Global Air Core Drilling Market - Key Trends and Drivers Summarized

How Does Air Core Drilling Differ from Conventional Drilling Methods?

Air core drilling stands out from other drilling techniques due to its unique approach of using compressed air to clear rock cuttings from the borehole, instead of relying on fluids like water or mud. This method involves a rotary blade system, typically outfitted with durable materials such as tungsten or steel, that cuts through unconsolidated ground and allows for faster drilling. The high-pressure air flushes the cuttings up through the annulus of the drill pipe to the surface, providing a cleaner and more accurate sample. One of the main advantages of this system is that it doesn't contaminate samples with drilling fluids, making it ideal for exploratory drilling where the integrity of the sample is crucial. This feature, coupled with its ability to reach depths of up to 100 meters, makes air core drilling particularly effective for shallow mineral exploration, geotechnical investigations, and environmental studies. The method is also favored in areas where water is scarce or where reducing environmental impact is a priority, as it eliminates the need for fluid circulation systems that can create waste and logistical challenges.What Are the Applications and Limitations of Air Core Drilling?

Air core drilling is widely used in mineral exploration, particularly for shallow surveys in search of precious metals like gold and copper, and other valuable mineral deposits. Its ability to quickly and cost-effectively produce high-quality samples makes it a preferred method in the initial phases of exploration projects. By providing accurate geological information early on, companies can make informed decisions about where to invest in deeper, more resource-intensive drilling techniques like reverse circulation (RC) or diamond core drilling. Beyond mining, air core drilling is also used in groundwater exploration, environmental site assessments, and soil contamination studies, where precise, uncontaminated samples are necessary for evaluating the subsurface. However, the technique has its limitations. While highly effective in soft or weathered rock formations, it struggles in hard rock environments, where more robust methods are required. Its depth capabilities are also limited, with the method generally not extending beyond 100 meters, making it less suitable for projects requiring deep drilling. Additionally, air core drilling may not be the most efficient choice for highly abrasive or compacted soils, which can wear down equipment more rapidly and reduce the overall speed and efficiency of the operation.How Has Technology Transformed Air Core Drilling?

Technological advancements have significantly enhanced the efficiency and scope of air core drilling, making it a more attractive option for a wider range of applications. Innovations in drill bit materials, such as polycrystalline diamond compact (PDC) and advanced tungsten alloys, have extended the lifespan of drill bits and improved their performance in tougher geological conditions. These materials allow for faster penetration rates, even in challenging environments, without sacrificing the accuracy of the samples. The evolution of air compressors has also played a key role in advancing air core drilling. Modern compressors are more powerful and energy-efficient, allowing for better clearance of cuttings and enabling deeper drilling capabilities than ever before. Furthermore, the incorporation of automation and remote monitoring technologies has revolutionized the way drilling operations are conducted. Drill rigs equipped with sensors and real-time data transmission systems can now monitor the drilling process with unprecedented precision, ensuring that operations are optimized and reducing the risk of human error. This level of automation also enhances safety, as drillers can operate equipment remotely, minimizing the need for personnel to be physically present at potentially hazardous sites. In addition to these hardware improvements, software developments in data analytics allow companies to process geological data more rapidly, speeding up decision-making processes in the field. As sustainability becomes increasingly important in industries like mining and construction, air core drilling is gaining attention due to its reduced environmental footprint compared to traditional fluid-based drilling methods.What's Driving Growth in the Air Core Drilling Market?

The growth in the air core drilling market is driven by several factors, primarily the rising demand for efficient and environmentally friendly mineral exploration. As global demand for critical minerals, such as lithium, cobalt, and other metals essential for the production of electric vehicles, batteries, and renewable energy technologies increases, air core drilling is playing a pivotal role in uncovering new reserves. The method's ability to provide rapid, cost-effective exploratory data in underexplored regions makes it an attractive choice for mining companies looking to expand operations in resource-rich areas like Africa and South America. Furthermore, the growing emphasis on sustainability in the mining industry is propelling the adoption of air core drilling. With regulatory pressure mounting on companies to reduce their environmental impact, air core's minimal water usage and low-waste footprint align well with the industry's shift toward greener practices. Technological advancements are also fueling market growth, as the increasing availability of more durable drill bits and more powerful air compressors is expanding the applicability of air core drilling to a broader range of geological conditions. Additionally, the rising use of air core drilling in non-mining sectors, such as environmental monitoring, groundwater surveys, and infrastructure development, is contributing to its expanding market presence. Governments and private sector projects, particularly in developing regions, are increasingly relying on air core drilling for its speed and efficiency in conducting site assessments before major construction or energy projects. The combination of these factors is driving the steady growth of the air core drilling market, positioning it as a key technology for both current and future exploration needs.Report Scope

The report analyzes the Air Core Drilling market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Dust, Aerated Fluid, Foam, Mist, Nitrogen Membrane).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dust Application segment, which is expected to reach US$774.5 Million by 2030 with a CAGR of a 6.4%. The Aerated Fluid Application segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $353.8 Million in 2024, and China, forecasted to grow at an impressive 10.5% CAGR to reach $483.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Air Core Drilling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Air Core Drilling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Air Core Drilling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allis Chalmers, Archer Limited, Atlas Copco AB, Ausdrill Limited, Baker Hughes and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Air Core Drilling market report include:

- Allis Chalmers

- Archer Limited

- Atlas Copco AB

- Ausdrill Limited

- Baker Hughes

- Bostech Drilling Australia Pty Ltd.

- Brown Bros Driling

- Geodrill Ltd.

- Halliburton

- Master Drilling Group Ltd

- Schlumberger

- Tesco Corp.

- Weatherford International Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allis Chalmers

- Archer Limited

- Atlas Copco AB

- Ausdrill Limited

- Baker Hughes

- Bostech Drilling Australia Pty Ltd.

- Brown Bros Driling

- Geodrill Ltd.

- Halliburton

- Master Drilling Group Ltd

- Schlumberger

- Tesco Corp.

- Weatherford International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

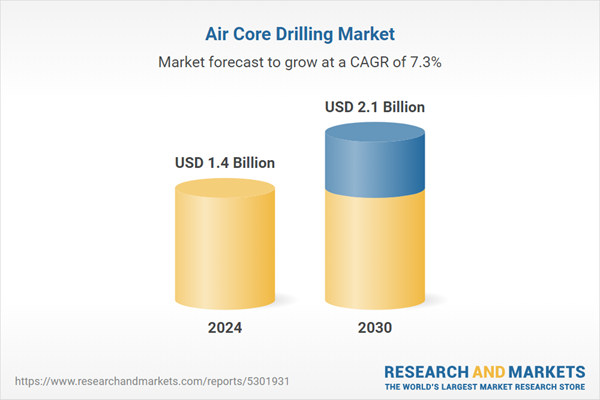

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |