Global Parkinson's Disease Drugs Market - Key Trends and Drivers Summarized

What Are Parkinson's Disease Drugs and Why Are They Essential?

Parkinson's disease drugs are a cornerstone in the management of one of the most common neurodegenerative disorders, characterized by progressive deterioration of motor functions. The disease primarily results from the loss of dopamine-producing neurons in the brain, leading to symptoms such as tremors, muscle rigidity, bradykinesia (slowed movement), and postural instability. While there is currently no cure for Parkinson's disease, pharmacological treatments play a crucial role in controlling these symptoms and improving the quality of life for patients. The drugs used to manage Parkinson's disease are broadly categorized into several classes, including dopaminergic agents like Levodopa, dopamine agonists, monoamine oxidase-B (MAO-B) inhibitors, and anticholinergics. Levodopa, often considered the gold standard, works by replenishing dopamine levels in the brain and is commonly used in combination with Carbidopa to enhance its effectiveness and reduce side effects. Meanwhile, other drugs like dopamine agonists mimic the action of dopamine on its receptors, providing symptomatic relief. MAO-B inhibitors, on the other hand, slow the breakdown of dopamine, extending its activity in the brain. This variety in pharmacological options allows clinicians to tailor treatments based on the progression of the disease and individual patient needs, making these drugs indispensable in the comprehensive management of Parkinson's disease.What Innovations Are Transforming Parkinson's Disease Drug Therapies?

The treatment landscape for Parkinson's disease is undergoing significant evolution, driven by innovations aimed at addressing the limitations of traditional therapies and tackling both motor and non-motor symptoms of the disease. A major advancement has been the development of extended-release formulations and novel delivery mechanisms that offer more consistent symptom control and reduce the frequency of dosing. For example, new Levodopa formulations with controlled-release properties provide steady dopamine levels, minimizing the “on-off” fluctuations often experienced by patients. Additionally, alternative delivery systems, such as transdermal patches and subcutaneous pumps, are emerging to bypass the gastrointestinal tract and improve drug absorption, addressing issues related to erratic oral bioavailability. Another breakthrough is the use of advanced dopamine agonists like Apomorphine, which can be administered as injections or infusions for rapid relief of sudden 'off' episodes. The exploration of non-dopaminergic therapies is also gaining traction, as researchers focus on targeting other neurotransmitter systems, such as glutamate or adenosine, to modulate symptoms that are resistant to traditional dopaminergic drugs. Furthermore, there is a growing interest in neuroprotective agents that aim to slow or even halt the progression of the disease by protecting dopamine neurons from degeneration. This includes compounds targeting mitochondrial function, oxidative stress, and neuroinflammation. Gene therapy and precision medicine approaches are also on the horizon, promising to deliver individualized treatments based on genetic profiles. These advancements are redefining the therapeutic landscape, offering hope for more effective management of both the motor and non-motor complexities of Parkinson's disease.Why Is Demand for Parkinson's Disease Drugs Rising in Various Regions?

The global demand for Parkinson's disease drugs is witnessing steady growth, driven by a combination of demographic trends, increased awareness, and advances in medical technology. An aging population is a major contributing factor, as the risk of developing Parkinson's disease increases significantly with age. Regions with rapidly aging demographics, such as North America, Europe, and parts of Asia, are seeing a higher prevalence of the disease, leading to increased demand for effective pharmacological treatments. Additionally, growing awareness about Parkinson's disease among both patients and healthcare professionals is prompting earlier diagnosis and intervention, which, in turn, is boosting the uptake of disease-modifying therapies. The expansion of healthcare infrastructure in emerging markets is also playing a critical role, as improved access to healthcare services and medications enables a larger number of patients to receive treatment. In high-income countries, advancements in diagnostic technologies, such as the use of imaging techniques and biomarker research, are leading to more accurate identification of Parkinson's at earlier stages, thereby broadening the patient pool eligible for treatment. Moreover, there is an increasing focus on managing non-motor symptoms like depression, cognitive impairment, and sleep disorders, which are often underrecognized but significantly impact patient quality of life. As a result, pharmaceutical companies are investing in developing new drugs that address the full spectrum of Parkinson's symptoms, further driving market demand across various regions.What's Driving Growth in the Parkinson's Disease Drugs Market?

The growth in the Parkinson's disease drugs market is driven by several factors, including ongoing research into novel therapeutic options, rising prevalence of the disease, and evolving treatment paradigms that emphasize personalized medicine. One of the primary drivers is the continuous innovation in drug development, as pharmaceutical companies are not only focusing on symptomatic relief but also on disease-modifying therapies that aim to alter the course of Parkinson's disease. This shift is leading to the exploration of new drug classes, such as glutamate receptor antagonists and alpha-synuclein inhibitors, which are being studied for their potential neuroprotective effects. Another key growth driver is the increasing prevalence of Parkinson's disease, which is linked to aging populations, higher life expectancy, and improved disease recognition. This demographic shift is particularly pronounced in developed nations, where the disease burden is expected to rise sharply over the coming decades. The adoption of combination therapies, which utilize multiple drug classes to target various pathways, is also contributing to market expansion, as these approaches offer more comprehensive symptom management. Moreover, advancements in pharmacogenomics and biomarker research are paving the way for precision medicine approaches, enabling the development of therapies tailored to the genetic and molecular profiles of individual patients. Regulatory support and financial incentives for drug research and development are further accelerating the introduction of new drugs to the market. Finally, the rise of telemedicine and digital health platforms is enhancing patient access to Parkinson's treatments, particularly in remote and underserved areas, making it easier for patients to receive continuous care. Collectively, these factors are driving robust growth in the Parkinson's disease drugs market and shaping its future trajectory towards more personalized and effective therapeutic solutions.Report Scope

The report analyzes the Parkinson’s Disease Drugs market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Route of Administration (Oral, Injection, Transdermal); Drug Class (Dopamine Agonists, MAO Inhibitors, AChE Inhibitors, Glutamate Inhibitors, Other Drug Classes); Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oral Administration segment, which is expected to reach US$4.6 Billion by 2030 with a CAGR of a 7.2%. The Injection Administration segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Parkinson’s Disease Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Parkinson’s Disease Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Parkinson’s Disease Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., ACADIA Pharmaceuticals, Boehringer Ingelheim GmbH, GlaxoSmithKline PLC, H. Lundbeck A/S and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Parkinson’s Disease Drugs market report include:

- AbbVie Inc.

- ACADIA Pharmaceuticals

- Boehringer Ingelheim GmbH

- GlaxoSmithKline PLC

- H. Lundbeck A/S

- Impax Laboratories Inc.

- M Somerset Pharmaceuticals Inc.

- Merck & Co. Inc.

- Mylan NV

- Novartis International AG

- Orion Pharma

- Pfizer Inc.

- Teva Pharmaceuticals Industries Ltd

- Vertical Pharmaceuticals

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- ACADIA Pharmaceuticals

- Boehringer Ingelheim GmbH

- GlaxoSmithKline PLC

- H. Lundbeck A/S

- Impax Laboratories Inc.

- M Somerset Pharmaceuticals Inc.

- Merck & Co. Inc.

- Mylan NV

- Novartis International AG

- Orion Pharma

- Pfizer Inc.

- Teva Pharmaceuticals Industries Ltd

- Vertical Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

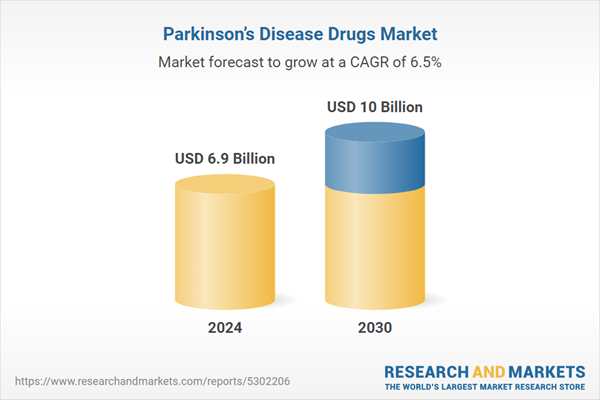

| Estimated Market Value ( USD | $ 6.9 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |