Global Aircraft Engines Market - Key Trends & Drivers Summarized

Why Are Aircraft Engines At The Core Of Aviation Advancements?

Aircraft engines represent the heart of aviation technology, driving progress in both commercial and military aerospace sectors. As the demand for air travel grows globally, airlines are under immense pressure to prioritize efficiency, reliability, and sustainability - objectives fundamentally tied to advancements in engine technology. Modern aircraft engines are designed to deliver higher thrust-to-weight ratios while consuming less fuel, addressing the dual imperatives of cost-efficiency and environmental sustainability. The evolution of turbofan and turboprop engines underscores the industry's focus on achieving superior performance metrics, enabling long-haul flights with reduced emissions and operational costs.In addition to commercial aviation, military applications continue to demand cutting-edge engines capable of supersonic speeds, high maneuverability, and resilience in extreme conditions. The emergence of next-generation fighter jets and unmanned aerial systems (UAS) has fueled innovations in engine designs, with greater emphasis on stealth capabilities and adaptive cycle technology. Furthermore, hybrid-electric and fully electric propulsion systems are emerging as game-changers in the pursuit of zero-emission aviation. With aviation regulations tightening globally, the role of advanced engine technologies in shaping the future of the industry has never been more critical. From enhancing operational performance to meeting sustainability targets, aircraft engines remain central to the aviation sector's ongoing transformation.

What Impact Do Technological Innovations Have On Engine Design And Performance?

Technological innovations are redefining aircraft engine design and performance, making them more efficient, reliable, and environmentally friendly. The adoption of advanced materials, such as lightweight composites and ceramic matrix composites (CMCs), has revolutionized the construction of engine components, enabling them to withstand higher temperatures while reducing weight. This is critical for improving fuel efficiency, which remains a key focus for airlines and manufacturers alike. Additionally, additive manufacturing, or 3D printing, is streamlining engine production by enabling the creation of complex geometries that enhance performance and reduce the number of parts required.Advancements in aerodynamics and computational fluid dynamics (CFD) tools have also played a pivotal role in optimizing engine designs. These tools allow engineers to simulate airflow and combustion processes, resulting in more efficient air intake systems and reduced drag. Digital twins, which replicate engine performance in virtual environments, are increasingly used for predictive maintenance, ensuring reliability and minimizing operational disruptions.

The rise of geared turbofan (GTF) engines is another major technological milestone. These engines offer unmatched fuel efficiency and noise reduction, addressing both economic and environmental concerns. Meanwhile, sustainable aviation fuel (SAF)-compatible engines are gaining traction, allowing airlines to meet carbon reduction goals without requiring a complete overhaul of their fleets. As the industry shifts towards electrification, hybrid-electric engines are making significant strides, paving the way for short-haul electric aircraft that promise minimal environmental impact. These technological innovations are setting new benchmarks in engine performance and reshaping the future of aviation.

How Are Market Dynamics Influenced By Global Trends And Challenges?

Global trends and challenges are profoundly influencing the aircraft engines market, shaping demand patterns and driving innovation. The steady recovery of air travel post-pandemic has reignited the demand for new aircraft, particularly in rapidly growing markets such as Asia-Pacific and the Middle East. This has spurred investments in high-performance engines capable of supporting the expansion of airline fleets. At the same time, environmental concerns have become a dominant force, with stricter emission regulations prompting manufacturers to accelerate the development of cleaner and more efficient engines.The competitive landscape is also undergoing significant changes as traditional players like General Electric, Rolls-Royce, and Pratt & Whitney face increasing competition from emerging manufacturers in China and India. These entrants are leveraging government support and growing regional demand to establish themselves in the global market. Additionally, geopolitical tensions and defense spending increases have amplified the demand for advanced military engines, further diversifying market opportunities.

Maintenance, repair, and overhaul (MRO) services have become a key area of focus, as airlines prioritize cost-effective engine maintenance strategies to extend the lifecycle of their fleets. The rise of predictive maintenance, enabled by IoT sensors and AI analytics, is transforming how engines are monitored and serviced. Meanwhile, supply chain disruptions and material shortages continue to pose challenges, prompting manufacturers to explore localized production and innovative sourcing strategies. These market dynamics, driven by global trends and challenges, underscore the complex and evolving nature of the aircraft engines sector.

What Drives The Growth Of The Aircraft Engines Market?

The growth in the aircraft engines market is driven by several factors, each reflecting the industry's pursuit of innovation, efficiency, and sustainability. A primary driver is the increasing demand for fuel-efficient engines, as airlines strive to reduce operational costs and meet stringent emission regulations. Modern engine designs, such as those incorporating geared turbofan technology, offer significant reductions in fuel consumption and noise levels, aligning with the aviation industry's environmental goals. The growing adoption of sustainable aviation fuels (SAF) is another critical driver, with engine manufacturers developing SAF-compatible models to facilitate the transition to greener aviation.The push for electrification is further accelerating market growth, with hybrid-electric and fully electric propulsion systems gaining prominence in regional and urban air mobility segments. These technologies promise to revolutionize short-haul and commuter flights by reducing carbon emissions and operating costs. End-use trends, such as the expansion of low-cost carriers and the rise of air cargo operations, are also driving demand for versatile engines that can support diverse operational needs.

Technological advancements in manufacturing, particularly additive manufacturing and digital twin technology, are enhancing production efficiency and engine performance, making them attractive to both commercial and military customers. The increasing reliance on predictive maintenance and AI-driven diagnostics is another growth driver, reducing downtime and optimizing engine performance. Consumer behavior, particularly the demand for quieter and more comfortable flights, has also influenced the development of advanced engines with reduced noise profiles. Lastly, strategic investments by governments and private stakeholders in next-generation propulsion technologies, including supersonic and hypersonic engines, are expanding the market's horizons. These drivers collectively highlight a market poised for sustained growth, fueled by technological innovation, operational demands, and the global push for sustainable aviation.

Report Scope

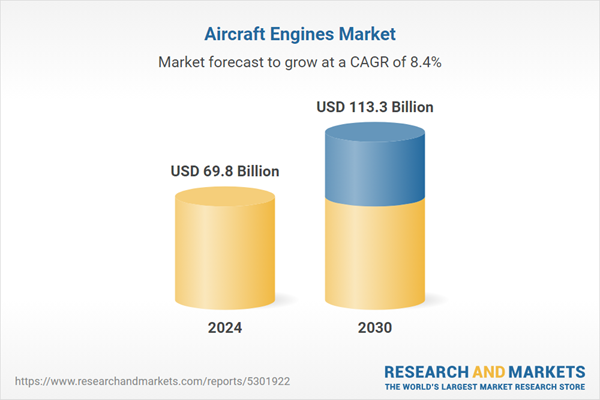

The report analyzes the Aircraft Engines market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Turbofan Engine, Turboprop Engine, Turboshaft Engine, Piston Engine); Platform (Fixed Wing Platform, Rotary Wing Platform, Unmanned Aerial Vehicles Platform); Technology (Conventional Technology, Hybrid Technology); Application (Commercial Aviation Application, Military Aviation Application, General Aviation Application).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Turbofan Engine segment, which is expected to reach US$77.3 Billion by 2030 with a CAGR of 8.5%. The Turboprop Engine segment is also set to grow at 8.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.8 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $15.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aircraft Engines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aircraft Engines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aircraft Engines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as GE Aerospace, Avio Aero, Honeywell Aerospace Technologies, IHI Corp., ITP Aero and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 61 companies featured in this Aircraft Engines market report include:

- GE Aerospace

- Avio Aero

- Honeywell Aerospace Technologies

- IHI Corp.

- ITP Aero

- Lycoming Engines

- Motor Sich JSC

- MTU Aero Engines AG

- Pratt & Whitney

- Rolls-Royce Holdings plc

- Rostec

- Safran Aircraft Engines

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- GE Aerospace

- Avio Aero

- Honeywell Aerospace Technologies

- IHI Corp.

- ITP Aero

- Lycoming Engines

- Motor Sich JSC

- MTU Aero Engines AG

- Pratt & Whitney

- Rolls-Royce Holdings plc

- Rostec

- Safran Aircraft Engines

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 388 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 69.8 Billion |

| Forecasted Market Value ( USD | $ 113.3 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |