Global Intimate Hygiene Market - Key Trends and Drivers Summarized

How Is Intimate Hygiene Becoming a Key Focus in Personal Care?

Intimate hygiene has emerged as a critical component of personal care, gaining attention for its importance in maintaining not only cleanliness but also overall health and well-being. This category encompasses a range of products designed specifically to clean and care for the delicate areas of the body, particularly for women but increasingly for men as well. Intimate hygiene products include washes, wipes, creams, and powders that are formulated to maintain the natural pH balance, prevent infections, and provide comfort throughout the day. The rise in awareness about personal hygiene, coupled with growing concerns around reproductive health, has made intimate hygiene a priority in the broader personal care market. Moreover, with societal shifts toward greater openness about previously taboo topics, there is increasing discussion about the importance of proper intimate care. These changes are fueling the demand for products that not only address hygiene needs but also offer soothing, moisturizing, and protective benefits. As consumers become more educated about the importance of maintaining intimate hygiene, this segment is becoming a vital part of everyday grooming routines, alongside skincare and haircare.What Technological Advancements Are Shaping the Intimate Hygiene Market?

Technological advancements have played a pivotal role in elevating the quality and effectiveness of intimate hygiene products, leading to safer, more specialized solutions for consumers. One significant development is the introduction of pH-balanced formulations, which are essential for maintaining the health of the intimate area. Unlike traditional soaps or body washes, these products are designed to work with the body's natural chemistry, reducing the risk of irritation, infections, and disruptions to the skin's microbiome. Another major innovation in this space is the use of natural and organic ingredients, catering to the growing consumer preference for clean, chemical-free personal care products. This includes the incorporation of plant-based antimicrobials, soothing botanicals like aloe vera, and probiotics, which help restore the balance of healthy bacteria in the vaginal or intimate area. In addition to ingredient innovation, the packaging and delivery methods of intimate hygiene products have seen advancements. Brands are offering single-use, biodegradable wipes, portable intimate sprays, and compact travel-friendly washes, making hygiene on-the-go more convenient and accessible. Moreover, eco-friendly packaging, such as recyclable materials and reduced plastic use, is gaining traction in the intimate hygiene sector, responding to the broader push for sustainability in personal care. Technology is also driving the creation of more targeted solutions, including products specifically designed for different life stages - such as pregnancy, postpartum, and menopause - offering personalized care for diverse consumer needs.How Are Changing Consumer Preferences Influencing the Intimate Hygiene Market?

Consumer preferences in the intimate hygiene market are rapidly evolving, with a noticeable shift towards products that prioritize health, comfort, and transparency. As consumers become more aware of the ingredients used in personal care products, there is growing demand for intimate hygiene products that are free from harsh chemicals, synthetic fragrances, and sulfates. Many consumers are now seeking hypoallergenic, dermatologically tested, and gynecologist-approved products to ensure safety and reduce the risk of irritation or infections. The rise of the clean beauty movement has had a direct impact on this sector, with an increasing number of shoppers opting for products labeled as organic, vegan, and cruelty-free. This is especially true among younger consumers, who are driving the demand for ethical and environmentally responsible brands. Furthermore, there is a growing trend towards gender inclusivity and personalization in intimate hygiene. While the market has traditionally focused on women, brands are now recognizing the importance of addressing intimate care needs for men, creating specialized products for male hygiene. Additionally, consumers are seeking personalized care solutions tailored to their specific concerns, whether it be sensitive skin, dryness, odor control, or infection prevention. This shift is also reflected in the rising demand for intimate hygiene products designed for different life stages, such as menstruation, pregnancy, and menopause. The increasing focus on holistic wellness has led consumers to integrate intimate hygiene into their broader health and self-care routines, driving innovation and diversification in the product offerings within this category.What Are the Key Growth Drivers in the Intimate Hygiene Market?

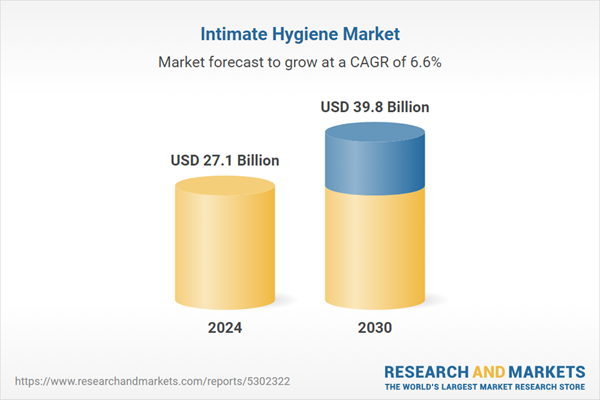

The growth in the intimate hygiene market is driven by several factors, most notably increased consumer awareness, advancements in product formulations, and expanding cultural acceptance around intimate care. A key driver is the rising awareness of the importance of intimate hygiene in preventing infections, maintaining comfort, and promoting overall health. This awareness has been amplified by education campaigns from healthcare professionals, increased media coverage, and the influence of social media, where discussions about intimate care are becoming more normalized. As consumers become more knowledgeable about the connection between intimate hygiene and health issues like urinary tract infections (UTIs) and bacterial vaginosis (BV), they are increasingly turning to specialized products for prevention and care. Advancements in product formulations are also driving market growth, particularly the move towards more natural, pH-balanced, and clinically tested ingredients that offer a safer and gentler experience. The demand for clean, chemical-free formulations has led to the development of products that are free from parabens, sulfates, and synthetic fragrances, which has resonated with health-conscious consumers. Additionally, the trend toward gender-neutral and inclusive products is expanding the market, as brands recognize the needs of all consumers, not just women. Cultural shifts are another important factor propelling the intimate hygiene market forward. As society becomes more open about discussions related to intimate care, personal hygiene practices are evolving, making intimate hygiene products an integral part of daily routines for many. The expansion of e-commerce platforms has also played a crucial role, providing discreet access to a wide range of intimate care products and driving consumer convenience. Lastly, the growing demand for sustainable and eco-friendly options is encouraging innovation in packaging and product development, further expanding the market. These combined factors - ranging from increased health awareness and product innovation to cultural openness and sustainability - are fueling the rapid growth of the intimate hygiene market.Report Scope

The report analyzes the Intimate Hygiene market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Wipes, Gels, Creams & Liquids, Soaps, Other Product Types); Distribution Channel (Supermarkets / Hypermarkets, Drug Stores & Pharmacies, Online Channel, Other Distribution Channels); End-Use (Female, Male).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wipes segment, which is expected to reach US$16.9 Billion by 2030 with a CAGR of a 7.9%. The Gels, Creams & Liquids segment is also set to grow at 5.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Intimate Hygiene Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Intimate Hygiene Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Intimate Hygiene Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Edgwell Personal Care, Glenmark, InLife Pharma, Johnson & Johnson, Kao Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Intimate Hygiene market report include:

- Edgwell Personal Care

- Glenmark

- InLife Pharma

- Johnson & Johnson

- Kao Corporation

- Procter & Gamble

- Sanofi

- The Boots Company

- Unicharm

- Unilever

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Edgwell Personal Care

- Glenmark

- InLife Pharma

- Johnson & Johnson

- Kao Corporation

- Procter & Gamble

- Sanofi

- The Boots Company

- Unicharm

- Unilever

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.1 Billion |

| Forecasted Market Value ( USD | $ 39.8 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |