Global Artificial Intelligence (AI) in Construction Market - Key Trends and Drivers Summarized

How Is AI Transforming Construction Operations?

Artificial intelligence is revolutionizing the construction industry, introducing advanced automation, predictive analytics, and precision management that are fundamentally changing how projects are planned, executed, and maintained. AI is employed in construction operations to streamline project management, automate repetitive tasks, and enhance on-site safety. One primary application is in project planning and scheduling, where AI algorithms analyze historical project data to create realistic timelines and anticipate potential delays, enabling better resource allocation and cost control. Construction managers also use AI-driven project management tools to monitor workflows in real-time, identifying bottlenecks and reallocating resources dynamically to meet deadlines. Additionally, machine learning is applied in logistics to optimize the supply chain by predicting material demand and timing shipments accurately, reducing waste and cost overruns. On-site, AI-powered drones and cameras monitor construction progress, capturing high-resolution images that are processed by computer vision to compare real-time progress with project plans, ensuring that timelines and quality standards are met. With these tools, AI is making construction operations more efficient, reducing human error, and enabling a level of precision and oversight that was previously challenging to achieve in such a complex industry.What Role Does AI Play in Enhancing Safety on Construction Sites?

AI is significantly improving safety on construction sites, an area where risks are high and rapid response is critical. Through the use of computer vision and real-time data analytics, AI systems can monitor on-site activities, identify hazards, and enforce safety protocols automatically. For instance, cameras powered by AI can detect when workers are not wearing required safety gear, like helmets or harnesses, and send real-time alerts to supervisors to take corrective actions. Similarly, AI algorithms analyze movement patterns on-site to identify potentially unsafe behavior, like workers entering restricted zones or heavy machinery operating too close to foot traffic, reducing the likelihood of accidents. Predictive analytics are also employed to evaluate safety risks based on historical data, such as accident records and environmental factors, helping managers take preventative measures to address high-risk areas before incidents occur. Additionally, AI-powered wearables monitor workers' health indicators, such as heart rate and fatigue levels, and issue alerts when thresholds are crossed, reducing the risk of incidents related to overexertion. By enhancing hazard detection, real-time monitoring, and proactive risk management, AI is playing a crucial role in transforming construction site safety, potentially reducing the industry's historically high accident rates and fostering a safer work environment.How Is AI Influencing Design and Project Efficiency in Construction?

AI is enhancing design processes and project efficiency in construction by enabling data-driven decision-making and providing innovative tools that support more accurate and sustainable designs. Architects and engineers are increasingly turning to AI-powered generative design, which explores multiple design permutations based on specific constraints like materials, structural load, and environmental impact. This process produces optimized designs that align with aesthetic and functional requirements while maximizing material efficiency and sustainability. Furthermore, AI is instrumental in assessing environmental impact, simulating building performance under various conditions, and recommending materials that reduce carbon footprint, aligning with the construction industry's growing emphasis on sustainable practices. In project execution, AI-driven robotics and autonomous machinery are deployed for repetitive tasks such as bricklaying, concrete pouring, and earth-moving, allowing skilled workers to focus on more complex activities. This improves project efficiency by accelerating construction timelines and reducing labor costs, which is particularly valuable given the labor shortages facing the industry. Additionally, AI in Building Information Modeling (BIM) allows for better coordination between architects, engineers, and contractors by integrating real-time data updates and clash detection, preventing costly rework and improving project collaboration. Together, these AI applications are driving efficiency in the design and construction process, ultimately supporting more sustainable, high-quality building outcomes.What Factors Are Driving the Growth of AI in the Construction Market?

The growth in the AI in construction market is driven by several factors, including advancements in digital technology, the demand for efficiency and sustainability, and evolving industry regulations. One of the primary drivers is the rapid development of AI technology, which has lowered costs and made these tools more accessible to construction firms of all sizes. The increasing adoption of cloud computing and edge processing allows construction sites to leverage real-time data analysis, supporting advanced AI applications on-site without requiring extensive infrastructure investments. Another key factor is the industry's need to address labor shortages and rising labor costs; AI-driven robotics and automation help fill this gap by performing tasks that are labor-intensive, allowing firms to complete projects faster and with fewer resources. The growing focus on sustainability in construction, driven by regulatory requirements and consumer demand for environmentally friendly practices, is also propelling AI adoption. AI-powered design tools, energy-efficient material recommendations, and predictive maintenance of building systems align with these sustainability goals. Additionally, heightened health and safety regulations are pushing companies to adopt AI for proactive safety management, as AI-based monitoring can improve compliance with evolving standards. Together, these technological, economic, and regulatory factors are driving AI integration in construction, making it an indispensable component in modernizing an industry that faces unique challenges in efficiency, safety, and sustainability.Report Scope

The report analyzes the Artificial Intelligence (AI) in Construction market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Stage (Pre-Construction, Construction-Stage, Post-Construction); Application (Project Management, Asset Management, Risk Management, Other Applications); End-Use (Heavy Construction, Residential, Public Infrastructure, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Regional Analysis

Gain insights into the U.S. market, valued at $713.7 Million in 2024, and China, forecasted to grow at an impressive 29.8% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Artificial Intelligence (AI) in Construction Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Artificial Intelligence (AI) in Construction Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Artificial Intelligence (AI) in Construction Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alice Technologies, Askporter, Assignar, Aurora Computer Services, Autodesk and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 251 companies featured in this Artificial Intelligence (AI) in Construction market report include:

- Alice Technologies

- Askporter

- Assignar

- Aurora Computer Services

- Autodesk

- Bentley Systems

- Beyond Limits

- Building System Planning

- Coins Global

- DarKTrace

- Deepomatic

- Doxel

- eSUB

- IBM

- Jaroop

- Lili.Ai

- Microsoft

- Oracle

- Plangrid

- Predii

- Renoworks Software

- SAP

- SmarTVid.Io

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alice Technologies

- Askporter

- Assignar

- Aurora Computer Services

- Autodesk

- Bentley Systems

- Beyond Limits

- Building System Planning

- Coins Global

- DarKTrace

- Deepomatic

- Doxel

- eSUB

- IBM

- Jaroop

- Lili.Ai

- Microsoft

- Oracle

- Plangrid

- Predii

- Renoworks Software

- SAP

- SmarTVid.Io

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 417 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

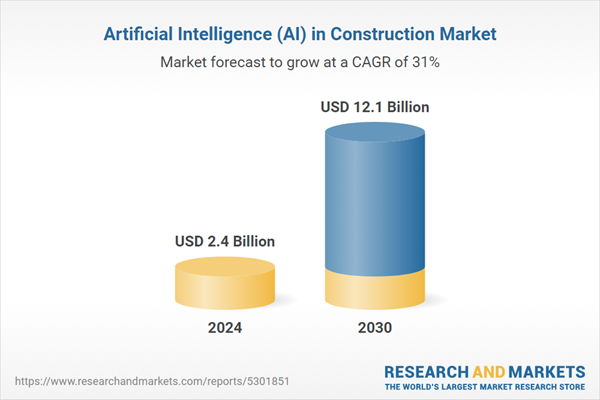

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 12.1 Billion |

| Compound Annual Growth Rate | 31.0% |

| Regions Covered | Global |