Global Alkaline Aluminate Market - Key Trends & Drivers Summarized

What Is Alkaline Aluminate & Why Is It Essential in Industrial Applications?

Alkaline aluminate, primarily represented by sodium aluminate and potassium aluminate, is an inorganic compound with strong alkalinity, typically produced by dissolving aluminum hydroxide in sodium hydroxide or potassium hydroxide. This compound serves as a critical coagulant, flocculant, and pH stabilizer in various industrial processes. It is widely used in water and wastewater treatment, as well as in the paper and pulp, construction, and chemical manufacturing industries. Alkaline aluminate plays a significant role in water treatment, where it helps remove suspended particles, heavy metals, phosphates, and organic impurities through coagulation and flocculation. In the construction sector, it is used as an accelerator in cement and concrete, enhancing early strength development and reducing setting time.The demand for alkaline aluminate has grown significantly due to its versatile properties and applications across industries. In water treatment, it is an effective coagulant for softening water, reducing turbidity, and removing contaminants, making it an essential component in municipal and industrial water treatment plants. The compound's use in the paper industry aids in improving paper sizing, brightness, and the removal of impurities during the production process. In the chemical sector, alkaline aluminate is utilized as an intermediate for producing aluminum-based chemicals and as a catalyst in various reactions. Its multifunctional role in improving efficiency, enhancing product quality, and supporting environmental compliance makes alkaline aluminate an indispensable compound in industrial processes.

How Does Alkaline Aluminate Improve Water Treatment & Industrial Efficiency?

Alkaline aluminate enhances water treatment processes by acting as a powerful coagulant and pH regulator. In wastewater treatment, it facilitates the aggregation of suspended solids, heavy metals, and other contaminants, forming flocs that can be easily removed through sedimentation or filtration. This improves water clarity, reduces turbidity, and ensures compliance with discharge regulations. Alkaline aluminate is particularly effective in removing phosphorus from wastewater, making it a preferred choice for preventing eutrophication in water bodies, where excess nutrients can lead to harmful algal blooms. By adjusting pH levels, it also helps maintain optimal conditions for other treatment chemicals, improving overall treatment efficiency and reducing the need for additional pH adjustments.In the construction industry, alkaline aluminate is used as an accelerating agent in cement and concrete formulations. It speeds up the hydration process, allowing for faster setting times and early strength development. This property is particularly beneficial in cold-weather concreting, where low temperatures slow down the curing process. Alkaline aluminate enhances the durability and strength of concrete, making it suitable for a variety of applications, from infrastructure projects to precast concrete production. In the paper industry, the compound is used during the paper sizing process, improving resistance to water absorption and enhancing printability. It also aids in the removal of impurities during the pulping process, resulting in higher-quality paper. By improving operational efficiency and product quality across different applications, alkaline aluminate supports more cost-effective and environmentally friendly industrial processes.

How Are Technological Advancements Shaping the Development of Alkaline Aluminate Applications?

Technological advancements have significantly improved the production, formulation, and application of alkaline aluminate, making it more effective for a broader range of industrial uses. One of the major innovations is the development of high-purity alkaline aluminate, which offers better solubility, higher reactivity, and lower impurities. This high-purity form is particularly useful in water treatment, where purity is critical for achieving optimal coagulation, flocculation, and pH adjustment. Improved manufacturing processes, such as closed-loop systems and advanced purification methods, have enhanced the quality and consistency of alkaline aluminate, supporting its use in sensitive applications like drinking water treatment and specialty chemical production.In the construction sector, advancements in formulation have led to the development of more efficient accelerators that incorporate alkaline aluminate. These formulations offer faster setting times, improved compressive strength, and better compatibility with different types of cement, making them suitable for use in a variety of climates and construction conditions. The integration of alkaline aluminate in eco-friendly cement mixtures, including low-carbon concrete and geopolymers, aligns with global sustainability trends, offering reduced carbon footprints and better performance in aggressive environments. Additionally, innovations in delivery methods, such as pre-mixed solutions and ready-to-use formulations, have improved handling, storage, and application efficiency, reducing operational costs and increasing adoption across industries.

In the chemical manufacturing sector, alkaline aluminate is used as a precursor for producing advanced aluminum-based compounds, such as zeolites and aluminum hydroxide, which are essential in catalysis, adsorbents, and flame retardants. Enhanced production techniques have improved the yield and purity of these derivatives, supporting their use in high-performance applications. The development of automated dosing systems in water treatment plants has further optimized the use of alkaline aluminate, allowing for precise and efficient dosing, better control of pH, and reduced chemical waste. These technological advancements have expanded the applicability and effectiveness of alkaline aluminate, making it more versatile and efficient for diverse industrial processes.

What Factors Are Driving Growth in the Alkaline Aluminate Market?

The growth in the alkaline aluminate market is driven by several factors, including increasing demand for efficient water and wastewater treatment, growing construction activities, advancements in paper production, and expanding chemical manufacturing. In the water treatment sector, the need for effective coagulants and pH regulators has increased as regulatory standards for water quality become more stringent worldwide. Alkaline aluminate's effectiveness in phosphorus removal and its role in improving water clarity have made it an essential compound for municipal water treatment plants, industrial wastewater treatment, and agricultural runoff management. The rising focus on environmental protection and sustainable water management has further fueled demand for this compound, as it helps industries comply with environmental regulations and supports water reuse initiatives.The expanding construction sector, particularly in emerging markets like Asia-Pacific and Latin America, has also contributed to market growth. With increasing investments in infrastructure development, housing projects, and commercial buildings, the demand for fast-setting and durable construction materials has risen. Alkaline aluminate, as a key ingredient in cement accelerators and specialty concrete mixtures, plays a critical role in meeting these demands, especially in time-sensitive and large-scale projects. The paper industry's focus on quality improvement and cost efficiency has led to increased use of alkaline aluminate in paper sizing and pulp purification processes, supporting the production of higher-grade paper with better printability and resistance to moisture.

Technological advancements in production processes, the development of more efficient formulations, and the rising adoption of automation in water treatment facilities have also supported market growth. As industries seek to improve process efficiency, reduce costs, and achieve better environmental compliance, the demand for versatile and effective compounds like alkaline aluminate is expected to grow steadily. Emerging applications in advanced chemical synthesis and sustainable construction materials offer new opportunities for market expansion. With ongoing innovations, increased regulatory requirements, and a focus on sustainability, the alkaline aluminate market is poised for sustained growth, driven by diverse applications, evolving industry needs, and global infrastructure development.

Report Scope

The report analyzes the Alkaline Aluminate market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Mining, Tunneling, Construction Repair, Water Retaining Structures, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $117.3 Million in 2024, and China, forecasted to grow at an impressive 11.6% CAGR to reach $173.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alkaline Aluminate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alkaline Aluminate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alkaline Aluminate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

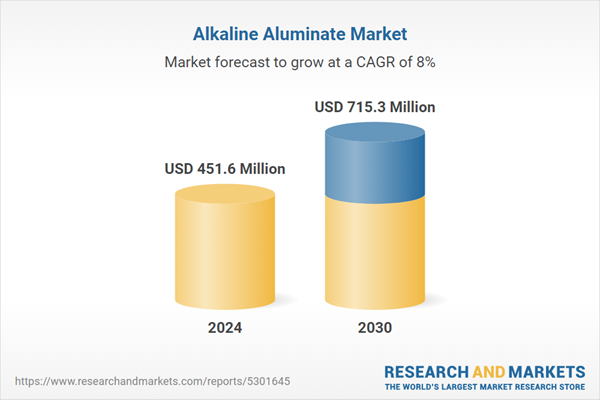

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Andmir Group, Anton Oilfield Services, Baker Hughes Company, China Oilfield Services, Halliburton and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Alkaline Aluminate market report include:

- Andmir Group

- Anton Oilfield Services

- Baker Hughes Company

- China Oilfield Services

- Halliburton

- Katt GmbH

- Kerui Petroleum

- Middle East Oilfield Services

- Mitchell Industries

- Oil States International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Andmir Group

- Anton Oilfield Services

- Baker Hughes Company

- China Oilfield Services

- Halliburton

- Katt GmbH

- Kerui Petroleum

- Middle East Oilfield Services

- Mitchell Industries

- Oil States International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 451.6 Million |

| Forecasted Market Value ( USD | $ 715.3 Million |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |