Global Airborne SATCOM Market - Key Trends and Drivers Summarized

What Is Airborne SATCOM and How Does It Function?

Airborne Satellite Communication (SATCOM) refers to the technology that enables real-time, long-range communication between aircraft and ground-based stations via satellites. This system facilitates uninterrupted, secure, and global communication, allowing aircraft to send and receive data, voice messages, and video transmissions from virtually anywhere in the world, even over oceans or remote regions where traditional radio communications may fail. Airborne SATCOM systems consist of onboard satellite terminals, antennas, modems, and routers that link with satellites in geostationary, medium, or low Earth orbits. These satellites relay signals to ground stations, which in turn connect the aircraft with air traffic control, airline operations centers, and other networks. The primary functions of Airborne SATCOM include enabling voice communications between pilots and ground controllers, delivering real-time data transmission for weather updates and flight management, and supporting passenger services like in-flight internet and entertainment. This technology is crucial for ensuring the safety, efficiency, and connectivity of modern air travel, particularly for long-haul flights and military operations.Where Is Airborne SATCOM Used, and What Are Its Key Applications?

Airborne SATCOM systems are widely used across several sectors, including commercial aviation, military operations, and government missions, due to their ability to maintain reliable communication over vast distances and in challenging environments. In commercial aviation, SATCOM provides pilots with real-time updates on weather conditions, route adjustments, and air traffic control communications, which are essential for enhancing flight safety and operational efficiency. It also enables airlines to offer in-flight connectivity services, such as internet access and entertainment systems, improving the passenger experience on long-haul flights. As passengers increasingly expect seamless connectivity, airlines are adopting Airborne SATCOM to provide continuous, high-speed internet access throughout the flight. In military and defense applications, Airborne SATCOM is crucial for mission-critical communications, supporting secure, high-bandwidth data exchange between aircraft and command centers. Military aircraft, including unmanned aerial vehicles (UAVs), rely on SATCOM for reconnaissance, surveillance, and intelligence gathering in remote or hostile environments. Real-time satellite communication ensures that military commanders have access to vital data on the battlefield, enhancing decision-making and coordination during operations. Additionally, Airborne SATCOM supports tactical operations by enabling secure, encrypted communications in areas where ground-based communication infrastructure is unavailable or compromised. Government and emergency response organizations also leverage Airborne SATCOM for disaster recovery, search and rescue operations, and humanitarian missions. In situations where terrestrial communication networks are damaged or non-existent, SATCOM enables reliable communication links between aircraft and ground teams, ensuring coordination during critical missions.How Have Technological Advances Shaped the Airborne SATCOM Industry?

Technological advancements have significantly enhanced the capabilities and performance of Airborne SATCOM systems, making them more reliable, faster, and efficient than ever before. One of the most transformative innovations has been the shift toward high-throughput satellite (HTS) networks. These next-generation satellites provide much higher data transmission rates compared to traditional satellites, allowing for faster internet speeds and greater bandwidth availability for both commercial and military users. With HTS, airlines can now offer passengers high-speed Wi-Fi on transcontinental flights, while military forces benefit from more robust, real-time data links for critical missions. The development of smaller, lighter, and more efficient onboard equipment has also revolutionized airborne SATCOM. Modern antenna systems, such as electronically steerable phased-array antennas, are more compact and energy-efficient, allowing aircraft to maintain stable satellite links without the need for large, mechanically steerable antennas. These smaller systems reduce the weight and fuel consumption of aircraft, which is particularly important in commercial aviation, where fuel efficiency is a key operational concern. The advent of multi-orbit satellite networks is another key advancement shaping the Airborne SATCOM industry. While traditional SATCOM systems relied primarily on geostationary satellites, new networks integrate satellites in low Earth orbit (LEO) and medium Earth orbit (MEO) to provide more comprehensive coverage, lower latency, and higher data speeds. LEO satellites, which orbit much closer to the Earth, offer lower latency and more reliable communication, especially for real-time applications like live video streaming or time-sensitive military operations. Moreover, cybersecurity has become a critical focus area in the development of modern SATCOM systems. As the reliance on satellite communication increases, so do the potential threats of cyber-attacks on SATCOM networks. Modern systems are now equipped with advanced encryption technologies, secure communication protocols, and anti-jamming capabilities to ensure that communications remain secure and resilient, especially for military and government operations. Additionally, innovations in artificial intelligence (AI) and machine learning (ML) are being integrated into SATCOM systems to improve the management of satellite networks, predict maintenance needs, and optimize bandwidth allocation, further enhancing the efficiency and reliability of airborne communication systems.What Is Driving the Growth of the Airborne SATCOM Market?

The growth of the Airborne SATCOM market is driven by several key factors, including the rising demand for in-flight connectivity in the commercial aviation sector, the increasing adoption of UAVs in defense and surveillance, and the need for secure and reliable communication in military operations. Passenger expectations for continuous, high-speed internet access during flights have become a major driving force in the commercial aviation market. Airlines are investing in SATCOM technologies to enhance customer satisfaction by offering uninterrupted connectivity services, from browsing the web to streaming content on long-haul flights. This growing demand for in-flight entertainment and connectivity (IFEC) solutions is expected to drive significant growth in the Airborne SATCOM market in the coming years. In the defense sector, the rise of unmanned aerial vehicles (UAVs) for surveillance, reconnaissance, and intelligence missions is a key factor fueling the demand for SATCOM systems. UAVs rely on secure, high-bandwidth satellite communication to relay real-time data to command centers, enabling remote operations over long distances or in remote areas. As military forces worldwide continue to expand their use of UAVs, SATCOM systems will play a crucial role in ensuring the success of these missions. Additionally, the need for interoperability and seamless communication between different branches of the military and allied forces is driving investments in advanced SATCOM systems that can support multi-domain operations. The global push for modernizing air traffic management (ATM) systems is also a significant driver in the market. As airspace becomes increasingly congested, particularly over major international hubs, SATCOM technology is becoming essential for enabling next-generation ATM systems that can manage traffic more efficiently, reduce delays, and enhance safety. SATCOM’s ability to provide reliable, long-range communication makes it a vital component in the modernization of air traffic systems, especially for aircraft flying over remote or oceanic regions. Finally, the increasing frequency of natural disasters and humanitarian crises is driving demand for Airborne SATCOM in government and emergency response sectors. When ground-based communication infrastructure is disrupted or destroyed, airborne SATCOM provides the critical communication links needed for disaster response teams and aircraft involved in search and rescue missions. As the world faces more frequent and severe climate-related disasters, the demand for reliable airborne communication systems is expected to grow. These factors, combined with the continuous advancements in satellite technology and the increasing use of multi-orbit satellite networks, are expected to drive the expansion of the Airborne SATCOM market in the coming years.SCOPE OF STUDY:

The report analyzes the Airborne SATCOM market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Platform (Commercial Aircraft, Narrow Body Aircraft, Wide Body Aircraft, Regional Transport Aircraft, Military Aircraft, Business Jets, Helicopters, Unmanned Aerial Vehicles); Application (Commercial, Government & Defense)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commercial Aircraft segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 6.1%. The Narrow Body Aircraft segment is also set to grow at 6.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.0 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Airborne SATCOM Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Airborne SATCOM Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Airborne SATCOM Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aselsan, Cobham Limited, Collins Aerospace, General Dynamic, Gilat Satellite Networks and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Airborne SATCOM market report include:

- Aselsan

- Cobham Limited

- Collins Aerospace

- General Dynamic

- Gilat Satellite Networks

- Honeywell International, Inc.

- Hughes Network Systems

- Inmarsat Global Limited

- L3 Harris Technologies, Inc. (US)

- Northrop Grumman Corp.

- Orbit Communications Systems Ltd.

- Raytheon Company

- Teledyne Microwave Solutions

- Thales Group

- Viasat

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aselsan

- Cobham Limited

- Collins Aerospace

- General Dynamic

- Gilat Satellite Networks

- Honeywell International, Inc.

- Hughes Network Systems

- Inmarsat Global Limited

- L3 Harris Technologies, Inc. (US)

- Northrop Grumman Corp.

- Orbit Communications Systems Ltd.

- Raytheon Company

- Teledyne Microwave Solutions

- Thales Group

- Viasat

Table Information

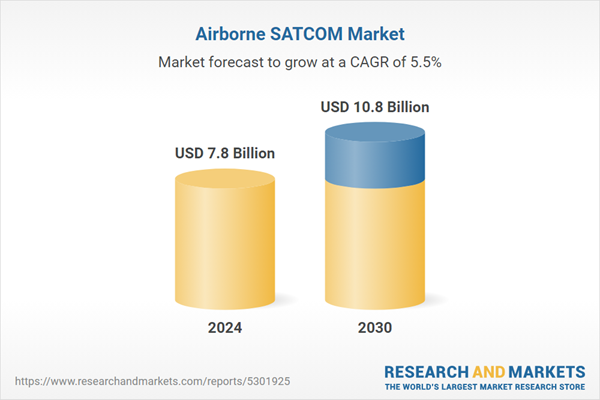

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.8 Billion |

| Forecasted Market Value ( USD | $ 10.8 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |