Global Absorbent Glass Mat (AGM) Battery Market - Key Trends and Drivers Summarized

What Is an Absorbent Glass Mat (AGM) Battery and How Does It Work?

An Absorbent Glass Mat (AGM) battery is a type of lead-acid battery that is designed to offer better performance, longevity, and durability compared to traditional flooded lead-acid batteries. The key innovation in AGM batteries is the use of an absorbent glass mat separator, which is placed between the battery's lead plates. This mat is made of thin glass fibers that absorb and immobilize the electrolyte (a mixture of sulfuric acid and water), preventing it from sloshing around inside the battery. This unique design not only makes AGM batteries spill-proof but also allows for greater efficiency in delivering power. AGM batteries work by utilizing the chemical reaction between the lead and the electrolyte to generate electrical energy, like other lead-acid batteries. However, because the glass mat holds the electrolyte in place, AGM batteries can discharge and recharge more efficiently, providing higher cranking power and faster charging times. This technology is ideal for applications where reliability, vibration resistance, and low maintenance are critical.Where Are AGM Batteries Used and Why Are They Preferred?

AGM batteries are highly versatile and are used across a wide range of applications, from automotive and marine industries to renewable energy storage and backup power systems. In the automotive sector, AGM batteries are commonly found in vehicles with start-stop technology, which automatically shuts off the engine to save fuel during idle periods and restarts it when the brake is released. AGM batteries are preferred for these vehicles because they can handle frequent cycling - charging and discharging - without deteriorating as quickly as traditional lead-acid batteries. Marine applications also benefit from AGM batteries, as they are resistant to vibrations, spills, and environmental hazards, making them ideal for boats and other watercraft that operate in rugged conditions. Moreover, AGM batteries are increasingly being used in renewable energy systems, such as solar and wind power storage, because of their deep cycle capabilities. They can be discharged to a greater extent than conventional batteries and still recover without significant capacity loss. Their ability to deliver consistent power output, even under heavy loads, makes them ideal for critical applications like uninterruptible power supplies (UPS) and emergency backup systems.What Are the Advantages and Challenges of AGM Battery Technology?

AGM batteries offer several advantages over traditional lead-acid batteries, which have contributed to their growing popularity across various sectors. One of the main advantages is their maintenance-free nature. Because the electrolyte is absorbed into the glass mat, AGM batteries are sealed and do not require regular topping off of water, as is the case with flooded batteries. This makes them more user-friendly and less prone to failure due to neglect. Another major benefit is their resistance to vibration and shocks, making them highly durable in rough environments like off-road vehicles or boats. AGM batteries also have a lower internal resistance, which allows for faster charging and better performance under high power demands, such as powering accessories in modern cars or handling surges in energy use in solar installations. However, AGM batteries are not without challenges. One of the primary concerns is their higher cost compared to traditional flooded lead-acid batteries. The advanced materials and construction techniques used in AGM batteries make them more expensive to produce, which can be a deterrent for cost-conscious buyers. Additionally, while AGM batteries are excellent at delivering short bursts of high power, they are less suited for prolonged, deep discharges in comparison to other types of deep-cycle batteries like lithium-ion. This makes them less optimal for some energy storage applications that require regular and deep cycling. Furthermore, if overcharged, AGM batteries can suffer from reduced lifespan, as their sealed nature makes them less tolerant of voltage spikes or excessive heat than flooded batteries that allow for some gas exchange.What Is Driving the Growth of the AGM Battery Market?

The growth in the AGM battery market is driven by several key factors that span advancements in automotive technology, renewable energy adoption, and the increasing need for reliable energy storage. One of the most significant drivers is the rising demand for start-stop vehicles, particularly in Europe and North America, where fuel efficiency and emissions regulations are pushing automakers to adopt this technology. AGM batteries are well-suited for these vehicles due to their ability to withstand frequent charge-discharge cycles without significant degradation. Another major factor driving market growth is the expansion of renewable energy systems, particularly solar and wind power. As the need for reliable and efficient energy storage solutions grows, AGM batteries are becoming an attractive option due to their deep-cycle capabilities and relatively lower cost compared to other battery types like lithium-ion. They are also widely used in off-grid and backup power systems, especially in areas prone to power outages or where uninterrupted power is critical, such as hospitals and data centers. Additionally, the rising demand for maintenance-free and vibration-resistant batteries in marine, RV, and off-road vehicle markets is contributing to the expanding use of AGM batteries. Consumers and businesses alike are looking for batteries that require little upkeep and can withstand harsh environments, further bolstering demand for AGM technology. Government policies supporting the use of clean energy and the reduction of vehicle emissions are also playing a role, particularly in regions where there are incentives for the adoption of energy-efficient technologies. Finally, advancements in battery management systems (BMS) are enabling AGM batteries to perform even better in controlled environments, ensuring longer lifespans and improved reliability, which are making them more attractive to industries with high energy demands.Report Scope

The report analyzes the Absorbent Glass Mat (AGM) Battery market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Stationary, Motive); Voltage (2-4 Volts, 6-8 Volts, 12 Volts & Above); Application (UPS, Automotive, Industrial, Energy Storage, Other Applications); End-Use (OEM, Aftermarket).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Stationary segment, which is expected to reach US$14.3 Billion by 2030 with a CAGR of a 7.1%. The Motive segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $4.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Absorbent Glass Mat (AGM) Battery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Absorbent Glass Mat (AGM) Battery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Absorbent Glass Mat (AGM) Battery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as B.B. Battery, Bosch, C&D Technologies, Cellpower Batteries, Clarios and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Absorbent Glass Mat (AGM) Battery market report include:

- B.B. Battery

- Bosch

- C&D Technologies

- Cellpower Batteries

- Clarios

- Concorde Battery Corporation

- Crown Battery

- Eaglepicher Technologies

- East Penn Manufacturing Company

- Enersys

- Exide Technologies

- Fiamm Energy Technology

- Fullriver Battery

- Gs Battery

- Leoch

- Panasonic Industry Europe

- Power Sonic Corporation

- Rolls Battery

- Storage Battery Systems

- Universal Power Group

- Victron Energy

- Vmax USA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- B.B. Battery

- Bosch

- C&D Technologies

- Cellpower Batteries

- Clarios

- Concorde Battery Corporation

- Crown Battery

- Eaglepicher Technologies

- East Penn Manufacturing Company

- Enersys

- Exide Technologies

- Fiamm Energy Technology

- Fullriver Battery

- Gs Battery

- Leoch

- Panasonic Industry Europe

- Power Sonic Corporation

- Rolls Battery

- Storage Battery Systems

- Universal Power Group

- Victron Energy

- Vmax USA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 463 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

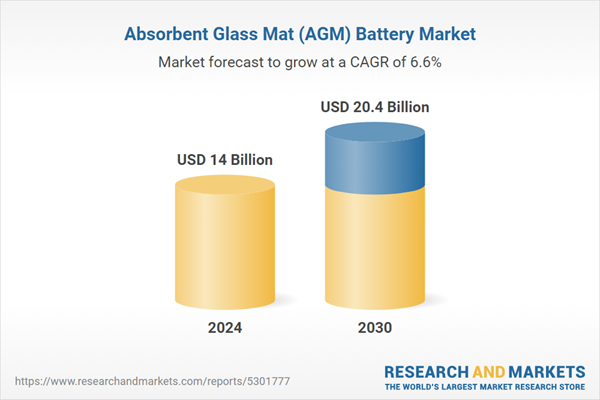

| Estimated Market Value ( USD | $ 14 Billion |

| Forecasted Market Value ( USD | $ 20.4 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |