Global Ethyl Acrylate Market - Key Trends & Drivers Summarized

What Is Ethyl Acrylate, And Why Is It Important in Various Industries?

Ethyl acrylate is a colorless, volatile liquid organic compound with the chemical formula C5H8O2. It is an ester of acrylic acid and ethanol, commonly used as a building block in the production of various polymers and copolymers. Ethyl acrylate is crucial in the manufacture of adhesives, coatings, sealants, and paints, contributing to their durability, flexibility, and adhesion properties. Due to its reactive nature, it is utilized in polymerization processes to produce acrylic resins, which are known for their clarity, weather resistance, and chemical stability. These characteristics make ethyl acrylate an essential ingredient in many applications across diverse industries.The significance of ethyl acrylate in industrial processes cannot be overstated. Its versatility allows it to serve multiple functions, from enhancing the properties of finished products to acting as a solvent in various formulations. In the coatings and adhesives industries, ethyl acrylate contributes to improved adhesion, water resistance, and flexibility, making it an ideal choice for applications in construction, automotive, and consumer goods. Additionally, ethyl acrylate is a key component in the production of superabsorbent polymers used in products like diapers and feminine hygiene items. As industries continue to seek materials that enhance product performance and sustainability, the importance of ethyl acrylate in modern manufacturing processes continues to grow.

What Are the Main Applications of Ethyl Acrylate, And How Do They Cater to Industry-Specific Needs?

Ethyl acrylate has a wide range of applications across various industries, primarily in the production of polymers and copolymers. One of its most significant applications is in the coatings industry, where it is used to formulate paints, varnishes, and surface coatings. Ethyl acrylate-based coatings offer excellent adhesion, durability, and resistance to environmental factors such as UV light and moisture. These properties make them suitable for use in a variety of settings, including automotive finishes, industrial coatings, and decorative paints for residential applications. The demand for high-performance coatings that provide protection and aesthetic appeal is driving the growth of ethyl acrylate in this sector.In the adhesive market, ethyl acrylate is a critical component in formulating pressure-sensitive adhesives (PSAs). These adhesives are widely used in tapes, labels, and packaging applications due to their strong bonding capabilities and versatility. Ethyl acrylate-based PSAs provide excellent adhesion to various substrates, including plastics, metals, and paper, making them ideal for both industrial and consumer applications. As the demand for efficient and reliable adhesive solutions continues to rise, the use of ethyl acrylate in adhesive formulations is expected to grow.

The production of superabsorbent polymers (SAPs) is another key application of ethyl acrylate. SAPs are commonly used in personal care products, such as diapers and feminine hygiene products, where they absorb and retain large quantities of liquid. Ethyl acrylate is incorporated into the polymerization process to enhance the absorbency and performance of these products. As the global market for personal care items expands, the demand for superabsorbent polymers and the ethyl acrylate used in their production is also on the rise.

In addition to these applications, ethyl acrylate is used in the manufacture of textiles and fibers, where it serves as a polymerizing agent to produce durable and water-resistant fabrics. Ethyl acrylate is also utilized in the formulation of sealants and caulks, providing flexibility and adhesion to various substrates, which is essential for construction and repair applications. The wide-ranging uses of ethyl acrylate across different industries highlight its importance as a versatile chemical compound that meets diverse industry-specific needs.

How Are Technological Advancements Impacting the Ethyl Acrylate Market?

Technological advancements are significantly influencing the ethyl acrylate market by improving production efficiency, enhancing product quality, and promoting sustainability. One notable development is the optimization of manufacturing processes for ethyl acrylate. Innovations in chemical synthesis, such as the use of more efficient catalysts and reaction conditions, are leading to higher yields and lower production costs. These advancements enable manufacturers to meet increasing demand while maintaining competitive pricing in the market.Additionally, advancements in polymerization techniques are enhancing the properties of ethyl acrylate-based products. Techniques such as emulsion polymerization and mini-emulsion polymerization are being used to produce high-performance polymers with tailored characteristics. These methods allow for better control over particle size, distribution, and morphology, resulting in improved performance in applications such as coatings and adhesives. The ability to customize polymer properties to meet specific requirements is driving innovation in the ethyl acrylate market.

Furthermore, the focus on sustainability and environmentally friendly practices is shaping the ethyl acrylate market. Manufacturers are increasingly seeking to reduce their environmental impact by adopting greener production methods and sourcing renewable feedstocks. The development of bio-based ethyl acrylate from renewable resources, such as biomass, is gaining traction as an alternative to traditional fossil fuel-derived production. This shift toward sustainability is not only responding to consumer preferences for eco-friendly products but also aligning with regulatory requirements aimed at reducing carbon emissions and promoting circular economies.

The rise of digital technologies and data analytics in manufacturing processes is also impacting the ethyl acrylate market. Smart manufacturing techniques, including real-time monitoring and predictive maintenance, are helping manufacturers optimize production efficiency and reduce downtime. By leveraging data analytics, companies can make informed decisions about resource allocation, inventory management, and quality control, ultimately improving their operational performance.

Moreover, ongoing research and development in the field of polymer chemistry are exploring new applications and formulations for ethyl acrylate. As industries seek innovative solutions to address emerging challenges, the potential for ethyl acrylate to be used in new products and applications continues to expand. For example, research into ethyl acrylate-based adhesives and sealants that exhibit enhanced performance characteristics is driving interest in this chemical compound for various industrial applications.

What Is Driving the Growth in the Ethyl Acrylate Market?

The growth in the ethyl acrylate market is driven by several key factors, including increasing demand for high-performance coatings and adhesives, the expansion of the construction and automotive industries, and the focus on sustainable products. One of the primary drivers is the rising demand for advanced coatings that offer durability, weather resistance, and aesthetic appeal. As industries continue to prioritize product quality and performance, ethyl acrylate-based coatings are increasingly being utilized to meet these requirements, contributing to market growth.The expansion of the automotive and construction industries is another significant factor driving the demand for ethyl acrylate. In the automotive sector, the need for high-quality paints, sealants, and adhesives that provide protection and performance is driving the use of ethyl acrylate in manufacturing processes. Similarly, the construction industry relies on ethyl acrylate for adhesives and sealants that ensure structural integrity and enhance building aesthetics. As global construction activities increase, the demand for ethyl acrylate in this sector is expected to grow.

Additionally, the trend towards sustainability and environmentally friendly products is influencing the ethyl acrylate market. Consumers and regulatory bodies are increasingly demanding products that are safe for the environment and human health. This has led manufacturers to explore sustainable formulations and production methods, including bio-based ethyl acrylate options. The growing emphasis on eco-friendly practices is encouraging companies to innovate and develop products that align with these values, boosting demand for sustainable ethyl acrylate solutions.

Moreover, the increasing awareness of health and safety standards in various industries is driving the demand for high-quality ethyl acrylate products. As industries adopt stricter regulations regarding the use of chemicals and materials, manufacturers are seeking reliable and compliant solutions that meet safety requirements. Ethyl acrylate's versatility and performance characteristics position it well to meet these demands across multiple applications.

Finally, the expansion of research and development activities in polymer chemistry is uncovering new applications for ethyl acrylate. Ongoing studies and innovations in product formulations are exploring its potential in various sectors, including textiles, electronics, and healthcare. As new applications emerge, the demand for ethyl acrylate is likely to expand, creating opportunities for market growth.

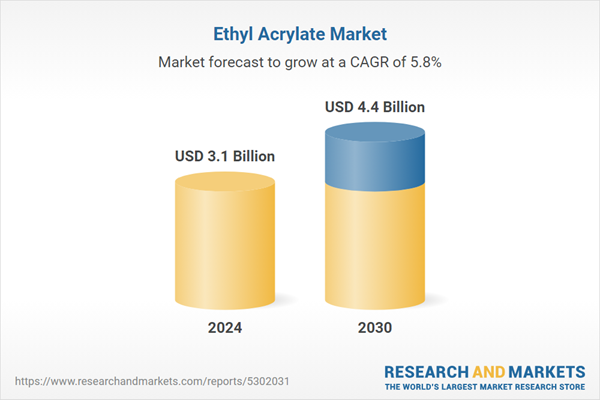

In conclusion, the ethyl acrylate market is poised for significant growth driven by increasing demand for high-performance coatings and adhesives, expansion in the construction and automotive sectors, and a focus on sustainability. Technological advancements in production processes, product formulations, and research into new applications will further enhance the market's potential. As industries continue to seek innovative solutions that prioritize quality and environmental responsibility, the demand for ethyl acrylate is expected to flourish in the coming years.

Report Scope

The report analyzes the Ethyl Acrylate market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Surface Coatings, Adhesive & Sealants, Plastic Additives, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Surface Coatings Application segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of a 6.1%. The Adhesive & Sealants Application segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $816.3 Million in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $992.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ethyl Acrylate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ethyl Acrylate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ethyl Acrylate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide, Arkema, BASF, DOW Chemical Company, Evonik Industries and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Ethyl Acrylate market report include:

- Air Liquide

- Arkema

- BASF

- DOW Chemical Company

- Evonik Industries

- Formosa Plastics Corporation

- LG Chem.

- Merck Millipore

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Polysciences, Inc.

- Sasol Limited

- Saudi Acrylic Monomer Company Limited

- Sibur

- Synthomer

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide

- Arkema

- BASF

- DOW Chemical Company

- Evonik Industries

- Formosa Plastics Corporation

- LG Chem.

- Merck Millipore

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Polysciences, Inc.

- Sasol Limited

- Saudi Acrylic Monomer Company Limited

- Sibur

- Synthomer

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |