Global Automotive Printed Circuit Boards Market - Key Trends and Drivers Summarized

Why Are Printed Circuit Boards (PCBs) Essential in Modern Automotive Electronics?

Printed Circuit Boards (PCBs) have become a cornerstone of modern automotive technology, playing an essential role as vehicles grow more reliant on electronic systems for performance, safety, and convenience. In today's cars, PCBs are integral to nearly every electronic function, from engine control and fuel management to advanced infotainment systems and sophisticated safety features like anti-lock braking and traction control. PCBs provide a structured platform on which intricate circuits and components are mounted, enabling the seamless transmission of electrical signals that power various vehicle systems. Given the demanding automotive environment, PCBs in vehicles must be designed to withstand extreme conditions such as high temperatures, vibrations, and exposure to moisture and chemicals, all while maintaining reliable performance. They are crafted to be compact and lightweight, which aligns with the industry's drive for fuel efficiency and weight reduction, critical in both traditional and electric vehicles. As the automotive industry continues to shift towards smarter, more interconnected vehicles, PCBs serve as the foundational technology, allowing automakers to embed intelligent features, enhance fuel efficiency, and implement complex safety mechanisms that transform the driving experience.What Are the Key Types of PCBs Used in Automotives and Their Applications?

In the automotive sector, various types of PCBs are designed to meet the specific demands of different applications, with each type offering unique structural and performance characteristics that suit particular functions. Rigid PCBs, known for their stability and durability, are commonly used in powertrain components, engine control modules, and braking systems, where they provide robust, vibration-resistant connections. These boards are well-suited for high-stress environments and can endure the temperature fluctuations found within a vehicle's mechanical systems. Flexible PCBs, on the other hand, are designed to bend and conform to tight spaces, making them ideal for applications in areas like the interior cabin, where they can be seamlessly integrated into dashboard displays, infotainment systems, and interior lighting without sacrificing space or aesthetics. Rigid-flex PCBs combine the strengths of both rigid and flexible boards, offering both durability and adaptability, which is crucial for complex, multi-layered systems found in advanced driver-assistance systems (ADAS) and other safety-critical modules. Additionally, high-frequency PCBs are essential in radar systems and connectivity applications, supporting vehicle-to-everything (V2X) communication, collision detection, and other data-heavy functions. By deploying these different types of PCBs, automotive designers can optimize each electronic system's performance, reliability, and longevity, ensuring that the vehicle meets rigorous safety and operational standards.How Are Technological Innovations Shaping the Future of Automotive PCBs?

Technological advancements in materials and design are propelling automotive PCBs to new levels of functionality, performance, and durability, keeping pace with the evolving needs of the automotive industry. As electric and autonomous vehicles become more common, PCBs are increasingly required to handle higher electrical loads, support faster data processing, and enable complex signal transmissions within a confined space. Multilayer PCB designs, for example, allow for the incorporation of multiple circuits within a compact footprint, a crucial advantage as vehicles become more electronics-intensive. This miniaturization trend allows designers to pack more functionality into smaller spaces, making room for additional features or helping to reduce overall vehicle weight. Furthermore, advancements in PCB materials, such as heat-resistant substrates, enable these boards to operate reliably under extreme conditions, like those encountered in electric vehicle (EV) powertrains and radar systems. Enhanced materials, including advanced copper and aluminum PCBs, have also improved heat dissipation capabilities, essential for managing the high-power components used in electric vehicles, inverters, and battery management systems. The emergence of 5G and Internet of Things (IoT) technologies is also reshaping PCB requirements, as vehicles increasingly rely on high-speed data transfer for functions like real-time navigation, autonomous decision-making, and connectivity with external infrastructure. These technological breakthroughs are not only expanding the role of PCBs in vehicles but are also paving the way for future capabilities, making PCBs central to the progression of electric, autonomous, and smart automotive technologies.What Are the Primary Drivers of Growth in the Automotive PCB Market?

The automotive PCB market is experiencing substantial growth, driven by a combination of technological, regulatory, and consumer-driven factors that reflect the industry's shift toward smarter, more connected, and environmentally friendly vehicles. A key driver is the increasing consumer demand for advanced electronic features in vehicles, from state-of-the-art infotainment and connectivity options to sophisticated safety and driver-assistance technologies, all of which rely on highly specialized PCBs for optimal functionality. The rapid growth of the electric vehicle (EV) sector is also propelling PCB demand, as EVs require intricate circuitry for power management, battery monitoring, and efficient energy distribution. Autonomous vehicles further heighten the need for PCBs, as these vehicles rely on data-intensive applications like LiDAR, radar, and high-frequency communications to make real-time driving decisions. Regulatory standards mandating safety features, such as automatic emergency braking and lane-keeping assistance, have also fueled the demand for PCBs, as these systems are increasingly required in new vehicles. Moreover, the automotive industry's commitment to sustainability has led to a demand for eco-friendly and recyclable PCB materials, aligning with manufacturers' environmental goals. Collectively, these factors are fueling a dynamic expansion of the automotive PCB market, driven by the need for high-performance, adaptable, and sustainable PCBs that meet the evolving demands of modern automotive engineering.Report Scope

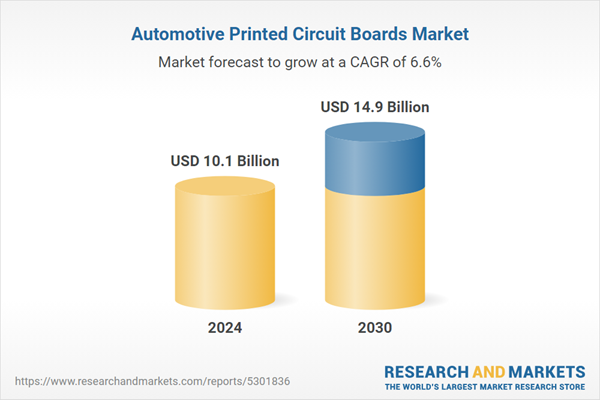

The report analyzes the Automotive Printed Circuit Boards market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Multi-Layer PCB, Double-Sided PCB, Single-Sided PCB, Other Types); Fuel Type (Electric Vehicles, IC Engines); Application (ADAS & Basic Safety, Body, Comfort & Vehicle Lighting, Infotainment Components, Powertrain Components, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Multi-Layer PCB segment, which is expected to reach US$7.2 Billion by 2030 with a CAGR of a 7.2%. The Double-Sided PCB segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.6 Billion in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Printed Circuit Boards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Printed Circuit Boards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Printed Circuit Boards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amitron, Chin Poon Industrial, CMK, Daeduck Electronics, Delphi and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive Printed Circuit Boards market report include:

- Amitron

- Chin Poon Industrial

- CMK

- Daeduck Electronics

- Delphi

- KCE Electronics

- Meiko Electronics

- Nippon Mektron

- Samsung Electro-Mechanics

- Tripod Technology

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amitron

- Chin Poon Industrial

- CMK

- Daeduck Electronics

- Delphi

- KCE Electronics

- Meiko Electronics

- Nippon Mektron

- Samsung Electro-Mechanics

- Tripod Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.1 Billion |

| Forecasted Market Value ( USD | $ 14.9 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |