Global Robot Gears Market - Key Trends & Drivers Summarized

What Are Robot Gears & Why Are They Essential in Robotics Applications?

Robot gears are mechanical components designed to transmit power and motion within robotic systems. These gears are integral to the functioning of robots, enabling precise movement, torque transmission, and speed control. Various types of gears, such as bevel gears, spur gears, worm gears, and planetary gears, are utilized in robotic applications, each serving specific purposes based on the required mechanical advantage and operational characteristics. Robot gears are essential for ensuring that robotic arms, mobile robots, and automated machinery operate efficiently and accurately, making them a fundamental aspect of modern robotics.The demand for robot gears has surged due to the rapid advancement of automation technologies across industries, including manufacturing, healthcare, logistics, and consumer goods. As businesses increasingly adopt robotics to improve productivity, precision, and efficiency, the role of gears in ensuring the reliable operation of these systems has become increasingly critical. The growth of industries such as industrial automation, collaborative robots (cobots), and autonomous vehicles has further fueled the demand for high-quality, reliable robot gears.

How Do Robot Gears Enhance Precision & Performance in Robotics?

Robot gears enhance precision and performance in robotics by allowing for controlled movement and effective force transmission. The design and configuration of gears play a crucial role in determining the speed and torque delivered to robotic joints and end effectors. For example, high-precision gears enable robots to perform intricate tasks that require fine movements, such as assembly operations or delicate handling of components in manufacturing settings. By providing accurate and reliable motion control, robot gears help ensure that robotic systems can execute tasks with high levels of repeatability and precision.Moreover, the use of gears in robotic systems allows for mechanical advantage, enabling robots to lift heavier loads and perform more demanding operations without compromising efficiency. By adjusting gear ratios, manufacturers can optimize the performance of robotic systems for specific applications, whether it involves high-speed operation or increased torque for heavy lifting. This versatility makes robot gears essential for a wide range of applications, from industrial robots used in manufacturing to service robots in healthcare and hospitality. Ultimately, the integration of high-quality gears contributes to the overall effectiveness and reliability of robotic systems, enhancing their ability to perform complex tasks.

How Are Technological Advancements Shaping the Development of Robot Gears?

Technological advancements have significantly influenced the design, materials, and manufacturing processes of robot gears, resulting in improved performance and reliability. One major innovation is the development of advanced materials, such as lightweight composites and high-strength alloys, which enhance the durability and performance of gears. These materials reduce the overall weight of robotic systems, allowing for more efficient movement and increased battery life in mobile robots.Additionally, advancements in gear design, such as the use of computer-aided design (CAD) and finite element analysis (FEA), have enabled engineers to create more efficient and effective gear profiles. These design tools help optimize gear geometry for specific applications, ensuring that gears can withstand the mechanical stresses encountered during operation. Innovations in gear manufacturing techniques, such as additive manufacturing (3D printing) and precision machining, have also improved the production of complex gear shapes, allowing for greater customization and faster prototyping.

The integration of smart technologies into robot gears is another significant advancement. Some modern gear systems are equipped with sensors that provide real-time data on performance and wear, allowing for predictive maintenance and improved reliability. This integration enhances the ability to monitor gear health and optimize performance, leading to reduced downtime and maintenance costs. As the robotics industry continues to evolve, these technological advancements will play a crucial role in the development of more efficient and capable robot gears.

What Factors Are Driving Growth in the Robot Gears Market?

The growth in the robot gears market is driven by several factors, including increasing automation across industries, the rising demand for advanced robotics, the expansion of the manufacturing sector, and the growing interest in collaborative robots (cobots). As industries strive to improve efficiency, reduce labor costs, and enhance productivity, the adoption of robotic systems has accelerated. Robot gears are essential components that enable these systems to operate effectively, leading to increased demand for high-quality gearing solutions.The expanding manufacturing sector, particularly in emerging markets, is also contributing to the growth of the robot gears market. As manufacturers invest in automation technologies to meet production demands, the need for reliable and precise robotic systems has grown. This trend is particularly evident in sectors such as automotive, electronics, and consumer goods, where robotics play a vital role in streamlining operations.

The rise of collaborative robots (cobots) is another significant factor driving market growth. Cobots are designed to work alongside human operators, enhancing productivity and safety in the workplace. The unique requirements of cobot designs, which often involve compact and lightweight gear systems, create new opportunities for gear manufacturers. Additionally, the increasing focus on sustainability and energy efficiency in manufacturing processes has led to the adoption of more advanced robotic systems, further boosting the demand for innovative robot gears.

Emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), are also influencing the growth of the robot gears market. These technologies require sophisticated robotics capable of advanced tasks and real-time data processing, driving the need for high-performance gears. With ongoing innovations, expanding applications across various sectors, and rising demand for automation solutions, the robot gears market is poised for sustained growth, driven by evolving industry needs and advancements in robotics technology.

SCOPE OF STUDY:

The report analyzes the Robot Gears market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Application (Material Handling, Assembly Line, Welding, Painting)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Material Handling segment, which is expected to reach US$117.0 Million by 2030 with a CAGR of a 6.7%. The Assembly Line segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $51.8 Million in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $65.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Robot Gears Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Robot Gears Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Robot Gears Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bevel Gears, Davall Gears, Gear Motions, Mitsubishi Heavy Industries, Nabtesco and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Robot Gears market report include:

- Bevel Gears

- Davall Gears

- Gear Motions

- Mitsubishi Heavy Industries

- Nabtesco

- Spinea

- Stober

- Stock Drive Products/ Sterling Instruments

- VEX Robotics

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bevel Gears

- Davall Gears

- Gear Motions

- Mitsubishi Heavy Industries

- Nabtesco

- Spinea

- Stober

- Stock Drive Products/ Sterling Instruments

- VEX Robotics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

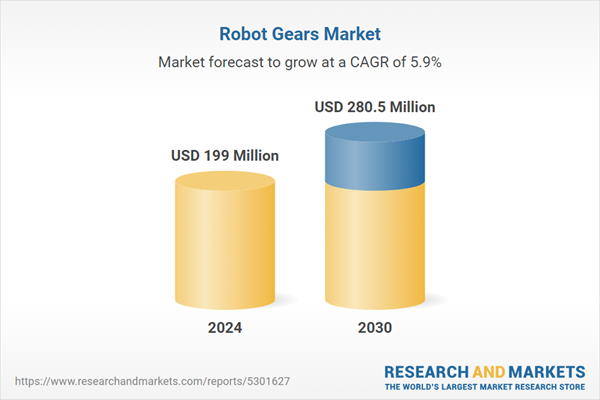

| Estimated Market Value ( USD | $ 199 Million |

| Forecasted Market Value ( USD | $ 280.5 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |