Global Autonomous Navigation Market - Key Trends and Drivers Summarized

What Is Autonomous Navigation, and How Is It Revolutionizing Movement Across Sectors?

Autonomous navigation refers to the capability of a system - such as a vehicle, drone, or robot - to independently determine its path, avoid obstacles, and reach its destination without human intervention. But how exactly does this technology work, and why is it transforming industries? Autonomous navigation relies on advanced sensors, artificial intelligence, machine learning, and computer vision to create a real-time model of the surrounding environment. These systems continuously analyze data from various sources, such as GPS, LiDAR, radar, and cameras, to make dynamic, informed decisions about direction, speed, and potential hazards. By calculating paths and adjusting to environmental changes in real time, autonomous navigation technology enables machines to operate safely and efficiently in complex and unpredictable environments. While originally developed for self-driving cars, autonomous navigation is now utilized in a range of applications, from unmanned aerial vehicles (UAVs) and robotic delivery systems to marine vessels and industrial robots. As these systems become more capable and widely deployed, autonomous navigation is set to revolutionize how people and goods move, offering increased safety, operational efficiency, and new possibilities in transportation, logistics, and even space exploration.How Are Different Sectors Leveraging Autonomous Navigation for Specialized Applications?

Autonomous navigation is being applied across diverse industries, but how are specific sectors utilizing this technology to address unique operational challenges? In the automotive sector, self-driving cars are designed to navigate urban and rural environments with minimal human assistance, using sensors to detect and respond to traffic, pedestrians, and other road hazards. The logistics and delivery industries have also embraced autonomous navigation, deploying driverless trucks and drones to streamline last-mile deliveries and reduce labor and fuel costs. In aviation, autonomous navigation enables UAVs to perform critical tasks such as surveillance, aerial mapping, and emergency response, often in hazardous environments where human pilots might be at risk. The maritime sector is also leveraging autonomous navigation to pilot unmanned ships through oceans and waterways, which reduces the need for large crewed vessels and optimizes fuel efficiency. Even in agriculture, autonomous tractors and drones are used to monitor crop health, analyze soil conditions, and automate planting and harvesting tasks, improving productivity and resource management. These examples highlight the adaptability of autonomous navigation, which has evolved to serve complex needs across industries, enabling safer, more efficient, and cost-effective operations in settings where human intervention can be minimized or eliminated.What Are the Primary Challenges in Achieving Reliable Autonomous Navigation?

While autonomous navigation offers exciting possibilities, several challenges remain that affect its reliability and safety. One major technical obstacle is ensuring accurate perception and decision-making in diverse and unpredictable environments. For example, self-driving cars must be able to navigate safely in challenging conditions like rain, snow, fog, or poorly marked roads, which can interfere with sensor accuracy and system performance. Achieving reliable navigation also requires that autonomous systems interpret and act on vast amounts of sensor data in real-time, a task that demands significant computational power and advanced machine learning algorithms. Another pressing concern is cybersecurity, as autonomous systems must securely transmit and process data to avoid manipulation or hacking that could jeopardize safety. Regulatory frameworks also play a critical role in the widespread adoption of autonomous navigation, as different regions have varying standards for safety, liability, and data privacy, making it difficult to establish universally accepted practices. Furthermore, the question of ethics arises in scenarios where an autonomous system must make split-second decisions that impact human lives, raising complex considerations around accountability and transparency. These technical, regulatory, and ethical challenges highlight the complexities involved in creating truly reliable autonomous navigation systems, and overcoming them is essential for the safe and effective deployment of autonomous technologies across industries.What's Driving the Growth of the Autonomous Navigation Market?

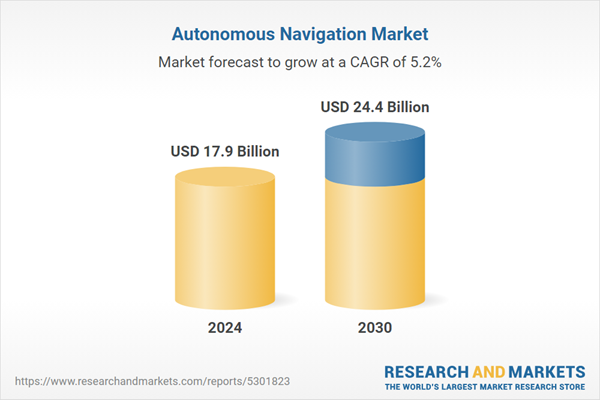

The autonomous navigation market is experiencing rapid growth, driven by advancements in artificial intelligence, increased demand for automation, and the need for improved safety and efficiency across sectors. One of the primary growth drivers is the progress in AI and machine learning, which have enabled systems to learn from real-world data, adapt to complex environments, and make decisions with minimal human input. This capability has opened up autonomous navigation applications in previously inaccessible areas, such as remote or hazardous locations. Additionally, industries are increasingly looking to automation to reduce operational costs and optimize productivity. Autonomous navigation allows companies to deploy fleets of drones, vehicles, or robots that can operate continuously and handle tasks that would otherwise require human oversight. Rising consumer expectations for quick and reliable delivery services have also fueled demand, as logistics companies invest in autonomous technology to enhance last-mile delivery and meet delivery speed expectations. Moreover, safety and sustainability are significant factors; autonomous navigation has the potential to reduce traffic accidents, optimize fuel consumption, and lower emissions by enabling vehicles to operate with greater efficiency. As these technological, economic, and consumer-driven factors converge, the autonomous navigation market is positioned for continued growth, paving the way for transformative changes across transportation, logistics, manufacturing, and beyond.Report Scope

The report analyzes the Autonomous Navigation market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Solution (Sensing System, Software, Processing Unit); Platform (Land, Airborne, Marine, Space, Weapon); Application (Commercial, Military & Government).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sensing System segment, which is expected to reach US$11.5 Billion by 2030 with a CAGR of a 5%. The Software segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 4.2% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Navigation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Navigation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Navigation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB, Furuno, General Dynamics, Honeywell International, Kongsberg Gruppen and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Autonomous Navigation market report include:

- ABB

- Furuno

- General Dynamics

- Honeywell International

- Kongsberg Gruppen

- L3 Technologies

- Moog

- Northrop Grumman

- Raytheon

- Rh Marine

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB

- Furuno

- General Dynamics

- Honeywell International

- Kongsberg Gruppen

- L3 Technologies

- Moog

- Northrop Grumman

- Raytheon

- Rh Marine

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.9 Billion |

| Forecasted Market Value ( USD | $ 24.4 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |