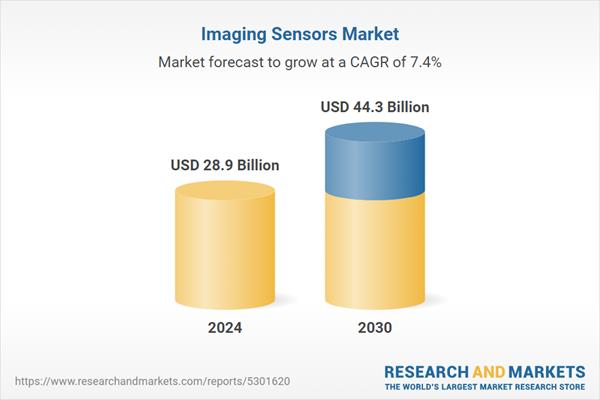

Global Imaging Sensors Market - Key Trends & Drivers Summarized

What Are Imaging Sensors & Why Are They Essential in Modern Technology?

Imaging sensors are devices that convert optical images into electronic signals, enabling the capture and processing of visual information. These sensors are fundamental components in various applications, including cameras, smartphones, automotive systems, medical imaging devices, and industrial inspection equipment. The two primary types of imaging sensors are Charge-Coupled Devices (CCDs) and Complementary Metal-Oxide-Semiconductors (CMOS). Each type has its advantages, making them suitable for different applications, such as high-resolution photography or low-light imaging. The versatility and critical function of imaging sensors make them essential for capturing high-quality images and videos in today's technology-driven world.The demand for imaging sensors has surged due to the rapid advancement of digital imaging technology and the increasing adoption of devices equipped with these sensors. As industries and consumers alike seek higher-quality imaging solutions for various applications, the importance of imaging sensors continues to grow. From enhancing smartphone cameras to enabling advanced driver-assistance systems (ADAS) in vehicles, imaging sensors are at the forefront of innovation across multiple sectors.

How Do Imaging Sensors Enhance Image Quality & Performance?

Imaging sensors enhance image quality and performance by converting light into electronic signals with high precision and sensitivity. The resolution, dynamic range, and noise performance of imaging sensors are critical factors that determine the quality of captured images. High-resolution sensors can capture finer details, while sensors with a broader dynamic range can effectively handle scenes with varying light levels, from bright highlights to deep shadows. These capabilities are essential for applications such as professional photography, medical imaging, and surveillance, where image clarity and detail are paramount.Additionally, advancements in sensor technologies, such as back-illuminated (BSI) designs and multi-layered sensor architectures, have significantly improved the low-light performance of imaging sensors. BSI sensors allow more light to reach the photodiodes, enhancing sensitivity and reducing noise in challenging lighting conditions. This is particularly beneficial for smartphone cameras and security systems, where users often need to capture clear images in low-light environments. By improving image quality and performance, imaging sensors enable a wide range of applications, from everyday photography to critical medical diagnostics.

How Are Technological Advancements Shaping the Development of Imaging Sensors?

Technological advancements have significantly transformed the design, functionality, and applications of imaging sensors, making them more efficient and versatile. One major innovation is the development of advanced materials and fabrication techniques, allowing for the production of smaller, lighter, and more sensitive sensors. For instance, the integration of organic photodetectors and nanomaterials has led to the creation of imaging sensors with enhanced performance characteristics, such as improved sensitivity and higher resolution.Another significant advancement is the incorporation of artificial intelligence (AI) and machine learning algorithms into imaging systems. These technologies enhance image processing capabilities, enabling real-time analysis, object recognition, and scene understanding. AI-powered imaging sensors can adapt to varying conditions and improve the overall user experience by providing features like automatic focus adjustment and enhanced image stabilization.

The rise of multi-sensor systems, where multiple imaging sensors work together to capture different aspects of a scene, has also reshaped the market. This trend is particularly evident in automotive applications, where sensor fusion from cameras, LiDAR, and radar enhances the performance of ADAS and autonomous driving systems. By leveraging multiple sensor technologies, manufacturers can create more robust and reliable imaging solutions. These technological advancements not only enhance the functionality and versatility of imaging sensors but also expand their applications across various industries, including consumer electronics, healthcare, automotive, and security.

What Factors Are Driving Growth in the Imaging Sensors Market?

The growth in the imaging sensors market is driven by several factors, including the increasing demand for high-quality imaging solutions, the expansion of consumer electronics, advancements in automotive technologies, and the rising adoption of smart devices. As consumers seek devices that offer superior camera capabilities, the demand for high-resolution imaging sensors in smartphones, tablets, and cameras has surged. This trend is particularly strong among younger consumers who prioritize photography and social media engagement.The expansion of the automotive industry, particularly in the areas of advanced driver-assistance systems (ADAS) and autonomous vehicles, is also contributing to market growth. Imaging sensors play a critical role in enabling safety features such as lane departure warnings, collision avoidance, and pedestrian detection, which are essential for modern vehicles. The increasing focus on vehicle safety and automation has driven manufacturers to incorporate advanced imaging solutions into their designs.

Advancements in imaging sensor technology, such as improvements in resolution, low-light performance, and processing capabilities, have further propelled market growth. The integration of AI and machine learning into imaging systems enhances the functionality and usability of these sensors, making them more appealing to consumers and industries alike. The rise of the Internet of Things (IoT) and smart home technologies has also led to increased demand for imaging sensors in security cameras and monitoring systems, driving further growth in the market.

Emerging markets in Asia-Pacific and Latin America are witnessing increased investments in technology and infrastructure, creating new opportunities for imaging sensor manufacturers. With ongoing innovations, expanding applications across various sectors, and rising demand for high-quality imaging solutions, the imaging sensors market is poised for sustained growth, driven by evolving industry needs and advancements in technology.

Report Scope

The report analyzes the Imaging Sensors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (CMOS, CCD, Other Technologies); Processing Technique (2D, 3D); End-Use (Consumer Electronics, Aerospace, Defense, & Law Enforcement, Automotive, Industrial, Commercial, Medical & Life Sciences).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the CMOS segment, which is expected to reach US$24.4 Billion by 2030 with a CAGR of a 7.9%. The CCD segment is also set to grow at 6.8% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Imaging Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Imaging Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Imaging Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMS AG, Canon, Inc., Galaxy Core, Inc., Hamamatsu Photonics K.K, Infineon Technologies AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Imaging Sensors market report include:

- AMS AG

- Canon, Inc.

- Galaxy Core, Inc.

- Hamamatsu Photonics K.K

- Infineon Technologies AG

- Omni Vision Technologies Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Pixel plus

- PMD Technologies AG

- Samsung Electronics Co. Ltd.

- Sharp Corporation

- SK Hynix, Inc.

- Sony Corporation

- STMicroelectronics N.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMS AG

- Canon, Inc.

- Galaxy Core, Inc.

- Hamamatsu Photonics K.K

- Infineon Technologies AG

- Omni Vision Technologies Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Pixel plus

- PMD Technologies AG

- Samsung Electronics Co. Ltd.

- Sharp Corporation

- SK Hynix, Inc.

- Sony Corporation

- STMicroelectronics N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 28.9 Billion |

| Forecasted Market Value ( USD | $ 44.3 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |