Global Aerospace and Defense Springs Market - Key Trends and Drivers Summarized

Why Are Springs Crucial to Aerospace and Defense Applications?

Aerospace and defense springs, though often overlooked, play a vital role in ensuring the reliability and performance of various aircraft systems and military equipment. These springs are integral to numerous components, ranging from landing gear systems and flight controls to engines, weapons systems, and even space exploration technologies. In aviation, precision is everything, and the performance of springs in applications such as shock absorption, load-bearing, and energy storage is paramount for ensuring smooth operation and passenger safety. Springs used in aerospace must endure extreme conditions, including high levels of vibration, pressure changes, and temperature fluctuations, while maintaining their integrity and performance over time. Moreover, these springs are typically made from high-strength alloys such as stainless steel, titanium, and Inconel to ensure they are lightweight yet durable enough to withstand the rigors of flight and combat. In defense applications, springs are found in a wide range of equipment, from missile systems to tanks and armored vehicles, where they provide essential mechanical support in high-stress environments. Their role in energy management, impact absorption, and structural stability makes them a critical component in both aerospace and defense systems, ensuring functionality in some of the most challenging conditions imaginable.How Has Technology Advanced the Design and Functionality of Aerospace Springs?

The design and functionality of aerospace and defense springs have evolved significantly, thanks to advancements in materials science and manufacturing processes. One of the most notable developments is the use of advanced alloys and composite materials, which allow springs to be both stronger and lighter - key considerations for aerospace applications where reducing weight directly impacts fuel efficiency and overall aircraft performance. Titanium and high-grade stainless steels are frequently used, as they offer exceptional strength-to-weight ratios, along with resistance to corrosion and fatigue under extreme stress. Another area of technological advancement lies in precision manufacturing techniques such as computer numerical control (CNC) machining and additive manufacturing (3D printing). These methods allow for the production of highly complex spring designs that offer improved functionality, such as progressive-rate springs that adjust their stiffness based on load conditions. Springs are also now being developed to meet the increasing demand for components that can operate in space. These springs must not only withstand the vacuum of space but also maintain performance in environments with extreme temperature variations and radiation exposure. Furthermore, advancements in surface coatings and treatments, such as shot peening and ion plating, enhance the durability and lifespan of springs, making them more resistant to wear and tear, and ensuring their performance over extended periods in both aviation and defense sectors.What Applications and End-Uses Are Driving Demand for Aerospace and Defense Springs?

Aerospace and defense springs find use in a broad spectrum of applications, each with stringent performance requirements. In commercial aviation, springs are essential in the operation of landing gear systems, which must absorb the immense impact forces during takeoff and landing, and in flight control mechanisms, where they ensure precision movement and responsiveness of the aircraft's control surfaces. Springs are also used extensively in the engines of both civilian and military aircraft, where they help manage the stresses of high-speed rotation and maintain critical clearances between moving parts. In defense, springs are found in everything from firearms and missile launch systems to vehicle suspension systems, where they provide shock absorption and structural support in rough terrains and combat scenarios. Space exploration is another growing application area, as springs are critical in mechanisms that require precise actuation, such as satellite deployment systems and spacecraft landing gears. These springs must perform reliably in environments where traditional materials and designs might fail, further underscoring their importance. Moreover, with the rise of autonomous drones and unmanned aerial vehicles (UAVs) in both military and commercial sectors, the need for lightweight, high-performance springs has expanded. These springs must be capable of delivering the same reliability as those used in manned aircraft, but within much smaller, lighter, and more compact systems.What Is Driving the Growth of the Aerospace and Defense Springs Market?

The growth in the aerospace and defense springs market is driven by several key factors, including increased aircraft production, the rising demand for military equipment, and advancements in manufacturing technologies. As global air travel continues to expand, driven by economic growth in emerging markets and the rise of low-cost carriers, there is an increasing need for new, more efficient aircraft. This has resulted in greater demand for high-performance springs that contribute to lighter, more fuel-efficient planes. Additionally, the ongoing modernization of military forces across the globe has led to increased spending on advanced defense systems, ranging from next-generation fighter jets and drones to missile systems and armored vehicles, all of which rely heavily on springs for critical mechanical functions. The space sector, too, is fueling market growth, as private companies and government agencies alike ramp up their efforts in space exploration and satellite deployment, requiring springs that can operate in the unique conditions of space. Another important growth driver is the need for springs that can handle the increasingly demanding performance requirements of aerospace and defense applications. These include the need for greater durability, corrosion resistance, and fatigue life, which has spurred the development of new materials and surface treatments. Additionally, the shift towards autonomous and unmanned systems, particularly in the defense sector, has created new opportunities for the springs market, as these systems require compact, lightweight springs that can perform with the same reliability as larger, traditional aircraft systems. Altogether, these factors are contributing to a robust and steadily growing market for aerospace and defense springs, driven by technological innovation and expanding demand across multiple industries.Report Scope

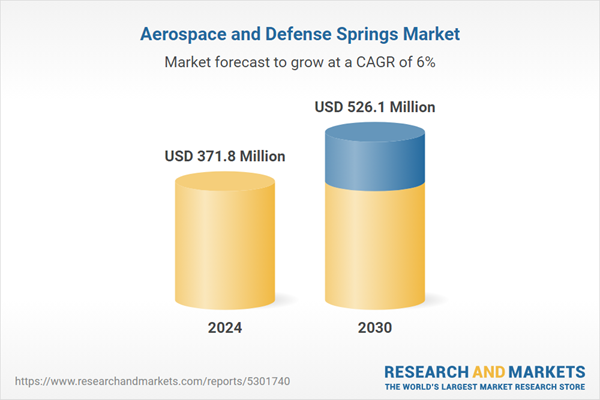

The report analyzes the Aerospace and Defense Springs market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Coil Springs, Flat Spiral / Power Springs, Torsion, Torque Coil, & Clutch Springs, Other Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Coil Springs segment, which is expected to reach US$215.6 Million by 2030 with a CAGR of a 6.6%. The Flat Spiral / Power Springs segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $96.2 Million in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $123.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aerospace and Defense Springs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aerospace and Defense Springs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aerospace and Defense Springs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ace Wire Spring & Form Co., Inc,, Argo Spring Manufacturing Co., Inc., John Evans' Sons Inc., M. Coil Spring Manufacturing Company, MW Industries Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Aerospace and Defense Springs market report include:

- Ace Wire Spring & Form Co., Inc,

- Argo Spring Manufacturing Co., Inc.

- John Evans' Sons Inc.

- M. Coil Spring Manufacturing Company

- MW Industries Inc.

- Myers Spring Co. Inc.

- Nordia Springs Ltd

- Vulcan Spring & Mfg. Co.

- Titan Spring, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ace Wire Spring & Form Co., Inc,

- Argo Spring Manufacturing Co., Inc.

- John Evans' Sons Inc.

- M. Coil Spring Manufacturing Company

- MW Industries Inc.

- Myers Spring Co. Inc.

- Nordia Springs Ltd

- Vulcan Spring & Mfg. Co.

- Titan Spring, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 371.8 Million |

| Forecasted Market Value ( USD | $ 526.1 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |