Global Acoustic Cameras Market - Key Trends and Drivers Summarized

Why Are Acoustic Cameras Becoming Crucial for Modern Noise Detection?

Acoustic cameras, an advanced technology designed to detect and visualize sound, are becoming indispensable tools in various industries. What sets acoustic cameras apart from traditional noise measurement devices is their ability to not only measure sound but also to visualize it in real-time, providing detailed acoustic maps of noise sources. These maps, often referred to as 'acoustic signatures,' allow users to pinpoint the exact origin of sound with remarkable accuracy, regardless of environmental complexity or background noise. This is particularly important in industries where sound plays a crucial role in performance, safety, or regulatory compliance. For instance, in automotive design, environmental monitoring, and industrial manufacturing, understanding and controlling noise emissions can directly impact product quality and operational efficiency. Acoustic cameras utilize an array of microphones working in tandem with advanced software to capture and analyze sound from multiple directions. The result is a visual representation of the sound intensity and location, offering a powerful diagnostic tool that enhances traditional sound analysis methods. The increasing demand for precision and efficiency in noise management is driving the adoption of acoustic cameras, transforming how noise-related challenges are addressed.Where Are Acoustic Cameras Making an Impact?

The deployment of acoustic cameras is rapidly expanding across a diverse range of industries, reflecting their growing importance. In the automotive sector, acoustic cameras have become essential in the noise, vibration, and harshness (NVH) testing processes, a critical area for vehicle design and refinement. As electric vehicles (EVs) gain traction, the reduction of engine noise has shifted the focus to isolating other sound sources, such as tire-road interaction or wind noise, which could compromise the overall driving experience. Acoustic cameras enable engineers to visualize and mitigate these sounds, leading to more acoustically optimized vehicles. Beyond the automotive industry, acoustic cameras are increasingly utilized in urban noise monitoring. Cities across the world are struggling with rising levels of noise pollution, which poses significant risks to public health and well-being. By using acoustic cameras, urban planners and environmental agencies can track and locate specific sources of noise - be it traffic, construction, or industrial activities - allowing for targeted interventions and regulatory measures. Furthermore, the industrial manufacturing sector is benefiting significantly from this technology. Acoustic cameras are being used in predictive maintenance to detect abnormal sound patterns in machinery, often signaling mechanical issues long before they become catastrophic failures. This capability not only prevents costly downtime but also enhances workplace safety, as potential faults are identified early.What Innovations Are Shaping Acoustic Camera Technology?

The evolution of acoustic camera technology has been marked by significant innovations that have made these devices more effective, accessible, and versatile. Early versions of acoustic cameras were bulky, expensive, and limited in functionality, restricting their use to highly specialized applications. However, recent advancements have transformed the technology into a more user-friendly and portable solution. One of the most significant developments is the miniaturization of microphones and sensors, which has made acoustic cameras lighter and easier to deploy in a variety of settings. This miniaturization has been complemented by improvements in data processing and visualization software, which now allow for more detailed and real-time analysis of acoustic data. Artificial intelligence (AI) has further enhanced the capabilities of acoustic cameras by enabling them to not only detect and visualize sound but also to analyze it more intelligently. AI algorithms can now classify and categorize noise sources automatically, offering deeper insights into the nature of the sound and helping to diagnose specific noise-related issues more efficiently. The integration of wireless technology has also broadened the applications of acoustic cameras, enabling remote monitoring in environments that are difficult to access or hazardous for human operators. With the help of cloud computing, acoustic data can be processed and analyzed in real-time, providing instantaneous feedback to users.What Factors Are Driving the Growth of the Acoustic Camera Market?

The growth in the acoustic camera market is driven by several factors, reflecting both technological advancements and evolving consumer needs. One of the key drivers is the increasing global focus on noise pollution, especially in urban environments. As cities become more densely populated, managing noise pollution has become a critical public health issue, leading to the adoption of acoustic cameras for monitoring and controlling noise in real-time. The automotive industry is another significant driver, particularly with the rise of electric vehicles. As these vehicles eliminate engine noise, manufacturers are focusing on mitigating other forms of noise, such as wind and road friction, to ensure a comfortable driving experience. Acoustic cameras are essential tools in this effort, enabling automakers to refine vehicle acoustics with precision. In the industrial sector, the growing emphasis on predictive maintenance has fueled the demand for advanced diagnostic tools. Acoustic cameras are proving invaluable in detecting anomalies in machinery sound patterns, allowing for early detection of potential mechanical failures and reducing the risk of costly downtime. Additionally, stricter government regulations around workplace noise and environmental noise limits are encouraging businesses to adopt more sophisticated noise monitoring technologies. The rise of smart cities is another important factor, as these urban centers increasingly rely on acoustic cameras to monitor noise pollution as part of broader environmental sustainability initiatives. Finally, the advancements in AI and cloud computing have made acoustic cameras more cost-effective and scalable, enabling even small and medium-sized enterprises to invest in this technology. Together, these factors are driving the expansion of the acoustic camera market and solidifying the technology's role in various industries.Report Scope

The report analyzes the Acoustic Cameras market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Array Type (2D Array, 3D Array); Measurement Type (Far Field, Near Field); Application (Noise Source Identification, Leakage Detection, Other Applications); End-Use (Automotive, Industrial, Aerospace, Energy & Power, Infrastructure, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 2D Array segment, which is expected to reach US$141.6 Million by 2030 with a CAGR of a 4.9%. The 3D Array segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $51.3 Million in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $41.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Acoustic Cameras Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Acoustic Cameras Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Acoustic Cameras Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

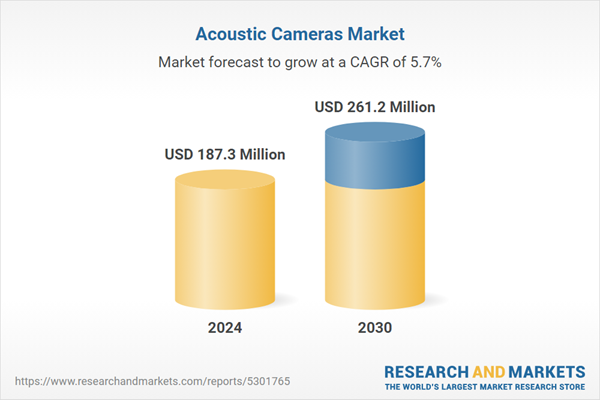

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 01DB, Brüel & Kjær, Cae Software And Systems GmbH, CAE Sofwtare & Systems, Gfai Tech GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Acoustic Cameras market report include:

- 01DB

- Brüel & Kjær

- Cae Software And Systems GmbH

- CAE Sofwtare & Systems

- Gfai Tech GmbH

- Microflown Technologies

- National Instruments

- Norsonic AS

- Polytec GmbH

- Siemens Product Lifecycle Management Software Inc.

- Signal Interface Group (SIG)

- Sinus Messtechnik GmbH

- SM Instruments

- Sorama

- Visisonics Corporation

- Ziegler-Instruments GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 01DB

- Brüel & Kjær

- Cae Software And Systems GmbH

- CAE Sofwtare & Systems

- Gfai Tech GmbH

- Microflown Technologies

- National Instruments

- Norsonic AS

- Polytec GmbH

- Siemens Product Lifecycle Management Software Inc.

- Signal Interface Group (SIG)

- Sinus Messtechnik GmbH

- SM Instruments

- Sorama

- Visisonics Corporation

- Ziegler-Instruments GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 187.3 Million |

| Forecasted Market Value ( USD | $ 261.2 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |