Global Autonomous Aircrafts Market - Key Trends and Drivers Summarized

What Are Autonomous Aircraft, and How Are They Changing the Aviation Industry?

Autonomous aircraft, which are planes capable of operating with minimal to no human intervention, represent a profound shift in aviation technology, but what exactly defines them, and how are they set to change the skies? These aircraft use advanced AI algorithms, sensor arrays, and real-time data processing to manage various flight operations, from navigation and altitude control to obstacle avoidance and landing. Autonomous systems can either fully control an aircraft or assist human pilots in making critical decisions, optimizing performance, and enhancing safety. With designs that range from unmanned aerial vehicles (UAVs) or drones to larger pilot-optional commercial planes, autonomous aircraft are suited for diverse applications such as cargo transport, surveillance, and even passenger travel. The technology driving autonomous aviation extends far beyond basic autopilot; it integrates machine learning, complex decision-making processes, and networked communication with ground control or other aircraft. This fusion of technology has led to an era of intelligent aviation systems, transforming what was once a pilot-controlled operation into an advanced, automated endeavor that could redefine air transport, logistics, and even urban mobility.How Are Autonomous Aircraft Impacting Commercial and Military Applications?

The versatility of autonomous aircraft enables them to serve in both commercial and military sectors, but how are they specifically changing operations within these domains? In commercial aviation, autonomous systems are being developed to transport cargo across long distances efficiently and with fewer human resources. Autonomous cargo planes, for instance, can fly routes continuously, ensuring timely delivery without the constraints of pilot shifts and fatigue, thereby cutting operational costs for logistics companies. As urban areas become denser, smaller autonomous aircraft are also finding roles in urban air mobility, where they are being trialed for short-range passenger flights, emergency medical deliveries, and air taxis. These aircraft could eventually alleviate road congestion and reduce transit times within and between cities. In the military realm, autonomous aircraft have already transformed surveillance, reconnaissance, and even combat operations. Unmanned aircraft, commonly known as drones, can conduct high-risk missions without endangering pilots, carrying out tasks such as enemy surveillance, target tracking, and supply drops in hostile territories. The capacity of autonomous aircraft to respond rapidly to changing environments makes them invaluable for military strategy. By eliminating the need for a pilot on board, autonomous aircraft offer new operational possibilities, increased safety, and flexibility, especially in dangerous or remote areas, fundamentally altering both commercial logistics and military capabilities.What Challenges Do Autonomous Aircraft Face Before They Can Fully Take Flight?

While autonomous aircraft present exciting opportunities, several challenges must be addressed to realize their full potential, but what are the most pressing obstacles? Ensuring safety is paramount in the development of autonomous aircraft, especially when it comes to passenger travel and high-stakes cargo missions. These aircraft must be able to navigate in real-time through complex airspaces, sometimes in unpredictable weather or with limited visibility, making robust sensor systems, AI, and machine learning essential. Technical reliability is critical; any malfunction in the autonomous system must be accounted for with fail-safes that can safely reroute or land the aircraft in case of emergencies. Additionally, regulatory approval presents a substantial hurdle, as aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have stringent standards for flight safety and airworthiness. Autonomous aircraft must prove that they can meet or exceed these standards to be granted permission for widespread commercial use. Data security is another critical challenge, as autonomous systems require constant communication between the aircraft, control centers, and other aircraft, making them vulnerable to cyber threats. Unauthorized access could compromise flight operations, so securing communication channels and flight data is essential. These technical, regulatory, and security challenges form a complex framework that autonomous aircraft developers must navigate to safely integrate these innovative systems into mainstream airspace.What's Fueling the Expansion of the Autonomous Aircraft Market?

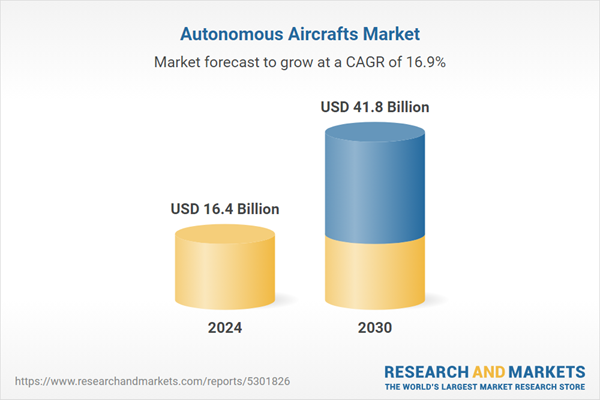

The autonomous aircraft market is expanding rapidly, driven by technological advancements, industry demands for efficiency, and evolving regulatory frameworks. One of the primary drivers is the improvement of AI and machine learning, which are making autonomous navigation, obstacle avoidance, and in-flight decision-making more reliable and capable. As AI systems improve, so does the feasibility of complex autonomous operations, opening doors to applications that were previously limited by technology. Rising demand in the logistics and delivery sectors has also pushed the development of autonomous cargo aircraft, as companies seek faster and more cost-effective methods of shipping goods without the limitations of traditional piloted flights. For the military, the growing need for remote, risk-free operations in challenging environments has led to increased investments in autonomous aerial technology, enabling safer and more efficient mission execution. Furthermore, regulatory agencies are gradually developing frameworks and certification standards specific to autonomous aircraft, which helps pave the way for safer integration into commercial airspace. Finally, the growing interest in urban air mobility, especially in densely populated cities, is spurring demand for small, autonomous passenger aircraft that could function as air taxis, offering a glimpse into the future of intra-city travel. Together, these technological advancements, industry needs, regulatory support, and urban mobility trends are propelling the autonomous aircraft market toward broader adoption and innovation.Report Scope

The report analyzes the Autonomous Aircrafts market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Increasingly Autonomous, Fully Autonomous); Component (Flight Management Computers, Sensors, Air Data Inertial Reference Units, Actuation Systems, Software, Other Components); End-Use (Commercial Aircraft, Air Medical Services, Cargo & Delivery Aircraft, Passenger Air Vehicle, Combat & ISR, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Increasingly Autonomous Aircrafts segment, which is expected to reach US$28.4 Billion by 2030 with a CAGR of a 17.6%. The Fully Autonomous Aircrafts segment is also set to grow at 15.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.6 Billion in 2024, and China, forecasted to grow at an impressive 16% CAGR to reach $6.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Aircrafts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Aircrafts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Aircrafts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aeronautics, Aerovironment, Airbus, Aston Martin, BAE Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Autonomous Aircrafts market report include:

- Aeronautics

- Aerovironment

- Airbus

- Aston Martin

- BAE Systems

- Bell Helicopter

- Boeing

- Elbit Systems

- Embraer

- General Atomics Aeronautical Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aeronautics

- Aerovironment

- Airbus

- Aston Martin

- BAE Systems

- Bell Helicopter

- Boeing

- Elbit Systems

- Embraer

- General Atomics Aeronautical Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.4 Billion |

| Forecasted Market Value ( USD | $ 41.8 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | Global |