings offer several advantages over traditional wound dressings such as gauze, hydrocolloids, or foam. One of the key differences is their ability to absorb significantly more fluid than many standard dressings, making them particularly useful for wounds with high exudate levels. Traditional dressings, like gauze, can dry out the wound bed, potentially causing the dressing to adhere to the wound and inflict pain during removal. Alginate dressings, on the other hand, maintain a moist environment that not only promotes faster healing but also ensures that the dressing can be removed without adhering to the wound, thus minimizing discomfort. This moist environment supports the body's natural healing process by facilitating cellular migration and reducing the risk of infection. Additionally, alginate dressings are biodegradable and generally require fewer dressing changes compared to traditional options, reducing the frequency of intervention and allowing the wound to heal undisturbed. Their ability to conform to the wound bed, particularly in deep or irregularly shaped wounds, offers another distinct advantage, ensuring that the wound is adequately covered and protected. In comparison to hydrocolloids and foams, alginate dressings stand out due to their superior absorptive capacity and their ability to manage wounds with active bleeding.What Are the Key Applications of Alginate Dressings in Modern Medicine?

Alginate dressings are used across a wide range of medical scenarios, primarily due to their versatility and effectiveness in managing various types of wounds. In wound care, these dressings are particularly favored for treating chronic wounds such as pressure ulcers, venous leg ulcers, and diabetic foot ulcers. Chronic wounds, which are often slow to heal due to poor circulation, excessive moisture, or infection, benefit greatly from the absorptive properties of alginate dressings, which help control wound moisture and create an ideal healing environment. For acute wounds, such as surgical wounds, donor sites, or burns, alginate dressings provide a barrier against infection while simultaneously managing exudate and reducing the frequency of dressing changes. Burn management, in particular, benefits from alginate's ability to form a gel, which cools the wound, eases pain, and accelerates healing. In surgical settings, the hemostatic properties of alginate dressings make them invaluable for controlling bleeding in both superficial and deep wounds. Additionally, their application extends to traumatic injuries where rapid exudate absorption and infection prevention are crucial for wound recovery. Alginate dressings are also finding use in outpatient care and home settings due to their ease of application and extended wear time, making them a practical option for both healthcare professionals and patients managing wounds over long periods.What's Fueling the Growth in the Alginate Dressings Market?

The growth in the alginate dressings market is driven by several factors, largely related to advancements in healthcare technology, an aging population, and the increasing prevalence of chronic wounds. One of the primary drivers is the rise in the incidence of conditions like diabetes, venous insufficiency, and obesity, all of which are associated with chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure sores. As the global population ages, the number of patients suffering from these types of wounds continues to rise, creating a growing demand for effective wound care solutions like alginate dressings. The superior absorptive capacity and moist healing environment provided by alginate dressings make them particularly suited for managing these chronic wounds, where controlling exudate and preventing infection are paramount to successful treatment. Additionally, advancements in biotechnology and materials science have enhanced the performance and affordability of alginate dressings, making them more accessible to a wider range of healthcare providers and patients. Moreover, the increased focus on reducing hospital readmissions and improving patient outcomes has encouraged the adoption of advanced wound care products like alginate dressings, which promote faster healing and minimize complications. This shift toward evidence-based, patient-centered care is also driving the market, as alginate dressings are recognized for their ability to reduce dressing change frequency, minimize patient discomfort, and improve overall quality of life for those with chronic or acute wounds. The rise of home healthcare services and the demand for cost-effective, easy-to-use dressings are further propelling the market, as alginate dressings are well-suited for use outside of hospital settings due to their simplicity and effectiveness. Furthermore, growing awareness about the importance of proper wound care and the risks of infection, particularly in post-operative and trauma care, is boosting the demand for alginate dressings. In sum, the convergence of these factors is driving the expansion of the alginate dressings market, positioning it as a critical component of modern wound care.Report Scope

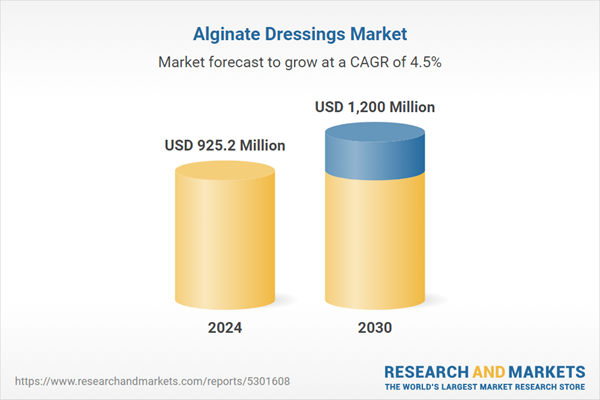

The report analyzes the Alginate Dressings market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Antimicrobial, Non-antimicrobial); Distribution Channel (Institutional, Retail); Application (Chronic Ulcers, Non-healing Surgical Wounds).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Antimicrobial Dressings segment, which is expected to reach US$727.2 Million by 2030 with a CAGR of a 4.9%. The Non-antimicrobial Dressings segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $243.7 Million in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $252.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alginate Dressings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alginate Dressings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alginate Dressings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, B. Braun Melsungen AG, BSN medical GmbH, Cardinal Health, Coloplast A/S and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Alginate Dressings market report include:

- 3M

- B. Braun Melsungen AG

- BSN medical GmbH

- Cardinal Health

- Coloplast A/S

- ConvaTec Group plc.

- Essity AB (BSN clinical)

- Integra Lifesciences, Inc.

- Kinetic Concepts Inc.

- Medline Industries Inc.

- Mölnlycke Health Care

- Smith and Nephew Plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- B. Braun Melsungen AG

- BSN medical GmbH

- Cardinal Health

- Coloplast A/S

- ConvaTec Group plc.

- Essity AB (BSN clinical)

- Integra Lifesciences, Inc.

- Kinetic Concepts Inc.

- Medline Industries Inc.

- Mölnlycke Health Care

- Smith and Nephew Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 366 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 925.2 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |