Global Piezoelectric Ceramics Market - Key Trends and Drivers Summarized

How Are Piezoelectric Ceramics Paving the Way for Smart Technologies?

Piezoelectric ceramics are a unique class of advanced materials that generate an electric charge in response to mechanical stress and, conversely, can produce mechanical movement when exposed to an electrical field. This dual functionality is made possible by their crystalline structure, which lacks a center of symmetry, allowing ions within the material to displace under applied pressure or electric fields. Typically composed of lead zirconate titanate (PZT), barium titanate, or other complex oxides, piezoelectric ceramics are engineered to exhibit high sensitivity and durability, making them indispensable in a broad range of applications. The ability of these ceramics to convert mechanical energy into electrical energy, and vice versa, is leveraged in a variety of industries, from electronics and automotive to medical and energy harvesting. For instance, in sensing applications, piezoelectric ceramics can detect minute changes in pressure, acceleration, or force, generating electrical signals that are used to monitor or control systems. Conversely, in actuation applications, they can create precise vibrations or movements in response to electrical inputs, making them suitable for micro-positioning devices, ultrasonic transducers, and precision machinery. The versatility of piezoelectric ceramics lies not only in their energy conversion capabilities but also in their adaptability to various shapes and sizes, allowing for the development of innovative devices ranging from micro-scale sensors to large-scale actuators.Why Are Piezoelectric Ceramics So Important in Modern Technology?

Piezoelectric ceramics are at the heart of many modern technologies due to their unparalleled ability to convert mechanical energy into electrical signals and vice versa, enabling a diverse range of applications that are critical for advanced electronic systems. One of the most significant advantages of these ceramics is their high sensitivity to pressure, making them ideal for use in sensors that require precision and reliability. In the automotive industry, for example, piezoelectric sensors are employed in fuel injectors, anti-lock braking systems (ABS), and engine knock detectors, where they play a crucial role in enhancing vehicle safety and performance. In the medical field, piezoelectric ceramics are used in ultrasound imaging equipment to generate and receive high-frequency sound waves, enabling non-invasive diagnostic procedures with high accuracy. Moreover, they are a key component in piezoelectric actuators, which are used in various precision applications, such as in inkjet printers, optical devices, and micro-electromechanical systems (MEMS), where their rapid response and fine control are essential. Another notable application is in energy harvesting systems, where piezoelectric ceramics can capture and convert ambient mechanical vibrations into usable electrical energy, offering a sustainable solution for powering low-energy devices such as wireless sensors and portable electronics. With the growing focus on renewable energy and sustainable technologies, the role of piezoelectric ceramics in energy harvesting is expected to expand significantly.How Are Manufacturers Innovating to Expand the Potential of Piezoelectric Ceramics?

The piezoelectric ceramics market is undergoing rapid innovation as manufacturers seek to enhance the performance, versatility, and environmental sustainability of these materials to meet the evolving demands of various high-tech industries. One of the most critical areas of innovation is the development of lead-free piezoelectric ceramics. Traditional piezoelectric ceramics, such as lead zirconate titanate (PZT), are known for their excellent piezoelectric properties but contain significant amounts of lead, raising environmental and health concerns. To address this issue, researchers are focusing on creating lead-free alternatives using materials like potassium sodium niobate (KNN) and bismuth sodium titanate (BNT). Additionally, the introduction of composite piezoelectric materials, which combine ceramics with polymers or other flexible materials, has opened new possibilities for the design of lightweight, flexible, and high-performance devices. These composites are particularly suitable for wearable technologies, flexible sensors, and energy harvesting systems, where conventional rigid ceramics might not be practical. Another area of innovation is in the miniaturization and integration of piezoelectric ceramics into micro-electromechanical systems (MEMS) and nano-scale devices. By using advanced fabrication techniques such as thin-film deposition and additive manufacturing, manufacturers can produce micro-scale piezoelectric elements that are integrated directly onto semiconductor wafers, paving the way for compact and highly efficient components in smartphones, medical implants, and advanced robotics. Furthermore, manufacturers are exploring the use of piezoelectric ceramics in smart materials and structures that can self-monitor, self-repair, or adapt to environmental changes, enhancing their functionality in aerospace, automotive, and civil engineering applications. Advances in processing technologies, such as precision sintering and hot-pressing methods, are also enabling the production of ceramics with higher density, improved mechanical strength, and superior piezoelectric properties.What Are the Major Growth Drivers in the Piezoelectric Ceramics Market?

The growth in the piezoelectric ceramics market is driven by several factors, including the increasing demand for precision sensors and actuators, the rising adoption of advanced medical imaging technologies, and the growing focus on energy harvesting and sustainable solutions. One of the primary drivers is the expanding use of piezoelectric ceramics in automotive electronics, where they are used in a wide range of sensors and actuators to enhance vehicle safety, efficiency, and performance. With the shift towards electric and autonomous vehicles, the need for reliable and precise sensing technologies is greater than ever, creating a robust demand for high-performance piezoelectric components. Another significant growth driver is the rising adoption of piezoelectric ceramics in medical applications, particularly in ultrasound imaging and therapeutic devices. The ability of these materials to generate and detect ultrasonic waves makes them essential for high-resolution imaging and non-invasive treatments, supporting the trend towards advanced diagnostics and personalized medicine. Additionally, the increasing emphasis on renewable energy and energy-efficient systems is propelling the demand for piezoelectric ceramics in energy harvesting applications. These materials are uniquely suited to convert ambient mechanical vibrations into electrical energy, making them ideal for powering wireless sensors, portable electronics, and other low-power devices. Moreover, the trend toward miniaturization in consumer electronics, robotics, and industrial automation is driving the development of smaller, more efficient piezoelectric devices that can perform complex tasks with high precision and reliability. Lastly, advancements in material science and processing technologies have enabled the production of more robust and environmentally friendly piezoelectric ceramics, addressing regulatory concerns and opening new opportunities in markets that require lead-free solutions. These factors, coupled with the continuous push for smarter, more efficient technologies, are expected to drive significant growth in the piezoelectric ceramics market in the coming years.Report Scope

The report analyzes the Piezoelectric Ceramics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Capacitors, Data Storage Devices, Optoelectronic Devices, Actuators & Sensors, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Capacitors Application segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 6.2%. The Data Storage Devices Application segment is also set to grow at 5.5% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Piezoelectric Ceramics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Piezoelectric Ceramics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Piezoelectric Ceramics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

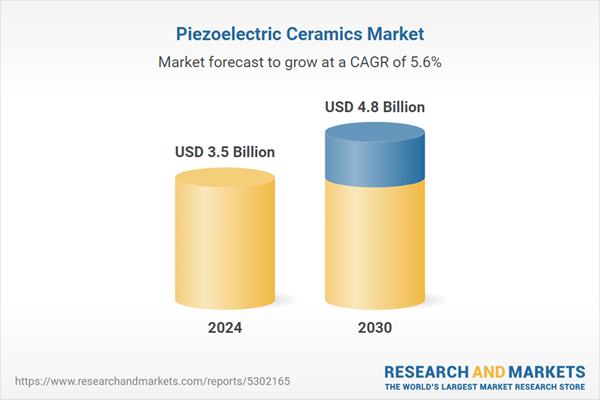

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerotech, Inc., APC International, Ltd., CeramTec GmbH, CTS Corporation, Kistler Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Piezoelectric Ceramics market report include:

- Aerotech, Inc.

- APC International, Ltd.

- CeramTec GmbH

- CTS Corporation

- Kistler Group

- L3harris Technologies, Inc.

- Mad City Labs, Inc

- Physik Instrumente (PI) GmbH & Co. KG.

- Piezo Technologies

- piezosystem jena GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerotech, Inc.

- APC International, Ltd.

- CeramTec GmbH

- CTS Corporation

- Kistler Group

- L3harris Technologies, Inc.

- Mad City Labs, Inc

- Physik Instrumente (PI) GmbH & Co. KG.

- Piezo Technologies

- piezosystem jena GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 4.8 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |