Global Hydroxypropyl Methylcellulose (HPMC) Market - Key Trends & Drivers Summarized

What Is Hydroxypropyl Methylcellulose, And Why Is It Important in Modern Industries?

Hydroxypropyl methylcellulose (HPMC) is a non-ionic, water-soluble cellulose ether that is widely used across industries for its excellent thickening, emulsifying, film-forming, and stabilizing properties. Derived from natural cellulose through chemical modification with methyl and hydroxypropyl groups, HPMC is biodegradable, non-toxic, and non-allergenic, making it highly versatile in applications such as pharmaceuticals, construction, food, personal care, and coatings. Its ability to dissolve in both hot and cold water, combined with its high thermal stability, makes HPMC an ideal ingredient in a wide variety of formulations.The importance of HPMC lies in its multifunctionality and environmental friendliness. In pharmaceuticals, HPMC is used as a binder, film-forming agent, and controlled-release matrix in tablet formulations. Its compatibility with other excipients and safety profile make it an indispensable component in oral drug delivery systems. In construction, it enhances the workability and water retention of cement and gypsum-based products. Additionally, HPMC is widely used in food as a thickening agent and stabilizer, and in cosmetics for its ability to improve texture and moisture retention. As industries increasingly shift toward bio-based, non-toxic, and multifunctional ingredients, HPMC has become a critical component across sectors.

What Are the Main Applications of Hydroxypropyl Methylcellulose, And How Do They Cater to Industry-Specific Needs?

Hydroxypropyl methylcellulose plays a significant role across various industries, where its thickening, emulsifying, and film-forming properties are highly valued. In the pharmaceutical industry, HPMC is widely used as a binder and film former in oral solid dosage forms such as tablets and capsules. HPMC's ability to form strong, flexible films makes it ideal for creating coatings that protect active pharmaceutical ingredients (APIs) from moisture, air, and light, ensuring the stability and efficacy of medications over time. Moreover, HPMC's solubility and gel-forming capabilities make it a key ingredient in controlled-release formulations, where it regulates the release of active ingredients, providing sustained therapeutic effects. Its non-toxic and biodegradable nature makes it a preferred excipient in various drug formulations.HPMC also serves as a key ingredient in ophthalmic drug formulations, particularly eye drops, due to its ability to create a protective, lubricating film on the surface of the eye. This makes it beneficial for treating dry eyes and other eye-related conditions. Furthermore, its biocompatibility and non-irritating properties ensure that it can be safely used in sensitive pharmaceutical formulations, further expanding its use in the pharmaceutical industry. As demand for innovative drug delivery systems and patient-friendly medications grows, the importance of HPMC in pharmaceutical applications is set to increase.

In the construction industry, hydroxypropyl methylcellulose is an essential additive used in cement-based products, plasters, and tile adhesives. HPMC improves the water retention, workability, and consistency of construction materials, ensuring that they can be easily applied and spread without sagging or drying too quickly. Its water-retaining properties are particularly valuable in hot or dry climates, where construction materials tend to lose moisture rapidly. By preventing premature drying, HPMC ensures that cement and mortar develop their full strength and durability. Additionally, HPMC enhances the adhesion of tile adhesives, ensuring that tiles remain firmly bonded to surfaces, even under challenging environmental conditions. As construction projects become more complex and materials demand greater performance, HPMC continues to play a vital role in enhancing the efficiency and durability of building materials.

The food industry also benefits significantly from HPMC's thickening, stabilizing, and emulsifying properties. It is commonly used in processed foods, such as sauces, dressings, bakery products, and dairy alternatives, to improve texture, consistency, and mouthfeel. In baked goods, HPMC is used to retain moisture and improve volume, particularly in gluten-free products, where it serves as a functional replacement for gluten. Additionally, in dairy-free and plant-based food products, HPMC helps stabilize emulsions, ensuring that ingredients like oil and water do not separate, maintaining a creamy texture in products like non-dairy ice creams and sauces. As consumer demand for plant-based, clean-label, and gluten-free food products continues to rise, HPMC's role as a safe, plant-derived additive is gaining prominence in the food industry.

The personal care and cosmetics sector also heavily relies on HPMC for its film-forming, thickening, and stabilizing properties. HPMC is used in skincare products, such as creams, lotions, and serums, where it enhances product texture and stabilizes emulsions, preventing ingredient separation. Its film-forming ability allows it to create a protective barrier on the skin, locking in moisture and improving the skin's hydration levels. This makes HPMC a key ingredient in moisturizing and anti-aging products. Additionally, HPMC is used in haircare formulations like shampoos and conditioners, where it improves viscosity and helps maintain the stability of the formulation. As the demand for natural, biodegradable ingredients grows in the beauty industry, HPMC is becoming a preferred choice for formulators seeking to create eco-friendly products without compromising performance.

In the paints and coatings industry, hydroxypropyl methylcellulose is used as a rheology modifier to control the viscosity and flow of water-based paints. It helps improve the application properties of paints, ensuring that they spread evenly and adhere well to surfaces without dripping or sagging. HPMC also stabilizes pigments in paint formulations, preventing sedimentation and ensuring consistent color distribution. With the growing demand for water-based, low-VOC (volatile organic compound) paints and coatings due to environmental regulations, HPMC's role as a natural, eco-friendly thickener is becoming increasingly important.

How Are Technological Advancements Impacting the Hydroxypropyl Methylcellulose Market?

Technological advancements are driving significant improvements in the production, functionality, and applications of hydroxypropyl methylcellulose. One of the most notable advancements is the optimization of HPMC production processes, allowing for the creation of high-purity, consistent HPMC grades tailored for specific industrial applications. Innovations in chemical modification and purification techniques have resulted in more efficient production processes that reduce impurities and improve the performance of HPMC in different formulations. These advancements are particularly important in industries such as pharmaceuticals and food, where product safety, quality, and purity are critical.Additionally, the development of specialized HPMC grades has expanded its use in a variety of industries. In the pharmaceutical sector, low-viscosity and high-viscosity grades of HPMC are now available, offering different solubility and gel-forming properties suited for controlled-release drug formulations, ophthalmic solutions, and other complex medical products. These specialized grades provide pharmaceutical manufacturers with the flexibility to create more precise drug delivery systems, improving the bioavailability and therapeutic effectiveness of medications. As the pharmaceutical industry continues to innovate in drug formulation and delivery, the demand for customized HPMC solutions is expected to grow.

In the construction industry, advancements in rheology modification and water retention technologies have improved the performance of HPMC in cement-based products. New formulations of HPMC are being developed to enhance the mechanical strength of building materials, ensuring better adhesion, flexibility, and durability in challenging environments. These innovations are particularly valuable for large-scale construction projects that require high-performance materials capable of withstanding harsh climates or fast-drying conditions. As construction practices evolve to incorporate more sustainable and high-performance materials, HPMC's role in improving workability, water retention, and strength in construction products is expected to expand.

The personal care and cosmetics industry is also benefiting from advancements in formulation technologies, allowing for more effective integration of HPMC into a broader range of beauty and skincare products. New techniques in emulsification and dispersion are making it easier to incorporate HPMC into multi-phase systems, where it stabilizes emulsions and enhances the sensory properties of formulations. The growing demand for clean beauty and sustainable skincare products is encouraging further innovation in HPMC formulations, particularly as consumers seek products that are safe, plant-based, and biodegradable. These technological advancements are helping cosmetic manufacturers meet the increasing consumer demand for performance-driven, eco-friendly personal care solutions.

In the food industry, advances in clean-label food formulation are driving new uses for HPMC. As food manufacturers shift toward natural, plant-based ingredients, HPMC is being developed into improved grades that offer better thickening, gelling, and stabilizing capabilities for a wider range of food products, including gluten-free, dairy-free, and reduced-fat foods. These advancements are helping food manufacturers meet consumer demands for healthier, more sustainable food products without sacrificing texture, taste, or shelf life.

Moreover, digital tools and automation in production are improving the scalability and cost-efficiency of HPMC manufacturing. Automated systems that use real-time monitoring and advanced analytics ensure more consistent production, enabling manufacturers to optimize yield and reduce waste. These technological innovations help meet the rising demand for high-quality HPMC products in global markets, particularly in industries where large volumes of HPMC are required.

What Is Driving the Growth in the Hydroxypropyl Methylcellulose Market?

The growth in the hydroxypropyl methylcellulose market is driven by several key factors, including the increasing demand for bio-based, sustainable products, the expansion of the pharmaceutical and construction sectors, and the rising applications of HPMC in personal care and food industries. One of the primary drivers is the shift toward sustainable, eco-friendly ingredients across multiple sectors. As industries move away from synthetic chemicals and prioritize biodegradable, plant-based alternatives, HPMC has emerged as an essential ingredient due to its natural origin and versatile properties. This trend is particularly evident in the personal care and cosmetics industry, where consumers are demanding clean beauty products free from harmful additives.The expansion of the pharmaceutical industry is another significant factor contributing to the growth of the HPMC market. As global healthcare needs increase, particularly with the rise in chronic diseases and aging populations, the demand for advanced drug delivery systems is rising. HPMC's role in controlled-release formulations and as a binder in tablets makes it a critical excipient in the pharmaceutical sector. Furthermore, the development of new drug delivery technologies, such as extended-release medications and biocompatible coatings, is driving further demand for high-quality HPMC in pharmaceutical formulations.

The construction industry is also playing a key role in the growth of the HPMC market. As infrastructure projects and urban development expand worldwide, particularly in emerging economies, the need for high-performance building materials is growing. HPMC's ability to improve the workability, water retention, and durability of construction materials such as cement, mortars, and tile adhesives makes it an essential additive in construction projects. Additionally, the shift toward sustainable construction practices, including the use of bio-based additives, is boosting the demand for HPMC as a key ingredient in green building materials.

The food industry is also contributing to the growth of the HPMC market, particularly as consumer demand for clean-label, plant-based, and gluten-free food products increases. HPMC's ability to improve the texture, consistency, and stability of processed foods makes it a valuable ingredient in a wide range of food applications. As food manufacturers look for natural alternatives to synthetic additives, the use of HPMC is expected to expand in processed foods, sauces, dressings, bakery products, and dairy alternatives.

Finally, the increasing focus on sustainable practices in industries such as paints and coatings is contributing to the growth of the HPMC market. As environmental regulations push manufacturers to adopt low-VOC, water-based paints, the demand for eco-friendly rheology modifiers like HPMC is rising. Its role in improving the viscosity and application properties of water-based paints makes it a critical component in the production of environmentally friendly coatings.

In conclusion, the hydroxypropyl methylcellulose market is poised for significant growth driven by rising demand for bio-based, sustainable ingredients, the expansion of the pharmaceutical and construction sectors, and the increasing use of HPMC in personal care and food industries. Technological advancements in production processes, formulation techniques, and sustainable applications will further enhance the market's potential. As industries continue to prioritize sustainability, performance, and safety, the demand for hydroxypropyl methylcellulose is expected to flourish in the coming years.

Report Scope

The report analyzes the Hydroxypropyl Methylcellulose (HPMC) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Pharmaceutical, Buildings & Construction, Food & Beverages, Paints & Coatings, Personal Care, Adhesives, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pharmaceutical Application segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 5.4%. The Buildings & Construction Application segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydroxypropyl Methylcellulose (HPMC) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydroxypropyl Methylcellulose (HPMC) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

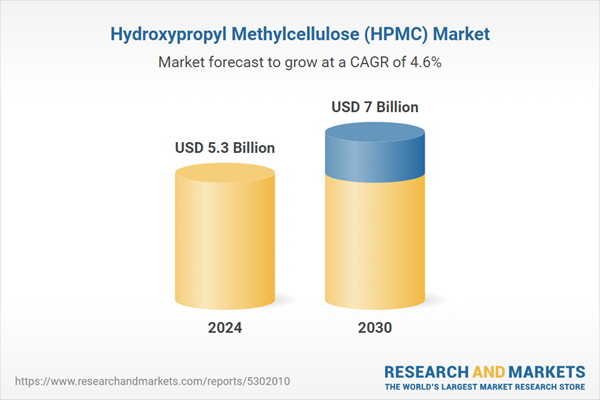

- How is the Global Hydroxypropyl Methylcellulose (HPMC) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ashland, China RuiTai International Holdings, Dow Chemical, Fenchem, Harke Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Hydroxypropyl Methylcellulose (HPMC) market report include:

- Ashland

- China RuiTai International Holdings

- Dow Chemical

- Fenchem

- Harke Group

- Hercules Tianpu Chemical

- Kingstone Chemical China

- Lotte Fine Chemicals

- SE Tylose (Shin-Etsu)

- Shandong Head

- Shijiazhuang Shangdun Cellulose

- Zhejiang Kehong Chemical

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ashland

- China RuiTai International Holdings

- Dow Chemical

- Fenchem

- Harke Group

- Hercules Tianpu Chemical

- Kingstone Chemical China

- Lotte Fine Chemicals

- SE Tylose (Shin-Etsu)

- Shandong Head

- Shijiazhuang Shangdun Cellulose

- Zhejiang Kehong Chemical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |