Global Industrial Hoists Market - Key Trends & Growth Drivers Summarized

Why Are Industrial Hoists Essential for Material Handling and Heavy Lifting?

Industrial hoists have become vital tools in various sectors, providing essential support for lifting and moving heavy loads safely and efficiently. But what exactly makes industrial hoists so crucial in today's industrial landscape? Industrial hoists are mechanical devices designed to lift and lower heavy objects using a system of ropes, chains, or cables, powered either manually or electrically. They are widely used in manufacturing, construction, warehousing, and shipping, allowing for the safe handling of equipment, materials, and goods. Their ability to increase efficiency and reduce the risk of injury makes industrial hoists indispensable for businesses that rely on heavy lifting.The demand for industrial hoists has surged as industries continue to expand and modernize their operations. As businesses seek to improve productivity and safety in the workplace, the adoption of reliable and efficient lifting solutions has become a priority. Additionally, the growth of e-commerce and the need for efficient logistics solutions have driven the demand for industrial hoists to facilitate the movement of goods within warehouses and distribution centers. As companies strive for operational excellence, the industrial hoists market continues to expand, driven by the increasing need for effective material handling solutions.

How Are Technological Advancements Elevating the Capabilities of Industrial Hoists?

The industrial hoists market has witnessed significant technological advancements that have improved the performance, safety, and usability of these essential devices. But what are the key innovations driving these developments? One of the most impactful advancements is the integration of smart technologies and automation in industrial hoists. Many modern hoists now feature wireless controls, load monitoring systems, and real-time data analytics, allowing operators to manage lifting operations more effectively and safely. These technologies not only enhance the user experience but also contribute to improved operational efficiency and reduced downtime.Another critical innovation is the development of lightweight yet durable materials used in the construction of industrial hoists. Advances in material science have led to the creation of stronger and more resilient components that can handle heavier loads while reducing the overall weight of the hoist. This focus on high-performance materials enhances the mobility and ease of use of industrial hoists, making them suitable for a wider range of applications. As industries increasingly demand versatile and efficient lifting solutions, the trend towards lightweight designs will likely continue to drive growth in the market.

Safety features have also seen significant advancements in industrial hoists. Manufacturers are incorporating advanced braking systems, overload protection, and emergency stop functions to enhance user safety. These features not only help prevent accidents and injuries but also ensure compliance with strict safety regulations in industrial settings. As companies prioritize workplace safety, the demand for industrial hoists equipped with advanced safety features is expected to rise.

What Market Trends Are Driving the Adoption of Industrial Hoists Across Various Sectors?

Several key market trends are shaping the adoption of industrial hoists across various sectors, reflecting the evolving needs of industries and advancements in technology. One of the most prominent trends is the increasing demand for automation in material handling processes. As businesses strive to enhance productivity and reduce labor costs, there is a growing reliance on industrial hoists to facilitate efficient lifting and movement of materials within facilities. This trend is particularly evident in sectors such as manufacturing, logistics, and construction, where the need for rapid and efficient material handling is paramount.Another key trend driving the adoption of industrial hoists is the rising emphasis on workplace safety and ergonomics. As organizations prioritize employee well-being and compliance with safety regulations, the demand for hoists that incorporate ergonomic designs and advanced safety features is increasing. Industrial hoists designed to reduce operator fatigue and improve usability are gaining traction in the market. This trend encourages manufacturers to develop innovative lifting solutions that prioritize safety, comfort, and ease of use.

The growth of e-commerce and changes in consumer behavior are also influencing the industrial hoists market. As online shopping continues to expand, businesses are investing in warehouse automation and efficient material handling solutions to meet increasing order volumes. This shift drives demand for versatile industrial hoists that can adapt to various tasks, from loading and unloading to lifting and moving heavy equipment. As businesses look to enhance their logistics capabilities, the adoption of advanced industrial hoist solutions is expected to accelerate.

What Factors Are Driving the Growth of the Global Industrial Hoists Market?

The growth in the global industrial hoists market is driven by several factors, including the increasing demand for efficient lifting solutions, advancements in technology, and the rising focus on safety and automation. One of the primary growth drivers is the rapid expansion of industries such as construction, manufacturing, and logistics, where effective material handling is essential for operational success. As these sectors continue to grow, the demand for reliable and innovative industrial hoists that meet their specific lifting needs is expected to rise.Another key growth driver is the ongoing advancement of technology that enhances the capabilities and efficiency of industrial hoists. Innovations in automation, control systems, and lightweight materials are enabling manufacturers to produce more efficient and user-friendly lifting equipment. As organizations seek to leverage these advancements to improve their operational efficiency and meet market demands, the demand for high-quality industrial hoists is anticipated to grow. Additionally, the increasing availability of affordable and high-performance hoisting equipment is making this technology more accessible to a broader range of businesses.

The global industrial hoists market is also benefiting from the rising emphasis on regulatory compliance and quality standards in material handling practices. As consumers and businesses prioritize safety and reliability in their operations, the demand for industrial hoists that meet high manufacturing standards is increasing. Manufacturers are investing in research and development to ensure that their products comply with industry regulations and provide reliable results, driving growth in the market.

With ongoing advancements in technology, the increasing demand for efficient lifting solutions, and the rising focus on safety and automation, the global industrial hoists market is poised for sustained growth. The dynamic interplay of technological innovation, market demand, and evolving consumer preferences is set to shape the future of the market, offering businesses new opportunities to enhance their product offerings, optimize performance, and drive revenue growth. As companies continue to prioritize effective industrial hoist solutions as part of their overall operational strategies, these machines will remain essential tools for achieving success in the competitive industrial landscape.

Report Scope

The report analyzes the Industrial Hoists market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Industrial Hoists).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $3.8 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Hoists Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Hoists Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Hoists Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Able Forge, Abus, Beijing Lieying, Columbus McKinnon, Daesan and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Industrial Hoists market report include:

- Able Forge

- Abus

- Beijing Lieying

- Columbus McKinnon

- Daesan

- Endo Kogyo

- Hitachi

- Imer International

- Ingersoll Rand

- J.D. Neuhaus

- Kawasaki

- Kito

- Konecranes

- Planeta

- Shanghai Yiying

- Terex

- Toyo

- Tractel

- Verlinde

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Able Forge

- Abus

- Beijing Lieying

- Columbus McKinnon

- Daesan

- Endo Kogyo

- Hitachi

- Imer International

- Ingersoll Rand

- J.D. Neuhaus

- Kawasaki

- Kito

- Konecranes

- Planeta

- Shanghai Yiying

- Terex

- Toyo

- Tractel

- Verlinde

Table Information

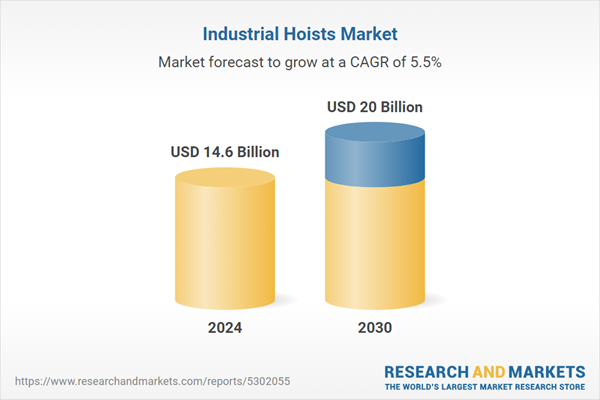

| Report Attribute | Details |

|---|---|

| No. of Pages | 129 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.6 Billion |

| Forecasted Market Value ( USD | $ 20 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |