Global Air Brake Systems Market - Key Trends and Drivers Summarized

How Do Air Brake Systems Provide Critical Safety in Heavy-Duty Vehicles?

Air brake systems are essential for ensuring the safety and functionality of heavy-duty vehicles, such as trucks, buses, and trains. These braking systems use compressed air to activate the brake pads or shoes, providing a reliable and powerful means of slowing or stopping large vehicles that carry significant weight. Unlike hydraulic brakes commonly found in passenger cars, air brakes are more robust and are capable of handling the higher loads and more extreme operating conditions that heavy-duty vehicles face. When a driver applies the brake pedal, compressed air flows through valves and into the brake chambers, forcing the brake pads against the wheels and bringing the vehicle to a stop. One of the major advantages of air brake systems is their fail-safe nature; if the system experiences a loss of pressure, the brakes automatically engage, preventing uncontrolled vehicle movement. This feature is crucial in high-risk environments, such as on highways or steep inclines, where a brake failure could lead to catastrophic accidents. As heavy-duty vehicles are integral to industries such as logistics, construction, and public transportation, the air brake system is fundamental to ensuring safety and operational efficiency.Why Are Air Brake Systems Critical in Commercial and Industrial Applications?

Air brake systems are critical in commercial and industrial applications because they provide the durability and reliability necessary for vehicles operating under extreme conditions. Heavy trucks, buses, and other large vehicles frequently carry substantial loads over long distances, requiring braking systems that can endure high levels of stress without failure. Air brakes are specifically designed to withstand these conditions, as compressed air can be replenished during vehicle operation, ensuring consistent brake performance over time. Additionally, air brake systems are often equipped with advanced safety features, such as anti-lock braking systems (ABS) and electronic braking systems (EBS), which help maintain vehicle control during emergency stops or adverse weather conditions. These systems allow the vehicle's brakes to be applied gradually and evenly, reducing the risk of wheel lockup and skidding. In industries such as freight transportation, construction, and public transit, the ability to safely manage large loads and navigate challenging terrains is essential, making air brake systems a critical component of vehicle safety. Their ability to provide consistent braking power under varying conditions ensures that heavy-duty vehicles can operate safely and effectively, even in demanding environments.How Is Technology Enhancing the Capabilities of Air Brake Systems?

Technological advancements are significantly enhancing the capabilities of air brake systems, making them safer, more efficient, and easier to maintain. One of the key areas of innovation is the integration of electronic control systems with traditional pneumatic components, leading to the development of electronic braking systems (EBS). These systems use electronic signals to control the distribution of air pressure to each brake, ensuring faster and more precise brake application. This not only improves the responsiveness of the brakes but also helps prevent wear by evenly distributing braking force across all wheels. Another technological advancement is the widespread adoption of anti-lock braking systems (ABS) in air brakes, which help prevent the wheels from locking up during emergency stops, reducing the risk of skidding and maintaining vehicle stability. Additionally, advancements in diagnostics and sensor technology are improving the way air brake systems are monitored and maintained. Modern air brake systems are often equipped with sensors that continuously monitor air pressure, brake wear, and overall system health. This data can be transmitted to fleet management systems in real time, allowing operators to detect potential issues before they lead to brake failure. Moreover, improvements in air compressor technology have led to more efficient systems that generate air pressure with greater reliability and lower energy consumption, reducing the overall operational costs for vehicles equipped with air brakes.What Are the Factors Propelling the Growth of the Air Brake Systems Market?

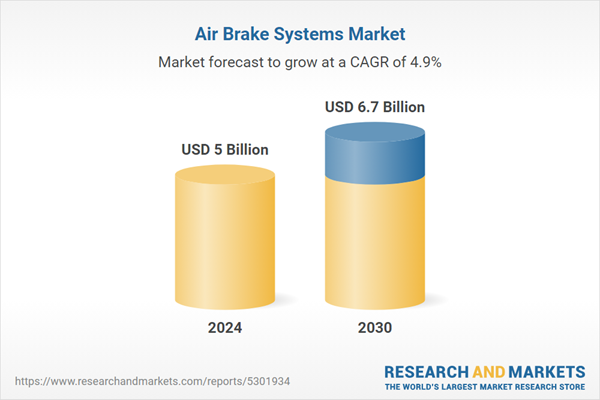

The growth in the air brake systems market is driven by several factors, including the expansion of the commercial transportation sector, increased safety regulations, and advancements in braking technology. One of the primary drivers is the growing demand for heavy-duty trucks, buses, and trailers in industries such as logistics, construction, and public transit. As global trade continues to expand and urbanization increases, there is a rising need for efficient transportation solutions that can move large quantities of goods and people over long distances. This, in turn, fuels demand for air brake systems, which are essential for ensuring the safety and functionality of these large vehicles. Additionally, stricter government regulations regarding vehicle safety are pushing manufacturers to adopt more advanced braking technologies, such as anti-lock braking systems (ABS) and electronic braking systems (EBS), which are increasingly becoming standard in air brake systems. These regulations are particularly prominent in regions such as North America and Europe, where governments have introduced stringent safety standards for commercial vehicles, leading to higher adoption of air brake systems that meet these requirements. Technological advancements are also driving growth, as the integration of electronic controls and real-time monitoring systems enhances the efficiency, reliability, and safety of air brake systems. Moreover, the rise of autonomous and semi-autonomous vehicle technologies in the heavy-duty sector is expected to further boost the air brake systems market. Autonomous trucks and buses rely heavily on advanced braking systems to ensure precise stopping and vehicle control, making air brakes a critical component in the future of automated transportation. Lastly, the increasing focus on reducing vehicle emissions and improving fuel efficiency has led to innovations in air brake systems that reduce energy consumption and minimize wear, further driving market growth. With these trends, the air brake systems market is poised for continued expansion as industries prioritize safety, efficiency, and technological integration in their vehicle fleets.Report Scope

The report analyzes the Air Brake Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Brake Chamber, Compressor, Governor, Storage Tank, Air Dryer, Foot Valve); Brake Type (Air Drum, Air Disc); On-Highway Vehicle Type (Heavy-duty Truck, Semi-trailer, Rigid Body, Bus).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Air Brake Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Air Brake Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Air Brake Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Federal-Mogul, Fort Garry Industries, Fritec, Haldex, Knorr-Bremse and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Air Brake Systems market report include:

- Federal-Mogul

- Fort Garry Industries

- Fritec

- Haldex

- Knorr-Bremse

- Mahle Aftermarket

- Meritor

- Nabtesco

- Sealco

- Silverbackhd

- Sorl Auto Parts

- TSE Brakes

- Wabco

- Wabtec

- ZF

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Federal-Mogul

- Fort Garry Industries

- Fritec

- Haldex

- Knorr-Bremse

- Mahle Aftermarket

- Meritor

- Nabtesco

- Sealco

- Silverbackhd

- Sorl Auto Parts

- TSE Brakes

- Wabco

- Wabtec

- ZF

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 6.7 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |