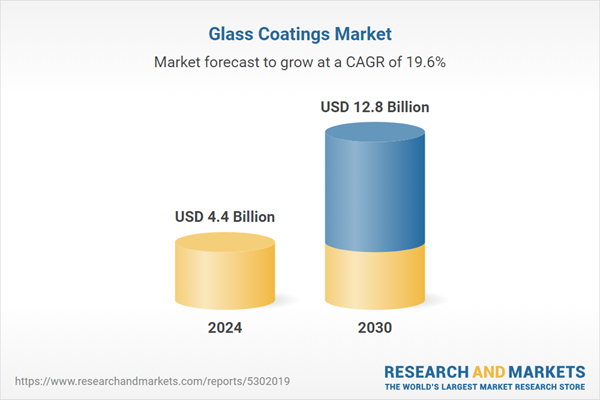

Global Glass Coatings Market - Key Trends & Drivers Summarized

What Are Glass Coatings, And Why Are They Essential in Modern Applications?

Glass coatings refer to a range of specialized surface treatments applied to glass to enhance its performance, durability, and functionality in various industrial, automotive, and architectural applications. These coatings can serve multiple purposes, such as improving scratch resistance, reducing glare, enhancing energy efficiency, and providing protection against UV radiation, corrosion, or dirt accumulation. Glass coatings are typically composed of compounds like silica, titanium dioxide, or metal oxides, which are applied in thin layers to alter the glass's properties and make it more resilient and efficient.The importance of glass coatings lies in their ability to significantly enhance the performance of glass, making it more suitable for demanding environments and high-performance applications. In architecture, for example, coated glass is used in windows and facades to improve thermal insulation and reduce energy consumption by controlling solar heat gain. Similarly, in the automotive sector, glass coatings are applied to windshields and windows to reduce glare, prevent fogging, and improve scratch resistance. These advancements are crucial as industries increasingly seek materials that can provide both aesthetic appeal and functional benefits. As energy efficiency and sustainability become more important, glass coatings are playing a vital role in achieving these objectives by enhancing the performance of building materials, vehicles, and consumer products.

What Are the Main Applications of Glass Coatings, And How Do They Cater to Industry-Specific Needs?

Glass coatings are widely applied across various sectors, including automotive, construction, electronics, and consumer goods, with each industry leveraging specific benefits of these coatings to meet its particular needs. In the automotive industry, glass coatings are extensively used on windshields, windows, and mirrors to improve visibility, durability, and overall vehicle safety. For instance, anti-glare coatings reduce the impact of bright lights during night driving, while hydrophobic coatings help repel water, improving visibility during rainstorms. Scratch-resistant coatings also protect windshields and windows from wear and tear, extending the lifespan of the glass and reducing maintenance costs for vehicle owners. The automotive industry's growing focus on safety and performance is driving the demand for advanced glass coatings that enhance both driver visibility and the durability of vehicle components.In the construction and architectural sector, glass coatings play a crucial role in energy efficiency and building aesthetics. Low-emissivity (Low-E) coatings, for example, are designed to reflect infrared light and reduce the transfer of heat through glass windows, improving thermal insulation and helping to maintain a stable indoor temperature. This reduces the need for heating and cooling, lowering energy costs and making buildings more environmentally friendly. Additionally, coatings that protect against UV radiation help prevent interior furnishings from fading while maintaining the transparency and clarity of windows. The rising trend of sustainable building design is further boosting the demand for glass coatings that provide energy savings and environmental benefits, making them essential for modern green architecture.

Another growing application for glass coatings is in the electronics industry, particularly for smartphones, tablets, and other touch-screen devices. Anti-reflective and smudge-resistant coatings are applied to the glass surfaces of these devices to enhance visibility, improve user experience, and protect against fingerprints and scratches. The demand for high-quality, durable touchscreens has led to significant advancements in glass coatings that provide both aesthetic appeal and functional protection. As the electronics industry continues to push the boundaries of design and innovation, glass coatings are becoming an integral part of enhancing the performance and longevity of electronic devices.

