Global Antineoplastic Agents Market - Key Trends and Drivers Summarized

How Are Antineoplastic Agents Shaping the Future of Cancer Treatment?

Antineoplastic agents, also known as anticancer drugs, have become pivotal in the fight against cancer, serving as the cornerstone of most therapeutic regimens. These agents work primarily by inhibiting the growth and proliferation of malignant cells through various mechanisms, such as interfering with cell division, damaging DNA, or targeting specific cancer cell receptors. They encompass a broad range of drug classes, including alkylating agents, antimetabolites, antitumor antibiotics, topoisomerase inhibitors, and mitotic inhibitors, each contributing uniquely to disrupting the life cycle of cancer cells. The importance of antineoplastic agents in oncology cannot be overstated, as they form the backbone of treatment for many types of cancers, either as monotherapies or in combination with other modalities like radiation and surgery. For instance, alkylating agents such as cyclophosphamide and ifosfamide are commonly used for their ability to cross-link DNA, thereby preventing the cancer cells from replicating. Similarly, antimetabolites like methotrexate interfere with cellular metabolism, halting cancer cell growth. What sets antineoplastic agents apart is their ability to be tailored to the specific biological characteristics of different cancers, allowing for precision in targeting diverse malignancies. However, their therapeutic potential is balanced by significant challenges, including adverse side effects like myelosuppression, cardiotoxicity, and neurotoxicity, which necessitate careful management and individualized treatment planning.Why Are Antineoplastic Agents Evolving Rapidly in Recent Years?

The landscape of antineoplastic agents has been evolving rapidly, driven by breakthroughs in molecular biology, genetics, and immunology. Traditional chemotherapy agents, which indiscriminately attack both cancerous and healthy cells, are being increasingly complemented and sometimes replaced by more sophisticated targeted therapies and immunotherapies. Targeted antineoplastic agents, such as tyrosine kinase inhibitors and monoclonal antibodies, are designed to specifically identify and inhibit molecular targets that are crucial for cancer cell survival and proliferation. For example, trastuzumab (Herceptin) targets the HER2 receptor in certain breast cancers, while imatinib (Gleevec) inhibits the BCR-ABL tyrosine kinase in chronic myeloid leukemia. These advancements have revolutionized cancer treatment by minimizing damage to healthy cells and reducing the intensity of side effects typically associated with chemotherapy. Similarly, immunotherapeutic agents, including checkpoint inhibitors like pembrolizumab and nivolumab, have opened new avenues by enabling the patient's own immune system to recognize and destroy cancer cells. The advent of CAR-T cell therapies, which involve modifying a patient's T cells to target cancer cells more effectively, has also emerged as a groundbreaking approach, particularly for hematologic cancers. Such innovations are the result of extensive research into the genetic and immunological underpinnings of cancer, leading to a more personalized and effective treatment paradigm.How Are Regulatory Challenges and Clinical Trials Impacting the Market for Antineoplastic Agents?

The development and approval of antineoplastic agents are governed by a complex and stringent regulatory framework that ensures these powerful drugs are both safe and effective. Given the potential toxicity and high-risk nature of cancer treatments, agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce rigorous guidelines for preclinical and clinical testing. Before any antineoplastic agent reaches the market, it must undergo a multi-phase clinical trial process, including Phase I studies to assess safety and dosage, Phase II trials to evaluate efficacy, and Phase III trials that compare the new agent against standard treatments. These trials are not only lengthy and costly but are also associated with high failure rates, often due to the narrow therapeutic windows and unpredictable responses in heterogeneous patient populations. Regulatory bodies also require comprehensive post-market surveillance to monitor long-term safety and efficacy, particularly for novel agents like biologics and immunotherapies, which may have delayed adverse effects. The high stakes involved in this process significantly impact the timelines and financial risks for pharmaceutical companies, influencing how and when new therapies can be brought to market. In response to these challenges, there has been a growing emphasis on adaptive clinical trial designs and the use of biomarkers to streamline patient selection, enhance study outcomes, and accelerate approval timelines. Regulatory agencies have also introduced special designations such as Orphan Drug, Breakthrough Therapy, and Fast Track approvals to incentivize the development of novel antineoplastic agents, particularly for rare or hard-to-treat cancers.What Are the Key Factors Driving Growth in the Antineoplastic Agents Market?

The growth in the antineoplastic agents market is driven by several factors that reflect both advancements in scientific research and shifts in healthcare demands. One of the most significant drivers is the increasing global burden of cancer, which is projected to rise substantially due to aging populations, lifestyle changes, and environmental factors. This growing incidence has heightened the need for more effective treatment options, spurring research and development in both traditional and novel antineoplastic therapies. Additionally, there has been a marked shift towards personalized medicine, which is influencing the market by promoting the development of targeted therapies and companion diagnostics. As a result, pharmaceutical companies are focusing on agents that can be customized to the genetic profile of individual tumors, enhancing therapeutic precision and outcomes. Another crucial factor is the expansion of healthcare infrastructure and rising healthcare expenditure in emerging economies, which are providing new opportunities for market penetration and revenue growth. Improved access to cancer treatments in regions like Asia-Pacific and Latin America is expected to drive substantial market expansion in the coming years. Furthermore, the increasing adoption of combination therapies, where multiple antineoplastic agents are used in tandem to overcome resistance and improve response rates, is boosting the demand for a broader range of anticancer drugs. Consumer preferences are also shifting, with patients and healthcare providers increasingly favoring treatments that offer fewer side effects and better quality of life, such as oral formulations and biologics over conventional cytotoxic drugs. Finally, strong government support and funding for cancer research, coupled with a robust pipeline of investigational drugs, are ensuring that the antineoplastic agents market remains dynamic and continues to grow at a rapid pace, positioning it as a critical segment within the global pharmaceutical industry.Report Scope

The report analyzes the Antineoplastic Agents market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Chemotherapeutic Agents, Biological Agents, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Chemotherapeutic Agents Application segment, which is expected to reach US$137.9 Billion by 2030 with a CAGR of a 6.9%. The Biological Agents Application segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $38.6 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $52.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Antineoplastic Agents Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Antineoplastic Agents Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

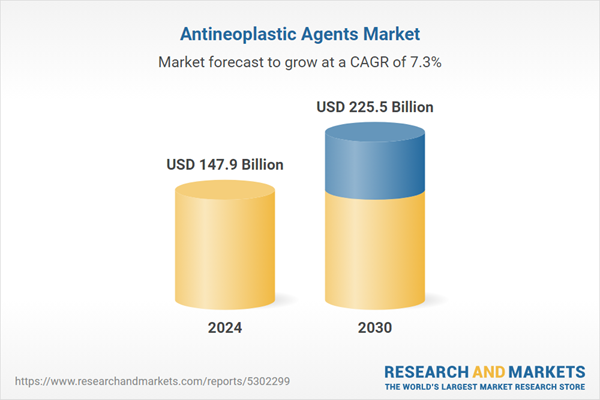

- How is the Global Antineoplastic Agents Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie, Abraxis, AstraZeneca, Baekdu Mountain Pharmaceutical, Baida Pharmaceutical and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Antineoplastic Agents market report include:

- AbbVie

- Abraxis

- AstraZeneca

- Baekdu Mountain Pharmaceutical

- Baida Pharmaceutical

- Bayer

- Biogen Idec

- BMS

- Celgene

- CTTQ

- Eisai

- Gilead

- Hainan Chang'an International Pharmaceutical

- Jiangsu Haosen Pharmaceutical Group

- Jiangsu Hengrui Pharmaceutical

- Johnson and Johnson

- Liaoning Novino Pharmaceutical

- Lilly

- Maanshan Fengyuan Pharmaceutical

- Meiluo Pharmaceutical

- MSD

- Novartis

- Pfizer

- Qilu Pharmaceutical

- Roche

- Sanofi

- Shandong Luoxin Pharmaceutical Group

- Shandong Lvye Pharmaceutical

- Shandong New Era Pharmaceutical

- Sinopharm

- Tesaro (GSK)

- Teva

- Wto-Day Order Pharmaceutical

- Zhejiang Kanglaite Pharmaceutical

- Zhejiang Yatai Pharmaceutical

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie

- Abraxis

- AstraZeneca

- Baekdu Mountain Pharmaceutical

- Baida Pharmaceutical

- Bayer

- Biogen Idec

- BMS

- Celgene

- CTTQ

- Eisai

- Gilead

- Hainan Chang'an International Pharmaceutical

- Jiangsu Haosen Pharmaceutical Group

- Jiangsu Hengrui Pharmaceutical

- Johnson and Johnson

- Liaoning Novino Pharmaceutical

- Lilly

- Maanshan Fengyuan Pharmaceutical

- Meiluo Pharmaceutical

- MSD

- Novartis

- Pfizer

- Qilu Pharmaceutical

- Roche

- Sanofi

- Shandong Luoxin Pharmaceutical Group

- Shandong Lvye Pharmaceutical

- Shandong New Era Pharmaceutical

- Sinopharm

- Tesaro (GSK)

- Teva

- Wto-Day Order Pharmaceutical

- Zhejiang Kanglaite Pharmaceutical

- Zhejiang Yatai Pharmaceutical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 147.9 Billion |

| Forecasted Market Value ( USD | $ 225.5 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |