Global Anti-Corrosion Coatings Market - Key Trends and Drivers Summarized

Why Are Anti-Corrosion Coatings Essential for Industrial Applications?

Anti-corrosion coatings are crucial in industrial applications as they provide a protective barrier that prevents materials, especially metals, from degrading when exposed to harsh environmental conditions. In industries such as oil and gas, marine, automotive, and construction, structures and equipment are often exposed to moisture, chemicals, saltwater, and extreme temperatures, which accelerate corrosion. If left unchecked, corrosion can lead to structural damage, equipment failure, and costly repairs, jeopardizing safety and efficiency. Anti-corrosion coatings act as the first line of defense by preventing oxidation, rust, and deterioration, thus prolonging the lifespan of critical assets. These coatings also help reduce maintenance costs and downtime by minimizing the frequency of repairs or replacements. Moreover, in industries like infrastructure and transportation, where safety is paramount, anti-corrosion coatings ensure the integrity of materials used in bridges, pipelines, ships, and other critical installations. The ability of these coatings to resist environmental and chemical damage makes them indispensable for ensuring long-term durability and operational efficiency in demanding environments.How Has Technology Advanced Anti-Corrosion Coatings?

Technological advancements have significantly enhanced the effectiveness and versatility of anti-corrosion coatings, leading to the development of more durable, environmentally friendly, and high-performance solutions. Traditional coatings like zinc-rich primers and epoxy-based coatings have long been used for corrosion protection, but recent innovations have taken these materials to the next level. One of the key breakthroughs in anti-corrosion technology is the development of nanotechnology-based coatings, which incorporate nanoparticles to create a more uniform and impenetrable protective layer. These nano-coatings are highly resistant to scratches, chemical exposure, and environmental degradation, providing superior protection even in the most extreme conditions. Additionally, smart coatings have emerged, offering self-healing properties that allow minor damages to the coating layer to automatically repair themselves, maintaining the integrity of the protection over time. Furthermore, advancements in eco-friendly coatings, such as water-based and solvent-free formulations, have addressed environmental concerns associated with traditional solvent-based coatings, reducing volatile organic compound (VOC) emissions and improving sustainability. These coatings not only offer robust corrosion protection but also meet stringent environmental regulations, making them attractive for industries aiming to reduce their ecological footprint. As industries seek more efficient and sustainable solutions, the ongoing development of advanced materials and smart technologies is reshaping the landscape of anti-corrosion coatings.How Is Consumer and Industry Demand Shaping the Market for Anti-Corrosion Coatings?

The demand for anti-corrosion coatings is being shaped by a combination of consumer expectations, industrial needs, and regulatory requirements. Industries such as oil and gas, marine, and construction are increasingly looking for long-lasting protective solutions that reduce the need for frequent maintenance and minimize operational disruptions. In these sectors, where downtime can lead to significant financial losses, there is a growing preference for high-performance coatings that can withstand extreme conditions, including chemical exposure, saltwater immersion, and intense heat. For example, offshore oil rigs, pipelines, and ship hulls require coatings that can endure constant exposure to seawater and other corrosive elements without compromising structural integrity. Additionally, in the automotive and aerospace industries, manufacturers are seeking coatings that not only provide corrosion resistance but also contribute to lightweighting and improved fuel efficiency, as lighter materials reduce fuel consumption. Consumer preferences for longer-lasting, durable products have also influenced the market, with expectations for extended product lifecycles driving demand for superior coating technologies. On the regulatory side, increasing environmental awareness and stricter regulations regarding the use of harmful chemicals in industrial coatings have also shaped the demand for environmentally friendly solutions. Many countries now impose limits on the use of volatile organic compounds (VOCs) and heavy metals in coatings, prompting manufacturers to develop eco-friendly alternatives that meet compliance while still delivering effective corrosion protection. This trend is particularly evident in the European Union and North America, where sustainability and green manufacturing practices are becoming integral to business operations. As a result, there is growing interest in water-based, low-VOC, and biopolymer coatings that offer both environmental benefits and corrosion resistance.What's Fueling the Growth of the Anti-Corrosion Coatings Market?

Several key drivers are propelling the growth of the anti-corrosion coatings market, including advancements in technology, the expansion of infrastructure projects, and the increasing need for sustainable solutions. One of the primary drivers is the rapid industrialization and urbanization taking place in emerging markets, particularly in regions like Asia-Pacific and Latin America. As these regions invest heavily in infrastructure development, including bridges, highways, pipelines, and power plants, the demand for anti-corrosion coatings to protect steel and other materials from degradation is rising sharply. In addition to new infrastructure, the aging infrastructure in developed countries is also driving demand for protective coatings to refurbish and extend the life of existing structures, further boosting the market. Another critical factor fueling market growth is the rise in oil and gas exploration activities, particularly in offshore environments where structures are continuously exposed to harsh marine conditions. The demand for advanced anti-corrosion coatings that can endure prolonged exposure to seawater, UV radiation, and chemical pollutants is particularly high in this sector. Moreover, the automotive and aerospace industries are seeking lightweight yet corrosion-resistant materials to improve fuel efficiency and reduce emissions, contributing to the rising use of high-performance anti-corrosion coatings. Environmental concerns and regulatory pressures are also major drivers in the market, as industries across the globe strive to meet stricter regulations aimed at reducing the environmental impact of industrial activities. The push for sustainable and eco-friendly coatings has led to innovations in low-VOC, water-based, and bio-based coatings, which are increasingly being adopted as industries work to reduce their carbon footprint and comply with environmental standards. These factors, combined with the increasing need for durable, long-lasting protection in harsh industrial environments, are driving the growth and evolution of the anti-corrosion coatings market, making it a critical component in the global drive for sustainability and infrastructure resilience.Report Scope

The report analyzes the Anti-Corrosion Coatings market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Water-based, Solvent-based, Powder, Other Technologies); Material (Acrylic, Alkyd, Epoxy, Polyurethane, Zinc, Other Materials); Application (Infrastructure, Marine, Building & Construction, Automotive & Rail, Aerospace & Defense, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water-based Technology segment, which is expected to reach US$23.8 Billion by 2030 with a CAGR of a 6.2%. The Solvent-based Technology segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.3 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $11.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Anti-Corrosion Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Anti-Corrosion Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Anti-Corrosion Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Co., AkzoNobel N.V., Ancatt Inc., Ashland Inc., Axalta Coating Systems LTD. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Anti-Corrosion Coatings market report include:

- 3M Co.

- AkzoNobel N.V.

- Ancatt Inc.

- Ashland Inc.

- Axalta Coating Systems LTD.

- BASF SE

- Bluechem Group

- Diamond Vogel

- E.I. Du Pont De Nemours and Company

- Hempel A/S

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Co.

- AkzoNobel N.V.

- Ancatt Inc.

- Ashland Inc.

- Axalta Coating Systems LTD.

- BASF SE

- Bluechem Group

- Diamond Vogel

- E.I. Du Pont De Nemours and Company

- Hempel A/S

Table Information

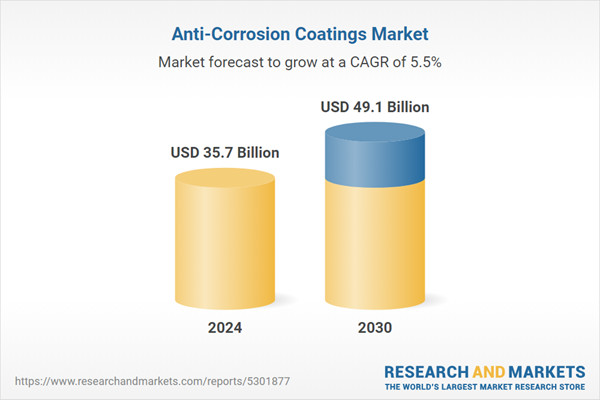

| Report Attribute | Details |

|---|---|

| No. of Pages | 397 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.7 Billion |

| Forecasted Market Value ( USD | $ 49.1 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |