Global Pregnancy and Fertility Testing Products Market - Key Trends and Drivers Summarized

How Are Pregnancy and Fertility Testing Products Transforming Reproductive Health?

Pregnancy and fertility testing products have fundamentally transformed reproductive health, providing individuals and couples with critical insights into their fertility and pregnancy status. These products, which range from simple home pregnancy tests to more advanced fertility tracking devices, have made it easier than ever to monitor reproductive health in real time. Pregnancy tests work by detecting the hormone human chorionic gonadotropin (hCG), which appears in urine shortly after implantation occurs, allowing users to confirm pregnancy within days of conception. On the other hand, fertility testing products help individuals understand their ovulation cycles by tracking key indicators like luteinizing hormone (LH) surges, basal body temperature, and cervical mucus, which can indicate the most fertile days for conception. These tools empower individuals by providing a private, affordable, and convenient way to manage reproductive health without the need for frequent medical appointments. Whether it's used for detecting early pregnancy or improving the chances of conception, these testing products are now essential for family planning and prenatal care, offering the kind of timely information that can significantly impact life decisions.What Technological Advancements Are Shaping Pregnancy and Fertility Testing Products?

Technological advancements have greatly enhanced the accuracy, ease of use, and functionality of pregnancy and fertility testing products, making them more sophisticated and reliable than ever. Home pregnancy tests have evolved from basic dipstick designs to digital devices that display results more clearly, reducing the potential for user error. Many of today's pregnancy tests use advanced chemical reagents that detect lower concentrations of hCG, allowing women to test for pregnancy earlier than in the past. Digital pregnancy tests offer the added benefit of displaying unambiguous results, such as “pregnant” or “not pregnant,” eliminating the guesswork associated with reading faint lines on traditional tests. In the realm of fertility testing, the introduction of advanced ovulation kits and fertility monitors has been revolutionary. These devices track hormonal changes, particularly surges in LH and estrogen, to predict fertile windows with remarkable precision. Many of these monitors are now integrated with smartphone apps that record data over time, providing users with a comprehensive view of their menstrual cycles and fertility trends. Emerging technologies such as wearable fertility trackers, which continuously monitor indicators like basal body temperature and heart rate, are pushing the boundaries of fertility monitoring, offering real-time feedback and making it easier for users to pinpoint their most fertile days. These innovations have turned fertility and pregnancy testing into dynamic tools for reproductive health management, providing deeper insights than ever before.Why Are Consumers Increasingly Turning to Pregnancy and Fertility Testing Products?

Consumers are increasingly turning to pregnancy and fertility testing products due to the rising awareness around reproductive health and the growing desire for control over family planning. For many, these products offer a level of convenience and privacy that eliminates the need for frequent trips to the doctor, allowing individuals and couples to manage their reproductive health on their own terms. The ability to test for pregnancy at home and monitor fertility cycles enables people to take a proactive approach to family planning, whether they are trying to conceive or seeking to avoid pregnancy. Fertility tracking has become particularly popular among couples attempting to optimize their chances of conception, as fertility tests provide accurate data about ovulation, helping users to better time intercourse. With increasing awareness of reproductive health issues such as infertility, hormonal imbalances, and conditions like polycystic ovary syndrome (PCOS), more individuals are relying on fertility testing products to track their cycles and seek medical intervention when necessary. The ease of integrating these tests with digital platforms, such as fertility apps, has also contributed to their appeal, as users can now receive personalized insights and real-time tracking that enable them to make informed decisions about their reproductive health. This rising demand reflects a broader trend toward personalized health management, where individuals are taking greater control over their reproductive choices through accessible and reliable technology.What Factors Are Driving the Growth of the Pregnancy and Fertility Testing Products Market?

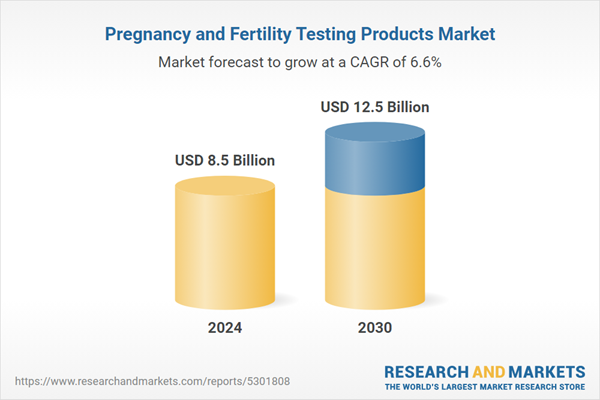

The growth in the pregnancy and fertility testing products market is being driven by several significant factors. One of the primary drivers is the increasing global focus on family planning, with more individuals and couples seeking to optimize the timing of conception or delay pregnancy based on personal and career-related goals. This has resulted in greater demand for fertility tracking tools and early pregnancy detection products. Additionally, the rising prevalence of infertility and reproductive health challenges, such as irregular menstrual cycles, hormonal imbalances, and polycystic ovary syndrome (PCOS), has heightened the need for accessible testing solutions that allow individuals to monitor their reproductive health more closely. The expansion of digital health technologies, such as smartphone-integrated fertility monitors and ovulation prediction kits, has further boosted market growth by providing users with accurate, easy-to-use, and data-driven insights into their fertility. This is particularly relevant as more women are choosing to delay pregnancy, leading to an increase in demand for fertility tracking devices to optimize the chances of conception. Furthermore, the trend toward personalized healthcare has made these products more attractive, as they allow individuals to tailor their reproductive health strategies based on real-time data. Finally, increasing consumer awareness about the importance of early pregnancy detection and the growing availability of affordable over-the-counter testing options have contributed to the market's expansion, positioning pregnancy and fertility testing products as indispensable tools in modern reproductive health management.Report Scope

The report analyzes the Pregnancy and Fertility Testing Products market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Pregnancy & Fertility Testing Products).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 10.7% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pregnancy and Fertility Testing Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pregnancy and Fertility Testing Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pregnancy and Fertility Testing Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Alere Inc, bioMrieux SA, Church & Dwight Co., Inc., DCC Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Pregnancy and Fertility Testing Products market report include:

- Abbott Laboratories

- Alere Inc

- bioMrieux SA

- Church & Dwight Co., Inc.

- DCC Plc

- Geratherm Medical AG

- Prestige Brands Holdings, Inc.

- Procter & Gamble Co.

- Quidel Corporation

- Swiss Precision Diagnostics GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Alere Inc

- bioMrieux SA

- Church & Dwight Co., Inc.

- DCC Plc

- Geratherm Medical AG

- Prestige Brands Holdings, Inc.

- Procter & Gamble Co.

- Quidel Corporation

- Swiss Precision Diagnostics GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 129 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.5 Billion |

| Forecasted Market Value ( USD | $ 12.5 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |