Global Ruthenium Market - Key Trends and Drivers Summarized

What Is Ruthenium and Why Is It So Rare?

Ruthenium is one of the lesser-known members of the platinum group metals, yet its rarity and unique properties make it highly valuable in several cutting-edge industrial applications. Like other metals in its group, such as platinum, palladium, and rhodium, ruthenium is primarily found in the Earth's crust in trace amounts, making it incredibly scarce. The majority of ruthenium is sourced from mining operations in countries like Russia and South Africa, where it is extracted as a by-product of platinum and nickel mining. Its silvery-white appearance and impressive durability make ruthenium highly resistant to corrosion and oxidation, even at high temperatures. This stability makes it indispensable in high-performance electronics and other technological applications. Though it is not as well-known as gold or platinum, ruthenium is a crucial material in industries requiring long-lasting, corrosion-resistant materials, ensuring its place as one of the most valuable, albeit lesser-utilized, precious metals in the world.Why Is Ruthenium Essential for Technological and Industrial Applications?

Ruthenium's importance to industry stems from its unique combination of chemical and physical properties, which make it indispensable in several key sectors, most notably electronics, chemical processing, and the jewelry industry. In electronics, ruthenium is increasingly used to create hard disk drives and other data storage devices due to its excellent conductive properties and durability. As the need for data storage continues to expand in the digital age, ruthenium plays a vital role in producing more efficient and long-lasting components. Another significant use of ruthenium is as a coating for electrical contacts, which benefit from the metal's high resistance to wear and corrosion. Ruthenium-coated contacts are essential in environments where reliable conductivity is needed over long periods without degradation. In the chemical industry, ruthenium's catalytic properties make it valuable in catalysis for various chemical reactions, including ammonia production and hydrogenation processes. It is also used as an alloying agent with platinum to increase the hardness and durability of platinum-based materials, especially in the production of jewelry and catalytic converters. This wide range of applications across several high-tech and industrial fields highlights the growing importance of ruthenium in modern technology.What Are the Emerging Trends Influencing Ruthenium Demand?

Several emerging trends are influencing the demand for ruthenium, especially as technology evolves and industries seek materials that can meet the demands of more advanced applications. One of the most significant trends is the increasing reliance on data storage solutions in the digital age. As global data generation continues to skyrocket, the demand for high-performance hard disk drives and memory storage devices, which use ruthenium as a key material, has surged. Ruthenium's role in improving data storage efficiency and longevity makes it an essential component in this rapidly expanding market. Another key trend is the growing importance of sustainable energy solutions, where ruthenium is gaining attention for its use in fuel cells and hydrogen production technologies. Fuel cells, which generate electricity by combining hydrogen and oxygen, rely on ruthenium's catalytic properties to improve the efficiency of the reactions. This application positions ruthenium as a valuable material in the shift towards cleaner energy sources. In addition to its role in emerging technologies, ruthenium's continued use in traditional industries such as jewelry and electronics is further driving demand. As industries push for materials that can withstand harsher environments and higher temperatures, ruthenium's corrosion resistance and chemical stability make it an attractive choice. Moreover, as global economies modernize and digitize, particularly in regions like Asia and Africa, the demand for electronic devices and infrastructure is increasing, indirectly boosting the demand for ruthenium.What Are the Key Factors Driving the Growth of the Ruthenium Market?

The growth in the ruthenium market is driven by several important factors, including technological advancements, evolving industrial needs, and its limited availability. One of the primary drivers is the increasing need for high-performance electronic components, particularly in the data storage industry. As the demand for faster and more reliable hard disk drives grows, so does the need for ruthenium, which plays a critical role in enhancing the efficiency and lifespan of these devices. Another major factor is the growing focus on clean energy technologies, where ruthenium's use in hydrogen fuel cells and other sustainable energy applications is expanding rapidly. With global efforts to reduce carbon emissions and transition to cleaner energy sources, ruthenium's role as a catalyst in fuel cell technology positions it as a vital material for the future of renewable energy. Ruthenium is primarily obtained as a by-product of platinum mining, meaning its production is closely tied to the demand and supply dynamics of platinum. Given the limited number of mines capable of producing ruthenium, and the complex processes involved in extracting it, supply shortages are not uncommon. This scarcity, combined with growing demand across various industries, leads to price volatility and market growth. Additionally, the increasing miniaturization of electronic devices has heightened the demand for ruthenium as it is ideal for creating smaller, more efficient electrical contacts and connectors. Finally, geopolitical factors, such as political stability in major producing regions like Russia and South Africa, directly impact the global supply chain for ruthenium, further driving its value and market expansion. These intertwined factors, driven by both technological needs and supply constraints, are ensuring robust growth in the ruthenium market, making it an indispensable metal for future industrial and technological advancements.Report Scope

The report analyzes the Ruthenium market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Automobile, Pharmaceutical, Refinery).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automobile End-Use segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of a 5%. The Pharmaceutical End-Use segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ruthenium Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ruthenium Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ruthenium Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

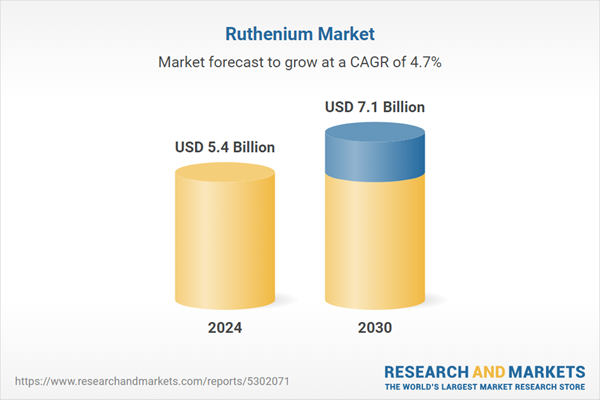

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Elements, Apeiron Synthesis, BASF, Dyesol, Heraeus Holding GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Ruthenium market report include:

- American Elements

- Apeiron Synthesis

- BASF

- Dyesol

- Heraeus Holding GmbH

- Johnson Matthey

- Merck KGaA

- Oxkem

- Strem Chemicals Inc.

- Tanaka Kikinzoku Kogyo K.K.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Elements

- Apeiron Synthesis

- BASF

- Dyesol

- Heraeus Holding GmbH

- Johnson Matthey

- Merck KGaA

- Oxkem

- Strem Chemicals Inc.

- Tanaka Kikinzoku Kogyo K.K.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |