Global Rail Sleepers Market - Key Trends & Drivers Summarized

What Are Rail Sleepers & Why Are They Critical to Rail Infrastructure?

Rail sleepers, also known as railroad ties or crossties, are essential components of railway infrastructure, serving as the base supports for railroad tracks. They are laid perpendicular to the steel rails and play a crucial role in maintaining the correct track gauge, distributing the load from the rails to the ballast (or subgrade), and providing stability to the overall rail system. Traditionally, sleepers have been made from wood, but modern rail networks also utilize concrete, steel, and composite materials to improve durability, load-bearing capacity, and resistance to environmental factors. The selection of sleeper material depends on factors such as train speed, track load, environmental conditions, and maintenance requirements. Rail sleepers are indispensable in both freight and passenger railways, including heavy-haul tracks, high-speed railways, urban transit systems, and light rails, as they ensure the safe and smooth operation of trains over long distances.The growing demand for efficient, resilient rail infrastructure has been a major driver for the rail sleepers market. As rail networks expand globally, driven by increased investments in public transportation, logistics, and freight mobility, the need for reliable track components like rail sleepers becomes more pronounced. In addition to supporting the physical structure of the tracks, rail sleepers are designed to absorb vibrations and reduce noise, contributing to passenger comfort and longer track lifespan. Modern sleepers, especially those made from concrete and composite materials, are engineered to handle heavy loads, resist water absorption, and minimize maintenance costs, making them a preferred choice for high-traffic and high-speed rail systems. The durability and reliability offered by advanced sleepers are crucial to meeting the rising demand for robust rail infrastructure worldwide.

How Do Rail Sleepers Enhance Track Stability & Longevity?

Rail sleepers play a vital role in ensuring track stability and extending the lifespan of rail systems. By maintaining the proper spacing and alignment of the rails, sleepers distribute the dynamic loads generated by passing trains evenly across the ballast, preventing track deformation and reducing the risk of derailments. Concrete sleepers, for instance, are known for their high compressive strength and resistance to extreme weather conditions, making them ideal for heavy-haul and high-speed rail networks. These sleepers provide strong lateral and longitudinal support, preventing rail buckling and maintaining track geometry under heavy loads. Steel sleepers, on the other hand, offer flexibility and are often used in areas with unstable ground, such as bridge approaches or regions prone to flooding. They are designed to resist bending and corrosion, ensuring consistent performance in challenging environments.Wooden sleepers, while still used in many traditional rail systems, offer benefits such as shock absorption and ease of handling. However, they require more maintenance and have a shorter lifespan compared to modern alternatives. Composite sleepers, made from recycled materials and polymers, offer an eco-friendly alternative with advantages such as low maintenance, resistance to moisture and rot, and long service life. They are increasingly being adopted in metro systems and urban rail networks due to their lightweight nature and high resistance to environmental wear. The choice of sleeper material is critical to track maintenance strategies, as it directly affects track resilience, safety, and the intervals between maintenance cycles. Properly designed and installed rail sleepers not only enhance track performance but also reduce long-term costs associated with track repairs and replacements, making them a key factor in sustainable rail operations.

How Are Technological Advancements Driving Innovation in Rail Sleepers?

Technological advancements have led to significant innovations in the design, material, and performance of rail sleepers, making them more durable, adaptable, and efficient. One of the most notable innovations is the development of pre-stressed concrete sleepers, which are designed to withstand greater loads and resist cracking under high-stress conditions. These sleepers are increasingly used in high-speed rail networks, where stability and load-bearing capacity are crucial. Advanced manufacturing techniques, such as automated casting and curing processes, have improved the consistency and quality of concrete sleepers, making them more cost-effective and reliable for large-scale rail projects. Additionally, composite sleepers, which incorporate recycled materials and advanced polymers, have emerged as a sustainable solution for modern rail infrastructure. These sleepers are not only environmentally friendly but also resistant to moisture, decay, and pests, making them suitable for use in diverse climates.The integration of smart sensors and IoT technologies into rail sleepers is another key development, enabling real-time monitoring of track conditions. Smart sleepers are equipped with embedded sensors that collect data on parameters such as load distribution, temperature, and vibration. This data is transmitted to central systems for analysis, allowing rail operators to detect early signs of track wear, identify potential hazards, and schedule predictive maintenance. The use of AI algorithms to analyze sleeper performance data has also improved decision-making in rail maintenance and operations, enhancing safety and efficiency. Additionally, innovations in lightweight concrete and composite materials have made sleepers easier to transport and install, reducing the overall cost and time of rail construction projects. As rail networks continue to expand and modernize, the adoption of technologically advanced sleepers is expected to increase, supporting the development of smarter, more resilient rail infrastructure.

What Factors Are Driving Growth in the Rail Sleepers Market?

The growth in the rail sleepers market is driven by several factors, including increased investments in railway infrastructure, the need for sustainable and durable track components, and the rise of urban transit systems. Governments around the world are prioritizing rail infrastructure development to improve public transportation, reduce road congestion, and lower carbon emissions, resulting in significant demand for high-quality rail components like sleepers. In emerging economies, the expansion of freight corridors and high-speed rail projects has led to greater adoption of concrete and composite sleepers, which offer the necessary load-bearing capacity and durability for heavy rail traffic. Meanwhile, developed countries are focusing on upgrading aging rail infrastructure, replacing wooden sleepers with more modern alternatives to enhance track safety, reduce maintenance costs, and extend track life.The growing emphasis on sustainable construction materials has also contributed to the demand for composite sleepers, as they are made from recycled materials and have a lower environmental impact compared to traditional wood or concrete options. In urban areas, the expansion of metro systems and light rail networks has further boosted the market, as these systems require sleepers that can support frequent, high-speed service with minimal maintenance. Additionally, technological innovations such as smart sleepers have gained traction as rail operators seek to improve track safety and maintenance through real-time monitoring. The use of advanced materials, automation in manufacturing, and the integration of IoT technologies are expected to drive continued growth in the rail sleepers market, meeting the demands of modern rail networks for efficient, resilient, and sustainable track components.

Report Scope

The report analyzes the Rail Sleepers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Concrete, Other Types); End-Use (Railway, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

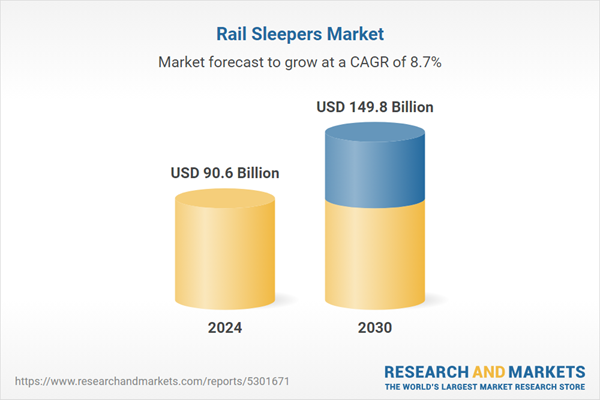

- Market Growth: Understand the significant growth trajectory of the Concrete Rail Sleepers segment, which is expected to reach US$140.7 Billion by 2030 with a CAGR of a 8.9%. The Other Types segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $23.4 Billion in 2024, and China, forecasted to grow at an impressive 12.6% CAGR to reach $37.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rail Sleepers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rail Sleepers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rail Sleepers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adelaide and Rural Salvage, AW Champion Timber, Biatec Group, Daya Engineering Works, Indian Hume Pipe and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Rail Sleepers market report include:

- Adelaide and Rural Salvage

- AW Champion Timber

- Biatec Group

- Daya Engineering Works

- Indian Hume Pipe

- Infraset

- Juli Railway Track

- Kirchdorfer Group

- Kunming Railway Sleeper

- Patil Group

- Peter Feckl Maschinenbau GmbH

- UK Sleepers

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adelaide and Rural Salvage

- AW Champion Timber

- Biatec Group

- Daya Engineering Works

- Indian Hume Pipe

- Infraset

- Juli Railway Track

- Kirchdorfer Group

- Kunming Railway Sleeper

- Patil Group

- Peter Feckl Maschinenbau GmbH

- UK Sleepers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 90.6 Billion |

| Forecasted Market Value ( USD | $ 149.8 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |