Global IP Cameras Market - Key Trends and Drivers Summarized

Why Are IP Cameras Revolutionizing Modern Surveillance?

IP (Internet Protocol) cameras have become a cornerstone of modern surveillance systems, offering capabilities that far surpass traditional analog systems. But what sets these cameras apart, and why are they considered a game changer? Unlike analog cameras, which transmit video via a direct connection to a recording device, IP cameras send data over a network, enabling remote access and real-time monitoring from virtually anywhere with an internet connection. This means that users can check live feeds, review recorded footage, and manage multiple cameras from different locations through a smartphone, tablet, or computer. Additionally, IP cameras come equipped with high-definition (HD) and even 4K resolution capabilities, offering superior image quality that allows for greater clarity, especially when it comes to identifying faces, license plates, and other critical details. They also often include advanced features such as night vision, wide dynamic range (WDR) for challenging lighting conditions, and motion detection, ensuring 24/7 surveillance. The flexibility of connecting through wireless networks also eliminates the need for extensive wiring, making these cameras easier to install and expand, which has contributed significantly to their growing popularity in various sectors.How Do IP Cameras Leverage Advanced Technology for Smarter Security?

IP cameras have truly evolved into intelligent security solutions by leveraging advanced technologies that enhance not only the user experience but also the effectiveness of surveillance. One of the most significant technological advances in IP cameras is the integration of edge computing, where data is processed locally within the camera itself rather than relying on central servers. This drastically reduces bandwidth consumption, minimizes latency, and lowers the cost of cloud storage. Many modern IP cameras also come with AI-driven video analytics capabilities, enabling features such as facial recognition, license plate detection, and object tracking. These intelligent systems can identify potential security threats in real-time, triggering alerts to users without requiring constant manual monitoring. In addition, multi-streaming capabilities allow users to access video feeds in different resolutions, optimizing performance based on the viewer's device and network conditions. This is especially beneficial for large organizations that need to monitor multiple locations simultaneously without overwhelming their network infrastructure. Moreover, IP cameras are equipped with built-in encryption and cybersecurity features, ensuring that sensitive video data remains protected from potential breaches. These technological innovations have turned IP cameras into more than just passive recording devices, making them active participants in security ecosystems.Who Benefits From The Versatility Of IP Cameras Across Different Sectors?

The versatility of IP cameras has made them an essential tool for a wide range of industries, with benefits extending far beyond traditional security applications. In the retail sector, for instance, these cameras are used not only to prevent theft but also to analyze customer behavior and optimize store layouts by tracking foot traffic patterns. This dual-purpose usage helps retailers improve both security and operational efficiency. In urban environments, government bodies use IP cameras as part of smart city initiatives, monitoring public spaces, managing traffic flow, and assisting in crime prevention. Educational institutions rely on IP cameras to safeguard campuses, monitor student activities, and ensure emergency preparedness. Similarly, in healthcare settings, IP cameras are indispensable for monitoring patients in sensitive areas like intensive care units (ICUs) and for ensuring the safety of pharmaceuticals in storage areas. The residential market has also seen a surge in the adoption of IP cameras, driven by the rise of smart home technology. Homeowners use these cameras to remotely monitor their properties, providing an added layer of security and peace of mind. From small businesses to sprawling industrial complexes, the flexibility and scalability of IP camera systems make them a perfect fit across diverse settings, enhancing security, productivity, and decision-making processes.What Factors Are Driving the Rapid Growth of the IP Camera Market?

The growth in the IP camera market is driven by several factors, reflecting both technological advancements and evolving consumer needs. A primary driver is the increasing demand for high-definition video surveillance, with users across industries seeking clearer, more detailed footage for security, legal, and analytical purposes. The integration of artificial intelligence (AI) and machine learning (ML) technologies into IP cameras has further accelerated market growth, as these systems can now perform advanced analytics such as facial recognition, crowd monitoring, and automatic threat detection in real-time. Another major factor propelling this market is the widespread adoption of cloud-based storage solutions. By leveraging the cloud, users can store vast amounts of data without the need for costly on-premises storage infrastructure, making IP camera systems more affordable and scalable. Additionally, the rise of smart cities and the Internet of Things (IoT) has created a growing demand for IP cameras, which play a vital role in urban monitoring and the seamless integration of smart technologies. Consumer behavior has also shifted, with a rising focus on security at both personal and organizational levels, driven by growing concerns over crime and property protection. This heightened awareness has led to an increased uptake of IP cameras in residential markets, while businesses are investing in more comprehensive surveillance solutions to protect assets and comply with regulatory requirements. Finally, advancements in wireless connectivity and the widespread availability of broadband internet have made IP cameras more accessible, fueling their global adoption across industries.Report Scope

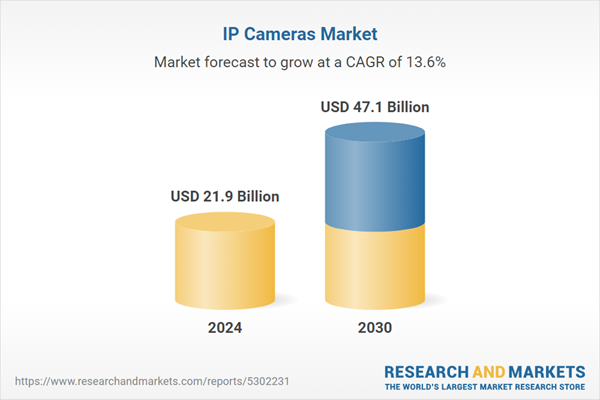

The report analyzes the IP Cameras market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Connection (Centralized, Decentralized); Application (Commercial, Public / Government, Residential).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Centralized IP Cameras segment, which is expected to reach US$31.3 Billion by 2030 with a CAGR of a 14.6%. The Decentralized IP Cameras segment is also set to grow at 11.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.6 Billion in 2024, and China, forecasted to grow at an impressive 17.8% CAGR to reach $11.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global IP Cameras Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global IP Cameras Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global IP Cameras Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apexis, ArecontVision, Avigilon, AxisCommunications, Belkin and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this IP Cameras market report include:

- Apexis

- ArecontVision

- Avigilon

- AxisCommunications

- Belkin

- Bosch SecuritySystems

- Dahua

- D-Link

- GeoVision

- Goscam

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apexis

- ArecontVision

- Avigilon

- AxisCommunications

- Belkin

- Bosch SecuritySystems

- Dahua

- D-Link

- GeoVision

- Goscam

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 267 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.9 Billion |

| Forecasted Market Value ( USD | $ 47.1 Billion |

| Compound Annual Growth Rate | 13.6% |

| Regions Covered | Global |