Glass coatings are also increasingly being used in solar panels and photovoltaic systems to improve their efficiency and durability. Anti-reflective coatings applied to the surface of solar panels help maximize light absorption by reducing the amount of light reflected off the glass, thereby increasing energy generation. These coatings also protect solar panels from environmental factors such as dirt, moisture, and extreme temperatures, ensuring optimal performance in various conditions. As the demand for renewable energy sources grows, the use of glass coatings in solar technologies is expected to expand, driving innovation in energy-efficient materials.

Furthermore, consumer goods like eyeglasses, mirrors, and kitchenware are benefiting from the application of glass coatings. Anti-scratch, anti-fog, and anti-reflective coatings enhance the durability and functionality of everyday products, making them more user-friendly and long-lasting. These coatings improve product performance while maintaining clarity and transparency, essential qualities for consumer satisfaction. As consumers increasingly demand durable, easy-to-maintain products, glass coatings that offer protective and functional benefits are becoming more widespread in various consumer goods markets.

How Are Technological Advancements Impacting the Glass Coatings Market?

Technological advancements are significantly shaping the glass coatings market by improving the performance, versatility, and environmental impact of coatings. One of the most notable advancements is the development of nanotechnology-based coatings. Nanocoatings allow for the creation of ultra-thin layers that enhance the surface properties of glass without affecting its transparency. These coatings offer improved durability, scratch resistance, and hydrophobic properties, making them highly effective for applications in automotive, electronics, and solar energy industries. Nanotechnology is enabling the production of more advanced and multifunctional glass coatings that can provide multiple benefits - such as self-cleaning, UV protection, and anti-bacterial properties - simultaneously.Another significant advancement in glass coatings is the development of energy-efficient coatings, such as Low-E (low emissivity) and solar control coatings. These coatings reflect or absorb specific wavelengths of light, helping to reduce heat gain or loss through glass surfaces. With growing concerns about climate change and energy consumption, these energy-efficient coatings are becoming increasingly important in architectural and construction applications. They allow buildings to maintain comfortable indoor temperatures while reducing reliance on heating and cooling systems. This technology is especially valuable in the construction of green buildings, where energy efficiency and sustainability are top priorities.

Self-cleaning glass coatings represent another exciting technological advancement. These coatings use hydrophobic or hydrophilic properties to repel water and prevent the buildup of dirt and grime on glass surfaces. Hydrophobic coatings cause water to bead up and roll off the glass, carrying away dust and dirt particles, while hydrophilic coatings allow water to spread evenly across the surface, helping to wash away contaminants. Self-cleaning glass is highly sought after in both residential and commercial buildings, where it reduces the need for manual cleaning and maintenance, making it a cost-effective and convenient solution.

Advancements in manufacturing techniques are also improving the scalability and cost-efficiency of glass coating production. Technologies such as chemical vapor deposition (CVD) and physical vapor deposition (PVD) allow manufacturers to apply thin, uniform coatings with greater precision and consistency. These methods enable the mass production of high-performance glass coatings at lower costs, making them more accessible to a wider range of industries. Additionally, the rise of digital coating technologies has allowed manufacturers to create custom coatings with specific properties, such as precise control over light transmission and reflection, which is essential for applications like smart windows and advanced optics.

Environmental sustainability is another major focus of technological advancements in the glass coatings market. Manufacturers are increasingly developing eco-friendly coatings that use less harmful chemicals and reduce the environmental impact of production. Water-based coatings, for example, are being developed as alternatives to solvent-based coatings, reducing the release of volatile organic compounds (VOCs) into the atmosphere. These advancements align with the global push for more sustainable materials and manufacturing processes, appealing to industries that prioritize environmental responsibility.

Finally, the growing demand for smart glass technologies is driving innovation in glass coatings. Smart glass, also known as switchable glass, uses coatings that can change their transparency or reflectivity in response to external stimuli such as heat, light, or electricity. These coatings allow users to control the amount of light and heat passing through the glass, offering energy savings and enhanced comfort in buildings and vehicles. As smart glass technology continues to evolve, advancements in the coatings that enable these dynamic properties are becoming a key area of focus for manufacturers looking to meet the needs of modern consumers.

What Is Driving the Growth in the Glass Coatings Market?

The growth in the glass coatings market is driven by several key factors, including the increasing demand for energy-efficient solutions, advancements in technology, and the growing adoption of coated glass in various industries. One of the primary drivers is the push for energy-efficient building materials, particularly in the construction and architectural sectors. As governments and organizations implement stricter regulations on energy consumption and carbon emissions, builders are increasingly turning to coated glass to improve the energy efficiency of buildings. Low-E coatings, in particular, are becoming a standard feature in modern windows and facades due to their ability to reduce heat transfer and lower energy costs, making them essential in green building initiatives.The rapid growth of the automotive industry, particularly in emerging markets, is another significant factor contributing to the expansion of the glass coatings market. Consumers are increasingly seeking vehicles with advanced features that enhance safety, comfort, and durability, driving demand for glass coatings that offer benefits such as UV protection, anti-glare properties, and scratch resistance. The rise of electric vehicles (EVs) and autonomous vehicles is further boosting demand for specialized coatings that improve visibility, reduce heat buildup, and enhance the overall driving experience. As automakers continue to innovate and differentiate their products, the integration of advanced glass coatings is expected to become even more widespread.

The growing adoption of solar energy and photovoltaic technologies is also influencing the glass coatings market. Solar panels require high-performance glass coatings that maximize light absorption and protect against environmental factors. Anti-reflective and self-cleaning coatings are particularly valuable in solar energy applications, where they help increase energy efficiency and reduce maintenance requirements. As governments and industries invest more heavily in renewable energy sources, the demand for coated glass in solar energy applications is expected to rise, driving further growth in the market.

Moreover, the increasing use of glass coatings in consumer electronics, such as smartphones, tablets, and wearables, is contributing to market growth. As devices become more advanced and multifunctional, there is a growing need for glass coatings that provide scratch resistance, anti-glare properties, and improved durability. Consumers expect their electronic devices to withstand everyday use while maintaining a sleek, polished appearance, making glass coatings an essential component in the design and manufacturing of these products.

Finally, the ongoing trend toward smart homes and connected devices is driving demand for smart glass technologies, which rely on advanced glass coatings to function. As more consumers adopt smart windows, dynamic displays, and other connected technologies, the need for coatings that enable these innovations is expanding. Smart glass coatings offer energy savings, privacy control, and enhanced comfort, making them an attractive solution for modern buildings and homes.

In conclusion, the glass coatings market is poised for significant growth driven by increasing demand for energy-efficient building materials, advancements in technology, and the expanding applications of coated glass in industries such as automotive, solar energy, and consumer electronics. Technological innovations in coatings, manufacturing processes, and sustainability will further enhance the market's potential. As industries continue to prioritize performance, durability, and environmental responsibility, the demand for advanced glass coatings is expected to flourish in the coming years.

Report Scope

The report analyzes the Glass Coatings market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Sol-Gel, Pyrolytic, Magnetic Sputtering, Other Types); Technology (Nano Glass Coatings, Liquid Glass Coatings); End-Use (Construction, Automotive & Transportation, Aerospace, Marine, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sol-Gel segment, which is expected to reach US$5.7 Billion by 2030 with a CAGR of a 21.4%. The Pyrolytic segment is also set to grow at 19.4% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Glass Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Glass Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Glass Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Co., Akzonobel N.V., Axalta Coatings, Corning, Inc., Euroglas GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Glass Coatings market report include:

- 3M Co.

- Akzonobel N.V.

- Axalta Coatings

- Corning, Inc.

- Euroglas GmbH

- Henkel A.G.

- Kyocera Corp

- Murata Manufacturing Co. Ltd

- PPG Industries

- The NSG Group

- The Sherwin-Williams

- Valspar Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Co.

- Akzonobel N.V.

- Axalta Coatings

- Corning, Inc.

- Euroglas GmbH

- Henkel A.G.

- Kyocera Corp

- Murata Manufacturing Co. Ltd

- PPG Industries

- The NSG Group

- The Sherwin-Williams

- Valspar Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 231 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 12.8 Billion |

| Compound Annual Growth Rate | 19.6% |

| Regions Covered | Global |