Global Sulfonates Market - Key Trends & Drivers Summarized

What Are Sulfonates and How Are They Manufactured?

Sulfonates are a class of chemical compounds that contain the sulfonate group (R-SO3?), which is derived from sulfonic acid. These compounds are widely used as surfactants, detergents, emulsifiers, and corrosion inhibitors across multiple industries, including oil and gas, personal care, pharmaceuticals, agriculture, and chemical processing. Their unique chemical structure allows sulfonates to act as excellent wetting agents and dispersants, making them highly effective in breaking down oils, greases, and other hydrophobic substances. Among the most commonly used sulfonates are alkylbenzene sulfonates (used in detergents), petroleum sulfonates (used in oil recovery), and lignosulfonates (used in construction and agriculture).The manufacturing process of sulfonates typically involves sulfonation or sulfation, where a hydrocarbon, alcohol, or aromatic compound is reacted with sulfur trioxide (SO3) or sulfuric acid (H2SO4). This reaction introduces the sulfonate group into the molecule, forming the desired sulfonate product. For example, alkylbenzene sulfonates are produced by sulfonating linear alkylbenzene (LAB) with sulfur trioxide, resulting in linear alkylbenzene sulfonic acid (LABSA), which is then neutralized with a base to form the sulfonate salt. Other types of sulfonates, such as petroleum sulfonates, are derived from crude oil fractions or refinery by-products, while lignosulfonates are extracted from wood pulp in the paper manufacturing process.

Recent innovations in sulfonate manufacturing have focused on improving the sustainability of production processes and reducing the environmental impact. Manufacturers are increasingly exploring greener routes, such as bio-based sulfonates made from renewable raw materials, and employing technologies that minimize the use of hazardous chemicals and energy consumption. Additionally, advancements in reaction control and catalysis have enabled the development of more efficient sulfonation processes, resulting in higher yields and better product purity. These developments are helping to meet the growing demand for environmentally friendly chemicals while maintaining the high performance required in industrial applications.

What Are the Primary Applications of Sulfonates Across Industries?

Sulfonates are used across a wide range of industries due to their excellent surfactant, dispersant, and emulsifying properties. In the oil and gas industry, sulfonates, particularly petroleum sulfonates, play a crucial role in enhanced oil recovery (EOR) operations. These compounds act as surfactants in the formulation of chemical flooding solutions that reduce the surface tension between oil and water, allowing for more efficient extraction of oil from reservoirs. By improving the displacement of oil trapped in porous rock formations, sulfonates help increase oil recovery rates in mature oil fields, making them valuable in extending the productive life of reservoirs and optimizing oil production.In the household and industrial cleaning sector, sulfonates are widely used in detergents and cleaning agents. Alkylbenzene sulfonates, one of the most common types of sulfonates, serve as the primary surfactant in many liquid and powder detergents, providing excellent cleaning power by breaking down oils, greases, and dirt. These sulfonates are also highly effective in hard water conditions, maintaining their cleaning efficacy in the presence of calcium and magnesium ions. Additionally, sulfonates are used in industrial cleaners and degreasers to remove heavy-duty contaminants from machinery, equipment, and surfaces, particularly in manufacturing plants and automotive workshops.

Sulfonates also find important applications in the personal care industry, where they are used as emulsifiers and dispersants in products such as shampoos, body washes, and creams. Their ability to stabilize emulsions and improve the texture and spreadability of personal care formulations makes them valuable in enhancing product performance. Furthermore, sulfonates are used in pharmaceutical applications as excipients and solubilizing agents, helping to improve the bioavailability of poorly soluble drugs. In the agricultural sector, lignosulfonates, derived from wood, are used as binders in animal feed, dust suppressants, and dispersants in pesticide formulations. Their ability to improve the dispersion of active ingredients in fertilizers and pesticides ensures better coverage and efficacy in agricultural applications.

Why Is Consumer Demand for Sulfonates Increasing?

The growing demand for sulfonates can be attributed to their widespread use across key industries such as oil and gas, household cleaning, and personal care. One of the primary drivers of demand is the increasing focus on enhanced oil recovery (EOR) technologies in the oil and gas industry. As global oil reserves become more difficult to access, oil producers are turning to advanced recovery techniques, including chemical flooding, to extract more oil from existing fields. Sulfonates, particularly petroleum sulfonates, are essential in EOR operations, as they reduce the interfacial tension between oil and water, enabling more efficient oil extraction. This increased reliance on EOR is driving demand for sulfonates in the energy sector.In the household cleaning and personal care markets, consumer demand for high-performance products is fueling the need for sulfonates. Consumers are seeking more effective cleaning products that can tackle tough stains, greases, and dirt while maintaining safety for household use. Sulfonates, especially alkylbenzene sulfonates, are highly valued for their cleaning power and compatibility with hard water, making them a critical ingredient in a wide range of household detergents and surface cleaners. Additionally, the personal care industry's demand for sulfonates is growing as consumers seek personal care products that offer improved texture, foam, and spreadability. Sulfonates' emulsifying properties enhance the feel and performance of personal care formulations, contributing to their popularity in shampoos, body washes, and skincare products.

Environmental concerns and regulatory trends are also influencing demand for sulfonates. As industries across the globe seek to reduce their environmental footprint, sulfonates are being used in the development of more sustainable and biodegradable products. For example, lignosulfonates, which are derived from renewable wood sources, are increasingly being adopted in agriculture and construction applications as eco-friendly alternatives to synthetic chemicals. Additionally, manufacturers are focusing on producing sulfonates with lower environmental impact, including bio-based variants and products with reduced toxicity. This shift toward greener formulations is driving demand for sulfonates in sectors that prioritize sustainability, including cleaning, agriculture, and personal care.

What Factors Are Driving the Growth of the Sulfonates Market?

The growth of the sulfonates market is driven by several key factors, including the increasing demand for surfactants in industrial processes, the rise of enhanced oil recovery (EOR) techniques in the oil and gas industry, and the expanding use of sulfonates in household and personal care products. One of the primary drivers of growth is the widespread use of sulfonates as surfactants in various industries. Sulfonates are highly effective in reducing surface tension, stabilizing emulsions, and dispersing particles, making them essential in a wide range of applications, from cleaning agents to industrial lubricants. As industries seek to improve the efficiency of their processes and products, the demand for high-performance surfactants like sulfonates is expected to rise.The oil and gas industry's increasing reliance on enhanced oil recovery (EOR) techniques is another significant driver of market growth. As conventional oil fields mature and the availability of easy-to-extract oil decreases, producers are turning to advanced recovery methods to boost output. Chemical flooding, which relies on sulfonate-based surfactants, is one of the most effective EOR techniques. Sulfonates help reduce the surface tension between oil and water, allowing for more efficient oil recovery from reservoirs. This growing need for EOR technologies, especially in regions where oil production is declining, is expected to drive demand for sulfonates in the energy sector.

The expansion of the household cleaning and personal care markets is also contributing to the growth of the sulfonates market. As consumer preferences shift toward more effective and sustainable cleaning products, manufacturers are increasingly relying on sulfonates to meet these demands. Sulfonates' ability to provide superior cleaning power, even in hard water, makes them a popular choice for liquid and powder detergents, household cleaners, and industrial degreasers. The personal care industry's demand for sulfonates is also growing, as these compounds are used to improve the texture and performance of shampoos, body washes, and skincare products. Additionally, the trend toward biodegradable and environmentally friendly formulations is driving demand for sulfonates that align with sustainability goals.

Technological advancements in sulfonation processes and the development of bio-based sulfonates are further enhancing the growth of the market. Innovations in production technologies have enabled manufacturers to produce sulfonates with improved performance characteristics, such as better dispersibility, higher purity, and enhanced biodegradability. The growing focus on green chemistry and the use of renewable raw materials in the production of sulfonates is also creating new opportunities in industries that prioritize environmental sustainability. As companies seek to comply with stricter environmental regulations and meet consumer demand for eco-friendly products, the market for sulfonates is expected to experience robust growth.

In conclusion, the global sulfonates market is poised for significant expansion, driven by rising demand across industries such as oil and gas, cleaning, personal care, and agriculture. The versatility and effectiveness of sulfonates as surfactants, emulsifiers, and dispersants make them indispensable in a wide range of applications. With advancements in production technology and the increasing focus on sustainability, the sulfonates market is expected to grow steadily in the coming years.

Report Scope

The report analyzes the Sulfonates market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Water & Wastewater Treatment, Power & Construction, Oil & Gas, Mining, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water & Wastewater Treatment Application segment, which is expected to reach US$844.8 Million by 2030 with a CAGR of a 7.1%. The Power & Construction Application segment is also set to grow at 5.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sulfonates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sulfonates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sulfonates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Clariant, Godrej Industries, Kao Corporation, Kimes Technologies International, Nirma Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Sulfonates market report include:

- Clariant

- Godrej Industries

- Kao Corporation

- Kimes Technologies International

- Nirma Limited

- Nouryon

- Pilot Chemical Company

- Solvay SA

- Stepan Company

- Sure Chemical Co. Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Clariant

- Godrej Industries

- Kao Corporation

- Kimes Technologies International

- Nirma Limited

- Nouryon

- Pilot Chemical Company

- Solvay SA

- Stepan Company

- Sure Chemical Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

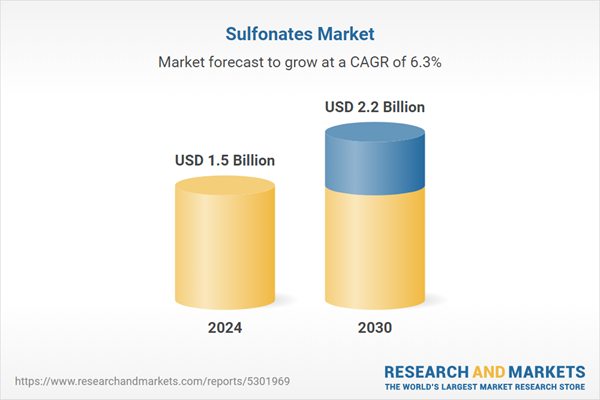

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |