Global Rhodium Market - Key Trends and Drivers Summarized

What Is Rhodium and Why Is It So Rare?

Rhodium is one of the rarest and most valuable precious metals, often overlooked despite its significant industrial applications. It belongs to the platinum group of metals, sharing properties with elements like platinum and palladium, but it stands out for its extreme rarity. Rhodium is found in the Earth's crust in exceedingly small amounts, and it is usually extracted as a by-product of platinum and nickel mining, primarily in regions like South Africa, Russia, and, to a lesser extent, North America. The extraction process is complex and costly, contributing to its scarcity and high market value. What makes rhodium particularly special is its unique combination of chemical and physical properties. It is highly reflective, extremely resistant to corrosion, and has a high melting point, which means it can endure harsh environments without degrading. These characteristics are not only rare but also irreplaceable in certain industrial applications, further enhancing its value. With its shining silvery appearance and high durability, rhodium is sought after for both functional and decorative uses, although its scarcity makes it one of the most expensive metals in the world today.Why Is Rhodium So Important for Industrial Applications?

Rhodium's importance stems from its unparalleled utility in industrial applications, particularly in sectors where its corrosion resistance and catalytic properties are essential. Its most critical use is in the automotive industry, where it plays a vital role in catalytic converters. Catalytic converters, required in nearly all vehicles with internal combustion engines, reduce harmful emissions by converting toxic gases like nitrogen oxides into less harmful substances such as nitrogen and oxygen. Rhodium's unique ability to handle high temperatures and resist corrosion makes it the preferred choice for this application, as it ensures durability and effectiveness over time. With increasingly stringent environmental regulations, especially in regions like North America, Europe, and China, automakers are using more rhodium in catalytic converters to comply with tough emissions standards. Beyond the automotive sector, rhodium's reflective properties make it invaluable in industries like optics, electronics, and jewelry manufacturing. It is used in the production of high-precision mirrors, electrical contacts, and protective coatings for other metals due to its high shine and resistance to tarnishing. While it remains relatively niche compared to metals like gold or platinum, rhodium is indispensable in industries where performance under extreme conditions is required.What Are the Current Trends Shaping the Demand for Rhodium?

Several key trends are shaping the demand for rhodium, primarily driven by environmental regulations, industrial shifts, and technological advancements. The most significant trend is the global tightening of vehicle emissions regulations, which has directly increased demand for rhodium in the automotive sector. Countries around the world, particularly in Europe, China, and the United States, are enforcing stricter emissions standards in an effort to reduce air pollution and combat climate change. As a result, automakers are using higher quantities of rhodium in catalytic converters to meet these regulations. This demand surge has caused rhodium prices to skyrocket in recent years, making it one of the most expensive metals in the world. Simultaneously, the rise of hybrid and electric vehicles has created mixed effects on rhodium's future demand. While fully electric vehicles do not require catalytic converters, hybrid vehicles still use internal combustion engines that rely on rhodium for emissions control. Thus, the shift toward hybrid cars continues to support rhodium demand even as the world gradually moves toward electrification. Moreover, outside the automotive industry, rhodium's uses in sectors like electronics, chemicals, and renewable energy have expanded, as industries seek materials that can perform under extreme conditions, further contributing to its growing market relevance.What Factors Are Driving the Growth of the Rhodium Market?

The growth in the rhodium market is driven by several interrelated factors, ranging from technological advancements and regulatory changes to supply chain dynamics and consumer behavior in key industries. A primary driver is the increasing pressure on automakers to meet stricter global emissions standards, which has pushed the automotive industry to increase the use of rhodium in catalytic converters. As countries worldwide enforce tighter regulations to reduce carbon footprints and improve air quality, the need for rhodium has surged, particularly in regions with the most stringent standards. Another significant growth driver is the expansion of technological applications that require materials with high corrosion resistance and thermal stability, which only rhodium can offer. Beyond the automotive industry, rhodium is finding new uses in cutting-edge technologies, including renewable energy systems, where its durability in harsh environments makes it essential for certain high-performance components. Supply-side constraints also play a critical role in rhodium's market growth. The limited number of mines producing rhodium, most of which are concentrated in South Africa, combined with the complexity of its extraction as a by-product, has created a tight supply that cannot easily be expanded. This scarcity is exacerbated by geopolitical risks and labor issues in mining regions, which can lead to supply chain disruptions, pushing prices even higher. Additionally, the rise of e-commerce has simplified the procurement of rhodium for industrial applications, enabling faster and more efficient sourcing of this precious metal globally. Finally, consumer awareness regarding sustainability and environmental impact has indirectly bolstered the rhodium market, as the demand for cleaner, more eco-friendly automotive solutions requires materials like rhodium to ensure compliance with environmental regulations. Altogether, these factors create a strong foundation for continued growth in the rhodium market, ensuring its importance in both traditional and emerging industrial applications for years to come.Report Scope

The report analyzes the Rhodium market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Automobile, Refinery, Pharmaceutical).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automobile End-Use segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 5.4%. The Refinery End-Use segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rhodium Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rhodium Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rhodium Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as African Rainbow Minerals Ltd., Alfa Aesar, Amass Metals, American Elements, Anglo American Platinum Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this Rhodium market report include:

- African Rainbow Minerals Ltd.

- Alfa Aesar

- Amass Metals

- American Elements

- Anglo American Platinum Ltd.

- Anglo American PLC

- Arora Matthey Limited

- Catalysts and Technologies

- Chimet S.P.A.

- DCL International, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- African Rainbow Minerals Ltd.

- Alfa Aesar

- Amass Metals

- American Elements

- Anglo American Platinum Ltd.

- Anglo American PLC

- Arora Matthey Limited

- Catalysts and Technologies

- Chimet S.P.A.

- DCL International, Inc.

Table Information

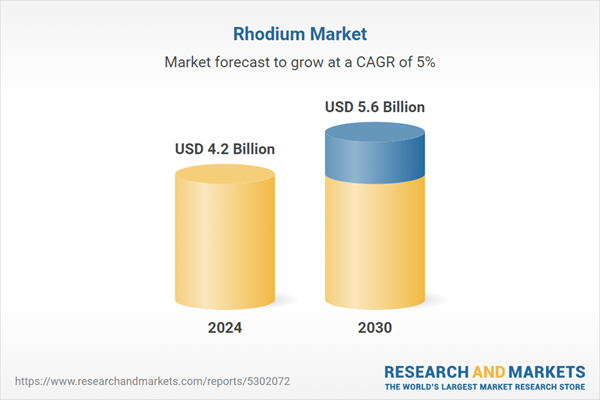

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 5.6 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |