Global Credit Risk Management Market - Key Trends and Drivers Summarized

What Is Credit Risk Management and Why Is It Crucial for Financial Stability?

Credit Risk Management (CRM) is a systematic approach used by financial institutions, businesses, and lending organizations to identify, evaluate, and mitigate the risk associated with a borrower's inability to repay a loan or meet contractual obligations. This process is crucial for maintaining financial stability and protecting the interests of both lenders and investors, as credit risk is one of the most significant sources of potential loss in the banking and finance sectors. CRM involves a variety of activities, including credit risk assessment, setting credit limits, monitoring loan performance, and implementing strategies to manage or transfer risk. Traditionally, credit risk was managed using basic financial ratios and credit scoring models. However, with the increasing complexity of financial markets and the global interconnectedness of economies, modern credit risk management now employs more sophisticated tools and methodologies, such as predictive analytics, machine learning, and scenario analysis. Effective CRM not only helps institutions prevent loan defaults but also optimizes capital allocation, enhances decision-making, and ensures compliance with stringent regulatory requirements like Basel III and IFRS 9. As credit risk is a dynamic and multifaceted challenge, robust credit risk management frameworks are essential for anticipating and responding to economic downturns, market volatility, and other financial disruptions that can impact the creditworthiness of borrowers.How Are Technological Innovations Transforming Credit Risk Management?

Technological advancements are significantly transforming the landscape of credit risk management, making the process more efficient, accurate, and proactive. One of the most impactful developments is the integration of artificial intelligence (AI) and machine learning (ML) into credit risk assessment models. These technologies enable institutions to analyze vast amounts of data in real-time, uncover patterns, and generate more accurate credit risk scores. AI-driven models can incorporate non-traditional data sources, such as social media activity, behavioral trends, and macroeconomic indicators, to create a holistic view of a borrower's risk profile, providing deeper insights than traditional credit scoring methods. Furthermore, machine learning algorithms can continually refine their risk predictions as new data becomes available, allowing for dynamic risk assessment that adapts to changing market conditions. The use of big data analytics is also playing a pivotal role, enabling credit risk managers to detect early warning signs of potential defaults by analyzing transactional data, payment histories, and sector-specific trends. Another technological innovation is the adoption of cloud-based CRM solutions, which offer scalability, flexibility, and real-time collaboration capabilities. Cloud technology allows financial institutions to centralize their risk data, making it accessible to various stakeholders while ensuring compliance with data security regulations. Additionally, the development of advanced scenario analysis and stress-testing tools has enhanced the ability of institutions to simulate a range of adverse economic conditions, helping them to better prepare for unexpected shocks. Blockchain technology is also emerging as a potential game-changer in credit risk management by providing a transparent and immutable record of credit histories, reducing the risk of fraud and improving the accuracy of credit evaluations.How Are Shifting Market Conditions and Regulatory Pressures Shaping the Credit Risk Management Landscape?

The credit risk management landscape is being reshaped by evolving market conditions, changing regulatory frameworks, and the increasing complexity of global financial systems. In recent years, financial institutions have faced mounting pressure to enhance their credit risk management practices due to factors such as economic uncertainty, geopolitical tensions, and the rapid pace of technological change. Regulatory requirements have also become more stringent, with global standards such as Basel III, IFRS 9, and the Comprehensive Capital Analysis and Review (CCAR) mandating higher levels of transparency, capital adequacy, and more sophisticated risk assessment models. Compliance with these regulations has driven financial institutions to adopt more advanced CRM technologies that can ensure accurate reporting, track risk metrics in real-time, and maintain audit trails. Market dynamics are also influencing the CRM landscape, as low interest rates and increased competition in the lending sector have led to a search for new revenue streams, often resulting in higher risk-taking. This has spurred demand for more granular and dynamic credit risk assessment tools that can provide insights at the portfolio, customer, and transaction levels. Additionally, the rise of non-bank financial institutions and fintech firms, which often operate with different risk profiles and less regulatory oversight, is complicating the risk environment, pushing traditional banks to strengthen their CRM practices to remain competitive.What Are the Key Growth Drivers in the Credit Risk Management Market?

The growth in the credit risk management market is driven by several critical factors, including the increasing complexity of financial markets, stringent regulatory requirements, and the rising adoption of advanced risk management technologies. One of the primary drivers is the need for more robust risk assessment frameworks in response to the growing complexity and volatility of global financial systems. Financial institutions are dealing with a wider array of risks, from economic downturns and geopolitical instability to rapid changes in market dynamics, necessitating more sophisticated tools to assess and manage credit risk effectively. Regulatory pressure is another significant growth driver, as standards such as Basel III and IFRS 9 require institutions to adopt comprehensive risk management strategies that include forward-looking credit risk models, stress testing, and capital adequacy planning. Compliance with these regulations is not just a matter of legal obligation but also a critical factor in maintaining investor confidence and avoiding penalties. Technological advancements, particularly in AI, big data analytics, and cloud computing, are also fueling growth in the CRM market. These technologies enable institutions to analyze large and diverse data sets, automate routine tasks, and generate actionable insights, improving the efficiency and accuracy of credit risk assessments. The rising focus on digital transformation across the financial sector has further accelerated the adoption of cloud-based CRM solutions, which offer scalability, real-time data access, and enhanced collaboration features. Another growth driver is the increasing demand for CRM solutions from non-banking financial institutions, such as fintech firms, asset management companies, and peer-to-peer lenders, which are expanding their lending operations and require sophisticated risk management tools to manage their diverse portfolios. These diverse growth drivers are positioning the credit risk management market for sustained expansion, as institutions continue to invest in advanced technologies and strategies to navigate an increasingly uncertain financial landscape.Report Scope

The report analyzes the Credit Risk Management market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (BFSI, Retail & Consumer Goods, IT & Telecom, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $674.7 Million in 2024, and China, forecasted to grow at an impressive 20.1% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Credit Risk Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Credit Risk Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Credit Risk Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACTICO GmbH, Experian Information Solutions Inc., Finastra (Turaz Global S.à r.l), Fiserv Inc., IBM Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 23 companies featured in this Credit Risk Management market report include:

- ACTICO GmbH

- Experian Information Solutions Inc.

- Finastra (Turaz Global S.à r.l)

- Fiserv Inc.

- IBM Corporation

- Oracle Corporation

- Pegasystems Inc.

- Resolver Inc.

- SAP SE

- SAS Institute Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACTICO GmbH

- Experian Information Solutions Inc.

- Finastra (Turaz Global S.à r.l)

- Fiserv Inc.

- IBM Corporation

- Oracle Corporation

- Pegasystems Inc.

- Resolver Inc.

- SAP SE

- SAS Institute Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 167 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

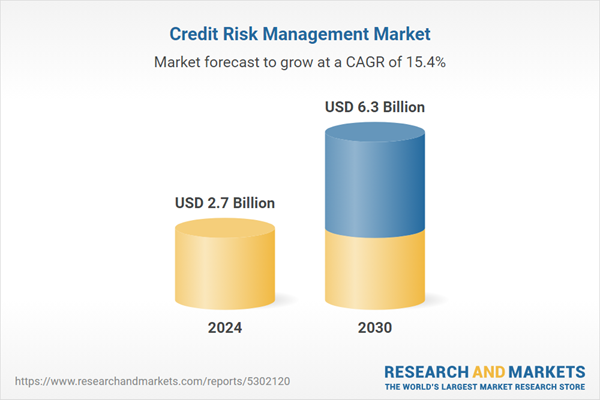

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 6.3 Billion |

| Compound Annual Growth Rate | 15.4% |

| Regions Covered | Global |