Global Integrated Sensors Market - Key Trends and Drivers Summarized

What Role Do Integrated Sensors Play in Enhancing System Functionality and Efficiency?

Integrated sensors are transforming the landscape of modern electronics by enabling more compact, efficient, and versatile designs that can be applied across a multitude of sectors. These sensors, which combine multiple sensing elements and functions into a single package, provide multi-parameter measurements such as temperature, humidity, pressure, and motion, making them ideal for a range of complex applications. By integrating different sensing capabilities, they eliminate the need for multiple discrete sensors, thereby reducing the overall size, weight, and power consumption of devices. This miniaturization is crucial for applications in fields such as consumer electronics, automotive, and healthcare, where space constraints and energy efficiency are paramount. In smartphones, for instance, integrated sensors enable features like gesture recognition, screen orientation, and environmental monitoring without adding bulk or complexity to the device's internal architecture. In automotive systems, integrated sensors contribute to advanced driver-assistance systems (ADAS), enhancing safety and performance through precise monitoring of parameters like tire pressure, vehicle dynamics, and environmental conditions. Additionally, the integration of multiple sensing functions reduces wiring complexity, which in turn improves system reliability and simplifies manufacturing processes. As a result, integrated sensors are becoming essential in any design where multifunctionality, efficiency, and compactness are prioritized.How Are Advanced Technologies Shaping the Evolution of Integrated Sensors?

The evolution of integrated sensors is being driven by rapid advancements in semiconductor technology, MEMS (Microelectromechanical Systems), and nanotechnology, which are pushing the boundaries of what these sensors can achieve. One key trend is the development of highly sophisticated System-on-Chip (SoC) solutions, where sensor functionalities are combined with microprocessors, signal processing units, and communication modules, all within a single chip. This integration allows for local data processing, reducing the need to transmit large volumes of raw data and thereby minimizing latency and power consumption. Additionally, breakthroughs in MEMS technology have enabled the production of micro-scale integrated sensors with improved sensitivity and durability, making them suitable for use in harsh environments such as industrial automation, aerospace, and defense applications. Another transformative technology is the incorporation of artificial intelligence (AI) at the sensor level, which allows integrated sensors to perform complex data analysis and pattern recognition tasks directly on the device. This capability is particularly valuable in IoT applications, where the ability to filter and interpret data at the edge minimizes the computational load on central systems and enhances real-time decision-making. Furthermore, the use of advanced materials such as graphene and nanowires has opened up new possibilities for creating sensors with unprecedented levels of accuracy and flexibility.Where Are Integrated Sensors Being Deployed and What Benefits Do They Offer?

The deployment of integrated sensors spans a diverse array of sectors, driven by their ability to offer enhanced functionality, reliability, and ease of integration into complex systems. In the automotive industry, integrated sensors are playing a pivotal role in the development of autonomous vehicles, where they provide critical inputs for navigation, collision avoidance, and vehicle health monitoring. Multi-function integrated sensors are used to simultaneously monitor parameters such as acceleration, gyroscopic orientation, and magnetic field strength, feeding data into advanced algorithms that enable precise vehicle control and situational awareness. In healthcare, integrated sensors are revolutionizing patient monitoring by allowing the continuous measurement of vital signs like heart rate, blood pressure, and blood oxygen levels in compact wearable devices. This not only enhances patient comfort but also enables real-time health analytics, reducing the need for frequent hospital visits and enabling early detection of potential health issues. Similarly, in smart home applications, integrated environmental sensors that measure temperature, humidity, and air quality are used to optimize energy use and indoor comfort automatically. In industrial automation, integrated sensors are employed to monitor machinery conditions, such as vibration, temperature, and operational status, providing real-time insights that enable predictive maintenance and minimize downtime. The adoption of integrated sensors is also expanding in the environmental monitoring sector, where they are used to track multiple parameters simultaneously, such as soil moisture, atmospheric conditions, and pollution levels, thereby supporting precision agriculture and environmental conservation efforts.What's Fueling the Expansion of the Integrated Sensors Market?

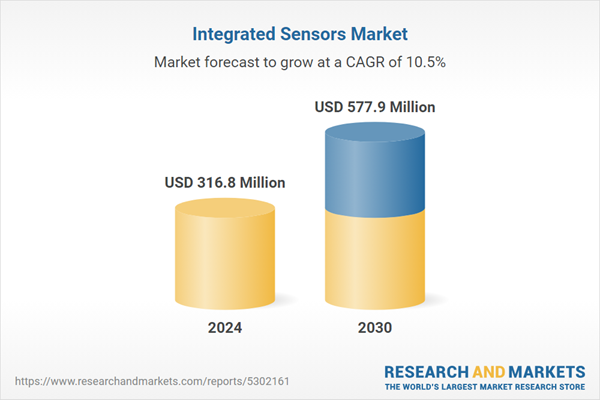

The growth in the integrated sensors market is driven by several factors, including the increasing demand for miniaturized and multi-functional devices, the proliferation of IoT (Internet of Things) applications, and the rapid expansion of autonomous and connected technologies across various industries. One of the key drivers is the rising trend of device miniaturization, which is prompting manufacturers to incorporate integrated sensors into compact designs without compromising on performance or functionality. This is particularly evident in consumer electronics, where there is a growing need for smaller, lighter, and more energy-efficient devices that can perform a wide range of functions, from health monitoring to environmental sensing. Another critical factor is the widespread adoption of IoT technologies, which rely heavily on integrated sensors to collect and process data from distributed networks. As IoT ecosystems expand in sectors such as smart homes, smart cities, and industrial automation, the demand for integrated sensors that can provide accurate and multi-modal data is increasing rapidly. Furthermore, the automotive industry's shift towards electric and autonomous vehicles is fueling demand for highly integrated sensors that can support advanced safety features, energy management, and vehicle-to-everything (V2X) communication. The need for sensors that can withstand harsh environments and deliver reliable performance under varying conditions is also driving innovation in material science and sensor design. Additionally, the healthcare sector is experiencing a surge in demand for integrated sensors, driven by the growing popularity of wearable devices and the need for remote patient monitoring solutions. These devices rely on integrated sensors to deliver continuous and non-invasive health monitoring, which is becoming increasingly important in managing chronic conditions and supporting preventive healthcare. As a result, the integrated sensors market is expected to see sustained growth, supported by technological advancements, increased adoption across diverse applications, and the need for multifunctional, cost-effective solutions that can meet the evolving demands of modern technology ecosystems.Report Scope

The report analyzes the Integrated Sensors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Government & Public Utilities, Industrial, Commercial, Consumer Electronics, Healthcare & Pharmaceutical, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Government & Public Utilities End-Use segment, which is expected to reach US$247.4 Million by 2030 with a CAGR of a 11.1%. The Industrial End-Use segment is also set to grow at 9.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $81.3 Million in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $136.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Integrated Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Integrated Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Integrated Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB, Analog Devices, Eaton Corporation, Emerson Electric, Honeywell and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Integrated Sensors market report include:

- ABB

- Analog Devices

- Eaton Corporation

- Emerson Electric

- Honeywell

- NXP Semiconductor

- Robert Bosch

- Siemens

- STMicroelectronics

- TE Connectivity

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB

- Analog Devices

- Eaton Corporation

- Emerson Electric

- Honeywell

- NXP Semiconductor

- Robert Bosch

- Siemens

- STMicroelectronics

- TE Connectivity

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 316.8 Million |

| Forecasted Market Value ( USD | $ 577.9 Million |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |