Global Acoustic Materials Market - Key Trends and Drivers Summarized

Why Are Acoustic Materials Gaining Importance in Noise Management?

Acoustic materials have become an essential component in the quest for better noise control and sound quality across a variety of industries. But why are they so vital? Acoustic materials are designed specifically to absorb, block, or diffuse sound waves, making them crucial for managing noise in both residential and industrial settings. As urbanization intensifies and industries grow, the need for effective noise control has increased significantly. Acoustic materials, which include products like foam panels, mineral wool, fabric absorbers, and acoustic barriers, play a central role in reducing unwanted noise and improving the acoustic quality of a space. These materials are particularly important in environments where sound clarity is essential, such as theaters, recording studios, and conference rooms, as well as in everyday applications like home soundproofing and office acoustics. By limiting sound transmission through walls, floors, and ceilings, acoustic materials contribute to creating quieter, more comfortable environments, improving both functionality and quality of life. As noise pollution becomes a growing concern, the demand for these materials continues to rise across sectors.Where Are Acoustic Materials Making the Biggest Impact?

Acoustic materials are being used in a wide range of industries, each with unique requirements for noise control and sound management. In the construction and building industry, acoustic materials are increasingly integrated into the design of residential, commercial, and public buildings to ensure compliance with noise regulations and enhance comfort. Multi-unit dwellings and high-rise buildings often face challenges with sound transmission between units, and acoustic materials are employed to reduce the impact of noise from adjacent apartments or external sources like traffic. In workplaces, particularly in open-plan offices, the use of acoustic materials has become a necessity to control ambient noise, allowing for better concentration and productivity. Additionally, in the entertainment and hospitality sectors, where sound quality is critical, acoustic panels, and sound diffusers are widely used in concert halls, theaters, and restaurants to enhance the auditory experience. In industrial settings, acoustic materials are employed to mitigate the harmful effects of noise on workers' health and to comply with increasingly stringent noise control regulations. The automotive industry is another major user of acoustic materials, particularly as manufacturers work to improve vehicle cabin acoustics and reduce noise from engines, vibrations, and road friction. These wide-ranging applications highlight the growing significance of acoustic materials in modern environments.What Technological Innovations Are Shaping the Acoustic Materials Industry?

The development of acoustic materials has been significantly enhanced by technological innovations that improve their effectiveness and broaden their applications. One of the key advancements is the creation of high-performance acoustic materials that are not only better at absorbing or blocking sound but are also more lightweight, durable, and environmentally friendly. For instance, the introduction of eco-friendly materials, such as recycled fibers and bio-based foams, is addressing the sustainability concerns of the construction and manufacturing industries. These materials offer the same, if not better, acoustic performance as traditional materials while reducing environmental impact. Another significant innovation is the development of smart acoustic materials that can adapt their properties based on external stimuli. These materials can change their acoustic behavior in response to variations in sound frequency or intensity, making them particularly useful in dynamic environments like concert halls, where sound levels can vary significantly. Additionally, 3D printing technology is beginning to play a role in the acoustic materials market by allowing for the production of complex, customized acoustic structures that were previously impossible to manufacture. This capability enables architects and engineers to design materials that are tailored to the specific acoustic needs of a space, ensuring optimal sound performance. The use of advanced simulation software also allows for better prediction of how acoustic materials will perform in different environments, facilitating more precise and efficient soundproofing and acoustic optimization. These technological developments are driving the evolution of the acoustic materials industry and expanding their utility in modern applications.What Are the Key Growth Drivers in the Acoustic Materials Market?

The growth in the acoustic materials market is driven by several key factors, reflecting both technological advancements and changing industry demands. One of the primary drivers is the rising concern over noise pollution, especially in urban areas. As cities become more densely populated, there is increasing pressure on developers and building managers to ensure that structures are equipped with soundproofing solutions that meet regulatory standards and improve the quality of life for occupants. Additionally, stricter government regulations on noise control in both residential and industrial settings are encouraging the use of advanced acoustic materials to meet compliance standards. In the automotive sector, the shift toward electric vehicles (EVs) is creating new demands for acoustic materials. With EVs being quieter than traditional combustion engine vehicles, manufacturers are focusing on mitigating other forms of noise, such as road and wind noise, to enhance the driving experience. The rise of green building initiatives is also fueling the growth of the acoustic materials market. Builders and architects are increasingly integrating eco-friendly acoustic materials into their designs to meet sustainability goals while ensuring superior sound management. Consumer awareness about the negative effects of noise on health and well-being is further influencing the demand for acoustic materials in homes, offices, and public spaces. Lastly, the advancements in material science and the development of more effective and affordable acoustic solutions are making these products accessible to a broader range of industries and applications. Together, these factors are propelling the expansion of the acoustic materials market, driving innovation, and reshaping the approach to noise control across sectors.Report Scope

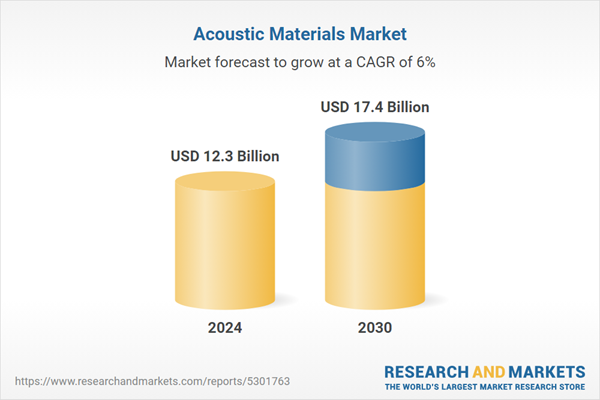

The report analyzes the Acoustic Materials market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Acoustic Materials).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Acoustic Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Acoustic Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Acoustic Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Autoneum, BASF, Borealis, Covestro and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Personal Mobility Devices market report include:

- 3M

- Autoneum

- BASF

- Borealis

- Covestro

- CTA Acoustics

- Dow, Inc.

- DuPont de Nemours, Inc.

- Henkel

- Huntsman

- ichias Corporation

- Jh Ziegler

- Johns Manville

- Lyondellbasell

- Nihon Tokushu Toryo

- Roush

- Sika

- Sumitomo Riko

- Tecman Speciality Materials

- Toray Industries

- UFP Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Autoneum

- BASF

- Borealis

- Covestro

- CTA Acoustics

- Dow, Inc.

- DuPont de Nemours, Inc.

- Henkel

- Huntsman

- ichias Corporation

- Jh Ziegler

- Johns Manville

- Lyondellbasell

- Nihon Tokushu Toryo

- Roush

- Sika

- Sumitomo Riko

- Tecman Speciality Materials

- Toray Industries

- UFP Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.3 Billion |

| Forecasted Market Value ( USD | $ 17.4 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |