Global Wafer Biscuits Market - Key Trends and Drivers Summarized

What Are Wafer Biscuits and What Makes Them Unique?

Wafer biscuits are a popular type of confectionery snack characterized by their light, crisp texture and layered structure. Typically consisting of thin sheets of baked dough, wafers are stacked together with layers of sweet filling, such as cream, chocolate, or fruit-flavored pastes, making them a versatile and indulgent treat. The unique texture of wafer biscuits comes from their low moisture content and the precise baking process that creates their distinctive, airy crunch. Originating in Europe, wafer biscuits have a rich history, and their production has evolved significantly over the years to include a wide variety of shapes, flavors, and coatings. Today, they are available in numerous forms, from simple rectangular wafers to intricately shaped and multi-layered designs. Their broad appeal lies in their ability to combine contrasting textures - crisp wafers paired with creamy or smooth fillings - making them a favored choice for consumers seeking a satisfying yet light snack. In recent years, manufacturers have further diversified the product range by introducing innovative flavor combinations, such as exotic fruits, nuts, and even savory options, catering to a broader audience and keeping up with changing consumer preferences. As a result, wafer biscuits have become a staple in the global confectionery market, valued for their affordability, ease of consumption, and suitability as both a standalone snack and a component of various desserts.Why Are Wafer Biscuits Gaining Popularity Among Consumers?

Wafer biscuits have gained tremendous popularity in recent years due to several consumer-driven trends and preferences. One of the primary factors contributing to their growing demand is their unique combination of taste, texture, and versatility. Consumers today are increasingly seeking snacks that provide a balance between indulgence and lightness, and wafer biscuits perfectly meet this criterion. Their crispy yet delicate structure, coupled with a wide array of flavors, allows consumers to enjoy them in different contexts - whether as a mid-day snack, a quick treat during travel, or an ingredient in more complex desserts. Additionally, the portability and convenience of wafer biscuits have made them a preferred option for on-the-go snacking, especially as busy lifestyles continue to drive the need for quick yet satisfying food options. Health consciousness has also influenced the market, leading to the emergence of low-sugar, gluten-free, and even high-protein wafer varieties that appeal to health-focused consumers. Meanwhile, premiumization trends have encouraged the launch of high-end wafer biscuits featuring gourmet ingredients, such as Belgian chocolate, Madagascan vanilla, and organic fillings, targeting a more discerning clientele. The increased focus on visual appeal and packaging innovation has further helped wafer biscuits capture consumer attention, as attractive, resealable packaging options enhance their shelf presence and convenience.How Are Manufacturers Adapting to Changing Market Dynamics?

The wafer biscuit market is witnessing a dynamic shift as manufacturers continuously adapt to changing market conditions, technological advancements, and evolving consumer preferences. One of the major trends reshaping the industry is the emphasis on product innovation and diversification. To stand out in a highly competitive landscape, manufacturers are exploring new textures, fillings, and coatings, experimenting with layers of various thicknesses and incorporating different flavor profiles that range from sweet to savory. This focus on innovation is evident in the rise of hybrid products, such as wafer bars that incorporate chocolate coatings, nutty layers, or caramel fillings, providing a multi-sensory experience. Additionally, as consumers become more health-conscious, there is a growing demand for cleaner labels, which has prompted manufacturers to reformulate recipes by eliminating artificial colors, preservatives, and hydrogenated fats. Production technologies have also evolved, with state-of-the-art automated lines allowing for greater precision in creating thinner, more uniform wafers, resulting in enhanced consistency and quality. Another area of focus is sustainability, as consumers and regulatory bodies alike call for eco-friendly practices. Many companies have started adopting sustainable sourcing for raw materials like cocoa and palm oil, and are investing in environmentally friendly packaging solutions. Furthermore, the rising influence of e-commerce and digital marketing has enabled wafer biscuit brands to reach a global audience, leveraging online platforms to launch new products, gather consumer feedback, and engage in targeted advertising strategies.What Are the Key Growth Drivers for the Wafer Biscuit Market?

The growth in the wafer biscuit market is driven by several factors, including changing consumer preferences, expanding distribution channels, and increased product innovation. One of the primary drivers is the surge in demand for convenience foods that offer a balance of taste, quality, and portability. As lifestyles become increasingly fast-paced, more consumers are opting for snacks that are easy to carry, require no preparation, and can be enjoyed on the go - characteristics that wafer biscuits inherently possess. Additionally, the expansion of organized retail and the proliferation of online shopping platforms have significantly boosted the availability and accessibility of wafer biscuits across various demographics and geographies. The global reach of e-commerce has enabled even smaller brands to compete in the global market, providing consumers with a diverse range of options that were previously unavailable in certain regions. Another key factor driving growth is the emphasis on product differentiation through innovation. Manufacturers are responding to the demand for novelty by introducing unique flavor combinations, healthier formulations, and premium options, thus catering to a broad spectrum of consumers from children and families to health-conscious adults and luxury snack enthusiasts. The growing trend of seasonal and limited-edition offerings has also contributed to sustained consumer interest, as brands capitalize on holidays and special occasions to launch exclusive products that drive short-term spikes in demand. Furthermore, the increasing awareness of healthier eating habits has led to a surge in the production of wafer biscuits with improved nutritional profiles, such as reduced sugar, high fiber, and added functional ingredients like probiotics and protein. This evolution towards “better-for-you” options has expanded the potential consumer base, attracting health-oriented individuals who previously avoided indulgent snacks. As a result, the wafer biscuit market is expected to witness robust growth, driven by a combination of product innovation, strategic marketing, and the rising popularity of convenient, on-the-go snacking options.Report Scope

The report analyzes the Wafer Biscuits market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Cream-Filled Wafer Biscuits, Coated Wafer Biscuits); Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online Stores, Specialty Food Stores); Application (Chocolate Wafers, Sandwich Wafers, Ice-Cream Wafers).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cream-Filled Wafer Biscuits segment, which is expected to reach US$92.8 Billion by 2030 with a CAGR of a 3.6%. The Coated Wafer Biscuits segment is also set to grow at 4.5% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Wafer Biscuits Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Wafer Biscuits Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Wafer Biscuits Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Antonelli Bros, Artisan Biscuits, Bolero, Dukes, Hershey Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Wafer Biscuits market report include:

- Antonelli Bros

- Artisan Biscuits

- Bolero

- Dukes

- Hershey Company

- Kellogg

- Lago Group

- Mars

- Mondelez International

- Nestlé

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Antonelli Bros

- Artisan Biscuits

- Bolero

- Dukes

- Hershey Company

- Kellogg

- Lago Group

- Mars

- Mondelez International

- Nestlé

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

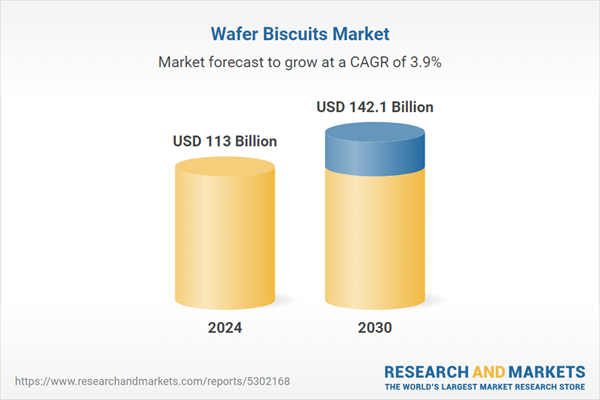

| Estimated Market Value ( USD | $ 113 Billion |

| Forecasted Market Value ( USD | $ 142.1 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |