Global Copper Cables Market - Key Trends and Drivers Summarized

What Makes Copper Cables Indispensable in Today's Electrical and Data Transmission Systems?

Copper cables have been a critical component in power transmission and telecommunications for decades, serving as the primary medium for carrying electrical currents and data signals across a wide range of industries. Renowned for their excellent electrical conductivity, durability, and flexibility, copper cables are used extensively in everything from residential wiring and automotive systems to large-scale industrial applications and advanced telecommunications networks. Their ability to transmit power with minimal energy loss and maintain signal integrity over long distances makes copper cables a preferred choice for many high-performance applications. This is particularly evident in the power industry, where copper cables are crucial for efficient electricity distribution in utility grids and renewable energy installations. Additionally, in the telecommunications sector, copper cables such as twisted pair and coaxial configurations continue to be widely used for local area networks (LANs) and last-mile connectivity in broadband systems, offering reliable data transmission with high-speed capabilities. The combination of high tensile strength and resistance to corrosion also allows copper cables to perform well in both indoor and outdoor environments, ensuring longevity and consistent performance under a variety of conditions.How Are Advancements Redefining the Role of Copper Cables in Modern Applications?

The copper cable industry is undergoing a significant transformation, driven by advances in technology that are enhancing their performance, efficiency, and versatility. One of the key trends is the development of next-generation copper cables designed to support higher data transmission rates and increased bandwidth, particularly for telecommunications and data center applications. Innovations such as advanced insulation materials, improved shielding techniques, and optimized cable designs have led to the creation of Category 8 Ethernet cables capable of supporting up to 40 Gbps speeds, making them ideal for high-speed networking in data centers and enterprise environments. Additionally, the use of hybrid cables that combine fiber optics with copper conductors is becoming more prevalent, providing both power and high-speed data transmission in a single solution. This is particularly useful in applications such as remote antenna systems and smart building infrastructure, where power and data connectivity need to be managed efficiently. Moreover, sustainability is emerging as a critical focus, with manufacturers exploring eco-friendly production techniques and recyclable materials to minimize the environmental impact of cable production. These innovations not only improve the performance and durability of copper cables but also ensure that they remain a competitive option in an industry increasingly dominated by fiber optics and other high-tech materials. As technology continues to evolve, copper cables are being redefined to meet the needs of modern applications, ensuring their continued relevance in an era of rapid technological change.What Challenges and Market Forces Are Shaping the Future of the Copper Cable Industry?

The copper cable industry faces a complex set of challenges and market forces that impact its growth and strategic direction. One of the most significant challenges is the volatility in raw copper prices, which can fluctuate due to global supply-demand dynamics, geopolitical factors, and speculative trading. These price fluctuations directly influence production costs and profitability for cable manufacturers, making cost management a critical concern. Additionally, the industry is seeing increased competition from fiber optics, particularly in the telecommunications sector, where fiber's superior data transmission capabilities over long distances are challenging the traditional dominance of copper cables. While fiber optics are gaining traction for backbone networks, copper cables still hold a strong position in shorter-distance applications and environments that require both power and data transmission, such as in-home networking and industrial automation. Another challenge is the growing emphasis on sustainability and environmental compliance. As regulations become stricter, manufacturers must adopt greener production methods and materials, which can increase costs and complicate manufacturing processes. On the market side, the demand for high-performance cables in emerging applications like electric vehicles (EVs), renewable energy systems, and smart infrastructure is creating new growth opportunities. However, tapping into these opportunities requires significant investment in new technologies and production capabilities.What Factors Are Driving the Growth of the Global Copper Cable Market?

The growth in the global copper cable market is propelled by a variety of factors that reflect the increasing need for robust power and communication infrastructure across different industries. One of the primary drivers is the global push towards electrification and renewable energy expansion, which has spurred demand for high-quality copper cables in power transmission, distribution networks, and renewable energy projects such as wind and solar farms. As countries modernize their electrical grids and integrate more renewable energy sources, copper's superior conductivity and durability make it an essential component in these projects. Another significant driver is the ongoing rollout of 5G and high-speed broadband networks, where copper cables, particularly coaxial and twisted-pair cables, are still widely used for last-mile connectivity and Power over Ethernet (PoE) applications. Copper's ability to carry both data and power makes it ideal for powering devices like wireless access points, security cameras, and IoT sensors in smart buildings and urban infrastructure. Additionally, the growing demand for electric vehicles (EVs) and their charging infrastructure is creating new opportunities for the copper cable market, as these vehicles require extensive cabling for power management, battery systems, and charging stations. The rise of smart grid technologies, which rely on advanced data communication and real-time monitoring, is further boosting the demand for high-performance copper cables capable of supporting these complex systems. Lastly, the trend towards smart homes, automation, and connected devices is increasing the need for reliable copper cables that can handle high-frequency signals and power requirements in residential and commercial settings. Together, these drivers are ensuring the sustained growth and adaptability of copper cables, making them a vital element in the ongoing development of global infrastructure.Report Scope

The report analyzes the Copper Cables market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (LAN, Data Center); End-Use (IT & Telecom, Government, Industrial, Residential & Commercial, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LAN Application segment, which is expected to reach US$11.8 Billion by 2030 with a CAGR of a 7.2%. The Data Center Application segment is also set to grow at 6.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 10.6% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Copper Cables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Copper Cables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Copper Cables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Elektrokoppar, KGHM, Luvata, Mitsubishi Materials Co., NBM Metals, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Copper Cables market report include:

- Elektrokoppar

- KGHM

- Luvata

- Mitsubishi Materials Co.

- NBM Metals, Inc.

- Ningbo Jintian Copper Group

- Sandvik AB

- SH Copper Products Co., Ltd.

- Tatung Co.

- Tongling Jingda Electromagnetic Wire Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Elektrokoppar

- KGHM

- Luvata

- Mitsubishi Materials Co.

- NBM Metals, Inc.

- Ningbo Jintian Copper Group

- Sandvik AB

- SH Copper Products Co., Ltd.

- Tatung Co.

- Tongling Jingda Electromagnetic Wire Co., Ltd.

Table Information

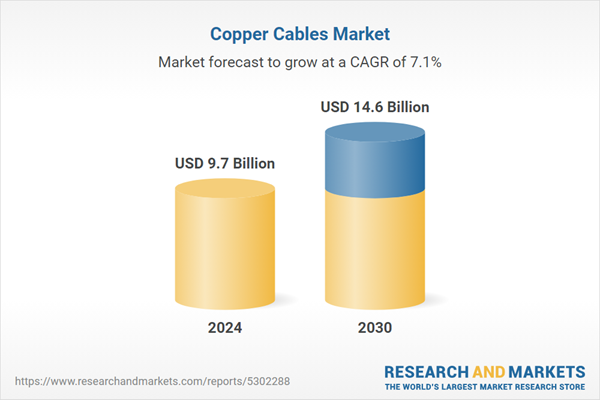

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.7 Billion |

| Forecasted Market Value ( USD | $ 14.6 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |