Global Activated Carbon Filtration Market - Key Trends & Drivers Summarized

What Is Activated Carbon Filtration and How Is It Manufactured?

Activated carbon filtration is a process that utilizes activated carbon, a porous material with a high surface area, to remove impurities, contaminants, and odors from liquids and gases. This filtration technology is widely used in various applications, including water treatment, air purification, food processing, and industrial processes. Activated carbon's adsorptive properties enable it to capture and hold onto molecules, making it effective for removing volatile organic compounds (VOCs), chlorine, heavy metals, and other contaminants, thereby improving the quality of water and air.The manufacturing of activated carbon involves the carbonization of raw materials, such as coconut shells, wood, or coal, followed by activation through high-temperature steam or chemical processes. The carbonization process removes moisture and volatile compounds, converting the raw material into carbon. The activation process enhances the material's porous structure, significantly increasing its surface area and adsorption capacity. The resulting activated carbon is then milled, sieved, and treated to meet specific requirements for various applications. Quality control measures are crucial throughout the production process to ensure that the activated carbon meets industry standards for effectiveness and safety.

Recent advancements in the production of activated carbon filtration materials focus on improving the efficiency, sustainability, and performance of activated carbon. Manufacturers are exploring innovative activation methods and raw materials that reduce environmental impact while enhancing adsorption capabilities. The development of specialized activated carbon formulations, such as those with functionalized surfaces or tailored pore structures, is also gaining traction, allowing for more effective removal of specific contaminants in targeted applications.

What Are the Primary Applications of Activated Carbon Filtration Across Industries?

Activated carbon filtration is utilized across a wide range of industries, with its primary applications found in water treatment, air purification, food and beverage processing, and industrial applications. In water treatment, activated carbon filters are widely used to remove impurities, such as chlorine, sediment, volatile organic compounds (VOCs), and heavy metals, from drinking water and wastewater. The ability to effectively adsorb a broad spectrum of contaminants makes activated carbon filtration a preferred choice for municipal water treatment plants, residential water purification systems, and industrial wastewater treatment facilities.In the air purification sector, activated carbon filters play a crucial role in improving indoor air quality by capturing odors, smoke, and harmful pollutants. These filters are commonly used in HVAC systems, air purifiers, and industrial ventilation systems to reduce the concentration of airborne contaminants. The effectiveness of activated carbon in adsorbing volatile organic compounds (VOCs) and other pollutants makes it a vital component in maintaining a safe and healthy indoor environment.

The food and beverage industry also employs activated carbon filtration for various applications, including the decolorization and purification of syrups, juices, and oils. Activated carbon is used to remove impurities and unwanted flavors from food products, ensuring that the final products meet quality and safety standards. This application is particularly important in producing clear beverages and improving the sensory attributes of food items.

In industrial applications, activated carbon filtration is used in processes such as solvent recovery, chemical manufacturing, and gas treatment. Activated carbon is employed to capture and recycle solvents, remove odors and contaminants from emissions, and purify chemicals. Its versatility and effectiveness in a wide range of industrial processes make activated carbon filtration an essential tool for maintaining operational efficiency and regulatory compliance.

Why Is Consumer Demand for Activated Carbon Filtration Increasing?

The demand for activated carbon filtration is increasing due to several key factors, including the rising awareness of water and air quality issues, regulatory pressures on environmental standards, and advancements in filtration technology. One of the primary drivers of demand is the growing concern among consumers regarding the quality of drinking water and indoor air. As public awareness of health risks associated with contaminated water and air increases, consumers are seeking effective solutions for purification and filtration. Activated carbon filtration is recognized for its ability to remove a wide range of contaminants, making it a popular choice for both residential and commercial applications.Regulatory pressures on environmental standards are also contributing to the rising demand for activated carbon filtration. Governments and regulatory agencies worldwide are implementing stricter regulations to ensure safe drinking water and reduce air pollution. As a result, municipalities, industries, and businesses are investing in advanced filtration technologies, including activated carbon systems, to comply with these regulations. The emphasis on environmental responsibility and sustainability is driving the adoption of activated carbon filtration solutions across various sectors.

Advancements in filtration technology are further influencing consumer demand for activated carbon filtration. Manufacturers are continually innovating to improve the efficiency and effectiveness of activated carbon filters. New developments in activated carbon formulations, such as enhanced adsorption capacities and specialized designs, are making these filtration systems more effective in removing specific contaminants. As filtration technologies evolve, consumers are more likely to adopt advanced solutions that provide better performance and reliability.

Additionally, the increasing popularity of home water and air purification systems is driving demand for activated carbon filtration in residential settings. As consumers become more health-conscious and environmentally aware, they are investing in systems that improve indoor air quality and provide clean drinking water. Activated carbon filters are often a key component of these systems, appealing to consumers looking for effective and convenient purification solutions.

What Factors Are Driving the Growth of the Activated Carbon Filtration Market?

The growth of the activated carbon filtration market is driven by several key factors, including the expanding water and air treatment industries, advancements in activated carbon technology, and increasing awareness of environmental sustainability. One of the most significant factors influencing market growth is the ongoing demand for effective water and air treatment solutions. As the global population increases and urbanization accelerates, the need for clean drinking water and breathable air is becoming more critical. Activated carbon filtration systems are increasingly adopted by municipalities and industries to address these growing concerns, driving market expansion.Advancements in activated carbon technology are also playing a crucial role in driving the growth of the filtration market. Research and development efforts are focused on creating new and improved activated carbon products with enhanced adsorption capacities, tailored pore structures, and longer service lives. These innovations are making activated carbon filtration systems more efficient and effective, appealing to both industrial and residential consumers. The continued evolution of activated carbon technology is expected to further boost demand as manufacturers strive to meet the diverse needs of various applications.

The increasing awareness of environmental sustainability is another important factor contributing to the growth of the activated carbon filtration market. As consumers and industries prioritize eco-friendly solutions, the demand for natural and sustainable filtration methods is rising. Activated carbon, derived from renewable resources, is perceived as a more sustainable option compared to chemical-based filtration methods. This trend is encouraging manufacturers to develop environmentally friendly activated carbon products, further driving market growth.

Additionally, the rising regulatory pressures on air and water quality standards are influencing the activated carbon filtration market. Governments worldwide are implementing stricter regulations to ensure safe drinking water and reduce air pollution levels. Industries are compelled to comply with these regulations, leading to increased investments in advanced filtration technologies, including activated carbon systems. As regulatory requirements become more stringent, the demand for activated carbon filtration solutions is expected to grow.

In conclusion, the global activated carbon filtration market is poised for significant growth, driven by the expanding water and air treatment industries, advancements in activated carbon technology, and increasing awareness of environmental sustainability. As consumers and industries seek effective solutions for improving air and water quality, activated carbon filtration will continue to play a vital role in various applications. With ongoing innovations and a commitment to meeting industry challenges, the market for activated carbon filtration is expected to experience sustained expansion in the coming years.

Report Scope

The report analyzes the Activated Carbon Filtration market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Industrial Water Purification, Drinking Water Purification, Food & Beverages, Pharmaceuticals, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Activated Carbon Filtration Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Activated Carbon Filtration Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Activated Carbon Filtration Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

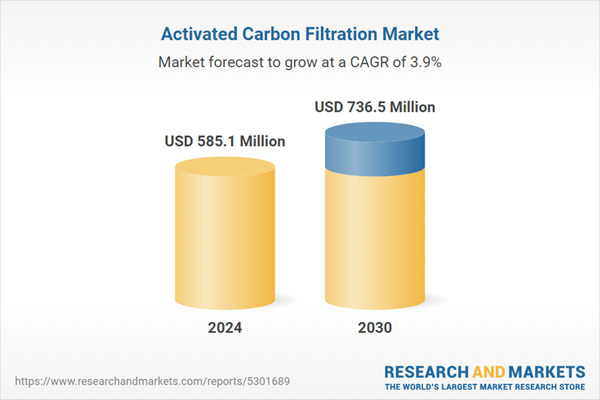

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bionics Consortium Pvt. Ltd., Cabot Corporation, Carbtrol Corp, Cocarb Solution, Condorchem Envitech and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Activated Carbon Filtration market report include:

- Bionics Consortium Pvt. Ltd.

- Cabot Corporation

- Carbtrol Corp

- Cocarb Solution

- Condorchem Envitech

- Donau Carbon Gmbh

- Ecologix Environmental Systems

- General Carbon Corporation

- Kuraray Co. Ltd.

- Lenntech B.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bionics Consortium Pvt. Ltd.

- Cabot Corporation

- Carbtrol Corp

- Cocarb Solution

- Condorchem Envitech

- Donau Carbon Gmbh

- Ecologix Environmental Systems

- General Carbon Corporation

- Kuraray Co. Ltd.

- Lenntech B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 585.1 Million |

| Forecasted Market Value ( USD | $ 736.5 Million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |