Global Aluminum Foil Packaging Market - Key Trends and Drivers Summarized

Why Has Aluminum Foil Packaging Become a Staple in Modern Packaging Solutions?

Aluminum foil packaging has rapidly become a cornerstone in modern packaging due to its unique and versatile properties. One of its standout features is its exceptional ability to act as a barrier against external factors such as light, moisture, oxygen, and bacteria, making it ideal for extending the shelf life of perishable products. As global demand for convenience and ready-to-eat foods increases, the role of aluminum foil in maintaining food quality and safety has become more pronounced. Its use is not limited to the food industry; aluminum foil is employed in various forms across numerous sectors, including pharmaceuticals, cosmetics, and electronics. From blister packs to stand-up pouches and trays, its flexibility makes it highly adaptable to different packaging needs, whether for retail or industrial purposes. Furthermore, aluminum's eco-friendly credentials are an increasingly critical factor driving its adoption. It is 100% recyclable without any loss of quality, making it an attractive option for companies and consumers focused on sustainability. In a world that is gradually moving away from single-use plastics, aluminum foil stands out as a packaging solution that meets the dual demands of functionality and environmental responsibility. Its ability to integrate seamlessly with high-speed production lines also makes it a practical choice for large-scale manufacturers who seek efficiency without compromising on quality or sustainability.What Makes Aluminum Foil the Go-To for High-Security Packaging?

The ability of aluminum foil to offer unrivaled protection has positioned it as a go-to material for high-security packaging, especially in industries where product integrity is paramount. In the pharmaceutical industry, for instance, packaging must guarantee that medicines and other sensitive products remain uncontaminated and protected from external elements such as moisture, light, and oxygen, which could degrade their efficacy. Aluminum foil's impermeability to gases, water vapor, and light ensures that pharmaceuticals maintain their potency over extended periods. This protective capability is also essential in the food industry, where the material's barrier properties help prevent spoilage and contamination, preserving the freshness of packaged goods, particularly perishable items like dairy, meats, and baked goods. Beyond food and pharmaceuticals, aluminum foil is increasingly used in specialized industries such as military and aerospace, where the need for highly protective, durable packaging is critical. Here, aluminum foil can withstand extreme conditions, ensuring the protection of delicate equipment and instruments. Its malleability further allows manufacturers to create tamper-evident packaging designs, providing an extra layer of security to safeguard against counterfeiting and product tampering. In sectors where consumer safety and product authenticity are non-negotiable, aluminum foil has emerged as a packaging material of choice.How Are Sustainability and Consumer Preferences Shaping the Aluminum Foil Packaging Market?

Environmental sustainability has become a dominant force reshaping the packaging industry, and aluminum foil has emerged as a favored material due to its strong environmental credentials. Aluminum's infinite recyclability without degradation in quality sets it apart from many other packaging materials, particularly plastics, which contribute significantly to the global waste crisis. As regulatory pressures increase and consumers become more environmentally conscious, many brands are turning to aluminum foil as part of their commitment to reducing their carbon footprint. This shift is particularly visible in sectors like food, beverage, and cosmetics, where companies are looking for sustainable packaging alternatives that also offer premium aesthetics. Aluminum foil packaging, with its sleek, modern appearance, aligns well with these industries' needs for high-quality, eco-friendly solutions. Moreover, the material's lightweight nature makes it an energy-efficient option for transportation, reducing shipping costs and associated emissions. Consumers are also increasingly gravitating toward packaging that reflects their environmental values, with many preferring minimalistic, functional packaging designs that reduce waste. Clean-label packaging, which emphasizes transparency and simplicity, is another trend benefiting aluminum foil, as it allows for innovative designs that are both environmentally friendly and visually appealing. As sustainability becomes an integral part of corporate strategies and consumer preferences, aluminum foil packaging is poised to grow in prominence as a material that bridges the gap between environmental responsibility and practicality.What Are the Key Drivers Behind the Growth in the Aluminum Foil Packaging Market?

The growth in the aluminum foil packaging market is driven by several factors that reflect broader trends in technology, consumer behavior, and market dynamics. First, the increasing demand for convenience foods and ready-to-eat meals has led to a surge in the use of flexible packaging solutions that can extend the shelf life of products while maintaining their quality. Aluminum foil is perfectly suited for this, offering a lightweight and durable packaging option that meets the needs of today's fast-paced consumer lifestyles. In addition to food, the pharmaceutical industry is another major driver of aluminum foil's growth. The global rise in healthcare needs, along with stricter regulations regarding drug safety and tamper-proof packaging, has increased the demand for secure, reliable materials like aluminum foil. The material's ability to protect medicines from contamination and degradation makes it an essential component of pharmaceutical packaging, particularly in the growing markets of emerging economies where healthcare access is expanding. Furthermore, aluminum foil's sustainability credentials are fueling its adoption across a wide range of industries. As companies face increasing pressure to reduce their environmental impact, many are switching to aluminum foil as a recyclable alternative to plastics. Technological advancements in the production and coating of aluminum foil have also expanded its application, making it more versatile and customizable for various packaging needs. Finally, rapid urbanization and the growth of the middle class in regions like Asia-Pacific and Latin America have created a growing demand for flexible, lightweight packaging solutions that offer both convenience and environmental responsibility, driving the global aluminum foil packaging market to new heights.Report Scope

The report analyzes the Aluminum Foil Packaging market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Foil Wraps, Containers, Pouches, Blisters, Other Products); End-Use (Food & Beverage, Pharmaceuticals, Cosmetics, Tobacco, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Containers segment, which is expected to reach US$36.4 Billion by 2030 with a CAGR of a 2.8%. The Foil Wraps segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.1 Billion in 2024, and China, forecasted to grow at an impressive 7% CAGR to reach $24.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aluminum Foil Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aluminum Foil Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aluminum Foil Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aleris Corporation, Aliberico S.L.U., Amcor Plc, Carcano Antonio S.p.A, Constantia Flexibles and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Aluminum Foil Packaging market report include:

- Aleris Corporation

- Aliberico S.L.U.

- Amcor Plc

- Carcano Antonio S.p.A

- Constantia Flexibles

- Coppice Alupack Ltd.

- Eurofoil Luxembourg S.A.

- JW Aluminum

- Novelis Aluminum

- Raviraj Foils Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aleris Corporation

- Aliberico S.L.U.

- Amcor Plc

- Carcano Antonio S.p.A

- Constantia Flexibles

- Coppice Alupack Ltd.

- Eurofoil Luxembourg S.A.

- JW Aluminum

- Novelis Aluminum

- Raviraj Foils Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

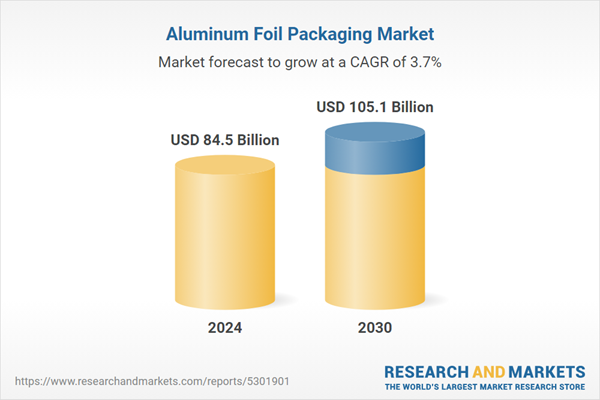

| Estimated Market Value ( USD | $ 84.5 Billion |

| Forecasted Market Value ( USD | $ 105.1 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |